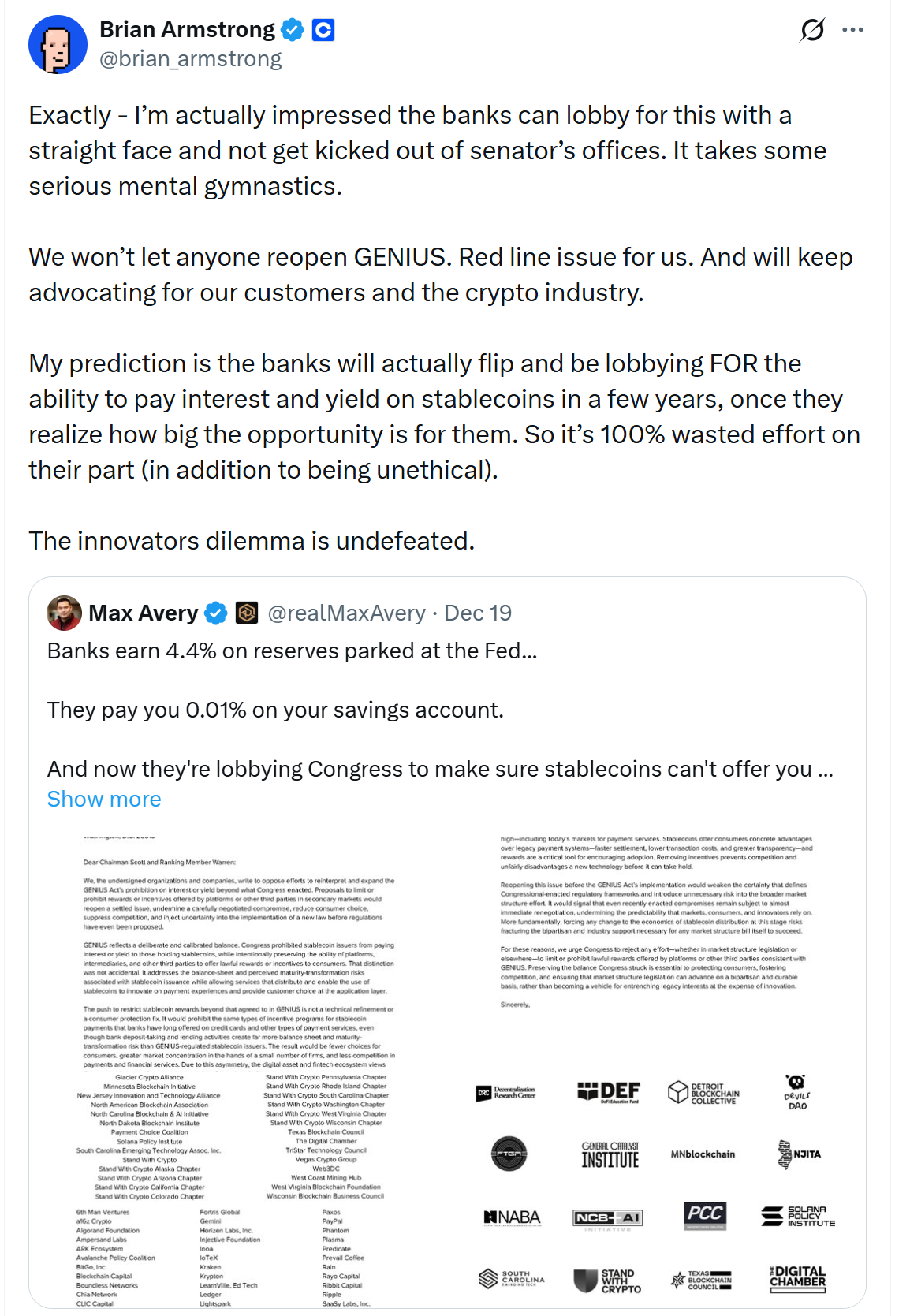

Coinbase CEO Brian Armstrong has issued a stark warning, declaring that any attempt to reopen or amend the recently passed GENIUS Act would constitute a "red line" for the cryptocurrency industry. In a forceful statement, Armstrong accused traditional banks of leveraging their political influence to stifle competition from stablecoins and emerging fintech platforms, highlighting a fierce ideological and economic battle for the future of financial services. His remarks underscore the deep-seated tensions between established financial institutions and the rapidly evolving digital asset space, particularly concerning the regulation and utility of stablecoins.

