The financial world is abuzz following former US President Donald Trump’s nomination of Kevin Warsh to potentially lead the US central bank, a move that has immediately sparked a complex array of reactions and sent decidedly mixed signals across cryptocurrency markets and the broader landscape of US dollar liquidity. This pivotal selection, if approved by the Senate, would see Warsh replace the incumbent Jerome Powell when his term concludes in May, ushering in a new era for monetary policy at a critical juncture for both traditional and nascent digital asset economies.

Kevin Warsh, a former Federal Reserve governor, comes to the fore with a reputation for being "Bitcoin-friendly" – a label that in itself hints at a more progressive stance towards digital assets than often seen in traditional central banking circles. His potential appointment is widely interpreted as signaling a continuation, or even an acceleration, of interest rate cut trajectories, aligning with persistent political pressure for lower borrowing costs. However, this seemingly straightforward interpretation is complicated by Warsh’s known skepticism regarding the expansion of the Fed’s balance sheet, a stance that suggests broader market liquidity might stabilize rather than meaningfully expand.

According to Thomas Perfumo, a global economist at the prominent cryptocurrency exchange Kraken, this nuanced outlook creates a "mixed macro backdrop for Bitcoin and crypto," which are inherently sensitive to overall liquidity conditions. Perfumo elaborated to Cointelegraph that this sensitivity is "perhaps moreso than changes to the Fed Funds Rate," highlighting the profound impact of the central bank’s balance sheet policy on risk assets. Investors, therefore, face a dichotomy: while lower interest rates might generally be seen as supportive of asset prices, Warsh’s "skeptical posture on balance sheet expansion" could temper enthusiasm. This skepticism extends to measures like quantitative easing (QE), a policy involving large-scale bond-buying designed to lower borrowing costs and stimulate economic activity by injecting liquidity into the financial system. Conversely, a contraction of the balance sheet, known as quantitative tightening (QT), removes liquidity, often leading to tighter financial conditions.

The timing of this nomination adds another layer of complexity, coming shortly after cryptocurrency markets experienced a significant downturn, shedding an estimated $250 billion in market capitalization over a single weekend. This crypto sell-off was not an isolated event, occurring amidst a wider retrenchment across global stock markets and even precious metals, suggesting a systemic rather than crypto-specific trigger. Influential analyst Raoul Pal has previously attributed such broad market corrections to a "US liquidity drought," arguing that a tightening of the money supply and credit availability is a primary driver behind crashes in both crypto and equities, rather than specific events within the digital asset space.

Nic Puckrin, an investment analyst and co-founder of the educational platform Coin Bureau, echoed this sentiment, directly linking Warsh’s nomination to intensified liquidity concerns among investors. Puckrin told Cointelegraph that "markets are digesting Warsh’s views on future Fed policy – most notably the central bank’s balance sheet, which he says is ‘trillions larger’ than it needs to be." This statement is a powerful indicator of Warsh’s potential approach, suggesting a strong inclination towards quantitative tightening. If he were to implement policies aimed at shrinking the Fed’s balance sheet, Puckrin warned, "markets will have to reckon with a lower-liquidity environment – a backdrop that isn’t supportive of either risk assets or precious metals."

The Federal Reserve, as the US central bank, wields immense power over the nation’s economy through its monetary policy tools, primarily the federal funds rate and the size of its balance sheet. Its dual mandate is to achieve maximum employment and stable prices (low inflation). The Fed Chair, nominated by the President and confirmed by the Senate, is the most powerful economic official in the US, shaping policy that affects everything from mortgage rates to global trade. Historical precedents show that the philosophy of the Fed Chair profoundly impacts market behavior. For instance, Paul Volcker’s aggressive interest rate hikes in the early 1980s crushed inflation but also triggered a recession, while Alan Greenspan’s long tenure saw periods of sustained growth and financial innovation. The post-2008 era, under Bernanke and Yellen, was characterized by unprecedented quantitative easing to combat the financial crisis, demonstrating the Fed’s capacity for large-scale balance sheet expansion. Warsh’s potential appointment signals a departure from this recent trend, leaning towards a more restrictive approach to monetary supply.

