Japan is decisively moving to integrate cryptocurrencies deeper into its established financial system, signaling a robust regulatory strategy that prioritizes handling digital assets through traditional exchanges and under stringent securities-style oversight, rather than fostering a parallel, less-regulated ecosystem. This strategic pivot positions Japan as a global leader in defining how digital innovation can coexist with financial stability and investor protection, marking a significant departure from earlier, more permissive approaches.

The nation’s firm direction was emphatically underscored on Monday by Finance Minister and Financial Services Minister Satsuki Katayama. Speaking at the venerable Tokyo Stock Exchange’s (TSE) New Year opening ceremony, Katayama publicly championed traditional securities exchanges and existing market infrastructure as the indispensable primary gateway for all blockchain-based assets. Her remarks were not merely ceremonial but served as a powerful declaration of intent, framing 2026 as Japan’s inaugural year of full-scale digitalization – a future where digital assets are seamlessly woven into the fabric of the nation’s capital markets.

The choice of venue for Katayama’s address was itself symbolic. The Tokyo Stock Exchange, a cornerstone of Japan’s economic landscape, represents stability, transparency, and deep liquidity. By making such pronouncements from this platform, the government is sending an unmistakable message: the future of digital assets in Japan will be built upon the same principles and infrastructure that have long governed its traditional financial markets. "To ensure citizens benefit from digital and blockchain-based assets, the role of exchanges and market infrastructure will be essential," Katayama stated during the ceremony, in remarks delivered in Japanese and machine-translated into English. She pledged unwavering government support to stock exchanges in "advancing cutting-edge, accessible, and efficient markets," indicating a collaborative effort between regulators and market operators to navigate this transformative era.

Katayama’s comments arrive amidst a continuous tightening of how cryptocurrencies are accessed and operated within Japan. This ongoing process encompasses a multi-pronged approach, including the implementation of stricter registration rules for service providers, vigorous enforcement actions against unregistered platforms operating within the country, and an overarching emphasis on channeling digital asset activities through regulated rails. This regulatory posture is not new but rather the culmination of years of learning, particularly after high-profile incidents like the Mt. Gox hack in 2014 and the Coincheck hack in 2018, which galvanized Japan’s commitment to robust oversight. These historical events instilled in Japanese regulators a deep understanding of the risks inherent in the nascent crypto space, propelling them to adopt a cautious yet progressive stance.

From Payments Law to Securities Regulation: A Foundational Shift

Katayama’s pronouncements are not isolated statements but rather build upon a significant regulatory groundwork that has been systematically laid. A pivotal development occurred on December 10, 2025, when Japan’s Financial Services Agency (FSA) unveiled comprehensive plans to transition the oversight of crypto assets from the relatively lighter Payment Services Act to the more rigorous Financial Instruments and Exchange Act (FIEA). This shift is profound, fundamentally reclassifying crypto assets from mere payment tools to sophisticated financial products, akin to stocks, bonds, and derivatives.

The implications of this reclassification under the FIEA are far-reaching. Under this robust framework, the issuance and trading of crypto assets will now be subject to a comprehensive suite of securities-style regulations. This includes, but is not limited to, stronger disclosure mandates requiring issuers and platforms to provide transparent and detailed information to investors, stringent insider trading prohibitions designed to ensure fair and equitable markets, and expanded enforcement powers against unregistered overseas platforms attempting to circumvent Japanese regulations. These measures are designed to afford investors the same level of protection and market integrity that they expect from traditional financial products, thereby fostering greater trust and potentially catalyzing broader institutional adoption.

The FIEA also brings with it requirements for licensed intermediaries, robust capital requirements, anti-money laundering (AML) and combating the financing of terrorism (CFT) protocols, and rules regarding asset segregation, ensuring that customer funds are protected even in the event of a platform’s insolvency. This comprehensive approach differentiates Japan from many other jurisdictions still grappling with how to categorize and regulate digital assets, positioning it as a mature and sophisticated market for crypto innovation.

Tax Policy Aligns with Capital Markets

Complementing the regulatory overhaul, Japan’s tax policy is also moving in the same direction, further solidifying the alignment of crypto with traditional financial instruments. On December 2, the Japanese government and ruling coalition backed plans to introduce a flat 20% tax on crypto profits. This represents a monumental shift from the previous regime, where crypto gains were categorized as "miscellaneous income" and subjected to progressive tax rates that could escalate to as high as 55% for high-income earners, often combined with local inhabitant taxes.

The previous tax structure was widely seen as a significant deterrent to both individual and institutional investors, discouraging long-term holding and incentivizing individuals to move their crypto activities offshore. By introducing a flat 20% tax, Japan is effectively aligning crypto assets with the tax treatment of stocks and investment funds, creating a level playing field and significantly enhancing predictability for investors. This reform is not merely a tax adjustment; it is a strategic move expected to be embedded within broader securities law amendments, reinforcing the holistic approach to integrating digital assets into the mainstream financial system. This tax predictability is crucial for attracting and retaining crypto businesses and talent, as it signals a stable and rational environment for investment and innovation. It also makes Japan a more attractive hub for institutional investors looking to allocate capital to digital assets without facing prohibitive tax burdens.

The legal and fiscal changes, taken together, suggest a deliberate and comprehensive effort to standardize crypto’s integration within the existing Japanese financial system rather than regulating it as a distinct and separate asset class. This approach aims to harness the potential of blockchain technology and digital assets while mitigating risks through established, proven regulatory mechanisms.