Armstrong conveyed his strong stance in a Sunday post on X (formerly Twitter), expressing a mix of frustration and disbelief at the apparent impunity with which banks are lobbying Congress. He noted he was "impressed" by the banking sector’s ability to openly push for legislative changes without significant public or political backlash, a situation he implicitly contrasted with the often-scrutinized lobbying efforts of the crypto industry. The Coinbase chief vowed that his company, a leading cryptocurrency exchange, would vehemently oppose any efforts to revise the existing law, stating unequivocally, "We won’t let anyone reopen GENIUS."

Beyond the immediate legislative battle, Armstrong offered a bold prediction about the long-term trajectory of this conflict. He theorized that banks, currently seeking to restrict stablecoin functionality, would eventually reverse course. "My prediction is the banks will actually flip and be lobbying FOR the ability to pay interest and yield on stablecoins in a few years, once they realize how big the opportunity is for them," he wrote. From Armstrong’s perspective, the current lobbying efforts are not only "100% wasted effort on their part" but also "unethical," implying a short-sighted and self-serving agenda that ultimately works against progress and potential mutual benefit. This perspective suggests that traditional finance may eventually recognize the immense market potential and operational efficiencies offered by stablecoins, much as they have adapted to other technological disruptions over time.

The GENIUS Act, a landmark piece of legislation, came into being after months of intense negotiations and debates among lawmakers, industry stakeholders, and regulators. Its passage was seen as a crucial step towards establishing a clearer regulatory framework for stablecoins in the United States. A central tenet of the act is its prohibition on stablecoin issuers directly paying interest to holders. However, critically, it carves out a significant allowance: platforms and third parties are permitted to offer rewards or yield on stablecoin holdings. This distinction is paramount to the current dispute, as it allows for innovative financial products and services built around stablecoins, which can offer users a return on their digital assets without directly involving the issuer in interest-bearing activities. The original intent of this nuanced approach was likely to balance consumer protection and financial stability concerns with the desire to foster innovation in the burgeoning stablecoin market.

Armstrong’s comments were directly triggered by an analysis from Max Avery, a board member and business development executive at Digital Ascension Group. Avery’s post shed light on the specific motivations behind parts of the banking sector’s push to revisit the GENIUS Act. According to Avery, the proposed amendments are not merely about reinforcing the ban on direct interest payments by stablecoin issuers. Instead, they aim to significantly broaden these restrictions, encompassing "rewards" more generally. This expanded scope would effectively cut off indirect yield-sharing mechanisms currently offered by various platforms and third parties within the crypto ecosystem. Such a move would severely curtail the utility and attractiveness of stablecoins, making them less competitive with traditional savings instruments, especially in an environment where interest rates are high.

Avery meticulously outlined the core economic threat that stablecoins, with their yield-sharing models, pose to traditional banks. He pointed out the significant disparity: banks currently earn approximately 4% on reserves they park at the Federal Reserve, while their average customers often receive close to zero interest on traditional savings accounts. This substantial arbitrage creates a lucrative profit margin for banks. Stablecoin platforms, by offering to share a portion of this yield with users, directly challenge this long-standing business model. By providing competitive returns, stablecoins can attract deposits and liquidity away from traditional banking channels, thus eroding banks’ profitability and market dominance.

