With the winter holiday season rapidly approaching, this past week was likely the final major burst of funding announcements for 2025, culminating in an exceptionally active period for the venture capital landscape. This week’s top 10 rounds alone collectively amassed over $6 billion, underscoring a robust end-of-year appetite for innovation, particularly in critical sectors like data, security, and energy. The venture market, often characterized by its cyclical nature, appears to be concluding 2025 on a high note, with investors pouring substantial capital into companies poised for significant disruption and growth.

While the broader economic climate has seen its share of fluctuations throughout the year, the sustained interest in transformative technologies remains undimmed. This week’s deals highlight a prevailing trend: investors are increasingly focused on businesses that promise fundamental shifts in how industries operate, whether through advanced AI, enhanced cybersecurity, or groundbreaking energy solutions. The emphasis on high-impact, scalable ventures suggests a strategic pivot towards long-term value creation rather than short-term gains, a healthy indicator for the venture ecosystem as it transitions into a new year.

Leading the charge by a substantial margin was Databricks, the perennial recipient of megadeals, securing an eye-popping $4 billion in Series L funding. This extraordinary raise, at a staggering $134 billion valuation, solidifies its position as a titan in the data and AI space. Following in its wake were Cyera, an innovator in AI-enabled data security, and Radiant, a pioneer in nuclear microreactors, both commanding significant investments that underscore the strategic importance of their respective fields. The remaining spots on the list were filled by diverse startups spanning healthcare, biotech, fintech, and advanced AI hardware, painting a comprehensive picture of where venture capital is currently flowing. This collection of funding rounds not only provides a snapshot of the week’s most lucrative deals but also serves as a barometer for the technological and economic trends shaping the future.

Here’s a detailed breakdown of the week’s biggest funding rounds:

-

Databricks, $4B, Data and AI: San Francisco-headquartered Databricks, a 12-year-old powerhouse in the data and AI sector, made headlines with its announcement of raising over $4 billion in a Series L financing round. This monumental investment valued the company at an astonishing $134 billion, reflecting immense investor confidence in its platform and future trajectory. The round was spearheaded by an impressive consortium of leading investors including Insight Partners, Fidelity, and J.P. Morgan Asset Management. Databricks’ success is deeply rooted in its unified data and AI platform, which enables organizations to consolidate their data warehousing and data lake operations into a single "lakehouse" architecture. This innovative approach helps businesses manage vast amounts of data, run advanced analytics, and build machine learning models with greater efficiency and scalability. The company further revealed its financial prowess, crossing a $4.8 billion revenue run-rate in its third quarter, demonstrating over 55% year-over-year growth. This consistent growth, coupled with the massive capital injection, positions Databricks to further expand its global footprint, accelerate product development, and continue to dominate the rapidly evolving landscape of enterprise AI and data management. Its continued ability to attract such substantial funding rounds, even in a more cautious venture market, speaks volumes about its critical role in the digital transformation journeys of countless enterprises worldwide.

