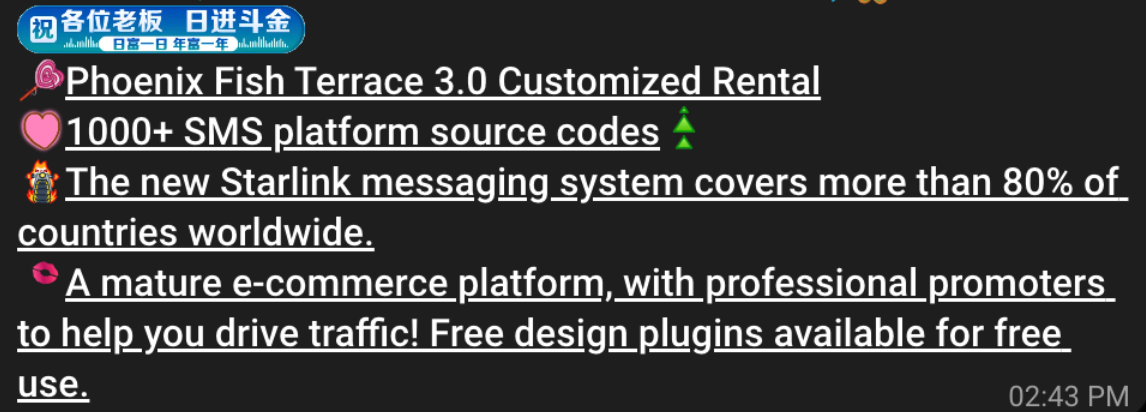

China-based phishing groups, notorious for relentless scam SMS messages concerning undelivered packages or unpaid toll fees, are now aggressively promoting a new, insidious offering designed to capitalize on the holiday shopping frenzy: sophisticated phishing kits capable of mass-producing convincing, yet entirely fake, e-commerce websites. These fraudulent platforms are engineered to pilfer customer payment card data, ultimately converting it into mobile wallets from Apple and Google. Security experts warn that these same malicious actors are also actively employing SMS lures that promise unclaimed tax refunds and enticing mobile rewards points, preying on consumers’ seasonal urgency and desire for deals.

