The year 2025, initially heralded as a watershed moment for XRP, ultimately concluded with a perplexing paradox: a cascade of anticipated bullish events, including the long-awaited resolution of the SEC lawsuit, the successful launch of multiple US-based spot Exchange Traded Funds (ETFs), and a notable surge in Ripple’s strategic partnerships, failed to propel the digital asset to its coveted $5 price target, leaving investors grappling with a profound sense of underperformance and an increasingly opaque outlook for 2026. Despite these monumental milestones, XRP’s price trajectory painted a starkly different picture, peaking at a promising $3.66 before a precipitous decline, plummeting as much as 50% to a low of $1.58 by October, thereby solidifying a year of unfulfilled expectations and heightening uncertainty regarding its future trajectory.

The XRP community, often referred to as the "XRP Army," had meticulously anticipated these pivotal events throughout 2025, believing each would serve as a catalyst for a parabolic price rally. However, the market’s reaction proved to be a sobering lesson in the complex interplay of regulatory clarity, institutional adoption, and inherent market dynamics. XRP, despite its fundamental developments, consistently underperformed the broader cryptocurrency market, raising critical questions about its price sensitivity to positive news.

One of the earliest and most intriguing developments came in March when XRP was unexpectedly listed as a candidate for the United States’ "Digital Asset Reserve." This announcement, coming from the Trump administration, initially sparked a significant surge of over 30% in XRP’s price, fueled by speculative optimism that the government might begin accumulating the asset. The prospect of sovereign endorsement and potential direct demand from a national reserve was a powerful narrative. However, this initial euphoria was short-lived. A subsequent executive order clarified that any such digital asset stockpile would be limited to seized assets only, explicitly excluding new purchases. Furthermore, the order indicated a separate, more favorable treatment for Bitcoin. This crucial distinction served as a significant letdown, as it offered only symbolic legitimacy to XRP without generating any direct, sustained buying pressure from the government. The market quickly digested this nuance, leading to a rapid dissipation of the initial price gains and leaving many investors disillusioned about the immediate impact of political endorsements.

The most anticipated event of the year, the resolution of the multi-year legal battle between Ripple Labs and the US Securities and Exchange Commission (SEC), finally materialized on May 8. This protracted lawsuit had cast a long shadow over XRP, stifling its growth and causing it to lag behind other major cryptocurrencies during bull markets. The settlement was widely perceived as a massive victory for Ripple, and indeed, XRP soared to a seven-year high on July 18, briefly reigniting hopes of a sustained rally. The market cap hit a record $210 billion, reflecting immense investor confidence following the legal clarity. However, the celebratory momentum proved ephemeral. Less than two weeks later, the price had already dropped a staggering 25% to $2.73, illustrating a classic "buy the rumor, sell the news" phenomenon. While the legal clarity was undoubtedly a long-term positive, the immediate market reaction suggested that much of the upside had already been priced in, or that other factors were exerting stronger downward pressure. The market seemed to interpret the settlement as an end to uncertainty rather than a fresh catalyst for growth, leading to profit-taking.

As 2025 progressed, the final significant hope for a parabolic XRP rally rested on institutional demand, specifically through the launch of US-based spot ETFs. These investment vehicles, which allow traditional investors to gain exposure to XRP without directly holding the cryptocurrency, finally launched in November. The initial performance of these ETFs was undeniably strong, reflecting a robust appetite among institutional investors. They recorded inflows for 24 consecutive days, accumulating cumulative inflows of $1.06 billion and pushing total assets under management (AUM) to over $1.14 billion. Such a strong start typically signals significant institutional confidence and can often precede substantial price appreciation for the underlying asset. Yet, paradoxically, this impressive institutional adoption did little to lift overall trader sentiment regarding XRP’s price growth odds. The price continued to languish, suggesting a disconnect between institutional investment flows and the broader market’s perception of XRP’s immediate value proposition. This raised questions about whether these inflows were merely absorbing existing supply without generating new demand, or if the market was simply too bearish to react positively.

