Faryar Shirzad, Coinbase’s chief policy officer, articulated these concerns in a widely noted post on X, highlighting how the ongoing legislative discourse surrounding the ability of US-issued stablecoins to offer "rewards" under the recently enacted GENIUS Act could critically impair the global competitiveness of dollar-denominated stablecoins. He pointed to a pivotal announcement from China’s central bank as compelling evidence that rival financial powers are rapidly innovating to bolster the attractiveness and utility of their state-backed digital money, thereby posing a direct challenge to the dollar’s long-standing dominance.

The People’s Bank of China (PBOC), the nation’s central bank, recently unveiled a groundbreaking framework designed to permit commercial banks to pay interest on balances held in digital yuan (e-CNY) wallets, effective January 1, 2026. Lu Lei, a deputy governor at the PBOC, emphasized that this strategic shift aims to elevate the e-CNY beyond its initial function as a mere digital cash substitute, integrating it more deeply into commercial banks’ asset and liability management systems. This move signifies a profound evolution, transforming the digital RMB from a basic digital cash instrument into a more sophisticated "digital deposit currency" (Digital Deposit Money). According to Lei, this enhanced e-CNY will boast comprehensive functions, including serving as a monetary value scale, a robust store of value, and a versatile tool for cross-border payments, positioning it as a formidable contender in the international digital finance arena.

Stablecoin Reward Debate Raises Competition Fears

The legislative backdrop to Shirzad’s warning is the GENIUS Act, a landmark piece of legislation that successfully passed in June. This act established stringent reserve requirements and comprehensive compliance rules for stablecoins, while simultaneously imposing a prohibition on issuers from directly paying interest. However, a crucial nuance within the law permits platforms and third parties to offer rewards that are linked to the usage of stablecoins. This distinction has become the focal point of intense debate, with significant implications for the future of US stablecoins.

