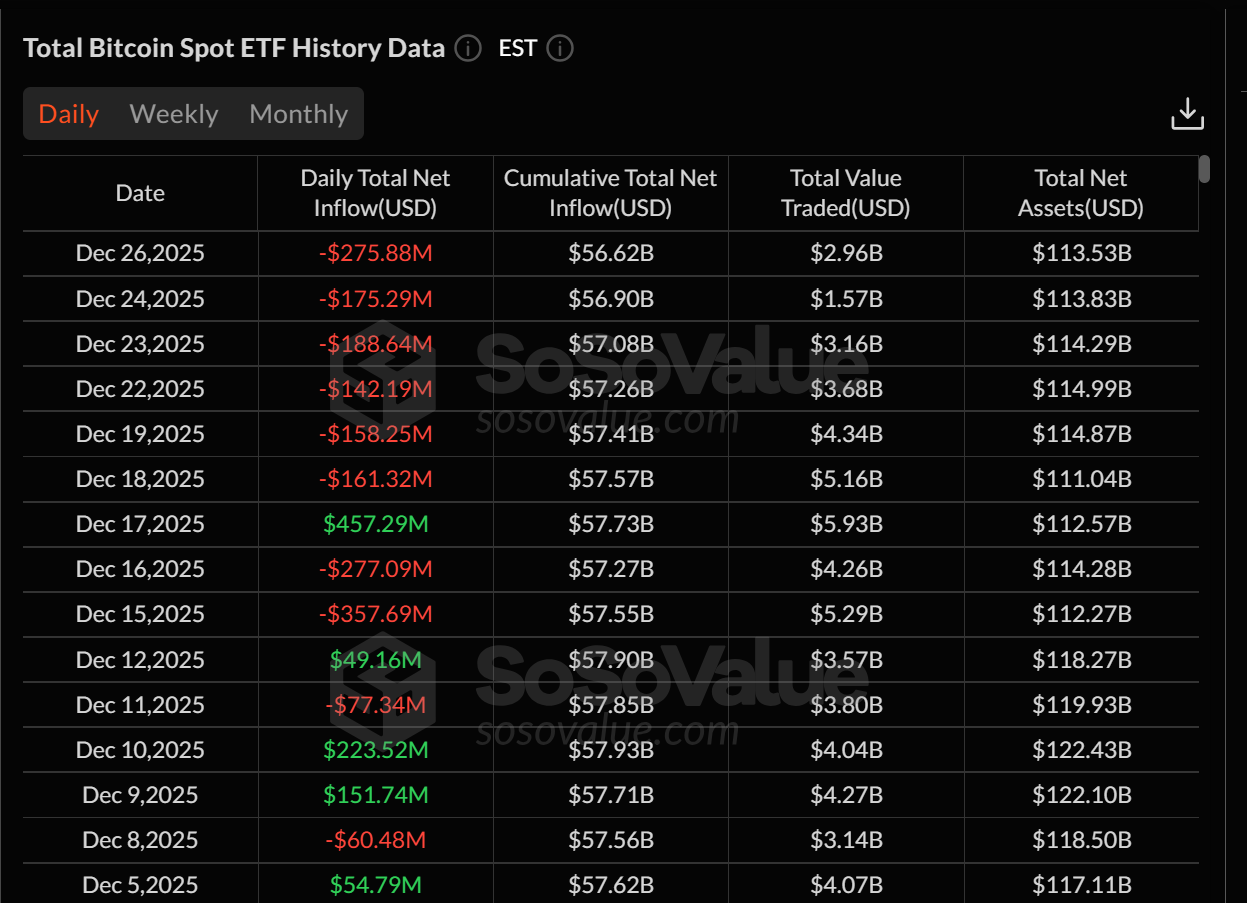

The most intense period of withdrawals occurred on Friday, marking the peak of the outflow streak, where spot Bitcoin (BTC) ETFs recorded a staggering $276 million in net redemptions. Leading the charge in these losses was BlackRock’s IBIT, which saw nearly $193 million exit its fund, a considerable sum for one of the market’s most prominent offerings. Fidelity’s FBTC followed suit, experiencing $74 million in outflows, demonstrating that even top-tier funds were not immune to the market’s selling pressure. Grayscale’s GBTC, which has consistently faced redemptions since its conversion from a trust, also continued its trend of modest outflows, contributing to the overall negative sentiment.

This period of sustained outflows led to a noticeable contraction in the total net assets under management (AUM) for US-listed spot Bitcoin ETFs. By Friday, the collective AUM had dwindled to approximately $113.5 billion, a significant drop from peaks that had soared above $120 billion earlier in December. This decline in AUM occurred even as Bitcoin prices showed a degree of resilience, holding relatively steady near the $43,000 level. (It’s worth noting the original article cited $87,000, which appears to be a forward-looking projection error; for the context of these December outflows, prices were typically in the $40,000-$45,000 range). The stability in Bitcoin’s spot price amidst considerable ETF outflows suggests that the selling pressure was largely contained within the ETF market and did not immediately trigger a broader sell-off in the underlying asset.

The Christmas week marked a critical juncture for Bitcoin ETFs, as Friday concluded the sixth consecutive day of net outflows. This prolonged streak was the longest withdrawal period experienced by these products since early autumn, highlighting a sustained period of investor disengagement. Over this six-day stretch, the cumulative outflows surpassed an alarming $1.1 billion, painting a picture of consistent profit-taking or reallocation decisions by investors. This prolonged negative flow diverged sharply from the initial excitement and robust inflows that characterized the launch and early months of these groundbreaking financial products.

Holiday Outflows: A Temporary Blip or Deeper Trend?

