Batten contends that the prevailing criticisms often stem from an incomplete picture, stating, "Every nascent disruptive technology is accompanied by claims that are based on lack of understanding, lack of data, and a fear of something unknown." This sentiment underscores his approach to systematically addressing the claims that have fueled much of the environmental backlash against Bitcoin. High-profile institutions have not shied away from vocal criticism; for instance, in November, the Dow Jones lambasted Harvard University for its investment in BTC, branding the digital asset as a "fake currency and money-laundering tool that is also an environmental catastrophe." Similarly, Bloomberg asserted in July that Bitcoin "devours the electricity meant for the world’s poor," painting a stark picture of its societal impact. While some environmental researchers acknowledge the difficulty in quantifying indirect emissions and opportunity costs associated with mining, Batten’s work focuses on direct, data-driven refutations.

Myth 1: Bitcoin’s Resource Consumption Scales with Transaction Volume.

A cornerstone of many criticisms is the assertion that Bitcoin consumes an exorbitant amount of energy, water, and generates significant e-waste per transaction. Batten unequivocally states this premise is "not true." He points to four peer-reviewed studies, summarized in the University of Cambridge’s 2025 Digital Mining Industry Report, which conclude that Bitcoin’s overall resource use is largely independent of its transaction volume. This crucial distinction means that the Bitcoin network can scale its transaction capacity without a proportional increase in its energy, water, or hardware consumption. The energy expended is primarily tied to securing the network, not processing individual transactions, fundamentally altering the calculus of its environmental cost-per-use.

Myth 2: Bitcoin Mining Destabilizes Power Grids.

Another prevalent myth is that Bitcoin mining operations, with their substantial and continuous energy demands, destabilize power grids. Batten argues the exact opposite is true: Bitcoin mining actually stabilizes grids, particularly those heavily reliant on intermittent renewable energy sources like solar and wind. This is achieved through flexible load management. Bitcoin miners are unique in their ability to quickly power down or ramp up operations in response to grid demands, acting as an "interruptible load." In regions like Texas, where renewable energy generation can fluctuate dramatically, miners can absorb surplus energy during periods of high generation and reduce consumption during peak demand or low generation, thereby balancing the grid and preventing waste or blackouts.

Myth 3: Bitcoin Mining Increases Electricity Costs for Everyday Consumers.

Critics frequently claim that the energy demands of Bitcoin miners drive up electricity prices for residential and commercial consumers. Batten directly challenges this, stating there is "no data to support the claim" and "neither in the data, nor in a peer-reviewed study is there evidence to support the claim." In fact, he highlights numerous instances where Bitcoin mining has been found to help lower electricity prices. By providing a consistent and flexible demand for otherwise stranded or underutilized energy, particularly from remote renewable projects, miners can improve the economic viability of power generation, leading to lower overall costs for utilities and, subsequently, for consumers.

Myth 4: Comparing Bitcoin’s Energy Use to Entire Countries is a Valid Environmental Metric.

The comparison of Bitcoin’s energy consumption to that of entire countries, such as Thailand or Poland (as cited by Morningstar in November), is a rhetorically powerful but ultimately misleading tactic, according to Batten. He refers to the Intergovernmental Panel on Climate Change (IPCC), which emphasizes that the focus in environmental discussions should be on energy source transformation – shifting towards cleaner, more sustainable energy – rather than simply reduction of usage. Such comparisons, while attention-grabbing, distract from the more critical issue of how the energy is generated and the role Bitcoin can play in accelerating the transition to renewable sources.

