BitMine Immersion Technologies has significantly escalated its commitment to the Ethereum network, injecting another 82,560 Ether, valued at approximately $259 million at current market prices, into Ethereum’s Proof-of-Stake (PoS) staking system, a move that is further intensifying the congestion within the network’s validator entry queue amidst a burgeoning institutional appetite for yield generation. This latest substantial deposit underscores a growing trend among corporate entities to leverage the economic incentives offered by decentralized finance (DeFi), particularly Ethereum staking, as a robust strategy for capital deployment and revenue generation. The continuous influx of such large-scale investments from firms like BitMine not only validates Ethereum’s transition to PoS but also highlights the network’s increasing role as a foundational layer for institutional-grade financial operations.

Detailed on-chain data provided by Arkham, a prominent blockchain intelligence platform, reveals a series of large-scale transactions where the Ether treasury firm dispatched multiple significant deposits to Ethereum’s designated BatchDeposit contract over the past several hours. This strategic move dramatically bolsters BitMine’s overall staked ETH holdings, which have now surged to an impressive 544,064 Ether. At the prevailing market rates, this colossal sum is estimated to be worth approximately $1.62 billion, as meticulously tracked and reported by the vigilant on-chain analyst, Lookonchain. This makes BitMine one of the most prominent institutional stakers on the Ethereum network, solidifying its position as a key player in the ecosystem’s economic security and operational integrity. The sheer volume of their staked assets demonstrates a profound conviction in Ethereum’s long-term value proposition and its capacity to deliver sustainable returns.

BitMine’s journey into the realm of Ethereum staking commenced on December 26, when the company made its initial foray by transferring nearly $219 million worth of ETH into staking-related contracts on the Ethereum network. This foundational stake marked the beginning of what has rapidly evolved into a comprehensive and aggressive staking strategy. The firm’s proactive engagement in staking activities aligns with its previously articulated long-term vision and strategic objectives, which aim to capitalize on the inherent yield opportunities within the decentralized ecosystem. This early entry provided BitMine with valuable experience and insights into the operational nuances and financial mechanics of Ethereum’s PoS system, paving the way for subsequent, even larger, capital allocations.

Months prior to its initial staking activities, in November, BitMine had publicly announced its ambitious plans to embark on Ether staking. The company outlined a phased approach, with the full-scale deployment slated to begin in the first quarter of 2026. This extensive staking operation is intended to be facilitated through an internally developed and managed infrastructure dubbed the Made-in-America Validator Network (MAVAN). The conceptualization of MAVAN signifies BitMine’s commitment not only to capitalizing on staking yields but also to establishing a secure, reliable, and domestically controlled validator infrastructure. According to the company’s disclosure, an initial pilot program was launched utilizing a limited amount of ETH, in collaboration with three carefully selected institutional staking providers. The primary objective of this pilot was to rigorously evaluate the performance metrics, security protocols, and operational reliability of these providers before committing to a broader expansion of the staking program. This methodical and risk-averse approach underscores BitMine’s dedication to ensuring the integrity and efficiency of its staking operations, minimizing potential vulnerabilities while maximizing returns.

The strategic rationale behind BitMine’s aggressive staking push extends beyond mere yield generation. By operating its MAVAN network, BitMine aims to enhance the decentralization and resilience of the Ethereum blockchain, contributing directly to the network’s security model. The "Made-in-America" aspect also carries implications for regulatory compliance and national technological independence, potentially appealing to a broader base of investors and partners seeking assurances in a rapidly evolving digital asset landscape. The long-term vision for MAVAN includes not just staking BitMine’s own treasury ETH but potentially offering staking-as-a-service to other institutions, further diversifying its revenue streams and cementing its position as a leader in institutional crypto infrastructure. This forward-thinking strategy positions BitMine not just as a participant but as an infrastructure provider within the Ethereum ecosystem.