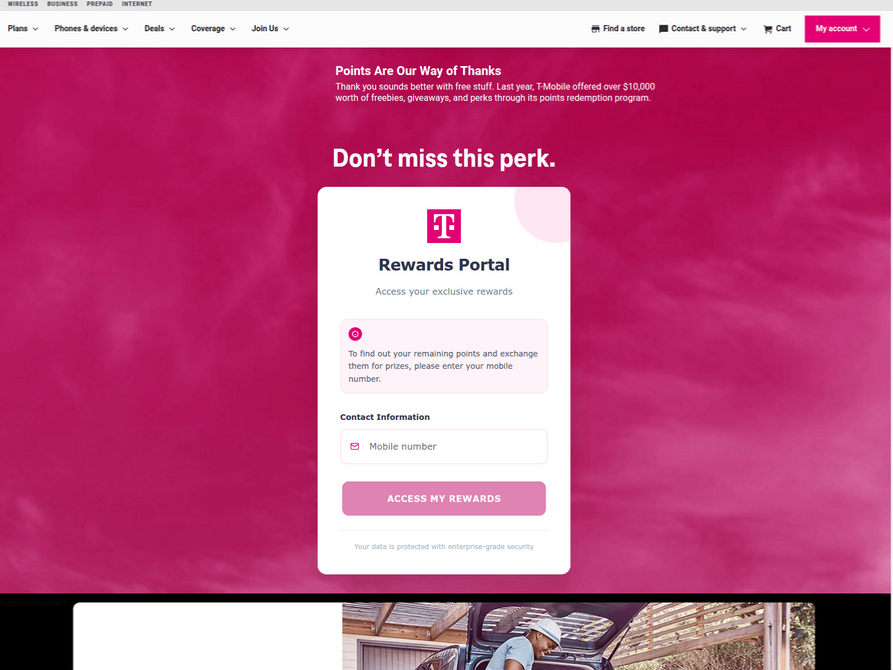

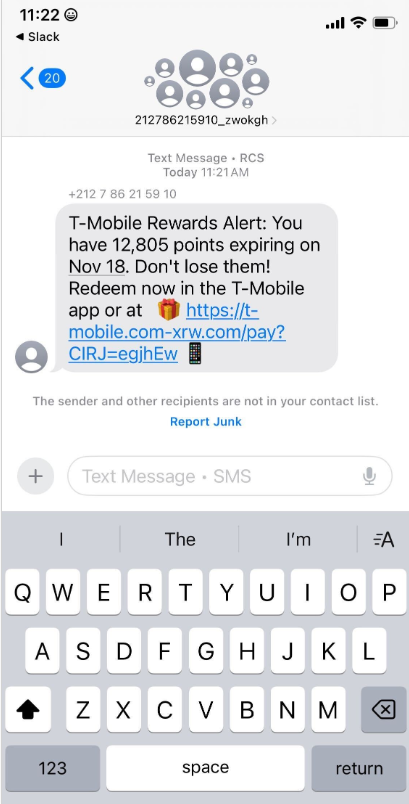

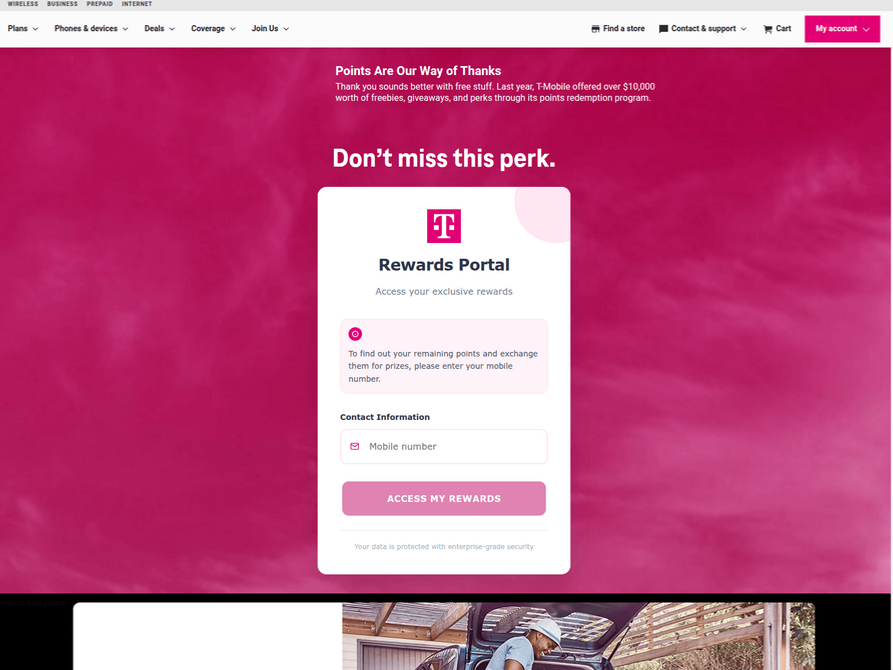

In a concentrated surge over the past week, thousands of domain names have been registered for scam websites masquerading as legitimate platforms offering T-Mobile customers the opportunity to claim substantial rewards points. These deceptive domains are being actively promoted through scam messages disseminated via Apple’s iMessage service and Google’s functionally equivalent RCS messaging service. The website scanning service urlscan.io has documented the deployment of thousands of these phishing domains in a remarkably short timeframe. A critical vulnerability of these phishing websites is their conditional loading; they only render successfully when accessed via a mobile device. Upon successful loading, they solicit sensitive personal information, including the visitor’s name, address, phone number, and crucially, payment card data, all under the guise of enabling the purported rewards point redemption.

Once a victim submits their card details, the phishing website then prompts them to share a one-time code sent via SMS by their financial institution. In reality, this code is dispatched by the bank because the fraudsters have initiated an attempt to enroll the victim’s compromised card details into a mobile wallet service from Apple or Google. If the victim obliges by providing this one-time verification code, the phishers gain the ability to link the victim’s compromised credit card to a mobile device they physically control, effectively hijacking their financial information.