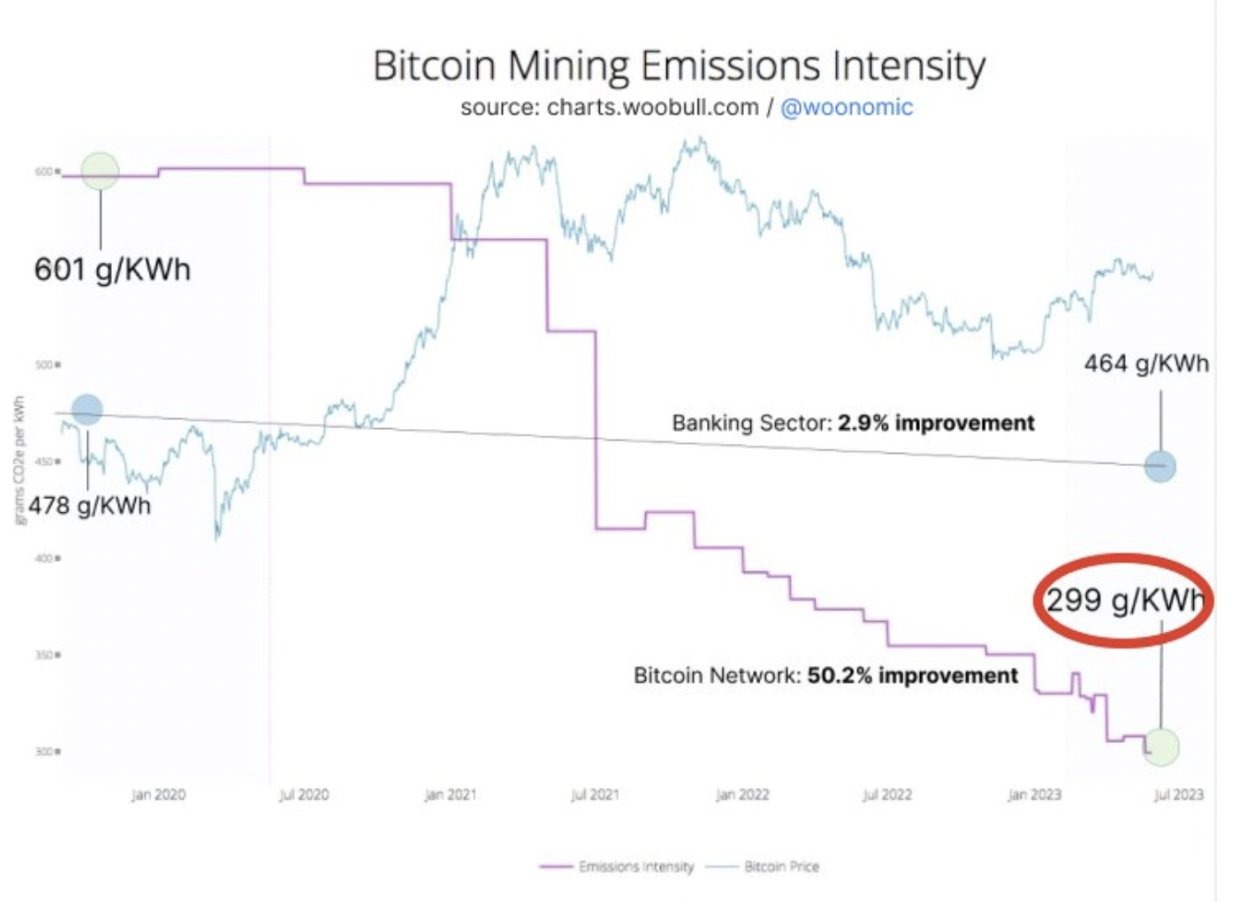

Myth 5: Bitcoin Mining Has a High Direct Carbon Footprint.

A significant portion of the "environmental catastrophe" narrative hinges on the belief that Bitcoin mining generates a high carbon footprint. Batten clarifies that Bitcoin mining itself produces no direct emissions. The emissions associated with it are classified as Scope 2 emissions, meaning they are indirect emissions from the generation of purchased electricity. This distinction is crucial; it means the carbon intensity of Bitcoin mining is entirely dependent on the energy mix of the grid it operates on. Furthermore, Batten points to data showing a falling emissions intensity, indicating a global shift towards cleaner energy sources within the mining sector.

Myth 6: Proof-of-Stake (PoS) is Inherently Environmentally Superior to Proof-of-Work (PoW).

The transition of Ethereum to a Proof-of-Stake (PoS) consensus mechanism was widely lauded as an environmental triumph over Bitcoin’s energy-intensive Proof-of-Work (PoW). However, Batten argues that claiming PoS is inherently more environmentally friendly "errs by conflating energy use with harm." While PoS undoubtedly uses less energy, Batten highlights that PoW offers distinct environmental benefits often overlooked. These include its unique ability to mitigate methane emissions from flaring gas, provide unparalleled stability to energy grids, incentivize the expansion of renewable energy capacity, and monetize otherwise wasted or curtailed renewable energy that PoS cannot.

Myth 7: Bitcoin Mining Takes Away Renewable Energy from Other Users.

This myth suggests that Bitcoin miners compete with and divert renewable energy from residential or industrial users, hindering broader decarbonization efforts. Batten counters this with compelling evidence demonstrating the opposite effect. He states, "Many people now have access to renewable energy who otherwise would not have, as a direct result of Bitcoin mining." He cites projects like Gridless in Africa, which has delivered renewable energy to an estimated 28,000 people by making remote, off-grid renewable power generation economically viable through the co-location of Bitcoin mining operations. Miners provide a consistent base load, making these projects financially sustainable and expanding access to clean energy in underserved regions.

Myth 8: Bitcoin Mining Wastes Energy.

The accusation that Bitcoin mining "wastes energy" is one of the most persistent criticisms. Batten firmly refutes this, explaining that mining actively prevents renewable energy waste by consuming curtailed or otherwise unused power. He cites peer-reviewed research by Moghimi et al. and Lai and You, which found that Bitcoin mining significantly reduces renewable energy curtailment and improves the economics of microgrids. Beyond the technical aspect, Batten challenges the subjective nature of the claim itself: "’Wasting energy’ is not an objective assessment, but a value judgment. One can only claim that energy is wasted if no good to humanity is produced in the process." He implies that the security, decentralization, and financial inclusion provided by Bitcoin represent a significant "good to humanity."

Myth 9: Bitcoin’s Overall Carbon Footprint is Excessively High and Demonstrates a Lack of Commitment to Sustainability.

Beyond the specifics of direct emissions, a broader myth persists that Bitcoin’s overall carbon footprint is inherently and unacceptably high, signaling a lack of commitment to environmental sustainability within the industry. Batten presents compelling data to contradict this, proudly stating, "Bitcoin mining is, in fact, the only global industry for which there is robust, third-party data showing it has crossed the 50% sustainable energy threshold." This signifies that over half of the energy used for Bitcoin mining now comes from sustainable sources, a testament to the industry’s rapid adoption of renewables and its unique economic incentives to seek out the cheapest, often greenest, power available. This rapid decarbonization rate is unparalleled in many traditional industries.

In summary, Daniel Batten’s rigorous debunking of these nine pervasive myths paints a far more nuanced and often positive picture of Bitcoin mining’s environmental relationship. By moving beyond sensationalist headlines and instead grounding the discussion in peer-reviewed research and real-world grid data, Batten challenges the narrative of Bitcoin as an "environmental catastrophe." He highlights its potential as a catalyst for renewable energy adoption, a stabilizer for fragile power grids, and a driver for innovation in sustainable energy practices, urging a data-driven assessment over fear-based judgments of this nascent, disruptive technology.