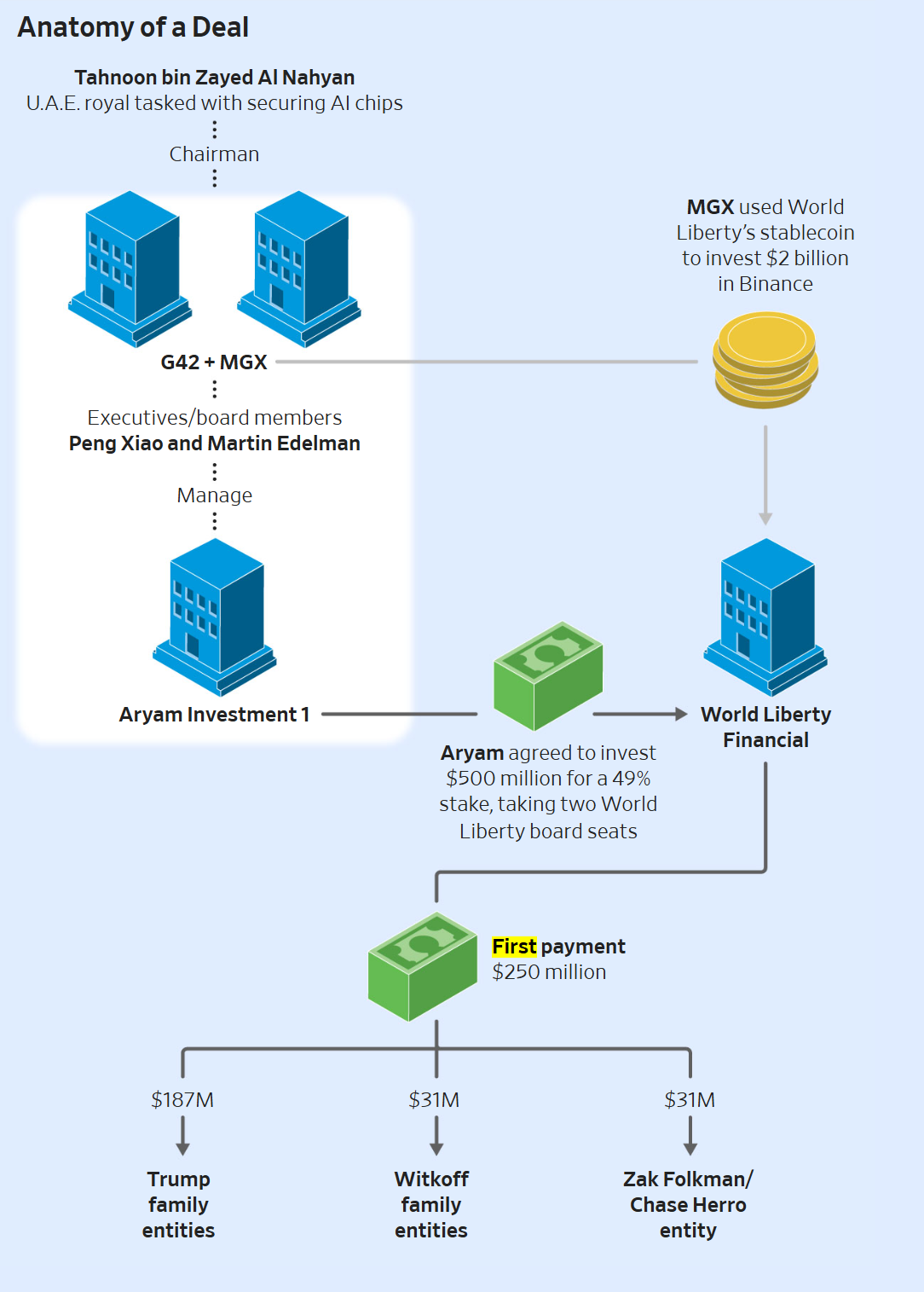

The core of the transaction involved Aryam Investment 1, an entity based in Abu Dhabi and notably backed by Sheikh Tahnoon bin Zayed Al Nahyan, a prominent figure in the United Arab Emirates. Aryam Investment 1 formally signed an agreement in January 2025 to purchase a 49% stake in World Liberty Financial for a staggering $500 million. The Wall Street Journal, which broke the story, cited internal documents and individuals familiar with the confidential matter, underscoring the secretive nature of the deal. A significant portion of this investment, specifically half of the agreed-upon amount, was paid upfront. This initial payment included a considerable sum of $187 million that flowed directly into entities controlled by the Trump family. Additionally, tens of millions of dollars were directed to entities linked to the co-founders of World Liberty Financial, among whom are relatives of Steve Witkoff, who serves as the U.S. Middle East envoy. The agreement itself was reportedly signed by Eric Trump, further cementing the Trump family’s direct involvement in the deal. Despite the substantial financial and political implications, the transaction had not been publicly disclosed by the parties involved, even though World Liberty Financial later revealed a sharp decrease in the Trump family’s overall stake in the company.