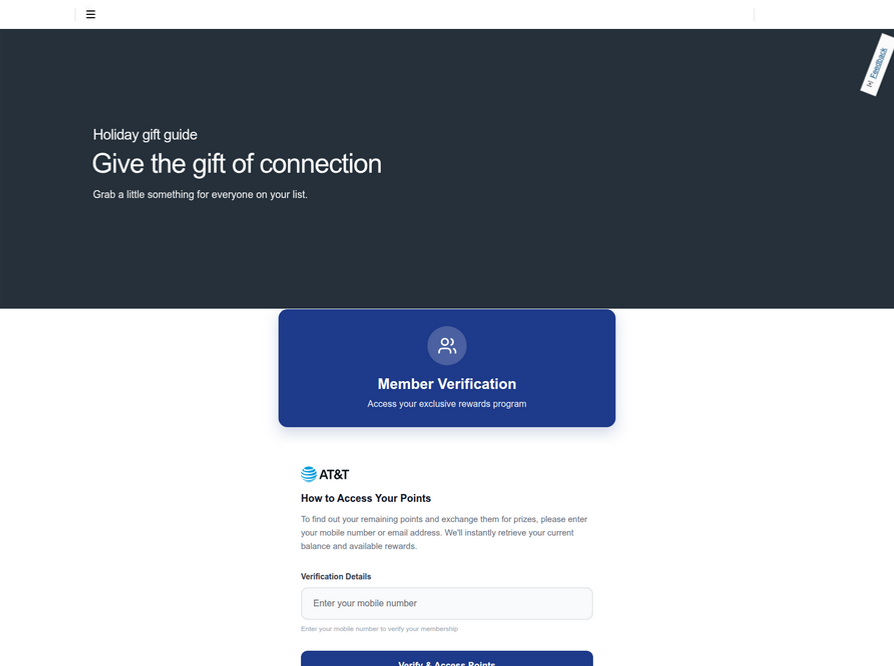

This alarming trend is not confined to a single telecommunications provider. Analysis of the T-Mobile phishing domains on urlscan.io reveals a similar scam meticulously targeting AT&T customers, employing analogous tactics to lure unsuspecting users. Ford Merrill, a security researcher at SecAlliance, a CSIS Security Group company, confirms that multiple China-based cybercriminal syndicates specializing in phishing-as-a-service platforms have been utilizing the mobile points lure for an extended period. However, this particular scam has only recently been amplified and directed towards consumers within the United States. Merrill notes that while these points redemption schemes have historically seen less traction in the U.S. compared to regions like the EU and Asia, their current aggressive deployment signals a significant shift in targeting.

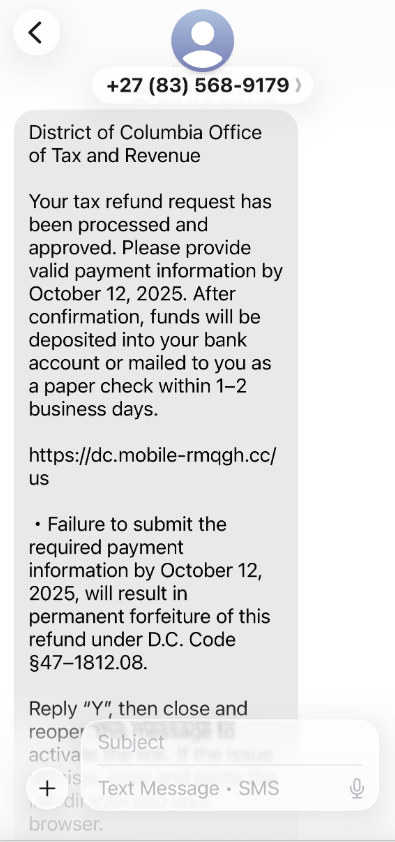

Further investigation of domains identified by urlscan.io as linked to this Chinese SMS phishing syndicate unveils a broader spectrum of their operations. These groups are now actively spoofing U.S. state tax authorities, sending out deceptive messages that inform recipients they are eligible for an unclaimed tax refund. The ultimate objective remains the same: to phish for the user’s payment card information and the critical one-time verification code.

