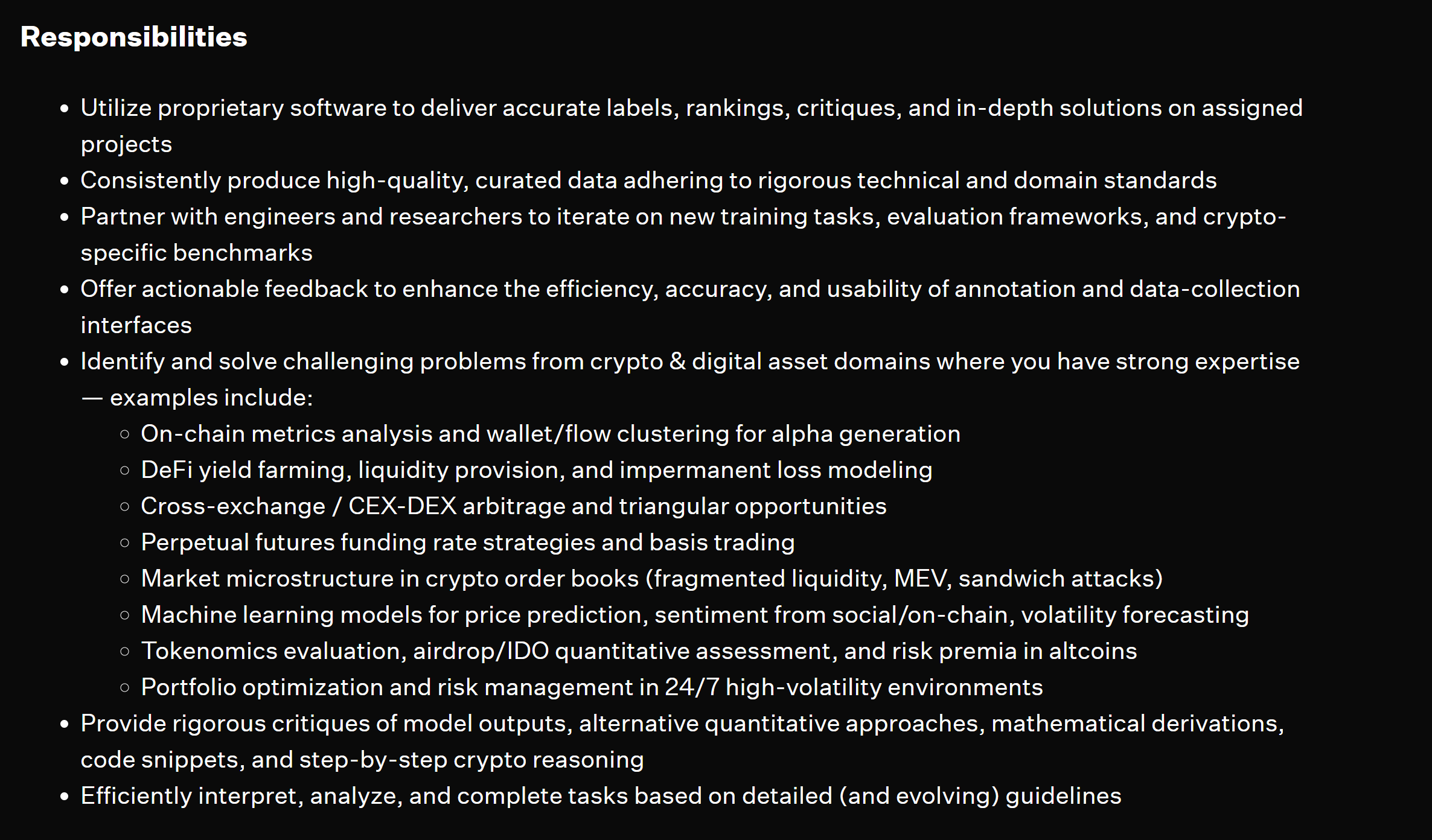

The strategic hiring, revealed through a recently published job listing, underscores xAI’s commitment to developing AI models capable of understanding and navigating complex financial ecosystems. This remote position is not merely for data entry; it seeks a seasoned professional to impart expert-level knowledge to xAI’s sophisticated AI systems, teaching them the nuanced methodologies employed by professional crypto traders. The scope of instruction includes, but is not limited to, the intricate art of analyzing on-chain data, evaluating the often-complex token economics of various digital assets, and mastering robust risk management strategies essential for survival in the perpetually active and notoriously volatile crypto markets.

