Global venture funding to fintech and financial services startups last year rose an impressive 27% to total $51.8 billion, once again surpassing pre-pandemic investment levels, according to Crunchbase data. This significant growth occurred despite a decrease in the overall number of funding deals, indicating a clear trend towards larger, more concentrated investments in mature companies. Building on this robust momentum, investors in the space are setting their sights on 2026, predicting a continued focus on pre-IPO companies, a notable increase in mergers and acquisitions (M&A) activity, and sustained, aggressive investment into startups that strategically integrate Artificial Intelligence (AI) to enhance their fintech offerings. The landscape is evolving, driven by a maturing ecosystem, a cautious but optimistic public market, and the undeniable transformative power of AI.

The long-awaited "IPO dam" finally appears to have broken in 2025, witnessing several prominent fintech companies either successfully going public or filing to do so. This development is crucial, as the performance of public-market counterparts often dictates the sentiment and flow of startup investment. Among those making their debut were stablecoin issuer Circle, digital bank Chime, buy now, pay later giant Klarna, and enterprise expense management platform Navan. Their public listings were eagerly watched, signaling a potential thaw in what had been a frozen IPO market for several years. However, despite initial impressive debuts and significant investor interest, shares for many of these newly public fintech entities have subsequently settled, often trading near or even below their first-day closing prices. This post-debut recalibration suggests that while the market is open for listings, investors are quickly adjusting valuations to reflect long-term fundamentals rather than initial hype, a sign of increasing market maturity and discernment.

Despite these mixed post-IPO performances, investor appetite for well-established, pre-IPO fintech companies remains remarkably strong. Industry stalwarts such as Plaid, Ramp, Monzo, and Revolut continue to attract significant interest, perceived as prime candidates for future public offerings. Nik Milanovic, general partner of The Fintech Fund, highlights this trend, stating, "The story of fintech funding this year will probably be dominated by those $100M+ rounds as these companies get ready to go public." This focus on substantial late-stage funding rounds underscores a strategic approach by investors to back market leaders with proven business models and clear paths to scalability and eventual liquidity. These companies often boast large user bases, innovative technologies, and strong revenue growth, making them attractive despite broader market uncertainties. Investors are keen to secure positions in these high-potential firms before they hit the public markets, anticipating further growth and returns.

Concurrently with the IPO preparations, Milanovic also anticipates a frenetic M&A environment in 2026, predicting that "M&A will go crazy." This surge in consolidation is expected to be driven by several factors: larger, more established financial institutions looking to acquire innovative technologies and talent, fintechs seeking to expand their market share or product offerings, and private equity firms looking for strategic buys. The current market environment, characterized by some valuation adjustments and a desire for strategic growth, creates fertile ground for M&A. Furthermore, Milanovic suggests that more companies will follow the lead set by Stripe and Revolut in providing tender offers to their employees. These tender offers serve as a crucial mechanism to provide liquidity to early investors and employees without the immediate pressure of an IPO, allowing companies to defer going public until market conditions are more favorable or they achieve further growth milestones. Such strategies offer flexibility, enabling companies to mature further while still rewarding their stakeholders. Milanovic notes that "Venture firms will both sell and buy into these rounds," indicating a dynamic secondary market for private company shares, further enhancing liquidity options within the venture ecosystem.

The conversation around Artificial Intelligence has undeniably reshaped the venture capital mindset, pushing valuations into what some might term "bubble territory." However, Amias Gerety, partner and head of U.S. investments at QED Investors, offers a nuanced perspective. While acknowledging the valuation exuberance, he asserts that "the underlying growth and performance of companies in the age of AI is astounding and unlike anything we’ve seen before," even surpassing the boom years of 2020 and 2021. This paradox highlights the genuine, transformative impact of AI on business models, contrasting with speculative fervor. AI’s integration into fintech is not merely an incremental improvement; it’s a fundamental shift, enabling unprecedented levels of personalization, efficiency, and risk management. From hyper-personalized financial advice and automated fraud detection to intelligent process automation and advanced credit scoring, AI is fundamentally redefining how financial services are delivered and consumed.