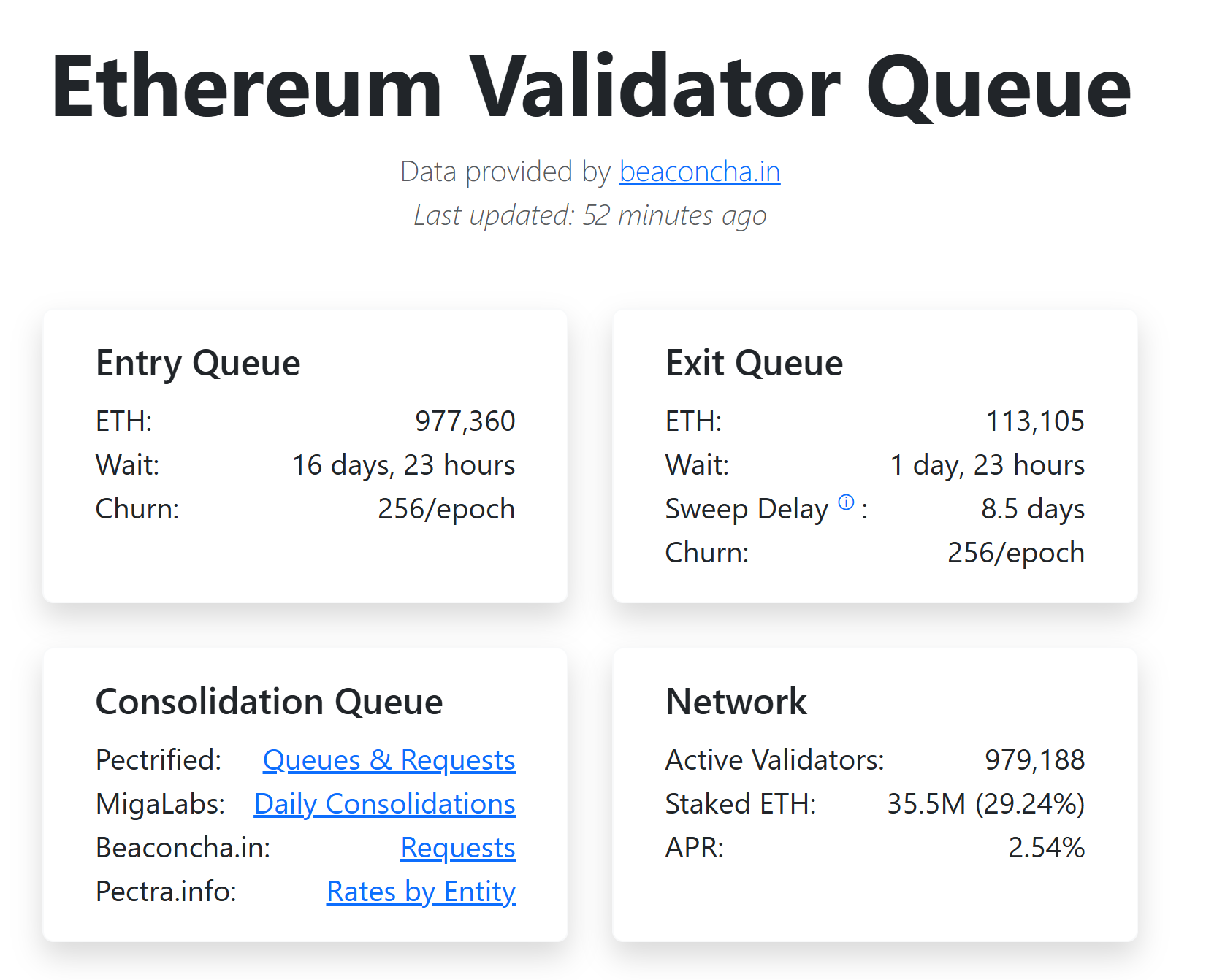

Meanwhile, the profound impact of BitMine’s aggressive staking strategy, combined with increasing institutional and retail participation, has propelled Ethereum’s validator entry queue to unprecedented levels. The queue, which dictates the waiting period for new validators to become active and begin earning rewards, has now swelled to approximately 977,000 ETH. This substantial backlog translates into an estimated wait time of nearly 17 days for any new validator attempting to join the network and participate in block validation, as meticulously reported by the specialized blockchain explorer, Ethereum Validator Queue. The existence of such a lengthy queue signifies a robust and sustained demand for staking on Ethereum, a testament to the network’s appeal and the perceived stability of its yield generation mechanisms. However, it also presents challenges, as new capital must wait longer to become productive, potentially impacting the immediate profitability calculations for some participants.

