The investigation, opened by federal prosecutors, centers on testimony Powell provided to a Senate committee concerning renovations undertaken at Federal Reserve buildings. While details of the specific allegations remain under wraps, the mere existence of such a probe into the head of the world’s most influential central bank has sent ripples through financial circles. In a rare and striking public statement issued on a Sunday, Powell directly addressed the investigation, asserting his belief that it is "a consequence of the Federal Reserve setting interest rates based on our best assessment of what will serve the public, rather than following the preferences of the President." This statement points to a deep-seated tension and a potential political motivation behind the probe, specifically linking it to past criticisms from former President Donald Trump. Trump had repeatedly and publicly attacked Powell and the Federal Reserve for their refusal to accede to his demands for lower interest rates, arguing that such cuts would stimulate the economy more aggressively. This history of presidential pressure on the nominally independent central bank adds a crucial layer of context to the current investigation, transforming it from a mere administrative inquiry into a potential flashpoint for central bank autonomy.

For the broader financial landscape, such an investigation immediately introduces significant short-term political headwinds. All traditional risk assets, particularly US equities, are vulnerable to the uncertainty and potential instability that could arise from a challenge to the leadership and independence of the Federal Reserve. However, this turbulence in conventional markets could paradoxically create a unique opportunity for decentralized assets like Bitcoin. Analysts from crypto exchange Bitunix suggest that a "systemic correction" in equities, driven by declining confidence in established financial institutions and government integrity, may precipitate a surge in demand for Bitcoin’s distinctive "non-sovereign" attributes.

The core argument hinges on the concept of "dollar credibility" and "central bank independence." When these pillars of the global financial system are questioned, investors tend to seek alternatives that are perceived to be outside the direct control or influence of sovereign governments. "When confidence in dollar credibility and central bank independence is questioned, decentralized assets tend to receive narrative-driven risk premia," the Bitunix analysts explained to Cointelegraph. They further elaborated that if political interference in monetary policy were to become a structural and enduring feature of the financial landscape, Bitcoin’s role as a "non-sovereign risk asset" would likely be significantly reinforced over the long term. This perspective posits Bitcoin not just as an alternative investment, but as a fundamental hedge against the erosion of trust in traditional state-backed currencies and institutions.

This sentiment resonates deeply with the foundational principles upon which Bitcoin was created. Emerging in the wake of the 2008 global financial crisis, Bitcoin was designed as a decentralized, peer-to-peer electronic cash system, free from the control of governments, central banks, or financial intermediaries. Its fixed supply and transparent, unalterable ledger were intended to provide an antidote to the perceived failures and manipulations of the traditional financial system. In an environment where the independence of the Fed chair is under scrutiny, and by extension, the integrity of the dollar and broader monetary policy, Bitcoin’s original value proposition becomes strikingly relevant.

The market’s immediate reaction offered some preliminary indicators. Bitcoin saw a modest increase of 0.85% over the last 24 hours following the news. More tellingly, privacy-preserving tokens like Monero (XMR) experienced a more significant surge, rising 18%, while Zcash (ZEC) climbed 6.5% during the same period. This outperformance by privacy coins could suggest that investors are not only seeking non-sovereign assets but also those that offer enhanced anonymity, further underscoring a potential flight from state oversight.

Prominent Bitcoin analyst Will Clemente succinctly captured the essence of the situation, stating, "This environment is literally what Bitcoin was created for." In a Monday X post, Clemente painted a broader picture, noting, "The President is coming after the Fed chair. Metals are ripping as sovereigns diversify reserves. Stocks & risk assets at record highs. Geopolitical risk rising." His analysis connects the Powell probe to a larger tapestry of global financial and geopolitical instability, where traditional safe havens like gold are seeing increased demand, and central banks globally are diversifying their reserves away from single-currency dominance. In this context, Bitcoin, with its decentralized and censorship-resistant nature, positions itself as a digital equivalent, or perhaps even a superior alternative, to traditional stores of value in times of systemic uncertainty.