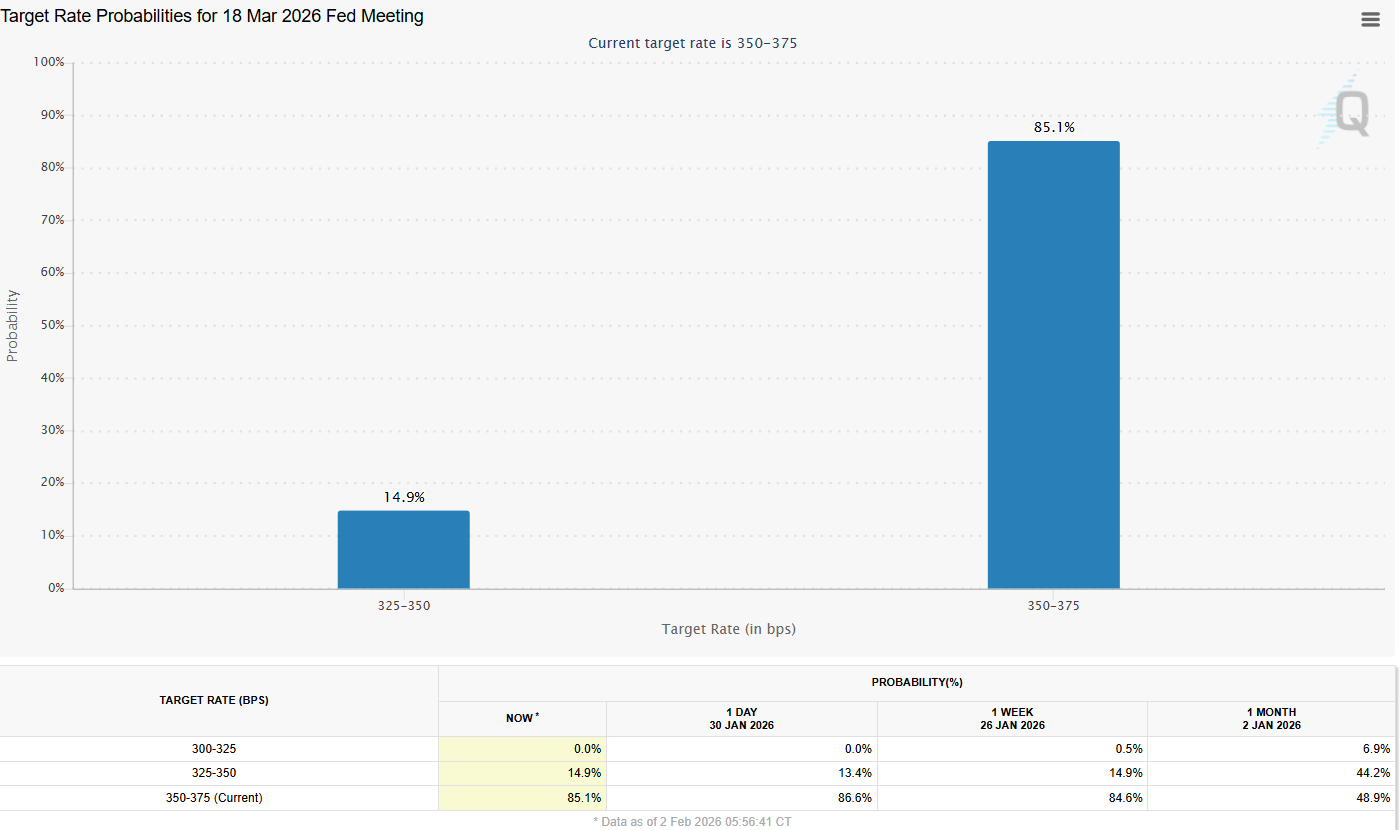

Gerety cautions that "absent a broader recession, we expect some pullback and return to rationality in the funding market," but he firmly believes that "funding in fintech and at the AI application layer should remain quite strong." This suggests a more discerning approach from investors, prioritizing companies with clear AI strategies that deliver tangible value and demonstrate robust unit economics, rather than those merely riding the AI hype wave. However, Gerety also tempers expectations, stating, "we just don’t expect fintech funding to ever recover to the highs we saw in 2020 and 2021, when fintech and crypto were the hottest themes in venture." He attributes this to a shift in investor focus, noting that "the tourists have moved on to chasing the AI-hype cycle." This implies that while fintech remains a critical sector, the speculative capital that flooded the market during the peak of the pandemic has largely reallocated, leaving behind a more focused and strategic investor base committed to sustainable growth.