Conversely, the activity within the exit queue, where validators signal their intent to withdraw their staked ETH and accumulated rewards, remains comparatively subdued. Current data indicates that just over 113,000 ETH is awaiting withdrawal, a stark contrast to the nearly 1 million ETH queued for entry. This significant imbalance between entry and exit activity is a crucial indicator of network health and participant sentiment. A high entry-to-exit ratio typically suggests strong confidence in the network’s future, a desire to secure long-term yield, and a general bullish outlook among stakers. If exit queues were to surge, it could signal a loss of confidence or a desire to reallocate capital, but currently, the trend is overwhelmingly towards accumulation and long-term commitment.

The broader Ethereum network statistics further illuminate the magnitude of staking participation. Currently, more than 35.5 million ETH, representing approximately 29% of Ethereum’s total circulating supply, is actively staked. This significant proportion of locked capital enhances the network’s security by increasing the cost of a 51% attack, making it economically infeasible for malicious actors to compromise the blockchain. The annualized staking yield, a key incentive for participants, currently hovers near 2.54%. While this figure can fluctuate based on network activity and the total amount of staked ETH, it remains an attractive proposition for those seeking passive income from their digital assets, especially when compared to traditional financial instruments in a low-interest-rate environment. The increasing total value locked in staking also solidifies Ethereum’s position as a robust and resilient decentralized network.

The dynamics of the validator queue have garnered considerable attention from market analysts and commentators. Abdul, the head of DeFi at the Layer 1 blockchain Monad, recently highlighted the historical significance of the entry and exit queue flip. In an insightful X post last week, Abdul recalled that the last instance where the entry queue substantially surpassed the exit queue, occurring in June, was followed by a dramatic market movement: Ether "doubled in price shortly after." Drawing parallels from this historical precedent, Abdul expressed an optimistic outlook for the coming year, boldly predicting that "2026 is going to be a movie," suggesting significant price appreciation and ecosystem growth for Ethereum. Such commentary from industry leaders reinforces the positive sentiment surrounding Ethereum’s staking ecosystem and its potential impact on market valuation. The correlation, while not a guarantee, adds a layer of speculative interest for investors observing these on-chain metrics.

BitMine’s strategic maneuvers are not confined solely to aggressive ETH staking. As Cointelegraph previously reported, Tom Lee, the highly influential chairman of BitMine, has been a vocal proponent of a massive share expansion for the company. Lee is actively urging shareholders to approve a sharp increase in the company’s authorized share count, proposing an expansion to an extraordinary 50 billion shares. His rationale for this significant corporate action is deeply intertwined with BitMine’s performance and the anticipated trajectory of Ether’s price. Lee argues that such a substantial increase is a necessary preemptive measure to accommodate future stock splits, which he believes will become essential if Ether’s price continues its upward trajectory, consequently driving BitMine’s valuation to unprecedented heights.

Tom Lee’s vision for BitMine is predicated on a strong belief in the symbiotic relationship between the company’s share price and the value of ETH. He has developed and modeled various scenarios, including highly bullish projections where Ether could reach an astounding $250,000, assuming Bitcoin achieves a benchmark of $1 million. In such a scenario, Lee contends that BitMine’s shares would naturally follow suit, potentially reaching prices that would effectively price out the majority of retail investors, thereby limiting accessibility and liquidity. By increasing the authorized share count, BitMine would retain the flexibility to execute stock splits, making its shares more affordable and accessible to a broader investor base, fostering greater liquidity and potentially wider institutional adoption. This long-term strategic planning by Lee reflects a deep understanding of market dynamics and a proactive approach to managing BitMine’s growth trajectory in alignment with the burgeoning crypto market. This proactive approach aims to ensure that BitMine remains an attractive investment vehicle, regardless of the significant price appreciation of its underlying asset, Ethereum.

The convergence of BitMine’s aggressive staking strategy, the swelling Ethereum validator queue, and Tom Lee’s ambitious corporate vision paints a compelling picture of institutional confidence in Ethereum’s future. The "Made-in-America Validator Network" initiative further positions BitMine as a leader in secure, compliant, and regionally optimized blockchain infrastructure. As the total amount of staked ETH continues to climb, Ethereum’s security and economic stability are reinforced, making it an increasingly attractive platform for a diverse range of decentralized applications and financial services. The current dynamics suggest a strong belief in Ethereum’s long-term value proposition, with market participants eagerly anticipating its continued evolution and adoption across global financial landscapes. This institutional embrace, epitomized by BitMine’s actions, signals a pivotal moment in the mainstreaming of cryptocurrency assets and their integration into traditional corporate finance strategies.