Mirae Asset’s Bold Move into Crypto with Korbit Acquisition

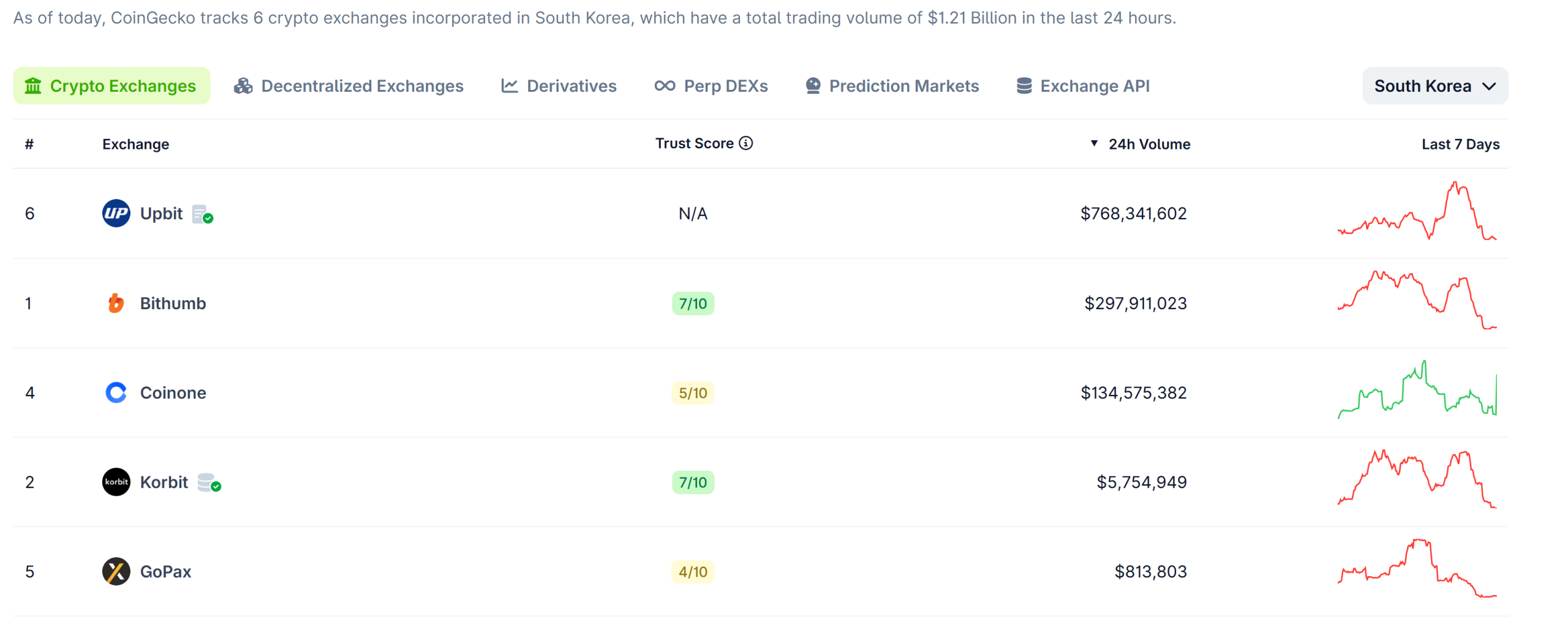

In a development poised to send ripples across both traditional finance and the digital asset sector, South Korea’s Mirae Asset Group, a colossal financial powerhouse with an estimated $600 billion in assets under management, is reportedly in negotiations to acquire Korbit, the nation’s fourth-largest cryptocurrency exchange. The potential deal, valued at approximately 100 billion to 140 billion Korean won (roughly $70 million to $100 million), signifies a strategic pivot by a major institutional player into the rapidly evolving world of digital currencies. This move would be spearheaded by Mirae Asset Consulting, a non-financial affiliate of the group, which has reportedly secured a memorandum of understanding (MOU) with Korbit’s principal shareholders.