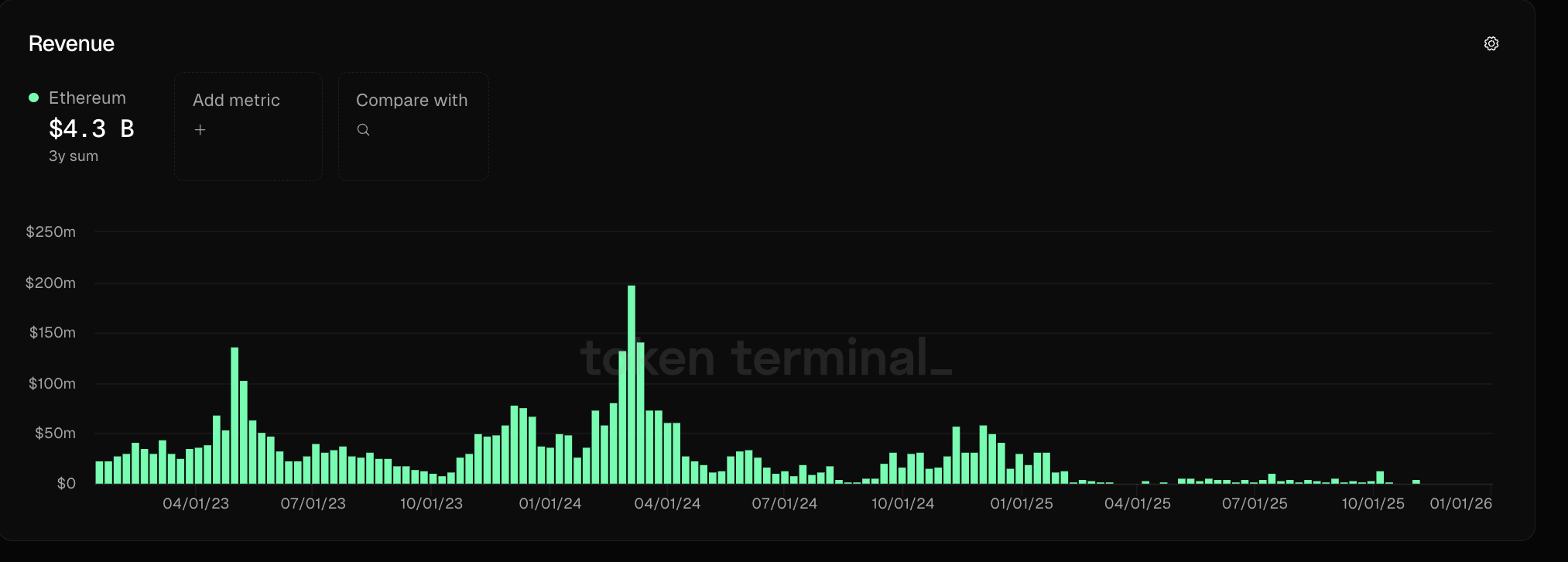

The concept of "rewards" for stablecoin users is inherently appealing. Stablecoin issuers typically hold their reserves in highly liquid, low-risk assets such as US Treasury bills, which generate yield. The ability to share a portion of this yield with users, even indirectly, makes stablecoins more attractive than traditional bank deposits, which often offer negligible or zero interest rates, particularly in a low-interest-rate environment. This competitive advantage is precisely what Shirzad fears could be jeopardized.

"If this issue is mishandled in Senate negotiations on the market structure bill, it could hand our global rivals a big assist in giving non-US stablecoins and CBDCs a critical competitive advantage at the worst possible time," Shirzad cautioned. His statement underscores the urgency and the potential strategic misstep if US policymakers fail to appreciate the broader geopolitical implications of their stablecoin regulations. The "worst possible time" refers to the current global landscape characterized by increasing demand for efficient cross-border payments, a growing appetite for digital assets, and a concerted push by nations like China to reduce reliance on the US dollar system.

This warning gains further weight amidst growing concerns within the crypto industry about aggressive lobbying efforts by traditional banks seeking to reopen and amend the GENIUS Act. Max Avery, a prominent crypto policy commentator, highlighted this sentiment last week, stating, "Now the banking lobby wants to reopen it." Avery meticulously pointed out a core discrepancy: while banks currently accrue significant earnings—around 4%—on reserves parked at the Federal Reserve, they frequently offer consumers near-zero interest on traditional savings accounts. Stablecoin platforms, by contrast, present a disruptive model, threatening to upend this status quo by offering to share a portion of that lucrative yield with their users, thereby attracting deposits away from traditional banking institutions. This perceived threat is a primary driver behind the banking sector’s lobbying efforts.

Coinbase CEO Calls GENIUS Act a ‘Red Line’

The gravity of the situation was further amplified last week when Coinbase CEO Brian Armstrong publicly declared that any attempt to reopen the GENIUS Act would constitute "crossing a red line." Armstrong did not mince words, directly accusing banks of lobbying Congress with the explicit aim of limiting stablecoin rewards to safeguard their established deposit bases. He reiterated Coinbase’s unwavering commitment to opposing any efforts to revise the law, expressing surprise at the overt nature of such lobbying, which he described as "unethical."

Armstrong’s critique extended beyond mere opposition, venturing into a prediction about the future trajectory of the banking sector. He argued that banks are fundamentally misjudging the long-term landscape of digital finance, predicting that they will eventually recognize the immense opportunity and themselves push to offer interest and yield on stablecoins. This foresight suggests that the current lobbying efforts are not only self-serving but also short-sighted, hindering innovation that banks themselves may eventually wish to adopt. His description of the current lobbying effort as "unethical" stems from the belief that it is designed to stifle competition and protect entrenched interests at the expense of consumer benefit and national competitiveness.

China’s Strategic Leap with the Digital Yuan

China’s decision to allow interest payments on its digital yuan balances is a significant strategic maneuver with profound implications. By moving from a "digital cash era" to a "digital deposit currency era," the PBOC is signaling a deeper integration of the e-CNY into its financial system. Historically, CBDCs, including the e-CNY, were designed primarily as direct substitutes for physical cash, offering no interest to prevent disintermediation of commercial banks. However, the PBOC’s new framework, effective 2026, directly challenges this conventional approach.