Looking ahead to 2026, the political landscape suggests continued regulatory support for the crypto industry from the Trump administration, which could, in theory, benefit XRP by fostering a more favorable operating environment. Furthermore, Ripple’s core business of cross-border payments is expected to experience further growth through strategic partnerships, such as those seen in South Korea involving XRP and the RLSUD stablecoin for custody solutions. These fundamental developments continue to build the utility case for XRP. However, the critical question remains: can XRP leverage these foundational strengths to finally reach the elusive $5 mark, or even higher, in the new year?

A closer examination of on-chain metrics paints a concerning picture for XRP’s immediate prospects. Over the past six months of 2025, the number of daily active addresses (unique users) on the XRP Ledger has remained conspicuously muted, consistently staying under 45,000. On December 18, this figure stood at a mere 38,500 active addresses. This represents a staggering 94% drawdown from the 2025 peak of over 600,000 active addresses recorded in March. A decline of this magnitude in network activity is a significant bearish signal, indicating a substantial reduction in organic usage and demand for the asset. A healthy and growing blockchain typically sees increasing active addresses, which correlates with greater utility and investor interest. The drastic drop suggests a loss of engagement from its user base, which inevitably translates to reduced buying pressure.

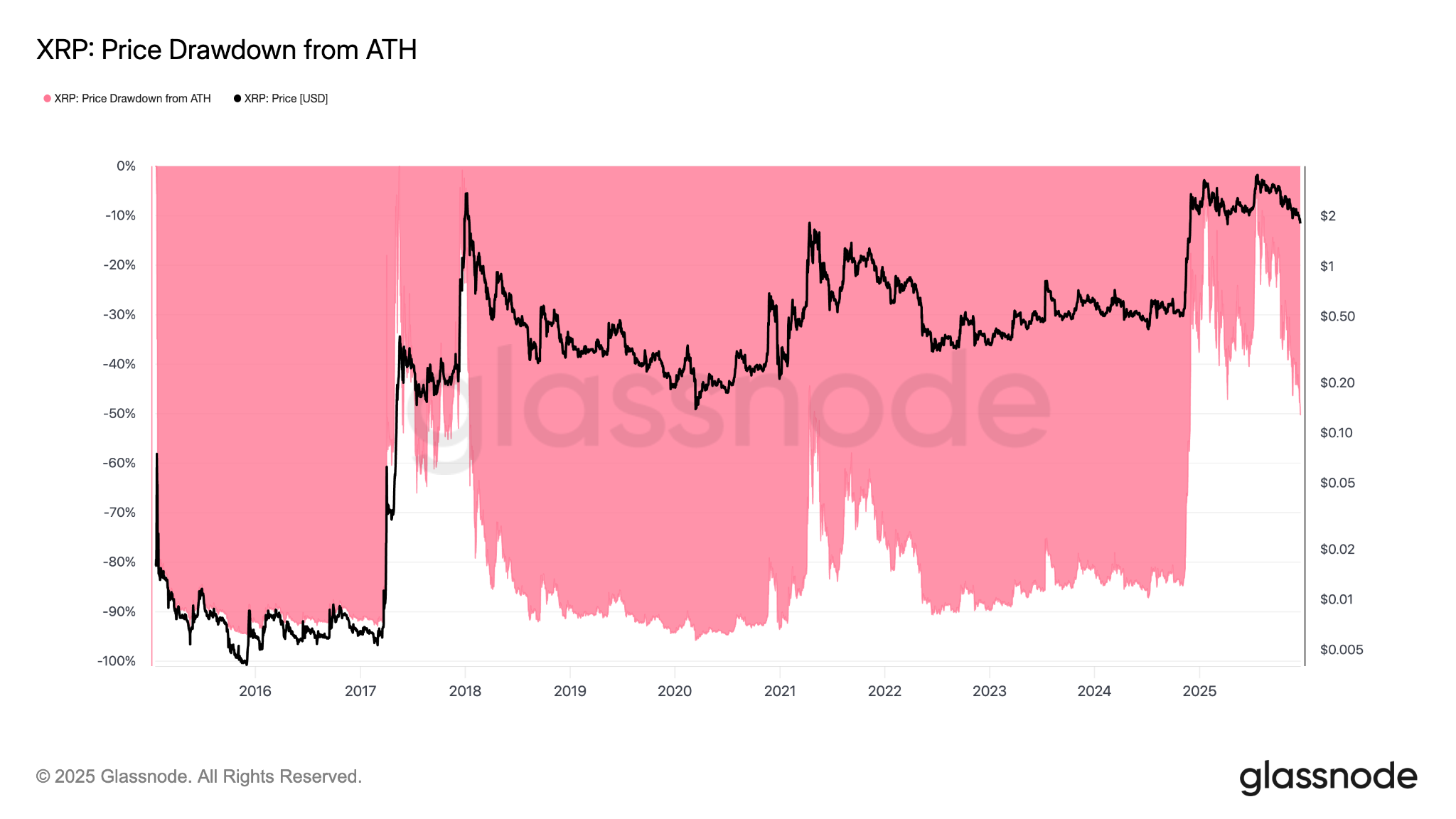

Historical precedents also cast a long shadow. XRP experienced a dramatic collapse of over 90% of its value within 12 months of hitting its all-time high in 2018. This significant decline occurred long before the SEC lawsuit, suggesting that XRP is inherently prone to steep corrections even in the absence of major regulatory headwinds. Considering that the token is already down more than 40% from its multi-year high above $3.66, another decline of a similar magnitude is not outside the realm of possibility. Such a scenario would make the prospect of reaching $5 in 2026 a formidable, if not impossible, challenge.

From a technical analysis perspective, the setup appears decidedly bearish. XRP has lost several key psychological and technical support levels. It has fallen below the critical psychological level of $2 and, more significantly, the 50-week exponential moving average (EMA) at $1.87. The 50-week EMA has historically served as a crucial indicator, often marking cycle peaks when broken on the downside. The current price action suggests a loss of bullish momentum and a potential shift towards a more protracted downtrend.

