Mirae Asset Group, one of South Korea’s largest financial services conglomerates, is reportedly engaged in discussions to acquire Korbit, the nation’s fourth-largest cryptocurrency exchange. The potential deal, valued at approximately 100 billion to 140 billion Korean won (equivalent to $70 million to $100 million USD), signals a significant move by a traditional financial powerhouse into the burgeoning digital asset sector. This strategic foray is anticipated to be spearheaded by Mirae Asset Consulting, a non-financial affiliate of the group, which, according to a recent Sunday report from The Chosun Daily, has already signed a memorandum of understanding (MOU) with Korbit’s principal shareholders.

The reported acquisition underscores a growing trend of established financial institutions seeking regulated pathways into the cryptocurrency market. For Mirae Asset, a group with diverse interests spanning asset management, wealth management, investment banking, and life insurance, the move into digital assets represents both a defensive strategy to adapt to evolving financial landscapes and an offensive play to capture new growth opportunities. Korbit, despite its relatively smaller market share, presents a particularly attractive entry point due to its robust regulatory standing. It holds a full operating license and boasts a well-established compliance infrastructure, crucial attributes for any major financial group aiming for regulated exposure to digital assets in South Korea’s stringent environment.

Korbit’s current ownership structure is primarily composed of NXC, the holding company of South Korean gaming giant Nexon, and its subsidiary Simple Capital Futures, which collectively command approximately 60.5% of the exchange. Additionally, SK Square, a prominent investment arm of SK Group, holds a substantial 31.5% stake. This diversified ownership base suggests a complex but potentially straightforward transaction, particularly if the principal shareholders are aligned on the sale. For NXC, a sale could represent a strategic divestment from a non-core asset, while for SK Square, it might be an opportunity to realize gains from their digital asset investment.

The South Korean regulatory landscape for cryptocurrencies is one of the most developed and closely monitored globally. The "full operating license" held by Korbit is a testament to its adherence to strict guidelines set forth by the Financial Services Commission (FSC) under the Act on Reporting and Using Specified Financial Transaction Information. This framework mandates stringent Anti-Money Laundering (AML) and Know Your Customer (KYC) protocols, requires real-name bank accounts for transactions, and imposes regular audits and reporting. For Mirae Asset, acquiring an entity that has already navigated these complex regulatory hurdles is far more efficient and less risky than attempting to build a compliant crypto exchange from the ground up. This compliance infrastructure not only mitigates regulatory risks but also enhances the credibility and institutional appeal of the acquired entity, making it a suitable platform for servicing both retail and institutional clients within Mirae Asset’s ecosystem.