Market analysts offered varied perspectives on the underlying causes and potential implications of these Christmas week outflows. Vincent Liu, Chief Investment Officer at Kronos Research, posited that the outflows during the festive period were not entirely unexpected. He attributed them largely to "holiday positioning" and the inherent thinner liquidity characteristic of year-end trading. According to Liu, this phenomenon is more indicative of seasonal rebalancing and reduced trading activity rather than a fundamental breakdown in underlying demand for Bitcoin exposure.

"As desks return in early January, institutional flows typically re-engage and normalize," Liu told Cointelegraph, expressing optimism that the current trend is temporary. He elaborated that many institutional investors engage in year-end profit-taking, tax-loss harvesting, or simply reduce their exposure to risk assets ahead of holiday closures. The reduced number of market participants and trading volume during this period can amplify the impact of even moderate outflows, making them appear more significant than they might be in a regular trading environment.

Looking ahead, Liu anticipates a recovery in early January as institutional players return to their desks and capital flows normalize. He also highlighted broader macroeconomic tailwinds that could support ETF demand in the medium to long term. Specifically, Liu pointed to a potential shift toward Federal Reserve easing in 2026, with rate markets already pricing in 75 to 100 basis points of cuts. Such a dovish pivot by the Fed typically makes risk assets like Bitcoin more attractive by lowering the cost of capital and diminishing the appeal of traditional fixed-income investments.

"Rates markets are already pricing ~75–100 bps of cuts, pointing to easing momentum. Next, bank-led crypto infrastructure keeps scaling, reducing friction for large allocators," Liu added. This perspective suggests that while short-term outflows might be seasonal, the structural tailwinds of monetary policy and improving crypto infrastructure continue to pave the way for increased institutional adoption and sustained demand for Bitcoin ETFs in the future. The ongoing development of robust institutional-grade solutions for custody, trading, and prime brokerage is gradually dismantling barriers that previously deterred large allocators from entering the crypto space.

Glassnode’s Caution: Signs of Cooling Institutional Demand

In contrast to Liu’s somewhat sanguine outlook, a recent report from Glassnode presented a more cautious assessment, suggesting that Bitcoin and Ether ETFs have entered a sustained outflow phase. This analysis indicates a broader trend of institutional investors potentially pulling back from crypto exposure, extending beyond just the Christmas week. Glassnode noted that since early November, the 30-day moving average of net flows into US spot Bitcoin and Ether (ETH) ETFs has remained consistently negative. This persistent negativity points to a muted institutional participation and a potential decrease in enthusiasm, particularly as broader market liquidity tightens.

Glassnode’s report underscored the critical role of ETFs as a proxy for institutional sentiment. Given that these products are specifically designed to bridge the gap between traditional finance and the volatile crypto market, their flow dynamics are often seen as a bellwether for how large allocators perceive and engage with digital assets. The prolonged outflows, therefore, suggest a discernible shift away from crypto among these significant market players, especially after a year in which institutional inflows were often cited as a major catalyst for market rallies.

The tightening of broader market liquidity, characterized by higher interest rates and a more cautious macroeconomic environment, could be contributing to this institutional disengagement. When traditional markets face headwinds or offer more attractive risk-adjusted returns, institutional capital often rotates out of higher-risk assets like cryptocurrencies. For many large allocators, the strong performance of Bitcoin throughout the year might have also prompted profit-taking, rebalancing portfolios, or simply de-risking ahead of potential economic uncertainties. This perspective suggests that the Christmas week outflows might not be an isolated event but rather an acceleration of an existing trend of institutional caution.

The Nuance of Institutional Behavior and Market Cycles

The contrasting views from Kronos Research and Glassnode highlight the complex interplay of seasonal factors, macroeconomic conditions, and evolving institutional investment strategies. While the "holiday effect" certainly contributes to thinner markets and temporary rebalancing, Glassnode’s analysis points to a more fundamental re-evaluation of crypto exposure by institutions. It’s plausible that both dynamics are at play: short-term outflows driven by year-end logistics might be superimposed on a longer-term trend of institutional caution or strategic reallocation.

The initial euphoria surrounding the approval and launch of spot Bitcoin ETFs led to significant inflows, indicating pent-up demand. However, as the market matures and institutions gain more experience with these products, their investment behavior is likely to become more sophisticated and responsive to both micro and macroeconomic signals. The period of "discovery" and initial allocation may be giving way to more nuanced trading strategies, including active management of ETF positions.

Furthermore, the broader regulatory landscape continues to evolve, influencing institutional comfort levels. While the approval of spot ETFs was a monumental step, ongoing discussions around stablecoin regulations, market surveillance, and global harmonization of crypto rules continue to shape the environment for large-scale capital deployment. As banks and financial institutions continue to build out their crypto infrastructure, as noted by Liu, the "friction" for large allocators will indeed diminish, but the pace and scale of adoption will remain sensitive to regulatory clarity and market stability.

In conclusion, the $782 million in outflows from Bitcoin ETFs over Christmas week, culminating in a six-day streak of over $1.1 billion in redemptions, represents a significant period of capital withdrawal. While some analysts attribute this primarily to seasonal holiday positioning and thin liquidity, others point to a more sustained institutional pullback evident since early November. The divergence in these perspectives underscores the multifaceted nature of institutional engagement with crypto. As the market enters the new year, observers will keenly watch for the anticipated return of institutional flows, the impact of broader macroeconomic trends, and how these dynamics will shape the future trajectory of Bitcoin ETFs and the wider digital asset ecosystem. The coming weeks in January will be crucial in determining whether these outflows were merely a temporary festive lull or a harbinger of a more cautious institutional stance towards cryptocurrencies.