-

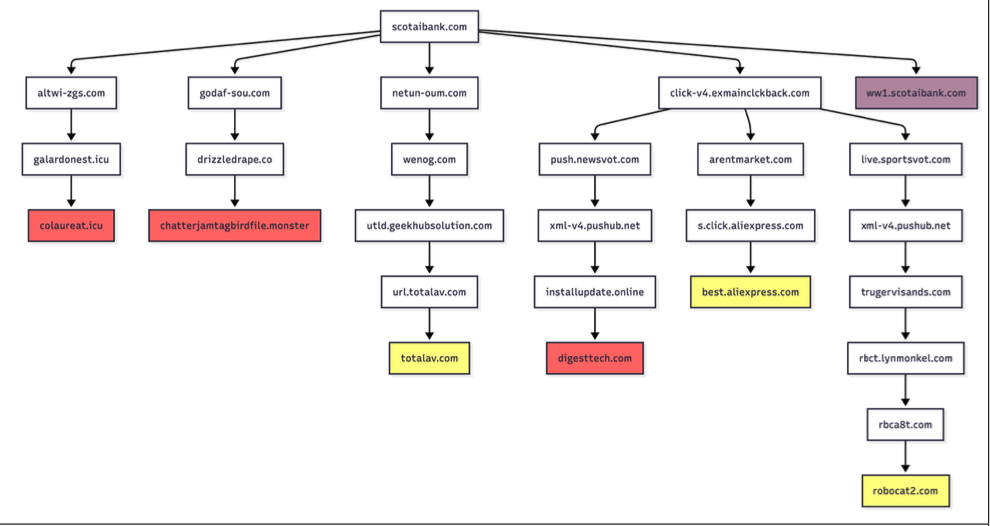

Cyera, $400M, Cybersecurity: New York-based Cyera, a rising star in the cybersecurity domain, reportedly secured a hefty $400 million in a funding round led by the formidable Blackstone Group, valuing the company at $9 billion. This significant investment underscores the escalating demand for advanced data security solutions, particularly those leveraging artificial intelligence. Cyera’s AI-enabled data security platform is designed to help organizations understand, classify, and protect their sensitive data across various environments, including cloud, on-premises, and SaaS applications. In an era of ever-increasing cyber threats and stringent data privacy regulations, Cyera’s ability to provide a comprehensive and automated approach to data security is proving invaluable. The four-year-old company has rapidly accumulated a total funding of $1.7 billion, a testament to its innovative technology and the urgent market need for its offerings. Blackstone’s leadership in this round signals a strong belief in Cyera’s potential to become a foundational pillar in enterprise data protection strategies, driving its expansion into new markets and further enhancing its platform capabilities to combat sophisticated cyberattacks.

-

Radiant, $300M, Nuclear Power: El Segundo, California-based Radiant is at the forefront of a potential energy revolution with its development of portable nuclear microreactors. The company announced the closure of over $300 million in Series D funding, led by prominent investors Draper Associates and Boost VC. Radiant’s vision is to make nuclear energy more accessible, flexible, and scalable by designing compact, modular reactors that can be deployed for various applications, from powering remote communities to supporting industrial operations. This innovative approach addresses critical challenges in energy security and decarbonization. The investment highlights a growing recognition of nuclear power’s role in a sustainable energy future, especially with advancements in small modular reactor (SMR) technology. Radiant’s plans to break ground on a factory in Oak Ridge, Tennessee, early next year, further demonstrate its commitment to scaling production and bringing its microreactors to market. This move could signify a major step towards decentralizing energy production and providing clean, reliable power where it’s needed most, marking a significant milestone for the nuclear industry.

-

Tebra, $250M, Healthcare Software: Corona del Mar, California-based Tebra, a leading provider of patient record software for healthcare private practices, announced a substantial $250 million in equity and debt financing. The round was strategically designed to fuel the company’s investments in artificial intelligence and automation, areas poised to revolutionize healthcare administration. Hildred Capital Management led the equity portion, which constituted the majority of the funding, while JP Morgan provided the debt financing. Tebra’s platform helps private practices streamline their operations, from patient scheduling and electronic health records (EHR) to billing and payment processing. By integrating AI and automation, Tebra aims to reduce administrative burdens on healthcare providers, improve efficiency, and enhance the patient experience. This investment reflects the ongoing digital transformation within the healthcare sector, with a particular focus on empowering independent practices to compete and thrive in an increasingly complex environment. The capital will enable Tebra to accelerate its product development, expand its market reach, and solidify its position as a vital technology partner for healthcare professionals.

-

(tied) Imprint, $150M, Fintech: New York-based Imprint, a disruptor in the fintech space, successfully raised $150 million in Series D funding, achieving a valuation of $1.2 billion. Khosla Ventures led this round, with strong participation from other notable investors including Thrive Capital, Ribbit Capital, Kleiner Perkins, Hedosophia, and Timeless. Imprint specializes in providing credit cards affiliated with consumer brands, offering a unique value proposition that combines financial services with brand loyalty. This model allows brands to offer customized credit products that deepen customer engagement and provide enhanced rewards, while Imprint handles the underlying financial infrastructure. In a competitive fintech market, Imprint’s ability to forge strong partnerships with consumer brands and deliver innovative financial products has set it apart. The new capital will be instrumental in scaling its platform, expanding its network of brand partners, and further developing its technological capabilities to deliver seamless and rewarding credit experiences to consumers. The strong investor backing at a unicorn valuation highlights the market’s belief in Imprint’s potential to redefine brand-consumer financial relationships.