Jake Gibson of Better Tomorrow Ventures reinforces the pervasive influence of AI, predicting a continued proliferation of AI companies across the entire fintech spectrum. He optimistically observes that "there’s a lot of innovation going on in fintech right now," extending beyond just AI. The regulatory environment also plays a pivotal role in shaping this innovation. Gibson notes that "the current administration has been much more friendly to fintech innovation," which is expected to translate into more fintechs successfully obtaining bank charters and pursuing vertical integration in 2026. This regulatory receptiveness could significantly lower barriers to entry and expansion for fintechs, allowing them to offer a broader range of financial services directly. Furthermore, Gibson anticipates increased activity around stablecoins and cryptocurrencies, alongside "a lot of new products in the wealth stack." This highlights the growing mainstream acceptance and integration of digital assets into traditional finance, as well as the ongoing evolution of wealth management to cater to diverse investor needs with technologically advanced solutions.

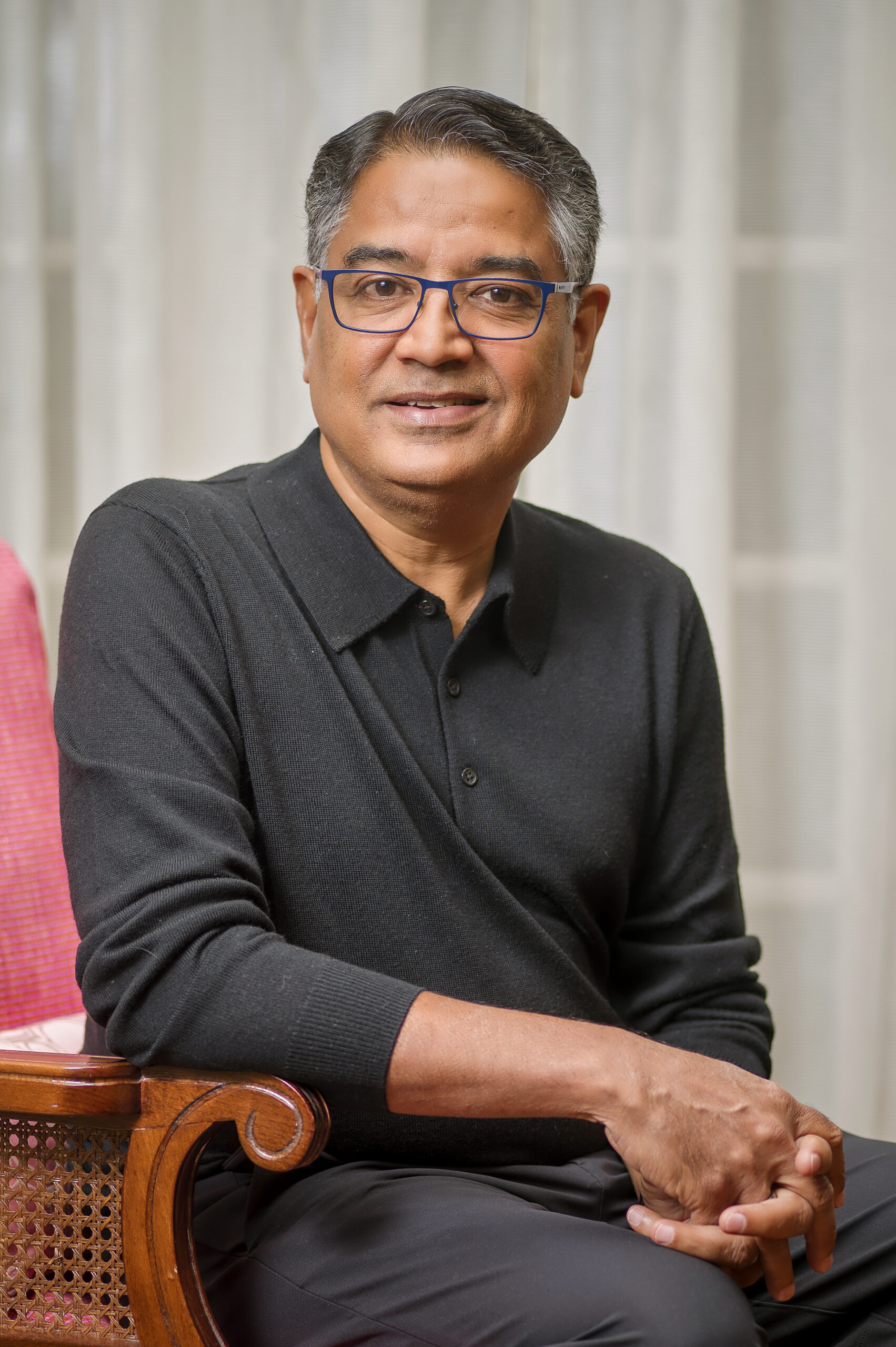

Looking at who will secure this funding, Jordan Leites, Vice President at Norwest Venture Partners, emphasizes that "the best teams will increasingly pull ahead." In a competitive and evolving landscape, exceptional leadership, deep technical expertise, and a clear vision are paramount. Startups leveraging AI and stablecoins, in particular, are demonstrating an ability to scale faster than previous generations of fintech companies. Leites explains, "These businesses can move more quickly and reach meaningful adoption earlier in their lifecycles," thanks to the inherent efficiencies and network effects these technologies offer.

Specifically, Leites predicts that stablecoins, agentic payments, and AI-native tools for financial services will command a disproportionate share of funding. These categories are not merely trending; they represent fundamental shifts in how financial transactions are executed and managed.

- Stablecoins: Their potential to revolutionize cross-border payments, provide a stable bridge between traditional finance and the broader crypto ecosystem, and enable efficient DeFi applications makes them incredibly attractive. They combine the programmability and efficiency of blockchain with the stability of fiat currencies.