Caveat Emptor: The Shifting Sands of Online Deception

While many SMS phishing or "smishing" domains are rapidly flagged by browser developers as malicious, a burgeoning area of growth for these phishing kits lies in the creation of fake e-commerce shops. These counterfeit storefronts are particularly insidious because they avoid widespread detection by not engaging in mass spamming campaigns that would draw immediate attention. Instead, the same Chinese phishing kits used to disseminate fake package redelivery scams are now equipped with modules that facilitate the swift deployment of a multitude of deceptive, yet highly convincing, e-commerce websites.

These fraudulent online stores are often advertised on major platforms like Google and Facebook, attracting consumers who are actively searching for deals on specific products. The deception unfolds during the checkout process, where customers willingly provide their payment card and personal information. This is then punctuated by a request for a one-time code, purportedly from their bank to verify the transaction. In reality, this code is sent because the scammers are immediately attempting to enroll the provided card data into a mobile wallet.

Merrill explains that the malicious code that exposes these fake shops as fraudulent is typically only fetched during the checkout process. This design makes them exceptionally difficult to detect through mass web scanning. Furthermore, most consumers who purchase items from these sites do not realize they have been defrauded until weeks later, when their ordered items fail to arrive. "The fake e-commerce sites are tough because a lot of them can fly under the radar," Merrill states. "They can go months without being shut down, they’re hard to discover, and they generally don’t get flagged by safe browsing tools."

Fortunately, reporting these SMS phishing lures and associated websites is one of the most effective methods for their rapid identification and subsequent shutdown. Raymond Dijkxhoorn, CEO and founding member of SURBL, a widely recognized blocklist for flagging malicious domains and IP addresses, has spearheaded the creation of smishreport.com. This website encourages users to submit screenshots of any smishing messages they receive. "If [a domain is] unlisted, we can find and add the new pattern and kill the rest of the matching domains," Dijkxhoorn explains. "Just make a screenshot and upload. The tool does the rest."

Merrill highlights that the final weeks of the calendar year consistently witness a significant surge in smishing activity, particularly concerning package redelivery schemes that impersonate the U.S. Postal Service or commercial shipping companies. "Every holiday season there is an explosion in smishing activity," he warns. "Everyone is in a bigger hurry, frantically shopping online, paying less attention than they should, and they’re just in a better mindset to get phished."

Shop Online Like a Security Pro: Navigating the Holiday Minefield

Adopting a shopping strategy solely based on the lowest advertised prices online can be akin to playing Russian Roulette with one’s finances. Even shoppers who primarily frequent reputable online retailers can fall victim to scams if they remain oblivious to excessively attractive, "too-good-to-be-true" offers, especially those from third-party sellers on major platforms.

For unfamiliar online merchants, taking a few minutes to investigate their reputation is crucial. Newly established online stores present a significantly heightened risk of scamming. A quick method to gauge a site’s longevity is to perform a basic WHOIS search on its domain name. A more recent "created" date for a site offering a highly sought-after gadget at an unusually low price is a strong indicator of a potential phantom store.

When receiving messages that purport to alert you to an issue with an order or shipment, it is paramount to navigate directly to the e-commerce or shipping website yourself, eschewing any links or attachments within the message. This advice is particularly pertinent for communications that warn of dire consequences if immediate action is not taken. Phishers and malware distributors frequently exploit a sense of urgency or emergency to create a false alarm, often causing recipients to lower their guard.

Beyond outright scams, the holiday shopping season also presents challenges from legitimate vendors who may inflate shipping and handling costs to offset steep product discounts. Therefore, it is vital to scrutinize all aspects of a purchase, including shipping times and return policies, and to be vigilant for hidden surcharges. Blithely clicking "ok" during the checkout process without thorough review can lead to unforeseen financial liabilities.

Most importantly, maintaining a close watch on monthly financial statements is indispensable. Fraudsters often leverage the holiday season to disguise unauthorized charges on stolen cards amidst the flurry of legitimate transactions. Consequently, diligently reviewing credit card bills and promptly disputing any unapproved charges is a critical safeguard against financial fraud.