In a significant strategic recalibration, global cryptocurrency exchange Coinbase has announced the suspension of its local fiat operations in Argentina, a move coming less than a year after its formal entry into the South American nation’s burgeoning crypto market. This decision entails a scale-back of peso-based services, although the platform’s core crypto-to-crypto functionality will remain fully operational, signaling a shift in focus rather than a complete withdrawal.

According to a report from Forbes Argentina, Coinbase has begun informing its Argentine user base about this "deliberate pause." The company framed the decision as a temporary measure, following an internal review of its operational efficacy and market approach. The stated aim is to reassess its strategy and, potentially, return with a more sustainable and robust product offering tailored to the unique complexities of the Argentine financial landscape. This indicates a proactive step to optimize its presence rather than a reactive retreat, suggesting an intent to learn and adapt.

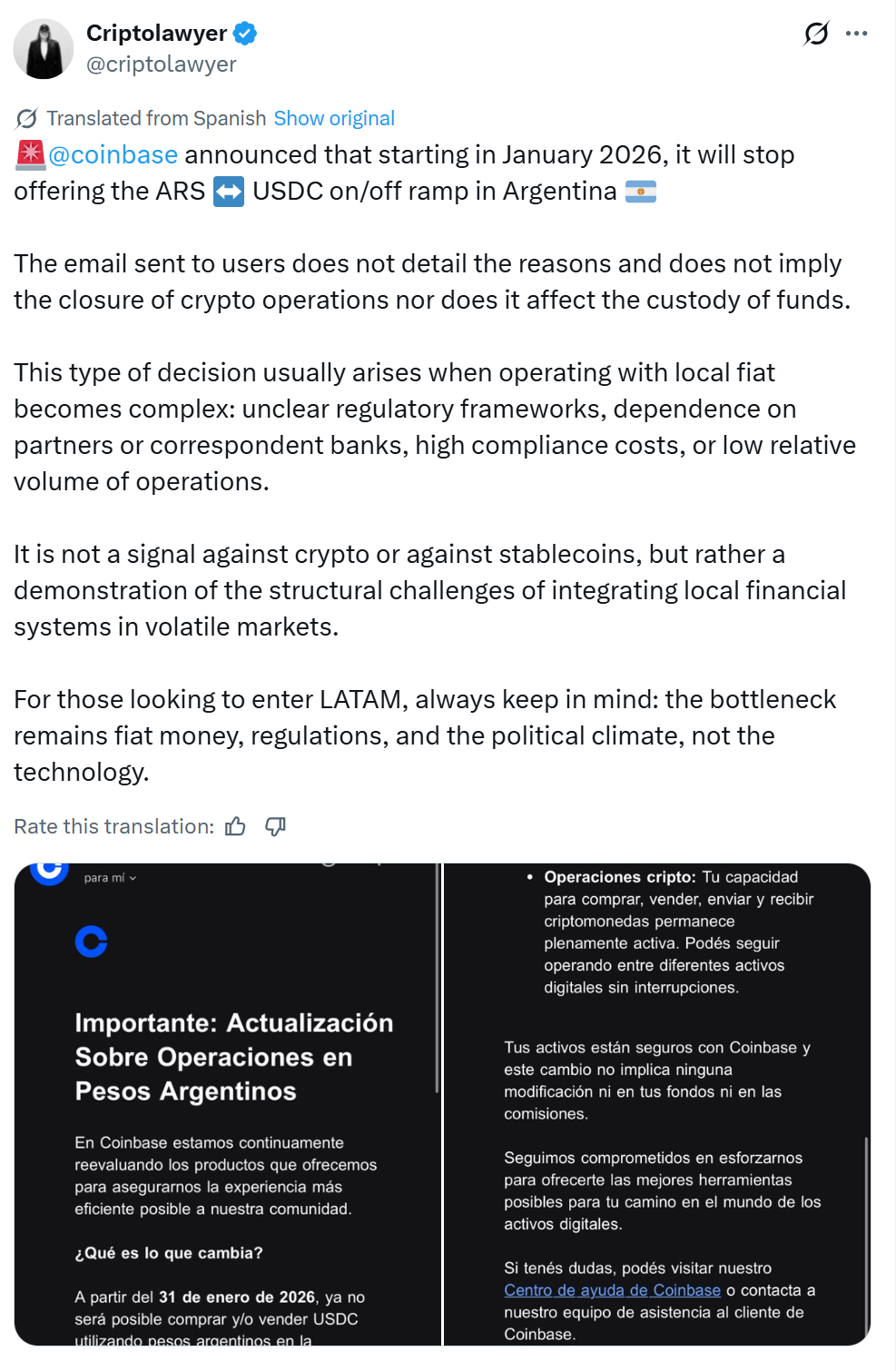

The primary impact of this operational shift will be felt by users engaging with Argentine pesos (ARS). Specifically, from January 31, 2026, Coinbase users in Argentina will no longer be able to purchase or sell USDC using local currency or withdraw funds directly to their Argentine bank accounts. While this date provides a substantial lead time for users to adjust, Coinbase has also specified a more immediate 30-day window from the announcement date for users to complete any pending peso-based USDC transactions and withdrawals. This dual timeline suggests a phased approach, giving users ample opportunity to manage their funds while also setting a clear long-term cessation point for fiat services. It underscores the company’s commitment to a responsible wind-down, ensuring minimal disruption to its existing customer base.

