This week has seen Bitcoin finally offer some much-needed relief to bulls, with BTC price action reacting favorably to the unfolding geopolitical events. The crucial question reverberating among traders and commentators alike is whether this rally, which saw BTC/USD touch $93,000 for the first time since December 11, will prove sustainable or merely a fleeting recovery. Data from TradingView illustrates Bitcoin’s impressive ascent, gaining as much as 6.6% over the past five days, signaling a potential shift in market sentiment.

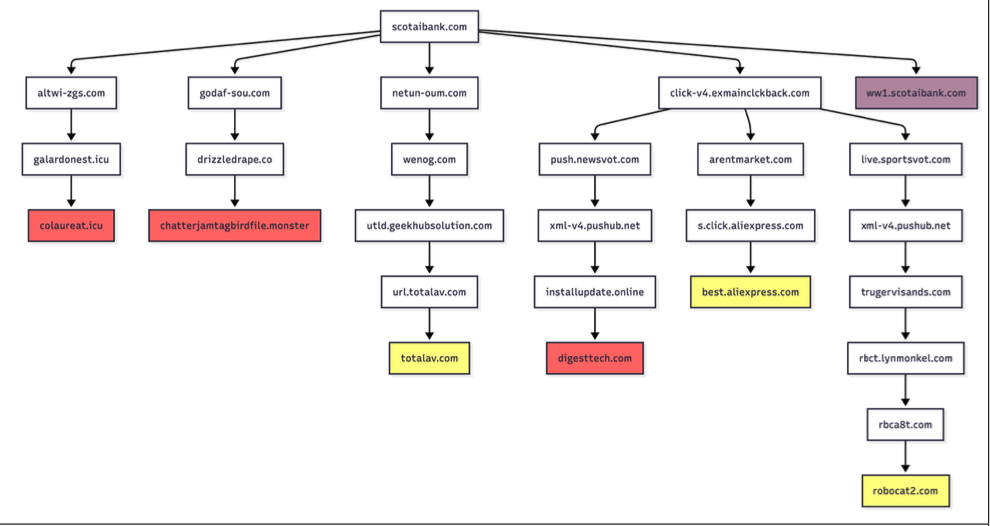

However, not all analysts are convinced of an immediate, straightforward recovery. Trader CrypNuevo, in a detailed thread on X, argued that "Price will unlikely recover straight from here." Drawing a compelling parallel to Bitcoin’s price behavior in October 2019, CrypNuevo suggested that current price action mirrors a pattern where the asset first hunts for nearby liquidity on exchange order books. "The structure is identical and price did a liquidity run before sweeping the lows, and then pumped," he explained, further adding, "I think we’ll sweep the lows with or without the liquidity run." This intricate analysis implies a potential dip below $80,000, a level not seen since last April, before a more sustained upward trajectory. Such a move would likely target two significant "gaps" in CME Group’s Bitcoin futures market. As Bitcoin education resource Coin Bureau confirmed, these gaps are positioned at $90,500–$91,600 and $88,200–$88,800, often acting as magnetic price targets that markets tend to "fill" before continuing a trend.

