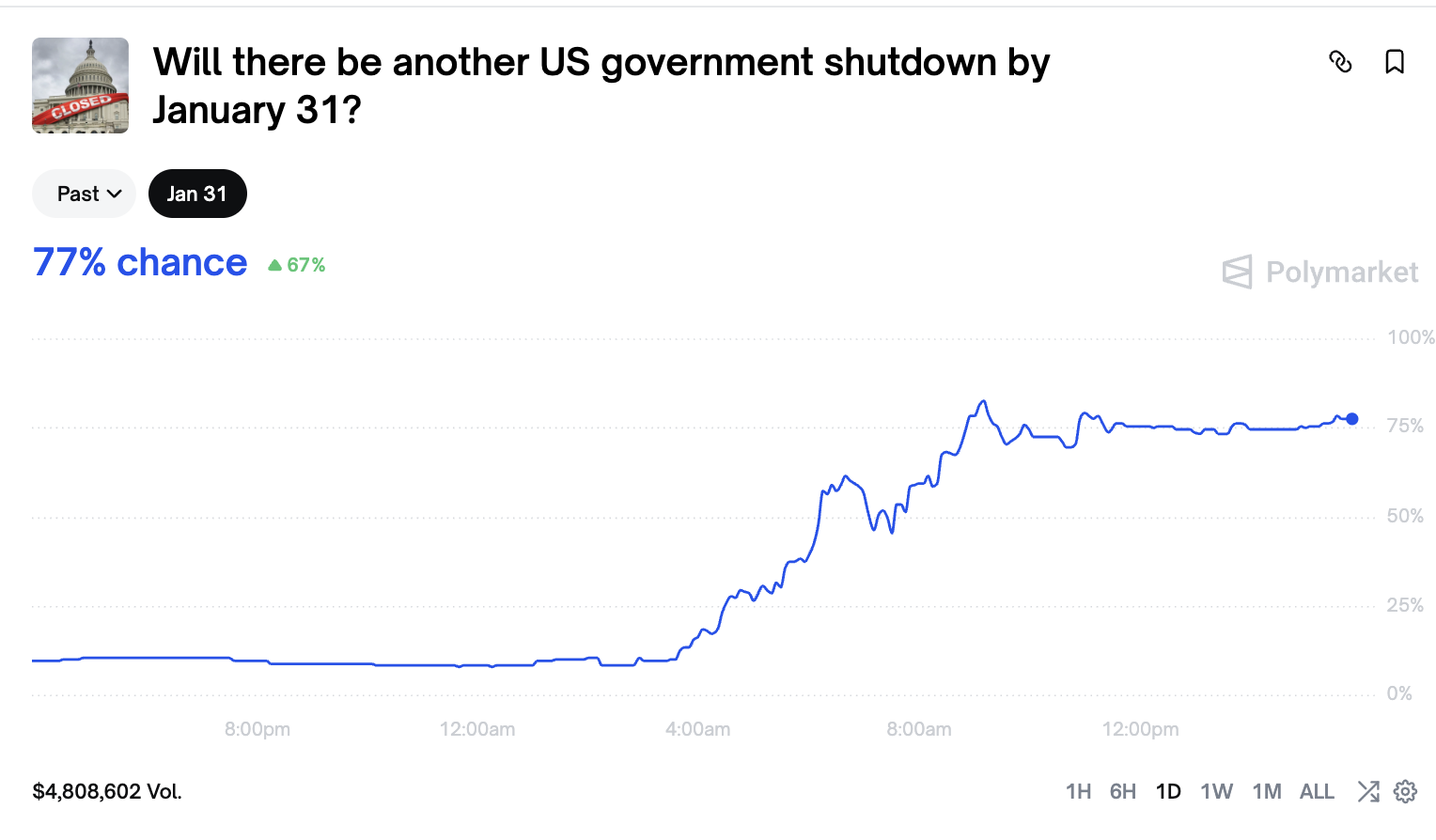

The immediate catalyst for this surge in odds appears to be a direct consequence of recent statements from Senate Majority Leader Chuck Schumer. On Saturday, Schumer publicly announced that Senate Democrats would collectively "not provide the votes to proceed" to the critical appropriations bill if it includes funding for the Department of Homeland Security (DHS) in its current form. This declaration, highlighted by political commentator Collin Rugg in an X post, effectively threw a wrench into the already fragile negotiations to keep the government funded, transforming a simmering dispute into an overt standoff.

Schumer’s firm stance on DHS funding is intrinsically linked to broader criticisms regarding the agency’s operations, particularly those of Immigration and Customs Enforcement (ICE). His statement, "What’s happening in Minnesota is appalling—and unacceptable in any American city," directly referenced recent reports of federal agents shooting and killing a 37-year-old man in Minneapolis. This incident ignited a firestorm of controversy, bringing renewed scrutiny to the conduct of federal law enforcement and providing a potent political rallying point for Democrats. Schumer further articulated his disapproval by stating the DHS bill is "woefully inadequate to rein in the abuses of ICE. I will vote no," signaling that the proposed funding package does not meet his party’s demands for accountability and reform within the agency.

Government shutdowns occur when Congress fails to pass the necessary appropriations bills or a continuing resolution (CR) to fund federal government operations by the specified deadline. When this happens, non-essential government functions cease, hundreds of thousands of federal employees are furloughed without pay, and various public services are disrupted. While essential services like national security and public safety typically continue, the economic and social ramifications can be substantial, creating uncertainty for businesses, markets, and individual citizens. Such impasses are often the result of intense partisan disagreements over spending priorities, policy riders attached to appropriations bills, or broader political leverage plays.