-

(tied) HawkEye 360, $150M, Satellite Intelligence: Herndon, Virginia-based HawkEye 360, a leader in satellite intelligence, secured $150 million in Series E equity and debt financing. NightDragon and Center15 Capital co-led the equity funding, with Silicon Valley Bank providing the debt component. HawkEye 360 operates a constellation of satellites designed to detect, geolocate, and characterize radio-frequency (RF) emissions across the globe. This unique capability provides critical insights for a range of applications, including maritime domain awareness, illegal fishing detection, spectrum interference monitoring, and national security. By identifying and tracking RF signals, the company offers an unparalleled layer of intelligence that complements traditional satellite imagery. This investment will enable HawkEye 360 to further expand its constellation, enhance its analytics platform, and broaden its service offerings to both government and commercial clients. The company also announced the completion of its strategic acquisition of Innovative Signal Analysis, a move that will likely bolster its technical expertise and data processing capabilities, solidifying its position as a key player in the burgeoning space-based intelligence market.

-

Chai Discovery, $130M, Biotech and AI: San Francisco-based Chai Discovery, a pioneering startup operating at the intersection of biotech and AI, landed $130 million in a Series B round, pushing its valuation to $1.3 billion. The financing was co-led by prominent investors Oak HC/FT and General Catalyst. Chai Discovery’s core innovation lies in its use of artificial intelligence to predict and reprogram interactions between biochemical molecules. This advanced computational approach has profound implications for drug discovery, material science, and synthetic biology. By simulating and analyzing complex molecular interactions, Chai Discovery aims to accelerate the development of novel therapeutics and other biotechnological solutions, potentially cutting down the time and cost associated with traditional research and development. The substantial Series B raise, coupled with a unicorn valuation, reflects the immense potential investors see in AI-driven platforms to transform the biotech industry. This capital infusion will allow Chai Discovery to expand its research efforts, recruit top talent, and further develop its proprietary AI models and experimental platforms, bringing groundbreaking discoveries closer to realization.

-

(tied) Ambros Therapeutics, $125M, Biotech: Irvine, California-based Ambros Therapeutics publicly launched with a significant $125 million Series A financing. This round was co-led by two major healthcare investors: RA Capital Management and Patient Square Capital’s strategic health care investment arm, Enavate Sciences. Ambros Therapeutics has licensed the rights to neridronate, a compound primarily used to treat Complex Regional Pain Syndrome (CRPS). CRPS is a debilitating chronic pain condition that often follows an injury, stroke, heart attack, or surgery, and for which effective treatments are scarce. By focusing on neridronate, Ambros aims to bring a much-needed therapeutic option to patients suffering from this severe and often misunderstood condition. The substantial Series A funding indicates a strong belief in neridronate’s therapeutic potential and Ambros’s ability to navigate the clinical development and regulatory pathways. This launch marks a critical step for the company in its mission to develop and commercialize treatments for challenging diseases, offering hope to patient populations with significant unmet medical needs.

-

(tied) Mythic, $125M, Microprocessors: Austin-based Mythic, a startup dedicated to developing cutting-edge semiconductor architecture for more energy-efficient AI computing, raised $125 million in a funding round. The investment was led by DCVC and saw participation from a long list of venture investors, highlighting the widespread interest in advanced AI hardware. Mythic’s innovation centers around its analog compute platform, which aims to overcome the energy consumption challenges typically associated with digital AI processors. By performing computations in the analog domain, Mythic’s chips can achieve significantly higher energy efficiency and performance for AI inference at the edge, enabling AI capabilities in devices with limited power budgets. As AI models become increasingly complex and ubiquitous, the demand for specialized, efficient hardware solutions is skyrocketing. This funding will enable Mythic to accelerate the development and commercialization of its groundbreaking microprocessors, expanding its market reach and catering to the growing need for powerful yet power-conscious AI inference capabilities across various industries, from autonomous vehicles to smart devices.