Korbit is predominantly owned by NXC, the parent company of gaming giant Nexon, and its subsidiary Simple Capital Futures, collectively holding about 60.5% of the exchange. Additionally, SK Square, a prominent investment arm of SK Group, controls a substantial 31.5% stake. The proposed acquisition highlights Korbit’s intrinsic value, particularly its robust regulatory compliance infrastructure and its coveted full operating license in South Korea. In a market known for its stringent regulatory environment, such a license is a golden ticket, offering a legitimate and secure entry point for a traditional financial group like Mirae Asset seeking regulated exposure to the digital asset ecosystem. This acquisition could provide Mirae Asset with immediate access to a user base, trading technology, and a compliant platform, bypassing the arduous process of building a crypto exchange from the ground up or navigating complex regulatory hurdles independently. For Korbit, aligning with a financial behemoth like Mirae Asset could unlock significant capital injection, enhance its market reach, and potentially integrate its crypto services with Mirae Asset’s extensive portfolio of traditional financial products, from asset management to securities and insurance. This synergy could create a powerful hybrid entity capable of bridging the gap between conventional finance and the burgeoning digital economy, setting a precedent for similar institutional mergers and acquisitions globally.

Institutional Staking Surges as Bitmine Deposits $219M in ETH

The institutional adoption of cryptocurrencies extends beyond acquisitions, as evidenced by Ethereum treasury firm Bitmine’s significant foray into staking its Ether (ETH) holdings. Bitmine, identified as one of the largest Ethereum treasury companies, has deposited nearly $219 million worth of ETH into Ethereum’s Proof-of-Stake (PoS) system. This substantial move, involving 74,880 ETH transferred to a designated "BatchDeposit" contract, marks Bitmine’s first venture into staking, a practice that allows holders to earn rewards by helping secure the network. On-chain data from Arkham intelligence and analysis by EmberCN reveal this pattern, characteristic of institutional-grade staking setups designed to aggregate funds efficiently for validator creation.

Ethereum’s transition to a Proof-of-Stake consensus mechanism with "The Merge" fundamentally altered its economic model, moving away from energy-intensive mining to a system where participants "stake" their ETH to validate transactions and secure the network. This shift offers several advantages, including significantly reduced energy consumption, enhanced security, and the ability for ETH holders to earn passive income through staking rewards. For an entity like Bitmine, which reportedly holds a staggering 4.066 million ETH, the decision to stake is a strategic one, aimed at generating interest income from its vast digital asset reserves. At an approximate annual percentage yield (APY) of 3.12%, Bitmine stands to earn around 126,800 ETH annually if its entire holding were staked. At current prices (around $2,927 per ETH at the time of the analysis), this translates to a potential annual income of over $371 million, representing a highly attractive yield compared to many traditional financial instruments. This institutional embrace of staking not only diversifies Bitmine’s revenue streams but also contributes to the overall security and decentralization of the Ethereum network, underscoring the growing maturity and appeal of PoS for large-scale investors seeking sustainable returns in the digital asset space.

Ethereum’s Ecosystem Poised for "10X" Growth, Predicts Sharplink CEO

The bullish sentiment surrounding Ethereum extends beyond staking rewards, with Sharplink Gaming’s co-CEO Joseph Chalom making a bold prediction: Ethereum’s Total Value Locked (TVL) could skyrocket ten-fold by 2026. TVL, a critical metric representing the total value of all digital assets locked within a decentralized finance (DeFi) protocol or blockchain, serves as a key indicator of a network’s adoption and economic activity. Sharplink Gaming itself is a significant player in the Ethereum ecosystem, ranking as the second-largest public Ethereum treasury company with holdings of 797,704 ETH, valued at approximately $2.33 billion. Chalom’s optimistic forecast is rooted in several converging trends, primarily the explosive growth anticipated in the stablecoin market.