This move is not merely about domestic financial innovation; it carries substantial geopolitical weight. China has long been at the forefront of CBDC development, driven by several strategic objectives: enhancing financial surveillance capabilities, improving the efficiency of its domestic payment systems, facilitating cross-border transactions under the Belt and Road Initiative, and, crucially, challenging the global dominance of the US dollar. By offering interest on e-CNY balances, China is making its digital currency significantly more attractive, especially for international users and nations looking for alternatives to the dollar-centric financial system. This feature could encourage greater adoption of the e-CNY for trade settlement and reserves, gradually chipping away at the dollar’s hegemony.

The e-CNY’s evolution to include "monetary value scale, value storage, and cross-border payment" functions underscores its ambition to become a comprehensive digital financial instrument. For countries seeking to diversify their foreign exchange reserves or streamline international payments without relying on the SWIFT system (which is largely controlled by Western nations), an interest-bearing e-CNY presents a compelling option.

The Intersecting Threat: Why US Inaction/Missteps Matter

Shirzad’s core argument brilliantly connects these two seemingly disparate developments: the internal US stablecoin reward debate and China’s external CBDC advancements. If US lawmakers, influenced by traditional banking lobbies, opt to severely restrict or outright ban rewards for US dollar stablecoins, they risk disarming a powerful tool that could otherwise reinforce the dollar’s digital presence globally. Simultaneously, if China continues to enhance the appeal of its e-CNY with features like interest payments, it creates a stark contrast: a dynamic, incentivized foreign CBDC versus a potentially handicapped, less attractive US dollar stablecoin ecosystem.

The implications for US dollar hegemony are immense. Currently, US dollar-denominated stablecoins like Tether (USDT) and USD Coin (USDC) dominate the stablecoin market, effectively extending the dollar’s reach into the digital realm. These stablecoins are widely used for trading, remittances, and decentralized finance (DeFi) activities globally. If their competitive edge—partially derived from the potential for yield or rewards—is blunted, users might gravitate towards non-US stablecoins or, more significantly, towards state-backed CBDCs like the e-CNY that offer such incentives. This shift could erode the dollar’s share in digital finance, impacting US influence, the effectiveness of its sanctions regime, and its overall economic power on the world stage.

The urgency of this situation cannot be overstated. In an era of increasing geopolitical competition and a global quest for financial innovation, the US cannot afford to cede ground. The debate currently unfolding in Senate negotiations over the market structure bill is thus not just about domestic financial regulation; it is about national strategic positioning in the evolving global financial architecture.

Broader Implications and Future Outlook

What’s truly at stake is nothing less than US leadership in financial innovation and its long-term status as the global reserve currency. Striking the right balance between robust regulation that ensures stability and consumer protection, and fostering innovation that allows US digital assets to remain competitive, is paramount. Over-regulation or stifling innovation out of protectionist impulses could inadvertently accelerate the very decline the US seeks to prevent.

Potential scenarios abound. In one, US policymakers recognize the strategic importance of stablecoins and craft a framework that allows for competitive reward mechanisms, ensuring that dollar-denominated stablecoins continue to lead the market and reinforce the dollar’s digital dominance. In another, US stablecoins are unduly restricted, creating a vacuum that is eagerly filled by foreign CBDCs, non-USD stablecoins, or other innovative digital payment systems, diminishing the dollar’s global footprint.

Coinbase’s firm stance, championed by Armstrong and Shirzad, reflects not only the company’s business interests but also a broader vision for an open, competitive, and US-led digital financial system. Their advocacy highlights the critical juncture at which the US stands, facing both internal regulatory challenges and external competitive pressures.

In conclusion, the dual challenge posed by the debate over stablecoin rewards in the US and the rapid advancements of China’s digital yuan underscores a critical moment for global finance. To secure its position in the rapidly evolving digital economy, the United States must adopt a clear, forward-thinking, and competitive stablecoin framework that encourages innovation rather than stifling it. Failure to do so risks handing a significant competitive advantage to rivals and potentially reshaping the landscape of global digital payments in ways that could diminish US economic influence for decades to come.