A key area of interest for bears lies between the 100-week EMA, currently positioned at $1.85, and the November 21 low of $1.80. If XRP fails to hold this support zone, it could trigger another cascade of long liquidations, as leveraged positions betting on higher prices are forced to close. This would likely push the price further down, with the local lows at $1.61 serving as the next area of interest for potential support. Should even this level fail, the 200-day EMA at $1.38 could provide some temporary respite, offering a zone where bulls might attempt to regroup and stage a recovery. However, the overall technical structure points to further downside risk before any sustained rebound.

Many prominent analysts believe that XRP’s price has already topped for this cycle, warning of a deeper price correction extending into 2026. Veteran trader Peter Brandt, known for his accurate market calls, specifically highlighted the presence of a "potential double top" pattern on XRP’s weekly chart. A double top is a bearish reversal pattern that typically indicates a trend reversal and can precede significant price declines. Brandt’s analysis suggested that this pattern could see XRP’s price drop below $1 over the coming weeks or months, a stark warning for investors hoping for a rapid recovery.

Conversely, a minority of analysts maintain a more optimistic outlook. Chad Steingraber, for instance, remains confident that the XRP price may experience substantial growth, projecting a move "from $2 to $10" in 2026. His bullish thesis often cites the persistent spot ETF inflows as a foundational driver, arguing that while these inflows haven’t immediately translated into price action, they represent sustained institutional accumulation that will eventually lead to higher valuations. He also points to "more bullish technicals on higher time frames," suggesting that while short-term indicators may be bearish, longer-term charts might reveal underlying strength or accumulation phases that precede major upward moves. This could include patterns like large-scale consolidation or bullish divergences not immediately apparent on shorter timeframes. However, given the current on-chain and short-to-medium-term technical signals, this bullish perspective faces considerable headwinds.

In conclusion, 2025 proved to be a year of significant fundamental achievements for XRP, marked by regulatory clarity, institutional validation through ETFs, and expanding partnerships for Ripple. Yet, these victories failed to translate into the anticipated price performance, leaving the $5 target elusive. The disconnect between positive news and price action, coupled with declining on-chain activity and bearish technical indicators, casts a long shadow over XRP’s prospects for 2026. While some bullish arguments persist, primarily centered on long-term institutional accumulation and potential future utility, the immediate outlook is fraught with uncertainty, with significant downside risks appearing more probable than a rapid ascent to previous highs. The journey for XRP in 2026 is poised to be a complex one, challenging the resolve of its most ardent supporters.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.