The timing of this investment is particularly salient, occurring on the cusp of a new political era in the United States, and it intertwines with Sheikh Tahnoon bin Zayed Al Nahyan’s ambitious strategic goals. As the brother of the United Arab Emirates president and the country’s national security adviser, Sheikh Tahnoon has been a central architect of Abu Dhabi’s aggressive push to establish itself as a global leader in artificial intelligence (AI) and advanced technology. Under the previous Biden administration, these efforts to secure cutting-edge U.S.-made AI chips faced considerable limitations. Concerns were frequently raised that sensitive dual-use technology could potentially be diverted to China, especially through companies like G42, a UAE-based AI firm closely associated with Tahnoon.

However, the political landscape shifted dramatically following Donald Trump’s election. Sheikh Tahnoon’s strategic endeavors in AI gained significant momentum. He reportedly held multiple meetings with President Trump and other senior U.S. officials. Within a mere few months of these engagements, the new administration committed to granting the UAE access to hundreds of thousands of advanced AI chips annually—a substantial and strategic concession that marked a clear departure from the previous administration’s more cautious approach. This development underscores the potential for political influence to shape technological access and strategic partnerships on a global scale.

Further enriching the complexity of this financial arrangement, the Journal’s report indicated that executives from G42 played an active role in managing Aryam Investment 1. As part of the deal, these executives also secured board seats at World Liberty Financial, effectively making Aryam the startup’s single largest outside shareholder. This integration of G42 personnel into World Liberty Financial’s governance structure further strengthens the ties between Sheikh Tahnoon’s strategic AI ambitions and the Trump-linked crypto venture. Moreover, weeks before the landmark U.S.-UAE chip framework was officially announced, another firm led by Sheikh Tahnoon, MGX, utilized World Liberty Financial’s stablecoin to facilitate a massive $2 billion investment into Binance, one of the world’s largest cryptocurrency exchanges. This sequence of events suggests a carefully orchestrated series of financial maneuvers and strategic alignments that converged around the change in U.S. leadership.

Amidst the swirling allegations and the appearance of potential conflicts of interest, both World Liberty Financial and the White House have issued strong denials of any wrongdoing. Spokespeople for both entities informed The Wall Street Journal that President Trump was not involved in the specifics of the deal and that the transaction did not provide any undue influence over U.S. policy decisions. These denials aim to decouple the private financial dealings of the Trump family from the official foreign policy and national security decisions of the U.S. government.

Nevertheless, the controversy surrounding World Liberty Financial extends beyond the scope of this particular investment. Last year, a group of prominent Democratic senators, including Elizabeth Warren and Jack Reed, publicly called on U.S. authorities to launch a thorough investigation into alleged links between World Liberty Financial’s token sales and various sanctioned foreign actors. In a pointed letter dispatched in November to both the Justice Department and the Treasury Department, the senators cited claims that WLFI governance tokens had been purchased by blockchain addresses purportedly tied to North Korea’s notorious Lazarus Group. Furthermore, the letter highlighted alleged connections to entities linked to Russia and Iran, raising serious national security concerns about the potential for illicit finance and circumvention of sanctions through the cryptocurrency platform.

The senators’ apprehension is significantly heightened by World Liberty Financial’s unique ownership structure, which, according to their assertions, grants Trump family-linked entities control over the majority of the revenue generated from token sales. This arrangement, lawmakers argue, creates a direct and undeniable conflict of interest. The concern is that a substantial portion of the proceeds from the company’s token sales flows directly into the pockets of the president’s family, thereby potentially incentivizing decisions or policies that could benefit their financial interests rather than the national interest. Such a structure raises profound ethical questions about transparency, accountability, and the potential for private gain to influence public office.

The confluence of a high-value, quietly executed international investment, the involvement of a powerful foreign dignitary with significant geopolitical aspirations, and a cryptocurrency firm linked to a sitting U.S. president creates a complex web of financial and political implications. The lack of initial public disclosure for such a significant deal involving the family of a president, coupled with the subsequent allegations of ties to sanctioned entities and the inherent conflict of interest in the revenue structure, has fueled intense scrutiny. As lawmakers push for deeper investigations and greater transparency, this case highlights the growing challenges in regulating the opaque world of cryptocurrency, particularly when it intersects with high-stakes international politics and the personal finances of public figures. The full ramifications of this intricate deal and its potential impact on U.S. foreign policy, national security, and the integrity of its political processes remain subjects of ongoing debate and investigation.