New Law Would Prevent Trump Officials From Invading a Country and Profiting by Placing Bets on Polymarket. The legislative landscape is poised for a significant shift with the introduction of the “Public Integrity in Financial Prediction Markets Act of 2026,” a groundbreaking bill spearheaded by New York Representative Ritchie Torres, aimed at curbing potential insider trading by government officials on burgeoning prediction markets.

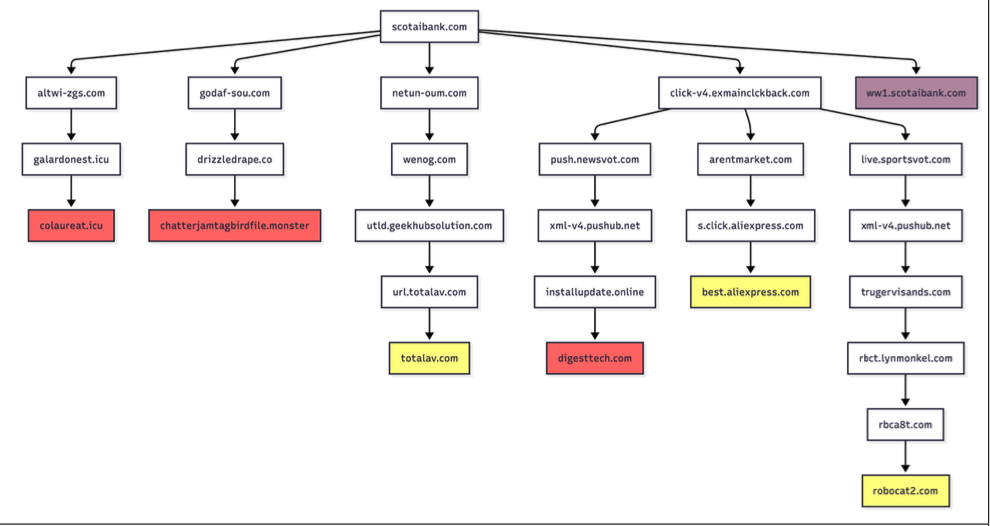

This proposed legislation comes as a direct response to what has been described as “compelling evidence” of highly suspicious trading activity surrounding a major geopolitical event: the recent “US attack on Venezuela” and the alleged “kidnapping of Venezuelan president Nicolás Maduro.” The controversy centers on a specific account on Polymarket, a popular prediction platform, which placed a series of substantial bets just two days before the surprise operation. This account reportedly invested over $30,000 in a prediction that Maduro would be “out” or that US troops would set foot “in Venezuela by January 31st,” leading to a staggering profit of $400,000 in less than 24 hours. As sports entrepreneur Joe Pompliano remarked, “Seems pretty suspicious! Insider trading is not only allowed on prediction markets; it’s encouraged.”

The incident has ignited a fierce debate about the ethics and legality of government officials, or individuals with close ties to government information, leveraging nonpublic knowledge for personal financial gain on these platforms. Traditionally, insider trading laws in established financial markets like stock exchanges are stringent, designed to ensure fairness and maintain public trust. However, the relatively nascent and often decentralized nature of prediction markets presents a new frontier for potential abuse, where the lines between informed speculation and illicit insider advantage can become dangerously blurred.

Representative Torres’s bill seeks to explicitly extend the prohibitions against insider trading to these digital arenas. The “Public Integrity in Financial Prediction Markets Act of 2026” would render it illegal for a broad spectrum of government employees to trade on platforms like Polymarket and Kalshi if they possess or may reasonably obtain “material nonpublic information” in the course of their official duties. This expansive definition aims to cover elected officials, political appointees, executive branch staffers, and any other government personnel whose positions grant them privileged insights into future policy decisions, military actions, or diplomatic maneuvers. The intent is clear: to prevent any individual serving the public from profiting from foreknowledge of events that can profoundly impact national and international affairs.

The underlying principle of this bill echoes sentiments often attributed to figures like US president Calvin Coolidge, who famously observed that “Laws must be justified by something more than the will of the majority. They must rest on the eternal foundation of righteousness.” In the context of public service, this “righteousness” mandates transparency, accountability, and the absolute prohibition of self-enrichment through information asymmetry gained at the public’s expense. The potential for individuals to monetize foreknowledge of critical events – be it a military intervention, a trade negotiation outcome, or a political appointment – undermines the very fabric of democratic governance and public trust.

Beyond the specific Venezuela incident, the rise of prediction markets has raised broader anxieties globally. These platforms, often operating on blockchain technology, allow users to wager on a vast array of future events, from political elections to economic indicators, and increasingly, even deadly conflicts. The article highlights examples of “crypto bros” gambling on “deadly conflicts in real-time,” with bets amounting to thousands of dollars on questions such as “will Russia capture all of Kupiansk by March 31?” This commodification of human suffering and geopolitical instability for speculative profit adds another layer of ethical complexity to the discussion, amplifying calls for regulation and oversight.

The article also draws attention to past regulatory scrutiny involving these platforms. In October, *Reuters* reported that the Trump Media and Technology Group was reportedly exploring implementing prediction market functionality into Truth Social, collaborating with Crypto.com. This development occurred amidst a period where, as the article notes, “dozens of federal investigations into crypto-based price fixing, securities fraud, and regulatory noncompliance have been dropped at the Trump administration’s urging.” Significantly, two of these dropped cases, according to the article, were against prediction platforms Polymarket – the very platform implicated in the Venezuela allegations – and Kalshi, for allegedly selling options contracts related to congressional elections. While the article doesn’t directly link the dropped investigations to the Venezuela incident or specific individuals profiting, it highlights a pattern of reduced regulatory pressure on these platforms during a period when their activities were expanding and drawing public concern.

The debate over insider trading is not new to Washington. The Stop Trading on Congressional Knowledge (STOCK) Act of 2012, for instance, aimed to prevent members of Congress and other federal employees from profiting from nonpublic information they obtained through their official positions. However, as the article points out, “Recent history shows that Congress has little appetite for regulation of insider trading.” This observation casts a shadow of doubt on the ultimate fate of Representative Torres’s new bill, suggesting that overcoming legislative inertia and potential resistance from various interest groups will be a significant challenge. The very fact that there doesn’t yet appear to be a wager on the outcome of the bill on either Polymarket or Kalshi is a subtle, yet telling, commentary on the current state of affairs.

The challenge of enforcing such a law against decentralized prediction markets is also considerable. Many of these platforms leverage blockchain technology, which can make it difficult to identify participants and trace transactions, especially across international borders. Regulators would need to grapple with the complexities of jurisdiction, privacy, and the inherent design of these systems, which often prioritize anonymity. However, the intent behind the “Public Integrity in Financial Prediction Markets Act of 2026” remains crucial: to adapt existing ethical standards and legal prohibitions against corruption to the rapidly evolving digital landscape. In an era where information travels at light speed and financial innovation constantly pushes boundaries, ensuring that public service remains untainted by the lure of illicit profits from privileged information is more vital than ever for maintaining democratic integrity and the public’s trust in its institutions. The Venezuela incident, whether a one-off anomaly or a harbinger of things to come, underscores the urgent need for a robust legal framework to address these emerging threats to public integrity.