Tether’s consistent and aggressive accumulation of Bitcoin is not an isolated event but rather a meticulously planned, quarterly strategy. CEO Paolo Ardoino has consistently articulated the company’s policy of funneling up to 15% of its net operating profits into Bitcoin every three months. This systematic approach transcends speculative gambling, representing a calculated and disciplined method of treasury management aimed at bolstering the long-term stability and value proposition of its flagship stablecoin, USDt (USDT). The rationale behind this strategy is multi-faceted: Bitcoin offers a robust deflationary hedge against the persistent devaluation of fiat currencies, serves as a non-sovereign, censorship-resistant store of value, and profoundly aligns with the decentralized, crypto-native ethos of the company. This continuous buying pressure from one of the industry’s most powerful entities provides a significant, albeit sometimes subtle, demand floor for Bitcoin, influencing market dynamics and potentially contributing to its sustained price appreciation over time.

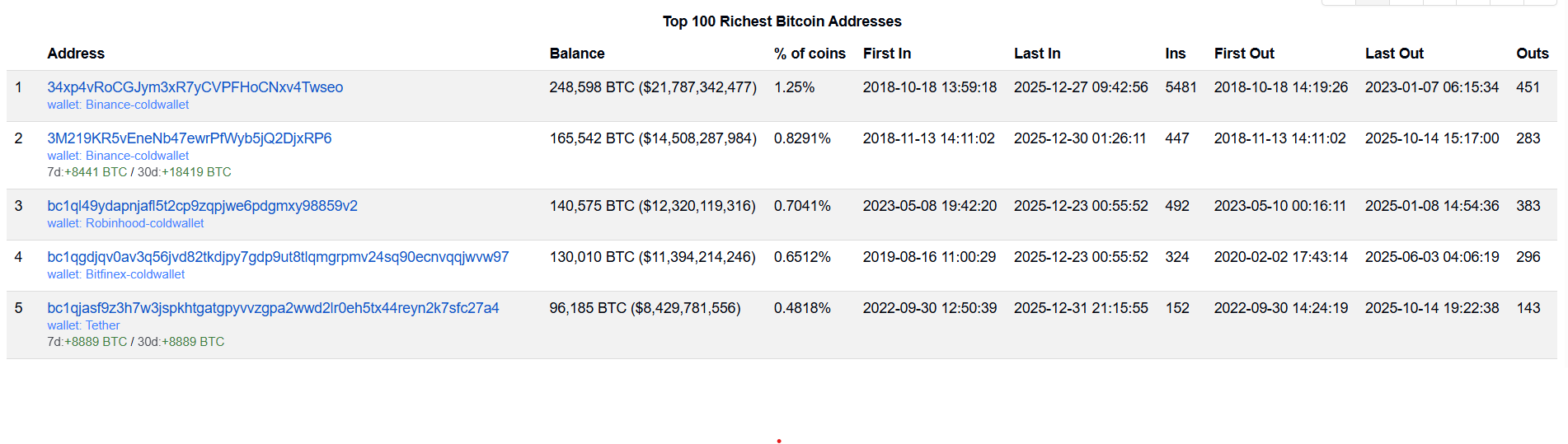

The designation of Tether’s Bitcoin address as the fifth-largest globally is a remarkable achievement, placing it in the rarefied air of entities that predominantly hold Bitcoin on behalf of millions of users. Unlike exchanges such as Binance or Robinhood, which function as custodians for their vast client bases, Tether’s holdings represent a direct corporate treasury investment. This critical distinction underscores Tether’s role not merely as a facilitator of crypto transactions but as a strategic investor, leveraging its substantial profits to acquire a strategic, long-term asset. This positions its 96,000+ BTC stash as the second-largest among privately held corporate treasuries, an indicator of its unique market standing and visionary approach. This monumental accumulation signals not just immense financial strength but also a deep-seated conviction in Bitcoin’s future, reinforcing the perceived robustness of USDT’s reserves in an increasingly uncertain global financial landscape. For Tether, this move transcends mere asset holding; it’s a powerful statement of confidence in Bitcoin’s enduring value and its potential to underpin the stability of the world’s leading stablecoin.

Tether’s diversification strategy extends well beyond Bitcoin, encompassing significant holdings in physical gold, a testament to its commitment to "hard assets." The company’s impressive acquisition of 26 tons of gold in Q3 2025 alone brought its total holdings to an astounding 116 tons. This places Tether among the world’s top 30 gold holders, an extraordinary feat for a cryptocurrency firm. This blend of traditional "hard assets" like gold with "digital gold" like Bitcoin, alongside its substantial US Treasury holdings, creates a unique and robust reserve profile. This multi-pronged approach is designed to provide comprehensive defense against various economic uncertainties, appealing to a broad spectrum of investors seeking stability and inflation protection in a volatile global economy. By strategically combining these assets, Tether aims to fortify its reserves against both traditional financial risks and emerging digital asset challenges, enhancing the long-term viability and trustworthiness of USDT.