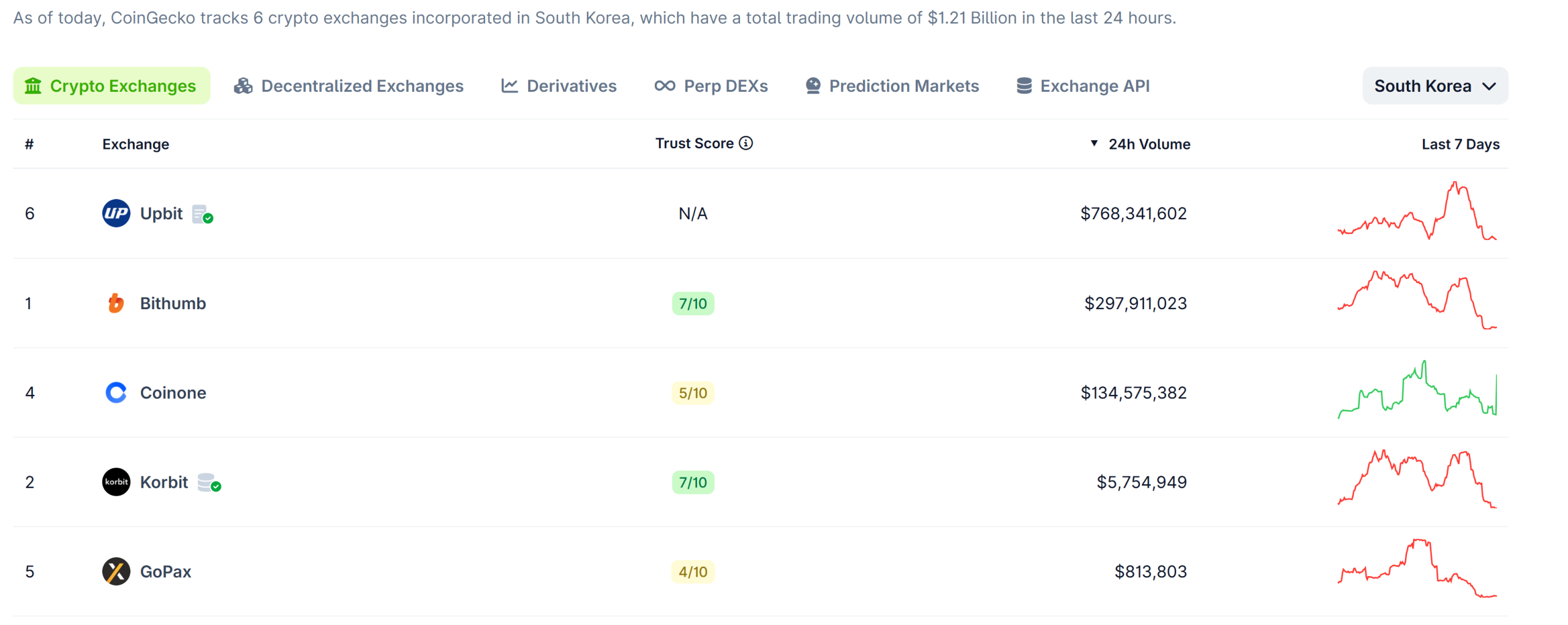

While Korbit’s regulatory compliance is a major asset, its current market performance paints a picture of a challenging competitive environment. According to recent CoinGecko data, Korbit’s share of South Korea’s crypto trading market is notably marginal when compared to its domestic peers. Out of an approximate total 24-hour trading volume of $1.21 billion across six Korea-based exchanges, Korbit accounted for a mere $5.75 million. This translates to well under 1% of the total activity, specifically about 0.475%. This stark reality highlights the extreme concentration within the Korean crypto market.

By contrast, the market is overwhelmingly dominated by Upbit, which single-handedly commanded more than $768 million in daily volume during the same period, securing a staggering market share. Bithumb followed as a distant but strong second, with nearly $298 million in daily volume, and Coinone took the third spot with about $135 million. The remaining exchanges, including Korbit, struggle for a fraction of the remaining market. This highly concentrated market structure implies that Mirae Asset isn’t merely buying a crypto exchange; it’s buying a regulated gateway into a market currently monopolized by a few giants. The strategic challenge for Mirae Asset will be to leverage its formidable brand, extensive client network, and financial capital to significantly boost Korbit’s trading volume and market relevance, potentially through new product offerings, enhanced liquidity, and integration with its existing financial services. The acquisition could also signify Mirae Asset’s long-term vision, looking beyond immediate trading volumes towards future applications of blockchain technology and digital assets.

The broader context of this potential acquisition also includes significant developments within the South Korean digital asset space. As Cointelegraph previously reported, another major Korean conglomerate, Naver Financial, is also making a monumental move into crypto by planning to acquire Dunamu, the operator of the dominant Upbit exchange. This proposed acquisition is structured as a stock-swap transaction valued at an astonishing 15.1 trillion won (approximately $10.3 billion), making Dunamu a wholly-owned subsidiary of Naver Financial. Shareholders of both firms are slated to vote on this transaction on May 22, 2026, with the share exchange scheduled for June 30, subject to necessary regulatory approvals.

Naver Financial’s ambitious plan to acquire Dunamu was initially revealed in September, with reports indicating that the move would pave the way for Naver Financial to launch a Korean won-backed stablecoin project, alongside other cutting-edge digital finance initiatives. This parallel development with Naver’s acquisition of the market leader, Upbit, provides crucial context for Mirae Asset’s interest in Korbit. It demonstrates a clear trend: traditional finance and tech giants in South Korea are aggressively moving to integrate digital assets into their core businesses. While Naver is aiming for market dominance and innovation through a massive acquisition, Mirae Asset appears to be pursuing a more measured, yet equally strategic, entry via a smaller, highly compliant player. This difference in scale and target suggests diverse strategies for achieving similar overarching goals: securing a foothold in the future of finance.

For Mirae Asset, the acquisition of Korbit could unlock a multitude of synergies. The group could integrate Korbit’s digital asset trading capabilities into its existing wealth management platforms, offering clients diversified investment opportunities beyond traditional equities, bonds, and real estate. This could include providing access to cryptocurrencies, digital asset custody solutions, or even eventually exploring tokenized securities. Furthermore, Mirae Asset’s institutional client base could benefit from regulated access to the crypto market, facilitating institutional-grade trading and investment in digital assets. This move also positions Mirae Asset to capitalize on potential future regulatory changes, such as the introduction of spot Bitcoin ETFs or other regulated crypto investment products in South Korea, similar to trends observed in the U.S. and Europe.

However, the path forward is not without its challenges. The cryptocurrency market remains inherently volatile, and regulatory frameworks, despite being established, are continually evolving. The recent delay in South Korea’s stablecoin bill deadline highlights the ongoing complexities and the need for adaptive strategies. Furthermore, the push towards imposing "bank-level liability on crypto exchanges" underscores the increasing regulatory scrutiny and the higher operational standards expected, even for already compliant exchanges like Korbit. Integrating a crypto exchange into a traditional financial conglomerate also presents cultural and technological challenges, requiring careful management to ensure seamless operations and avoid potential friction.

In conclusion, Mirae Asset’s reported talks to acquire Korbit signify a landmark development in the convergence of traditional finance and digital assets in South Korea. By targeting a regulated, albeit smaller, player, Mirae Asset seeks to strategically position itself within the burgeoning crypto economy, leveraging Korbit’s compliance infrastructure as a springboard for future growth. This move, alongside Naver Financial’s larger acquisition of Upbit, paints a clear picture of South Korea’s leading conglomerates actively embracing digital assets, setting the stage for increased institutional participation, innovation, and competition within the nation’s financial landscape. The coming months will reveal the finalization of this deal and its broader implications for Mirae Asset’s strategic trajectory and the evolution of digital finance in South Korea.