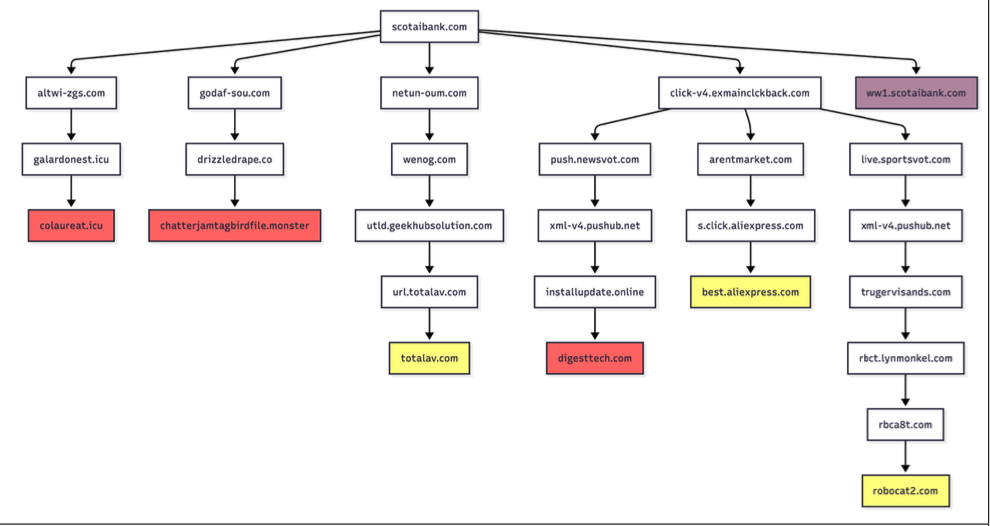

Exchange-Led Access Takes Shape and Market Reshaping

The clarity in policy direction has already translated into concrete enforcement actions, reshaping the landscape for crypto service providers in Japan. On February 7, 2025, regulators took decisive action, requesting tech giants Apple and Google to remove apps linked to unregistered crypto exchanges from their respective app stores. Prominent platforms such as Bybit, MEXC, and KuCoin were specifically targeted. This action served as a potent reinforcement of Japan’s stance: access to Japanese users would be strictly limited to platforms that are fully compliant with local regulations, including registration with the FSA. This move underscores the regulator’s commitment to preventing regulatory arbitrage and protecting Japanese investors from potentially risky, unregulated offshore entities.

The regulatory pressure has inevitably reshaped market participation. Following these developments, on December 23, Bybit, one of the world’s largest crypto exchanges, announced its decision to begin phasing out services for Japanese residents in 2026. Citing evolving regulatory requirements and registration rules, Bybit’s departure is a clear testament to the stringent and non-negotiable nature of Japan’s regulatory framework. This exit, while potentially inconvenient for some users, sends a powerful signal to the global crypto industry: operate within Japan’s rules, or exit the market.

While some international players are moving towards the exit, Japan’s regulators are simultaneously fostering innovation within regulated boundaries. The FSA has notably backed bank-led stablecoin initiatives, recognizing the potential of stablecoins for payments and remittances while ensuring they operate within a robust regulatory perimeter. Furthermore, regulators are actively exploring frameworks that would allow traditional regulated financial institutions to play a significantly larger role in crypto asset markets. This includes facilitating the entry of established banks, brokerages, and asset managers into the digital asset space, leveraging their existing infrastructure, compliance expertise, and customer bases. Such an approach aims to bring institutional-grade liquidity and trust to the crypto market, integrating it further into the mainstream financial ecosystem. Discussions around a digital yen, while distinct from private stablecoins, also reflect Japan’s comprehensive strategy towards digitalizing its financial infrastructure responsibly.

Broader Context and Future Outlook

Japan’s proactive and integrated approach to crypto regulation holds significant implications, not just domestically but globally. As a G7 nation and a major economic power, Japan’s regulatory precedents often influence international discourse and policy development. Its strategy of treating crypto assets as securities and integrating them into existing financial law could serve as a blueprint for other jurisdictions grappling with similar challenges. This move aligns with a broader global trend where regulators are increasingly looking to apply existing financial frameworks to digital assets, moving away from creating entirely new, bespoke regulatory regimes.

The challenges for Japan will include ensuring that the regulatory framework remains agile enough to accommodate rapid technological advancements in the blockchain space, preventing regulatory overreach that could stifle legitimate innovation, and effectively communicating these complex changes to both domestic and international stakeholders. However, the opportunities are substantial. By providing a clear, predictable, and robust regulatory environment, Japan could become a preferred hub for institutional crypto investment and a leader in developing innovative, compliant blockchain applications. This approach promises to unlock the economic benefits of digitalization while safeguarding financial stability and protecting investors.

In essence, Japan is not merely regulating crypto; it is strategically incorporating it into its vision for a fully digitized, secure, and efficient financial future. The alignment of crypto regulation with securities markets, supported by parallel tax reforms and rigorous enforcement, demonstrates a mature and holistic strategy. This comprehensive framework is designed to ensure that digital assets contribute positively to Japan’s economy, driven by innovation, trust, and robust oversight, setting a strong precedent for the global financial landscape.