The cryptocurrency market is witnessing a significant shift in 2026, as institutional investors are demonstrating an unprecedented appetite for Bitcoin (BTC), acquiring considerably more per day than the total amount mined. This surge in institutional demand, which has outpaced newly supplied Bitcoin by a staggering 76%, signals a potential turning point for the digital asset, setting the stage for a robust bullish trend.

Key Points:

- Institutional buying of Bitcoin has exceeded newly mined supply by 76% in early 2026.

- The Net Institutional Buying metric, encompassing corporate treasuries and US spot Bitcoin ETFs, has recorded eight consecutive days of net positive inflows.

- Historically, similar periods of institutional demand outpacing supply have led to average BTC price increases of 109%.

- Market analysts project a return above $100,000 for Bitcoin in January, following a rare pattern of three consecutive monthly declines.

- The confluence of strong institutional conviction and historical price patterns suggests a significant upward trajectory for Bitcoin.

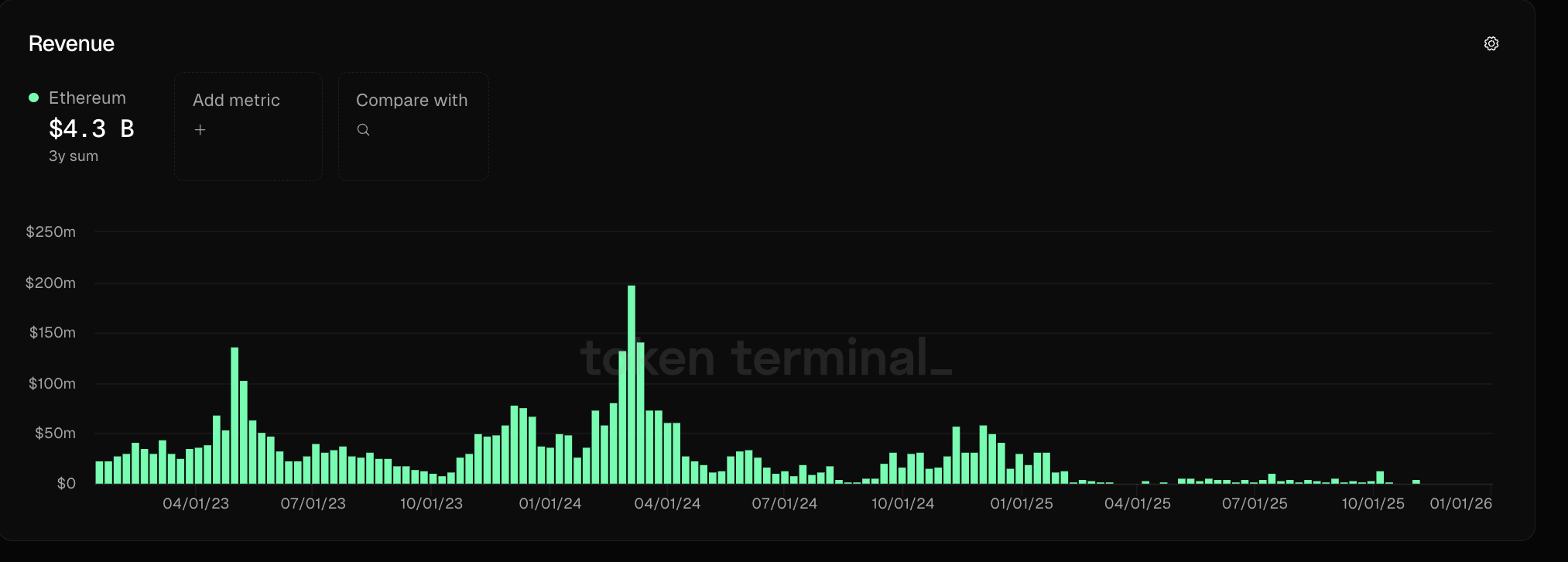

The latest comprehensive data from Capriole Investments, a leading quantitative Bitcoin and digital asset fund, has unveiled compelling statistics: institutional purchases are now beating the daily mined supply by a remarkable 76%. This substantial imbalance between demand and supply underscores a renewed, aggressive interest from major corporate and financial entities in Bitcoin exposure, following what had been a period of relative quietude and uncertainty at the close of the previous year.

For two months leading up to the new year, the Bitcoin market experienced a notable slowdown in institutional demand, leading to a breakdown in buying momentum. This period was characterized by cautious investor sentiment, likely influenced by various factors such as macroeconomic concerns, profit-taking after significant rallies, and a general wait-and-see approach from large-scale players. However, that phase appears to have concluded definitively. Capriole Investments’ proprietary Net Institutional Buying metric, a crucial indicator that aggregates purchases made by corporate treasuries and the recently established and highly influential US spot Bitcoin exchange-traded funds (ETFs), has now registered eight consecutive "green" days. This consistent streak signifies that for over a week, the net institutional buying appetite has unequivocally surpassed the amount of new Bitcoin added to the circulating supply by miners. On Monday, this "excess" demand reached its peak, totaling a commanding 76%.

The implications of this metric are profound. Bitcoin, by its design, is a deflationary asset with a strictly limited supply of 21 million coins. New Bitcoin enters circulation through a process known as mining, where powerful computers solve complex cryptographic puzzles to validate transactions and add new blocks to the blockchain. As a reward, miners receive newly minted Bitcoin. The rate at which new Bitcoin is created is halved approximately every four years, an event known as the "halving," which further constrains supply. With the most recent halving having occurred in 2024, the current rate of new Bitcoin issuance is already significantly reduced. When institutional demand not only matches but substantially exceeds this already constrained new supply, it creates a powerful supply shock dynamic, driving up prices due to basic economic principles.