The responsibilities outlined in the job description extend far beyond traditional data analysis. The selected crypto expert will be tasked with generating "high-quality data in text, voice, and video formats." This encompasses creating detailed annotations, providing incisive critiques of model outputs, constructing step-by-step reasoning traces to explain complex financial decisions, offering audio explanations of advanced trading strategies, and conducting occasional structured video sessions. This multi-modal data generation is crucial for training AI models through advanced techniques like reinforcement learning from human feedback (RLHF), ensuring the AI doesn’t just process information but truly understands the underlying rationale and decision-making processes of human experts. The role’s fully remote nature and competitive hourly compensation, ranging from $45 to $100 depending on experience and location, highlight the high value xAI places on this specialized expertise.

Moreover, a critical aspect of the role involves identifying and resolving "challenging problems from crypto." This includes tackling market microstructure issues such as fragmented liquidity, which arises from the dispersion of trading volumes across numerous exchanges and decentralized platforms, making efficient large-scale trading difficult. Another crucial area is addressing Miner Extractable Value (MEV)-related execution risks. MEV refers to the profit miners (or validators in proof-of-stake systems) can extract by reordering, censoring, or inserting transactions within a block. Understanding and mitigating MEV risks is paramount for any AI system aiming to execute trades or provide reliable market insights in the crypto space, as MEV can significantly impact trade profitability and market fairness. The ability to dissect these intricate problems and translate human understanding into actionable data for AI models will be central to the specialist’s contribution.

The broader implications of xAI’s recruitment effort point towards a rapidly accelerating convergence of artificial intelligence and the cryptocurrency sector. Sumit Gupta, co-founder and CEO of the prominent Indian crypto exchange CoinDCX, succinctly captured this sentiment when commenting on the job posting. Gupta asserted that the role unequivocally demonstrates that "the future lies in the convergence of crypto and AI." He further speculated on Elon Musk’s ambitious goals, questioning if Musk intends to transform xAI/Grok – xAI’s generative AI chatbot known for its real-time access to information on X and its unique, often sarcastic personality – into "the #1 research platform for crypto folks too," given that X (formerly Twitter) is already recognized as the primary digital meeting ground for the "Crypto Twitter" (CT) community.

This convergence is not merely theoretical; it’s manifesting in various forms across the industry. AI is increasingly being leveraged for sophisticated market prediction algorithms, high-frequency arbitrage trading bots, sentiment analysis of social media and news, smart contract auditing for security vulnerabilities, and optimizing decentralized finance (DeFi) protocols. Conversely, blockchain technology is being explored for its potential to ensure data integrity for AI training, create decentralized AI networks, and facilitate verifiable computation. xAI’s move signifies a top-tier AI company actively bringing this convergence into its core development strategy, potentially setting a new benchmark for AI capabilities in financial markets.

Elon Musk’s multifaceted involvement in both AI and the digital sphere further contextualizes xAI’s crypto focus. Beyond xAI, Musk’s ownership of X (formerly Twitter) positions him at the nexus of global communication and increasingly, financial interaction. In November, Musk revealed plans for X to launch a standalone encrypted messaging app, "X Chat," within months, aiming to compete with established platforms like Telegram and WhatsApp. Notably, Musk stated on The Joe Rogan Experience podcast that X Chat would utilize peer-to-peer encryption similar to Bitcoin (BTC), hinting at a deeper integration of decentralized technologies into his platforms.

Adding to this, just last month, X’s head of product, Nikita Bier, announced the impending rollout of "Smart Cashtags." This innovative feature will provide real-time price data for cryptocurrencies and stocks, alongside curated news and relevant on-platform discussions. Crucially for the crypto community, Smart Cashtags will also surface vital smart contract details for various crypto tokens and highlight recent mentions tied to companies, development teams, and prevailing market narratives. These initiatives on the X platform itself create a rich, real-time data environment that can serve as an invaluable training ground and information source for xAI’s crypto-focused models. The integration of X’s vast, dynamic data stream with xAI’s learning algorithms could create an unparalleled AI tool for crypto analysis.

The implications of xAI successfully training its models on crypto are profound. Grok, with its access to real-time information and its evolving understanding of digital assets, could become an indispensable tool for traders, investors, and researchers. It could potentially offer predictive insights, risk assessments, and explanations of complex market events with unprecedented speed and accuracy. However, this also raises questions about ethical considerations, potential market manipulation if such powerful AI tools are misused, and the broader impact on market efficiency and fairness.

Ultimately, xAI’s recruitment of a crypto specialist is more than just a hiring announcement; it’s a strong declaration of intent. It signifies a strategic decision to embed deep financial and cryptographic expertise directly into the fabric of its advanced AI models. This move by one of the most prominent AI companies, spearheaded by a visionary like Elon Musk, not only validates the growing importance of the crypto sector but also promises to accelerate the fusion of artificial intelligence and digital assets, potentially unlocking new frontiers in financial analysis, trading, and understanding of the global economy. The future, as many are now observing, is increasingly an intelligent and decentralized one.