Crucially, the pause does not affect Coinbase’s crypto-to-crypto activities. Users will continue to have full access to buy, sell, send, and receive various digital assets on the platform. Coinbase has also emphatically assured its users that all customer funds remain secure and are unaffected by this strategic decision. This distinction is vital, as it highlights that the challenges lie primarily in integrating with the local traditional financial system rather than issues with the core crypto services themselves. The company reiterated that this pause should not be interpreted as a permanent exit from the country, leaving the door open for a future re-entry with a refined model.

The decision has prompted analysis from experts within the Latin American Web3 community. Ana Gabriela Ojeda, a prominent voice in the region, shared insights on X, suggesting that such operational pauses by international players often stem from a confluence of factors that make local fiat operations unduly complex and costly. Ojeda pointed to several key challenges, including the pervasive issue of unclear or evolving regulatory frameworks, the inherent reliance on correspondent banks for international transactions, high compliance costs associated with navigating diverse legal landscapes, and often, limited transaction volumes that may not justify the extensive operational overhead.

Ojeda articulated that this move is "not a signal against crypto or against stablecoins, but rather a demonstration of the structural challenges of integrating local financial systems in volatile markets." Her assessment provides a critical lens through which to understand Coinbase’s decision, emphasizing that the issue is less about the viability of cryptocurrency itself and more about the friction points at the intersection of traditional finance and the nascent digital asset economy, especially in regions marked by economic instability.

Argentina, in particular, presents a unique and often challenging operating environment for financial services, including crypto exchanges. The country has grappled with persistent high inflation and economic volatility for decades, leading many Argentinians to seek refuge in stable assets, including stablecoins like USDC, as a hedge against the rapid devaluation of the Argentine peso. This dynamic has fueled significant crypto adoption, making Argentina one of the most active crypto markets in Latin America. However, this very volatility, while driving demand for crypto, simultaneously complicates the operational mechanics of fiat on-ramps and off-ramps for international exchanges. Managing liquidity, mitigating exchange rate risks, and navigating capital controls in such an environment can become prohibitively expensive and logistically arduous.

For an international player like Coinbase, which operates under stringent regulatory requirements in its home jurisdiction and globally, adhering to complex and often ambiguous local regulations in a market like Argentina adds layers of cost and risk. The need for robust Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures, coupled with the necessity of establishing reliable banking partnerships in a volatile economy, can quickly erode profit margins, especially if the transaction volumes for fiat services do not scale as anticipated. The "deliberate pause" thus appears to be a strategic decision to avoid burning resources on operations that are currently not yielding a sustainable return on investment or are diverting focus from more promising avenues.

Despite the curtailment of direct fiat services, Coinbase intends to maintain a presence in Argentina through other strategic initiatives. Notably, the company plans to continue its engagement in the country via Base, its Ethereum layer-2 network. Forbes Argentina reported that Coinbase will persist in collaborating with local partners, including the established Argentine crypto exchange Ripio, on Base-related projects. This indicates a pivot towards infrastructure and ecosystem development rather than direct consumer-facing fiat services, potentially leveraging Argentina’s strong developer talent and high crypto adoption rates in a different capacity. This strategy allows Coinbase to retain a foothold in the market and contribute to its long-term growth without directly shouldering the operational burdens of fiat integration.

Coinbase’s initial foray into Argentina was publicly announced in early 2025, following a preparatory period throughout the preceding year. This means the pause comes just months after their official launch, highlighting the rapid assessment and agility often required in the fast-paced crypto industry. The swift re-evaluation underscores the unpredictable nature of emerging markets and the necessity for global players to adapt quickly to changing conditions.

The broader context of Argentina’s regulatory stance on cryptocurrencies adds another layer of complexity. Historically, the Banco Central de la República Argentina (BCRA) has taken a cautious, sometimes restrictive, approach to digital assets. In 2022, the central bank famously banned financial institutions from offering crypto trading services, citing risks to users and the broader financial system, even as major banks explored such offerings. However, recent reports suggest a potential reversal of this stance. The BCRA is reportedly drafting new regulations that could permit traditional banks to engage directly with cryptocurrencies, though the timeline and final scope of these rules remain uncertain. This shifting regulatory landscape, from restrictive to potentially permissive, creates a highly dynamic and challenging environment for international exchanges, which must constantly adapt their compliance frameworks and operational models. The election of Javier Milei, a self-proclaimed anarchist and proponent of free markets, including crypto, as president, has further fueled speculation about a more crypto-friendly regulatory future, but concrete changes take time to materialize.

For Argentine users, Coinbase’s pause means one fewer option for convenient fiat on-ramps and off-ramps, potentially redirecting them to local exchanges like Ripio, Lemon Cash, or international giants like Binance, which have more deeply entrenched fiat services in the country. While the ability to trade crypto-to-crypto remains, the ease of converting local currency to stablecoins and vice-versa is a critical component for many users seeking to preserve wealth or engage in decentralized finance.

In conclusion, Coinbase’s decision to pause fiat operations in Argentina, while seemingly a setback, is a nuanced strategic adjustment. It reflects the inherent difficulties faced by global crypto platforms when navigating the intricate web of economic volatility, regulatory uncertainty, and high operational costs prevalent in certain emerging markets. By stepping back from direct peso-based services, Coinbase aims to reassess its approach, possibly paving the way for a more sustainable and impactful return. The continued focus on its Base network and local partnerships suggests a long-term commitment to the Argentine market, albeit with a refined strategy that prioritizes infrastructure and ecosystem development over the immediate challenges of fiat integration. This situation serves as a poignant reminder that while crypto offers solutions to economic instability, the path to mainstream adoption, especially when interfacing with traditional finance, remains fraught with significant, market-specific hurdles.