Adding to the volatile political environment, former President Donald Trump did not rule out the possibility of another government shutdown in the future. Speaking to Fox Business on Thursday, Trump remarked, "I think we have a problem, because I think we’re probably going to end up in another Democrat shutdown." This rhetoric, framing any potential shutdown as a deliberate move by the Democratic party, reflects the highly polarized nature of American politics, particularly in an election year. Trump’s past presidency was marked by the longest government shutdown in U.S. history, a 35-day impasse from late 2018 to early 2019 over funding for a border wall, demonstrating his willingness to use shutdowns as a negotiating tactic. His recent comments suggest a continuation of this high-stakes political strategy, further fueling the current uncertainty.

The specter of an imminent shutdown casts a long shadow over critical legislative efforts, including the CLARITY Act. This significant crypto bill, aimed at providing much-needed regulatory clarity for digital assets in the United States, has been making its way through Congress, albeit slowly. Previous legislative delays, including those stemming from prior government funding impasses and the general uncertainty surrounding congressional priorities during shutdown threats, have notably impacted its timeline. The crypto industry has long clamored for clear regulatory guidelines to foster innovation and protect consumers, making the CLARITY Act a pivotal piece of legislation for its future development in the U.S.

However, the CLARITY Act’s journey through Congress has been anything but smooth, recently receiving a mixed response from the crypto industry itself. Notably, Coinbase CEO Brian Armstrong, a prominent figure in the digital asset space, publicly withdrew his support for the bill. On January 15, Armstrong voiced strong objections, stating, "This version would be materially worse than the current status quo. We’d rather have no bill than a bad bill. Hopefully we can all get to a better draft." His powerful critique indicates that the bill, in its present form, fails to address the industry’s core concerns and could potentially introduce more harm than good, leading to significant challenges in building consensus around the legislation.

Echoing these industry concerns, Alex Thorn, head of research at Galaxy Digital, detailed in a report on Thursday that substantial uncertainty persists around stablecoin yields. This particular aspect of the bill has drawn criticism from the US banking lobby, which argues that allowing stablecoin yields could undermine the competitiveness of the traditional banking sector. The debate highlights the intricate balance Congress must strike between fostering innovation in the digital asset space and protecting established financial institutions. Thorn’s analysis underscores the deep divisions and complex technical issues that still need to be resolved for the CLARITY Act to gain broad industry and bipartisan support.

The legislative path for the CLARITY Act remains shrouded in uncertainty. Thorn further emphasized that "There aren’t yet any significant indications that the two sides have identified a compromise that can rejuvenate the bill’s prospects." He added that "the additional 4-6 weeks until a second attempt at markup should give the parties more time to work on that." A markup session is where a congressional committee debates, amends, and rewrites proposed legislation. The fact that such fundamental issues, particularly regarding stablecoin rewards, are still gridlocked raises serious questions about whether a bipartisan agreement can be reached to make a successful markup possible. The ongoing political instability only compounds these legislative challenges, pushing the timeline for comprehensive crypto regulation further into the future.

The current political maneuvering is taking place within the broader context of the US federal budget and appropriations process. Each year, Congress is responsible for passing 12 individual appropriations bills to fund the various government agencies and programs. When these bills cannot be agreed upon by the fiscal year deadline (September 30), Congress typically passes a continuing resolution (CR) to temporarily fund the government at existing levels, thereby averting a shutdown. However, these CRs are often short-term fixes, pushing the funding deadlines further into the year and creating a recurring cycle of brinkmanship. The current situation around DHS funding illustrates how a single appropriations bill can become a political battleground, threatening the entire funding apparatus.

This period of intense political negotiations and the looming threat of a shutdown are particularly potent given that the U.S. is heading into a presidential election year. Both major parties are keen to use the appropriations process as a lever to advance their political agendas and score points with their respective bases. For Democrats, standing firm on issues like ICE reform and government accountability resonates with progressive voters. For Republicans, challenging what they perceive as excessive spending or advocating for stricter border policies appeals to their base. A shutdown, while potentially damaging, can also be strategically employed to galvanize support and frame political narratives, making compromise even more difficult to achieve.

Beyond the political theater, a government shutdown carries tangible economic and reputational costs. Economically, even a short shutdown can shave points off GDP growth, disrupt government contracts, and create significant uncertainty for businesses. Federal employees who are furloughed or forced to work without pay face immediate financial hardship, impacting local economies. Moreover, repeated shutdowns erode public trust in government’s ability to govern effectively and can damage the U.S.’s standing on the global stage, signaling internal instability to international allies and adversaries alike. The disruption to government services, from scientific research to permit processing, has cascading effects across various sectors.

The ongoing struggle over government funding and the CLARITY Act highlights the broader, pressing need for comprehensive regulatory clarity in the crypto space. While the CLARITY Act aims to address market structure, other agencies like the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC) have also been actively involved in regulating digital assets, often leading to a patchwork and sometimes conflicting regulatory environment. The industry’s calls for clear rules are not just about fostering innovation but also about establishing investor protection, preventing illicit activities, and ensuring the U.S. remains competitive in the global digital economy. The inability of Congress to consistently pass funding bills directly hampers its capacity to address these critical long-term policy challenges.

In conclusion, the confluence of escalating political tensions, particularly surrounding DHS funding and the contentious role of federal agencies, has propelled the Polymarket odds of a January government shutdown to an alarming 77%. This high probability reflects the deep partisan divides and the strategic use of government funding as a political weapon, especially in an election year. The legislative progress of vital bills like the CLARITY Act, crucial for bringing regulatory certainty to the burgeoning crypto industry, remains critically vulnerable to these ongoing funding impasses. As the clock ticks down to the end of January, the nation watches to see if lawmakers can navigate this treacherous political landscape and avert another costly and disruptive government shutdown.