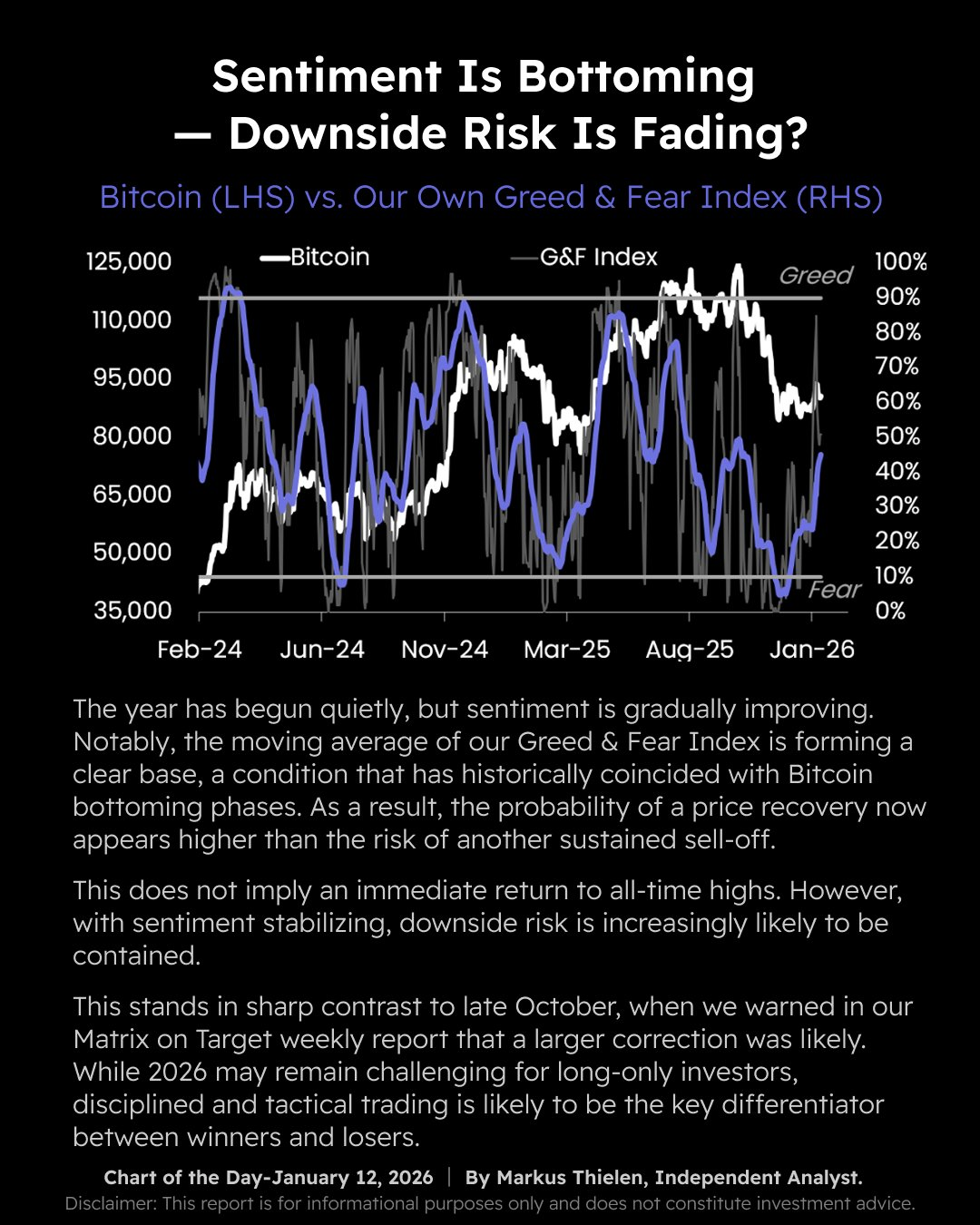

Beyond the immediate political implications, broader crypto market sentiment data offers a nuanced picture. Data from crypto platform Matrixport indicated a gradual improvement in overall crypto investor sentiment, suggesting an increased probability of a market recovery. "The moving average of our Greed & Fear Index is forming a clear base, a condition that historically coincided with Bitcoin bottoming phase," Matrixport wrote in a Monday X post, accompanying a chart illustrating the trend. The Greed & Fear Index is a widely watched metric that aggregates various market factors, including volatility, trading volume, social media sentiment, and dominance, to gauge the prevailing emotional state of crypto investors. A "clear base" forming in the moving average suggests that extreme fear is subsiding, and a more stable, potentially upward-trending sentiment is beginning to solidify, often preceding a price rebound.

However, this improving sentiment among retail investors and the broader market is contrasted by the actions of the industry’s most successful traders, often referred to as "smart money." According to data tracked by Nansen, a crypto intelligence platform, these sophisticated investors were still betting on a short-term decline in Bitcoin. Smart money traders were net short on Bitcoin for a cumulative $127 million, with an additional $1.6 million worth of shorts added in the past 24 hours. This divergence suggests that while the long-term narrative for Bitcoin as a non-sovereign asset gains traction, and general market sentiment improves, experienced traders might be anticipating short-term volatility, profit-taking opportunities, or even a tactical dip before any sustained rally. Their short positions could be a hedge against broader market instability or a calculated move to capitalize on potential price corrections.

Interestingly, while smart money traders maintained a net short position on Bitcoin, they showed a contrasting preference for other major cryptocurrencies. Nansen’s data revealed that smart money was net long on Ether (ETH) for a significant $674 million and net long on XRP for $72 million. This indicates a strategic rotation of capital or a belief in specific catalysts for these altcoins. For Ethereum, the anticipation of network upgrades, the growth of its ecosystem, and its role in decentralized finance (DeFi) could be driving factors. For XRP, ongoing developments related to its legal battles and potential for cross-border payments might be influencing smart money’s bullish stance. This selective positioning highlights that even in times of broader market uncertainty and shifting narratives around Bitcoin, smart money retains a nuanced view, seeking opportunities across the diverse crypto landscape.

In conclusion, the criminal investigation into Federal Reserve Chair Jerome Powell has ignited a crucial debate about central bank independence and the credibility of traditional financial institutions. While creating short-term political headwinds for conventional risk assets, this development is seen by many analysts as a reinforcing factor for Bitcoin’s narrative as a non-sovereign hedge. The potential for a "systemic correction" in equities and a questioning of dollar credibility could drive increased demand for decentralized assets, aligning with Bitcoin’s original anti-establishment ethos. While broader investor sentiment shows signs of improvement, the cautious short-term positioning of "smart money" suggests that the path forward may still involve volatility, even as the long-term case for Bitcoin in an increasingly uncertain global financial environment appears to strengthen. The unfolding events surrounding Powell and the Fed could indeed introduce a significant "risk premia" for Bitcoin, reflecting its growing role as an alternative store of value in an era of unprecedented political and economic flux.