A seasoned cryptocurrency trader, operating under the pseudonym Vida, reported a staggering profit of approximately $1 million on New Year’s Day, achieved by astutely capitalizing on what they described as "abnormal" trading behavior emanating from a suspected market maker account on the global cryptocurrency exchange, Binance. This unusual incident, which unfolded during the early hours of Thursday morning in Asia, has ignited fervent discussions across social media, prompting both suspicion and a formal internal review from Binance.

Vida, an investor active on the social media platform X (formerly Twitter), meticulously documented their observations and trading activities, pointing to a low-liquidity token named BROCCOLI714 on the BNB Chain as the epicenter of this anomalous market event. The memecoin, reportedly inspired by Binance co-founder Changpeng Zhao’s pet dog, experienced an abrupt and significant price surge, followed almost immediately by an equally sharp reversal. This volatile oscillation, according to Vida, was directly attributable to unusually large spot buy orders appearing repeatedly on Binance’s order book, defying conventional market-making logic.

"I figured it had to be either a hacked account or a bug in the market-making program, because no whale would be dumb enough to do charity like that," a machine translation of Vida’s insightful post conveyed, encapsulating the perplexing nature of the activity. The sheer volume and seemingly indiscriminate nature of these buy orders suggested a malfunction or compromise rather than a deliberate, profit-seeking strategy from a sophisticated market participant. Market makers typically aim to profit from the spread between bid and ask prices, maintaining liquidity without causing dramatic price swings against their own positions. The "charity pumping" described by Vida implies an entity buying aggressively at rising prices, effectively providing exit liquidity for others, a behavior antithetical to a rational market maker’s objectives.

Vida’s success was not merely a stroke of luck but the result of a well-honed, automated trading strategy designed to exploit market inefficiencies. The trader relied on a sophisticated system of automated alerts, configured to detect rapid price movements and significant divergences between spot market prices and perpetual futures contract prices. When the suspected market maker’s relentless spot buying began to drive BROCCOLI714’s price upwards, creating a premium over its futures counterpart, Vida’s automated system initiated long positions, riding the upward momentum. This phase required swift execution and robust infrastructure to enter trades before the price appreciation fully normalized.