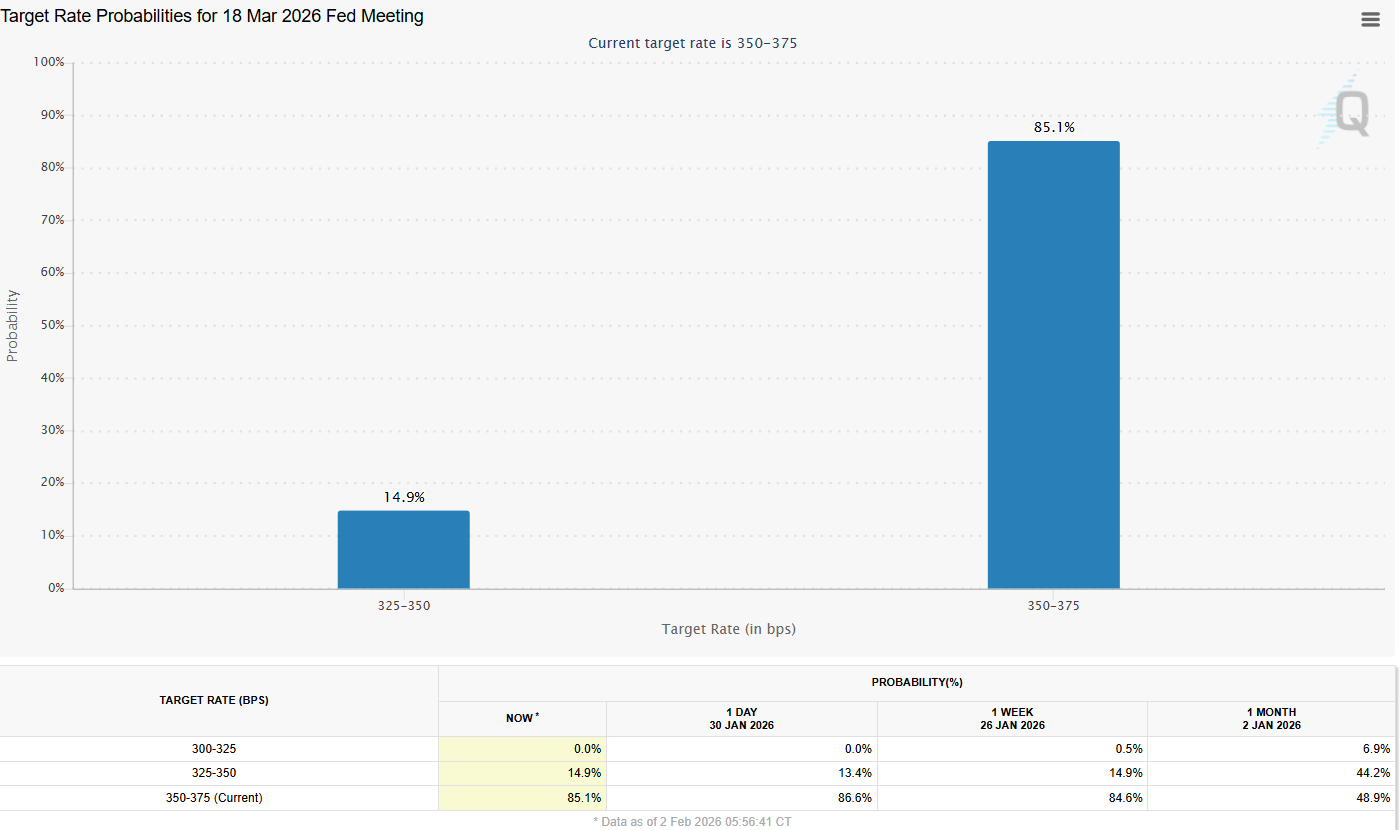

A crucial point of contention remains Warsh’s stance on interest rates and the extent to which he might "align himself" with Trump’s well-documented desire for significantly lower rates. While a new Fed Chair often tries to assert independence, the political dynamic is undeniable. Interestingly, despite the significant implications of Warsh’s nomination for liquidity, market expectations for interest rate policy have remained relatively stable in the immediate aftermath. Data from the CMEGroup’s FedWatch tool indicates that approximately 85% of market participants anticipate rates to remain steady at the next Federal Open Market Committee (FOMC) meeting on March 18. Looking further ahead to the June 17 meeting – which would be the first FOMC meeting after Powell’s term ends in May – 49% of participants still expect a 25 basis-point interest rate cut, a modest increase from 46% the previous week. This suggests that while concerns about liquidity tightening are palpable, the market is still pricing in some degree of rate reduction, perhaps banking on the political pressure from the White House.

The "Bitcoin-friendly" aspect of Warsh’s profile warrants closer examination. While the original article does not detail specific statements, a "Bitcoin-friendly" central banker might be interpreted as someone who acknowledges the innovation and potential of digital assets, perhaps even viewing them as a necessary evolution in financial markets. Such a stance could influence the regulatory landscape for cryptocurrencies, fostering an environment that is more open to their integration into the traditional financial system, or at least one less inclined to outright hostility or excessive restrictions. This perspective, however, stands in contrast to the potential tightening of overall liquidity, creating a complex push-pull dynamic for the crypto market. On one hand, a more understanding Fed Chair could pave the way for clearer regulatory frameworks and institutional adoption; on the other, a shrinking money supply could reduce the speculative capital that often fuels crypto rallies.

In essence, Warsh’s potential leadership presents a multifaceted challenge for investors. A tightening of US dollar liquidity, driven by a reduction in the Fed’s balance sheet, typically strengthens the dollar but also makes capital more expensive and less abundant for risk assets. This "lower-liquidity environment" could prove challenging for assets like Bitcoin, which have historically thrived during periods of ample money supply. While the prospect of continued interest rate cuts might offer some support, the overarching narrative emerging from Warsh’s views is one of fiscal prudence and a potential recalibration of the Fed’s expansive post-crisis monetary policy. The global economic implications are also significant; as the world’s reserve currency, US dollar liquidity conditions ripple across international markets, affecting everything from emerging market debt to commodity prices. Investor sentiment will undoubtedly remain highly sensitive to any signals emanating from the Fed regarding its future balance sheet and interest rate strategies.

Ultimately, Trump’s nomination of Kevin Warsh sends a series of conflicting signals that demand careful interpretation. The possibility of lower interest rates, a desire often articulated by the former president, clashes with Warsh’s documented skepticism towards an expanded balance sheet, which would naturally lead to tighter liquidity. For Bitcoin and the broader cryptocurrency market, this means navigating an environment where a potentially "friendly" regulatory disposition might be offset by a less supportive macro-liquidity backdrop. The coming months will be crucial as markets grapple with these uncertainties, anticipating Senate confirmation and the articulation of a clear monetary policy vision under a potentially new Fed Chair.