Chalom predicts the stablecoin market capitalization will hit $500 billion by the end of next year (likely referring to 2025 or 2026, given the report’s timeframe), a significant jump from its current approximate $308.46 billion. Ethereum is already the dominant platform for stablecoin activity, hosting over 54% of the total stablecoin market. A substantial increase in stablecoin market cap directly translates to higher TVL on Ethereum, as stablecoins are extensively used as collateral, liquidity, and payment rails within DeFi applications. Beyond stablecoins, the predicted "10X" surge in TVL would also be fueled by the continued expansion of various DeFi sectors, including decentralized exchanges (DEXs), lending and borrowing protocols, liquid staking solutions, and the burgeoning trend of real-world asset (RWA) tokenization. As institutional investors, such as Mirae Asset, increasingly enter the digital asset space, they are expected to engage with these DeFi protocols, further locking capital and driving TVL upwards. Moreover, the continuous development and adoption of Ethereum Layer 2 scaling solutions (like Arbitrum, Optimism, zkSync, and Starknet) enhance the network’s capacity and reduce transaction costs, indirectly contributing to the overall TVL of the broader Ethereum ecosystem by enabling more users and applications to interact efficiently. While a ten-fold increase is ambitious, it reflects a growing confidence among industry leaders in Ethereum’s foundational role as the backbone for the future of decentralized finance and tokenized economies, contingent on sustained market growth, regulatory clarity, and technological innovation.

US Regulatory Landscape: Lummis Aims to End "Operation Chokepoint 2.0"

While South Korea sees traditional finance embracing crypto through acquisitions, the regulatory landscape in the United States continues to be a battleground, with concerns persisting over what many in the crypto industry term "Operation Chokepoint 2.0." This refers to the alleged informal pressure exerted by federal banking regulators, including the Federal Reserve, the Federal Deposit Insurance Corporation (FDIC), and the Office of the Comptroller of the Currency (OCC), on commercial banks to limit or sever relationships with crypto-related businesses. This pressure has reportedly made it exceedingly difficult for crypto companies to access essential banking services, effectively "choking off" their access to the traditional financial system.

A prominent voice advocating for regulatory clarity and fairness for the digital asset industry is US Senator Cynthia Lummis. A staunch proponent of cryptocurrency, Senator Lummis has been vocal about the detrimental impact of "Operation Chokepoint 2.0" on innovation and competition within the US. She believes that a potential solution lies in the Federal Reserve’s "skinny" accounts, which refer to direct master accounts at the Federal Reserve that certain non-bank financial institutions could potentially access. By providing direct access to the Fed, these "skinny" accounts could bypass the commercial banking system, thereby alleviating the pressure on crypto firms to secure banking relationships with institutions that may be wary of regulatory scrutiny. This move could empower crypto companies with direct access to payment rails and financial services, fostering a more level playing field and reducing the perceived regulatory risk associated with serving the crypto industry. The ongoing debate highlights a significant divergence in regulatory approaches globally, with some jurisdictions like South Korea developing clear frameworks that facilitate institutional entry, while others like the US grapple with how to integrate digital assets into existing financial structures without stifling innovation or creating undue risk. Senator Lummis’s efforts underscore a persistent push within the US political sphere to establish a more transparent and accommodating regulatory environment for the burgeoning digital asset economy.

In conclusion, today’s crypto news paints a vibrant picture of an industry undergoing rapid institutionalization and technological evolution. Mirae Asset’s potential acquisition of Korbit signifies a crucial step in bridging traditional finance with digital assets, particularly within a regulated environment like South Korea. Simultaneously, the substantial ETH staking by Bitmine highlights the growing sophistication of institutional engagement with decentralized finance and the attractive yield opportunities presented by Ethereum’s Proof-of-Stake mechanism. These developments, coupled with Sharplink CEO Joseph Chalom’s optimistic forecast for Ethereum’s TVL, suggest a robust growth trajectory for the entire ecosystem. However, these advancements are not without their challenges, as evidenced by the ongoing regulatory debates in the US concerning banking access for crypto firms, underscoring the critical need for clear, consistent, and forward-thinking policies to foster sustainable innovation in the global digital economy.