-

Atavistik Bio, $120M, Biotech: Cambridge, Massachusetts-based Atavistik Bio, a company focused on developing allosteric small molecule therapeutics, secured $120 million in Series B funding. The round was led by The Column Group and Nextech Invest. Founded in 2021, Atavistik has rapidly established itself in the biotech scene, accumulating $220 million in known funding to date, according to Crunchbase data. Allosteric modulators represent a sophisticated approach to drug discovery, targeting sites on proteins distinct from the active binding site, which can offer greater specificity and fewer off-target effects compared to traditional active-site inhibitors. This approach holds immense promise for treating a wide range of diseases, including cancer, metabolic disorders, and neurological conditions, by precisely modulating protein function. The substantial Series B investment will empower Atavistik Bio to advance its pipeline of novel allosteric small molecules through preclinical and clinical development, bringing it closer to delivering innovative therapies to patients. The strong backing from specialized biotech investors underscores the potential of its platform and its strategic focus on a highly impactful area of drug discovery.

Sectoral Insights and Broader Trends:

This week’s funding rounds underscore several pervasive trends shaping the venture capital landscape as 2025 draws to a close:

-

The Unstoppable Rise of AI: Artificial intelligence remains the undeniable king of investment, permeating almost every sector. Databricks’ colossal raise highlights the demand for platforms that manage and leverage vast datasets for AI. Cyera demonstrates AI’s critical role in next-gen cybersecurity, while Chai Discovery exemplifies AI’s transformative power in drug discovery and molecular science. Even in hardware, Mythic’s focus on energy-efficient AI microprocessors reflects the industry’s need for specialized infrastructure to support AI’s computational demands. Tebra’s integration of AI into healthcare software further illustrates its cross-industry applicability.

-

Strategic Importance of Security: Both data security and national security continue to attract significant capital. Cyera’s massive round emphasizes the urgent need for robust, AI-powered solutions to protect sensitive data in an increasingly complex threat landscape. Simultaneously, HawkEye 360’s funding highlights the strategic importance of satellite intelligence and RF monitoring for defense, environmental monitoring, and global surveillance, showcasing a broader definition of "security."

-

The Green Horizon: Energy Innovation: Radiant’s impressive raise in nuclear microreactors signals a growing investor appetite for disruptive and sustainable energy solutions. As the global energy crisis and climate change imperatives intensify, venture capital is increasingly flowing into technologies that promise clean, reliable, and scalable power, moving beyond traditional renewables into advanced nuclear and other frontier energy sources.

-

Healthcare and Biotech’s Enduring Appeal: The life sciences sector remains a hotbed of innovation. Chai Discovery, Ambros Therapeutics, and Atavistik Bio collectively represent a significant investment in novel therapeutic approaches, from AI-driven drug discovery to specific treatments for debilitating conditions and advanced small molecule development. Tebra’s funding further demonstrates the ongoing digitalization and efficiency drive within healthcare administration.

-

Fintech’s Niche Innovation: While not the largest category this week, Imprint’s successful round shows that specialized fintech solutions, particularly those that blend financial services with consumer engagement and brand loyalty, continue to find strong investor support.

In conclusion, the final significant funding week of 2025 has provided a powerful glimpse into the future of technology and industry. The sheer volume of capital, particularly the megadeal secured by Databricks, alongside substantial investments in security, energy, and advanced biotech, suggests a market that is consolidating its bets on transformative, high-growth companies. As we look ahead to 2026, the trends observed this week—the pervasive influence of AI, the critical need for robust security, and the pursuit of sustainable energy solutions—are poised to continue driving innovation and investment across the global venture capital ecosystem. The "megadeal" appears to be alive and well, signifying a confidence in the long-term potential of these groundbreaking ventures.