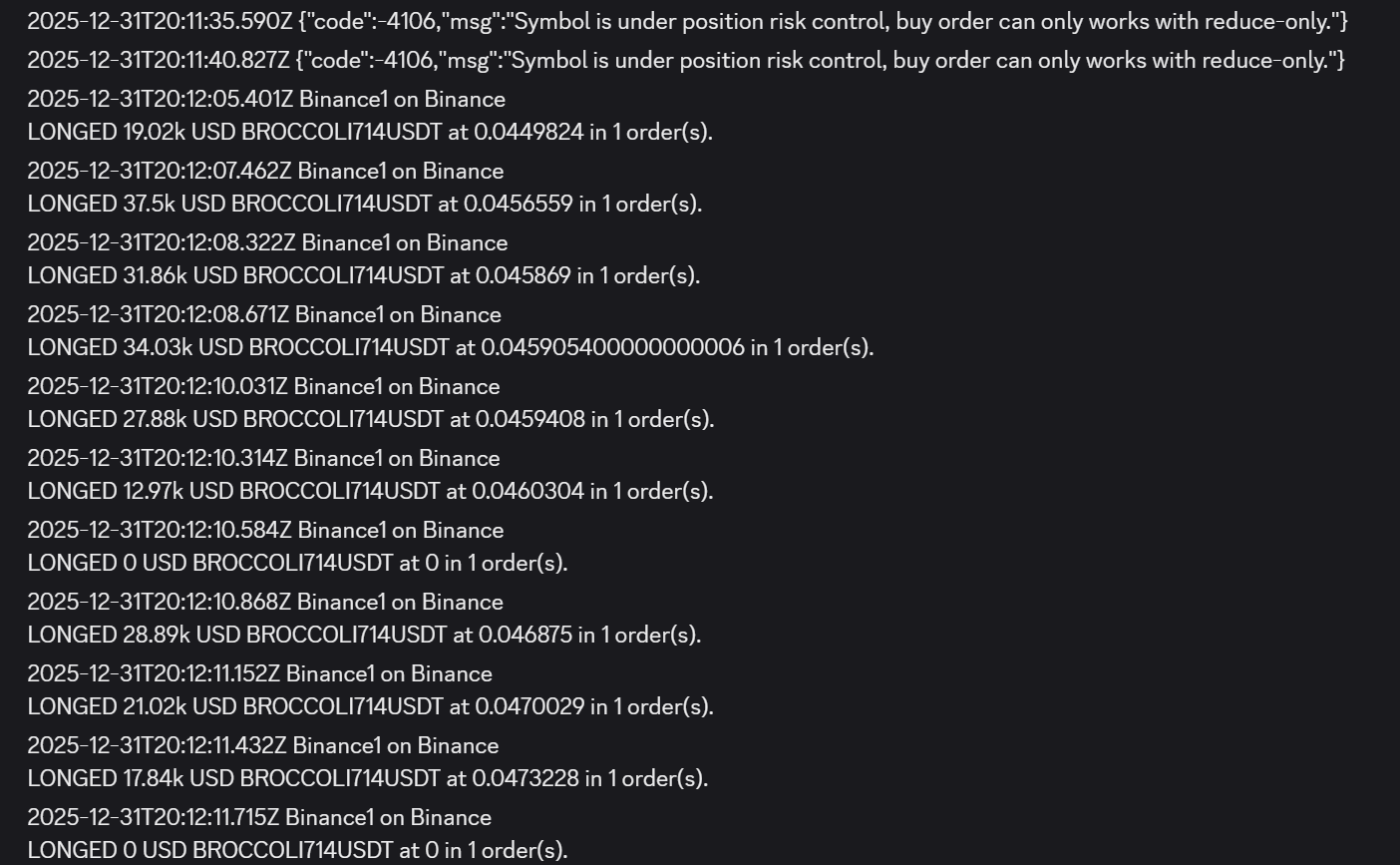

However, the strategy’s genius lay in its dynamic reversal. As the intensity of the spot buying pressure waned and the market began to digest the massive influx of orders, the price inevitably started to correct. Concurrently, the liquidity in the futures market, which had initially lagged the spot surge, began to normalize, often offering a more efficient price reflection. At this critical juncture, Vida swiftly transitioned from long to short positions, capitalizing on the subsequent price decline as the market corrected itself. This arbitrage strategy, exploiting the temporary dislocation between spot and perpetual markets, allowed Vida to profit from both the ascent and the subsequent descent of the token’s price, culminating in the reported $1 million gain. The trading execution log shared by Vida showcased a flurry of automated order attempts and fills on the BROCCOLI714USDT perpetual contract, illustrating the high-frequency nature of the trades.

The unusual market behavior quickly became a hot topic on social media platforms, with many users speculating that a hack might be responsible for the erratic trading patterns. Given the magnitude of the orders and the irrationality of the suspected market maker’s actions, a security breach seemed a plausible explanation to many observers. However, Binance was quick to address these concerns. In an official statement provided to Cointelegraph, a Binance spokesperson acknowledged the widespread online discussions surrounding the BROCCOLI714 price movement and confirmed that the exchange had initiated an internal review.

Crucially, the spokesperson emphatically denied any indication of a hack or security breach: "Based on initial system checks, Binance’s risk controls and security mechanisms are operating as intended," the spokesperson affirmed. "At this stage, there is no indication of a platform security breach or hacker activity, and we have not received reports of account compromise through our customer support or key client channels." This statement aimed to reassure users about the integrity of the platform, yet it simultaneously deepened the mystery surrounding the true nature of the "abnormal" activity. If not a hack, then what could explain such a seemingly irrational series of trades involving "tens of millions of [USDT]" in spot purchases?

Vida, despite Binance’s denial, remained unconvinced that the pattern was normal. "I don’t know what’s going on either; how could someone use tens of millions of [USDT] in spot to do charity pumping," the investor reiterated, reflecting the broader perplexity within the trading community. This persistent skepticism underscores the difficulty in reconciling Binance’s assurances with the observable market data. Possible alternative explanations for such behavior, if not a hack or a bug, could include a "fat finger" error (a human mistake in order entry), a highly unusual and perhaps experimental market-making strategy that went awry, or even a deliberate but poorly executed attempt at market manipulation. The low liquidity of BROCCOLI714 would make it particularly susceptible to large orders, amplifying the impact of any such anomaly.

The BROCCOLI714 incident also casts a spotlight on the burgeoning memecoin ecosystem, particularly its resurgence on the BNB Chain in 2025. Memecoins, often characterized by their community-driven nature, viral marketing, and lack of inherent utility, have become a recurring theme, with many inspired by Binance co-founder Changpeng Zhao’s pet dog, Broccoli. The BNB Chain itself witnessed a significant uptick in activity throughout 2025, positioning itself as one of the industry’s most active and dynamic networks.

At the start of 2025, the BNB Chain recorded fewer than 1 million daily active addresses. However, this narrative underwent a dramatic shift as the year progressed, largely fueled by a burgeoning memecoin boom that began to rival, and in some aspects, surpass the interest observed in similar tokens on the Solana blockchain. By mid-September, data from Nansen, a blockchain analytics firm, indicated that BNB Chain’s active address count had climbed to levels comparable with Solana’s, marking a significant milestone in its competitive landscape. This growth trajectory continued unabated, with BNB Chain reaching over 2.6 million daily active users by New Year’s Eve, solidifying its position as the second-ranked blockchain overall in both active addresses and transaction volume for the year.

This surge in activity, heavily propelled by the speculative fervor surrounding memecoins, creates a fertile ground for both immense profits and significant risks. The low-liquidity nature of many memecoins, like BROCCOLI714, makes them highly volatile and susceptible to large orders, whether intentional or accidental. While this volatility presents opportunities for agile traders like Vida, it also poses considerable risks for less experienced participants who might be caught in rapid price swings. The incident on Binance, irrespective of its underlying cause, serves as a vivid illustration of the complex interplay between automated trading, market dynamics, and the inherent volatility of the cryptocurrency market, particularly within the memecoin sector. It highlights the constant need for vigilance, sophisticated tools, and a deep understanding of market mechanics to navigate these rapidly evolving digital financial landscapes. The investigation by Binance will be crucial in understanding if this was an isolated anomaly or indicative of broader issues that need addressing within the exchange’s vast and complex trading environment.