Banks, in their lobbying efforts, are framing their concerns around "safety concerns" and worries about the impact on "community bank deposits." However, Avery countered these claims, citing independent research that "shows zero evidence of disproportionate deposit outflows from community banks" due to stablecoin adoption. This suggests that the banks’ stated concerns may serve as a pretext for protecting their incumbent market position rather than genuinely addressing systemic risks. The history of financial innovation is replete with examples of established industries resisting disruptive technologies, often under the guise of safety or stability concerns, only to later adopt or integrate them.

The implications of reopening and amending the GENIUS Act, particularly in the manner proposed by the banking sector, are profound and far-reaching for the stablecoin market and the broader cryptocurrency industry. For stablecoins themselves, such amendments could severely impede their growth and utility. By restricting the ability of platforms to offer rewards, the attractiveness of stablecoins as a store of value or an alternative savings mechanism would diminish. This could stifle innovation in areas like decentralized finance (DeFi), cross-border payments, and other applications where stablecoins play a crucial role. For consumers, the outcome would likely be fewer competitive options for earning yield on their digital assets and potentially higher costs for financial services, as competition from innovative fintech platforms is suppressed.

More broadly, this legislative battle sets a dangerous precedent for the crypto industry. It highlights the risk of "regulatory capture," where incumbent industries exert undue influence to shape regulations in their favor, thereby protecting their market share at the expense of innovation and consumer choice. If successful, such efforts could push significant portions of crypto innovation offshore, hindering the United States’ ability to lead in the rapidly evolving digital asset space. This would be particularly detrimental given the global race for fintech leadership, with other nations actively embracing and building frameworks for digital assets. The outcome of this debate will also significantly influence the tenor and direction of future crypto legislation, potentially signaling a more restrictive approach to digital assets in the US.

The ongoing debate about the GENIUS Act takes place within a broader context of stablecoins’ growing importance in the digital economy. With a market capitalization now exceeding $310 billion, stablecoins have become an indispensable component of the crypto ecosystem. They facilitate global remittances, enable efficient cross-border payments, and serve as the backbone for much of the DeFi landscape. Their potential to act as a more efficient, faster, and cheaper payment rail, circumventing traditional banking infrastructure, is immense. This potential directly challenges the existing financial order, leading to the current friction. The discussion around stablecoins is also intertwined with the global dialogue on central bank digital currencies (CBDCs), with some arguing that well-regulated private stablecoins can offer many of the benefits of CBDCs without the associated risks of centralized government control.

Interestingly, this aggressive push by some banking factions contrasts with other recent legislative developments that show a more accommodating stance towards crypto. Just last week, US lawmakers unveiled a discussion draft aimed at reducing the tax burden on everyday crypto users. Introduced by Representatives Max Miller and Steven Horsford, the proposal seeks to exempt small stablecoin transactions, specifically payments of up to $200 in regulated, dollar-pegged stablecoins, from capital gains taxes. This initiative aims to make stablecoins more viable for routine payments and microtransactions, acknowledging their potential as a functional currency. Furthermore, the bill targets taxation issues around staking and mining, allowing taxpayers to defer income recognition on rewards for up to five years. These contrasting legislative efforts underscore the complex and sometimes contradictory nature of policymaking in the digital asset space, reflecting a divided understanding and approach within Congress.

In conclusion, Brian Armstrong’s declaration of a "red line" signifies the high stakes involved in the battle over stablecoin regulation. The GENIUS Act, a critical piece of legislation for the stablecoin market, is now at the center of a direct confrontation between the innovative potential of digital assets and the entrenched interests of traditional finance. The banking sector’s attempts to amend the act, allegedly to curb stablecoin "rewards," are perceived by the crypto industry as a move to protect their outdated business models and stifle competition. The outcome of this legislative skirmish will not only determine the future trajectory of stablecoins in the United States but also send a powerful message about the nation’s commitment to fostering innovation versus preserving the status quo in the global financial landscape. As Armstrong’s warning echoes, the crypto industry stands ready to fiercely defend what it considers a fundamental pillar of its future growth and utility.