The entities contributing to this surging demand are diverse yet unified in their conviction regarding Bitcoin’s long-term value proposition. Corporate treasuries, exemplified by pioneering companies like MicroStrategy, continue to view Bitcoin as a strategic reserve asset, an effective hedge against inflation, and a means to optimize their balance sheets in an uncertain economic climate. These companies, having navigated previous market cycles, have demonstrated a deep understanding of Bitcoin’s potential as a store of value. Their continued accumulation validates Bitcoin’s role beyond speculative trading, cementing its status as a legitimate asset class.

Complementing this, the emergence and rapid growth of US spot Bitcoin ETFs have revolutionized institutional access to Bitcoin. Approved in 2025, these ETFs provide a regulated, accessible, and familiar investment vehicle for traditional financial institutions, wealth managers, and even retail investors who prefer to gain exposure through conventional brokerage accounts rather than directly holding Bitcoin. Giants like BlackRock and Fidelity, among others, have launched their own spot Bitcoin ETFs, attracting billions of dollars in inflows within their first year of operation. Each dollar invested in these ETFs directly translates into the purchase of physical Bitcoin by the fund managers, creating a direct and substantial conduit for institutional capital into the Bitcoin ecosystem. The ease with which large institutions can now allocate capital to Bitcoin, without the complexities of direct custody or navigating nascent crypto exchanges, has been a game-changer, significantly broadening the pool of potential investors.

Charles Edwards, the astute founder of Capriole Investments, commented on this pivotal data in a post on X (formerly Twitter), stating, "Institutions are once again net buyers of Bitcoin." Edwards further elaborated on the historical significance of this trend, revealing that periods where institutional buying flips positive versus newly mined supply have historically been precursors to significant price appreciation for BTC/USD. Since 2020, the average increase observed in the wake of such a flip has been an impressive 109%. The most recent comparable instance, prior to the current surge, saw Bitcoin register a substantial 41% upside. This historical correlation suggests that institutional conviction acts as a powerful catalyst, often preceding broader market rallies as "smart money" leads the charge, validating the asset for a wider spectrum of investors. This institutional embrace lends credibility and stability to the market, fostering greater confidence among both large-scale and individual investors.

Adding to the chorus of optimistic takes on Bitcoin’s future price performance, network economist Timothy Peterson has also weighed in, highlighting historical patterns that suggest an imminent rebound. Peterson noted that history is firmly on the side of the bulls, especially after a substantial near 40% drawdown from October’s all-time highs of $126,200. "History favors a return above $100,000 for Bitcoin this month. Bitcoin has had 3 consecutive months of declines. That has only happened 9 times since 2015," Peterson wrote on X. He meticulously detailed the subsequent price action following these rare occurrences: "What happens next? 1 month later, Bitcoin was positive 67% of the time. However, the 3 negative instances were all in 2018 and marked the end of that bear market." While the average gain in these scenarios was a more modest 15%, the high probability of a positive return, coupled with the current market dynamics, paints a compelling picture for January 2026. The fact that the negative instances occurred during the capitulation phase of a major bear market provides further reassurance that the current situation, marked by strong institutional demand, is fundamentally different.

The current market sentiment reflects this growing optimism. Bitcoin’s price has already shown significant recovery, returning to the $94,000 mark after Monday’s Wall Street open and achieving its highest levels since mid-November. This upward momentum, fueled by sustained institutional inflows, suggests that the market is already beginning to price in the renewed demand.

Beyond the immediate supply-demand dynamics, several underlying factors contribute to Bitcoin’s allure for institutional investors in 2026. The global macroeconomic landscape, characterized by persistent inflationary pressures and geopolitical uncertainties, continues to drive demand for scarce, decentralized assets. Bitcoin’s fixed supply and independence from central bank policies make it an attractive hedge against currency debasement and a reliable store of value in turbulent times. Furthermore, the increasing regulatory clarity surrounding digital assets, particularly in major jurisdictions, has significantly reduced perceived risks for institutional players, paving the way for larger allocations. The continued development and maturation of the Bitcoin ecosystem, including advancements in scaling solutions like the Lightning Network and enhanced security protocols, also bolster confidence in its long-term viability and utility.

While the outlook is overwhelmingly positive, it is prudent to acknowledge the inherent volatility of the cryptocurrency market. Bitcoin, despite its growing institutional acceptance, remains a relatively young asset class. Price movements can be swift and significant, influenced by a multitude of factors ranging from macroeconomic shifts to regulatory changes and technological developments. However, the current confluence of overwhelming institutional demand, a constrained supply, and historical price patterns provides a powerful argument for a sustained bullish trajectory.

In conclusion, the early months of 2026 mark a pivotal moment for Bitcoin. The data unequivocally points to a robust resurgence of institutional interest, with buying volume significantly outpacing the rate of new Bitcoin entering circulation. This supply-demand imbalance, amplified by the structural scarcity of Bitcoin and facilitated by sophisticated investment vehicles like spot ETFs, is creating a fertile ground for substantial price appreciation. As institutional "smart money" continues to flow into Bitcoin, historical precedents suggest that the digital asset is well-positioned for significant gains, potentially propelling its price beyond the $100,000 threshold and further solidifying its role as a cornerstone of the global financial landscape.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.