However, Tether’s innovative and aggressive reserve mix has not been immune to scrutiny and criticism. Ratings agencies like S&P Global expressed significant concerns, leading to a notable downgrade of USDT’s score from "constrained" to "weak" in November 2025. The core issues cited revolved around "transparency and concentration risks." Critics argue that while Bitcoin and gold offer potential hedges against inflation and currency debasement, their inherent price volatility could introduce new and unforeseen risks to USDT’s peg, particularly during periods of extreme market stress. Prominent crypto figures, such as former BitMEX CEO Arthur Hayes, publicly amplified these concerns, raising "red flags" over the escalating share of Bitcoin and gold within Tether’s overall reserve composition. The ensuing debate centers on a fundamental trade-off: whether the pursuit of higher yields and superior inflation protection through volatile assets ultimately outweighs the paramount need for absolute stability, liquidity, and transparency, which are traditionally expected from a stablecoin. Tether, in response, consistently counters these arguments by emphasizing the long-term strategic value and superior performance of these assets, alongside its proven ability to actively manage potential volatility through a meticulously diversified portfolio and deep operational expertise.

The journey to accumulating over 96,000 BTC has not been a straightforward, linear ascent for Tether. Earlier in 2025, following its first-quarter purchase, the company’s Bitcoin holdings briefly surpassed 100,000 BTC before experiencing a reported dip. This fluctuation sparked widespread speculation among market pundits about potential Bitcoin sales. However, CEO Paolo Ardoino swiftly moved to refute these claims, clarifying that the apparent change in holdings was primarily due to contributions made to "XXI," referring to Twenty One Capital, a distinct entity backed by Tether. This crucial distinction highlights a more complex and expansive Bitcoin strategy: while Tether itself maintains a direct corporate treasury, it also strategically supports and invests in other ventures that independently hold significant amounts of Bitcoin. As of New Year’s Day, Twenty One Capital held a substantial 43,514 BTC, positioning it as the third-largest Bitcoin holder among publicly listed companies, trailing only the formidable treasuries of Mara Holdings and MicroStrategy. This multi-layered approach demonstrates Tether’s broader influence and investment philosophy within the Bitcoin ecosystem, extending its strategic reach beyond its immediate balance sheet.

Tether’s latest allocation is set against the backdrop of an accelerating "corporate Bitcoin land grab," a phenomenon witnessing companies across diverse sectors increasingly recognizing Bitcoin as a strategic, long-term asset. Japan-listed Metaplanet, for instance, dramatically bolstered its treasury by adding another 4,279 BTC in late December, bringing its total holdings to an impressive 35,102 BTC. This mirrors the pioneering strategy of MicroStrategy, which continues its relentless accumulation, actively raising equity and debt to expand its already colossal treasury, pushing its stack above an astounding 670,000 BTC. These companies, driven by a collective desire to hedge against rampant inflation, optimize their balance sheets, and attract forward-thinking investors, are collectively shifting trillions of dollars in corporate capital towards Bitcoin. This burgeoning trend signifies a fundamental maturation of the market, where Bitcoin is progressively transitioning from a purely speculative asset to a legitimate and widely accepted treasury reserve asset, thereby fundamentally altering its demand profile and long-term price trajectory. The embrace of Bitcoin by such powerful corporate entities is reshaping the financial landscape, cementing its role as a global, decentralized store of value for the 21st century.

The cumulative impact of Tether’s consistent and substantial Bitcoin purchases, alongside those of other major corporate and institutional players, creates a powerful and sustained demand dynamic for Bitcoin. Each significant acquisition effectively removes a substantial amount of BTC from the circulating supply, inevitably exerting upward pressure on its price, especially given Bitcoin’s inherently fixed supply cap. This overarching trend strongly suggests a future where stablecoin issuers and corporations alike will increasingly integrate Bitcoin into their established financial frameworks, further legitimizing digital assets within the broader traditional finance ecosystem. As global regulatory frameworks continue to evolve and greater clarity emerges regarding digital asset classifications and oversight, the adoption curve for Bitcoin and other cryptocurrencies is poised to steepen dramatically. Tether’s bold and often controversial strategy, despite the criticisms it garners, firmly positions it at the forefront of this profound financial evolution. It demonstrates a deeply held conviction that "digital gold" is not merely a speculative play but a fundamental and indispensable component of a robust, future-proof financial reserve. This continued embrace of Bitcoin by such powerful and influential entities fundamentally reshapes the market narrative, solidifying its pivotal role as a global, decentralized store of value for the modern era.