- Agentic payments: These refer to autonomous, intelligent payment systems capable of executing transactions based on predefined conditions and machine learning algorithms. This includes smart contracts for automated escrow, embedded finance solutions where payments are seamlessly integrated into other services, and systems that can proactively manage financial flows.

- AI-native tools for financial services: These are solutions where AI is not an add-on but the core engine, driving everything from risk assessment and compliance automation to personalized customer interactions and predictive analytics. They promise unparalleled efficiency, accuracy, and insights.

Leites articulates the core reason for this concentration of capital: "These categories sit at the intersection of technological inflection points and clear customer demand, which is where capital tends to follow." This confluence of groundbreaking technology and demonstrable market need creates an irresistible proposition for investors seeking high-impact opportunities.

In conclusion, the fintech landscape of 2026 is poised for strategic growth rather than speculative frenzy. While the "tourist" capital that chased every hot trend may have receded, a more mature and discerning investor base is channeling significant funds into companies demonstrating clear value, robust business models, and a strategic embrace of transformative technologies. The breaking of the IPO dam, though met with post-debut market adjustments, signals renewed confidence in public markets. Simultaneously, M&A activity is expected to surge, offering alternative liquidity pathways and fostering industry consolidation. At the heart of this evolution is AI, acting as a fundamental driver of innovation across all fintech verticals, promising unparalleled efficiency, personalization, and security. As stablecoins, agentic payments, and AI-native tools continue to mature, they will define the next generation of financial services, attracting the lion’s share of investment and reshaping the future of finance. The focus remains on "the best teams" who can harness these technological inflection points to meet clear customer demands, signaling a period of dynamic and impactful growth for the fintech sector.