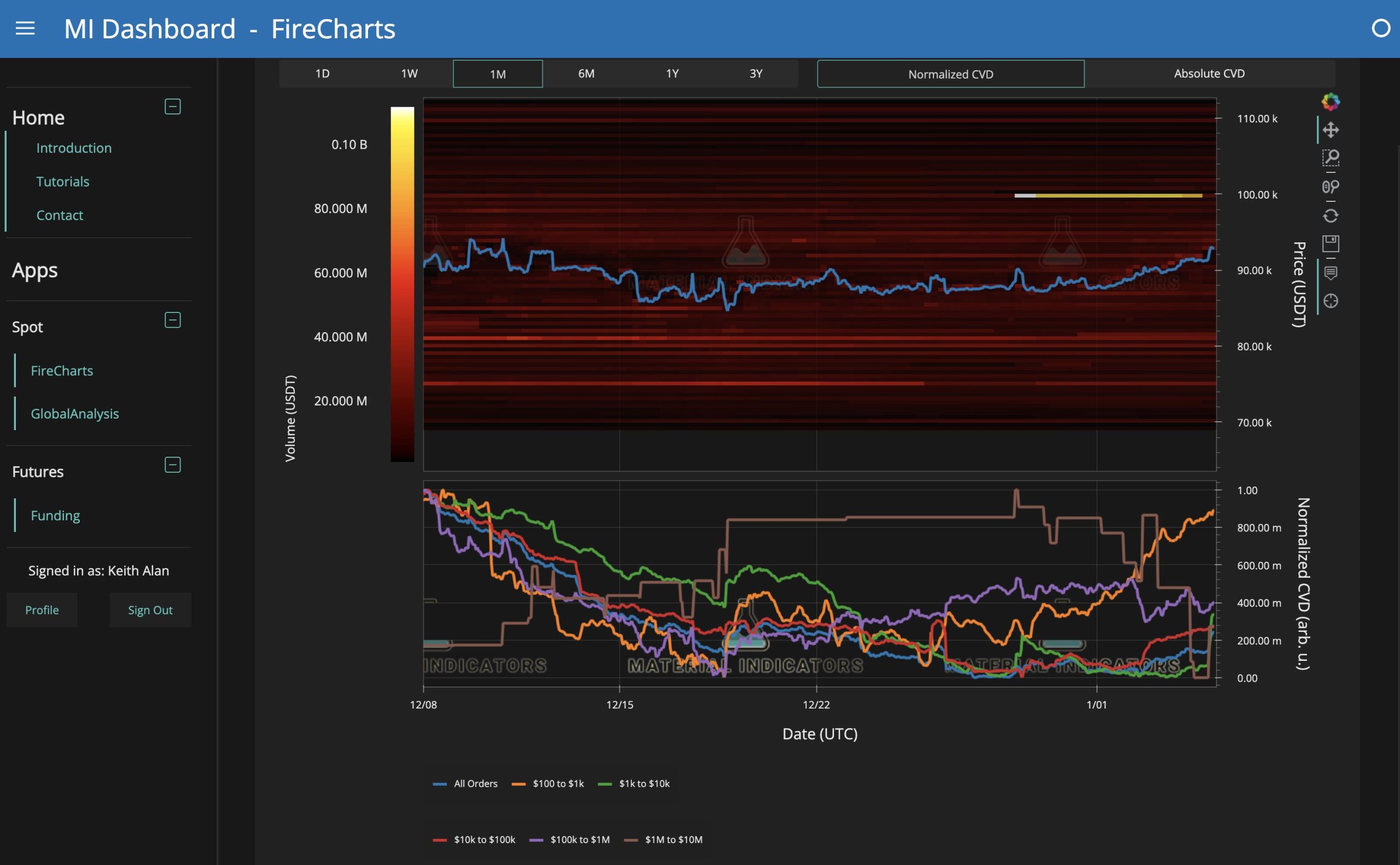

The volatile price swings have also triggered substantial liquidations. The latest data from monitoring resource CoinGlass revealed that 24-hour crypto short liquidations reached a staggering $250 million, indicating that many bearish bets were caught off guard by the sudden upward momentum. With liquidity piled high into the weekly close, bulls are now eyeing $93,700 as their next key upside target. Keith Alan, cofounder of the trading platform Material Indicators, shared insights from his proprietary trading tools, noting a significant change in the order book. A formidable "wall" of sell orders, previously positioned at the psychologically important $100,000 mark, has now dissipated. Alan enthusiastically told X followers, "Now the fun begins," accompanying his statement with a chart that highlighted increased buying activity from smaller Bitcoin whales, suggesting a broader base of accumulation.

Despite the modest 5% BTC price rebound by typical crypto market standards, the underlying trend implications could be profoundly significant. Analyzing various moving averages provides Bitcoin bulls with substantial reason for optimism above $90,000. A particularly bullish phenomenon currently unfolding is the 50-period Simple Moving Average (SMA) crossing above its 200-period equivalent on the four-hour chart. This formation, known as a "golden cross," is a widely recognized technical indicator signifying short-to-medium-term buying momentum and a potential reversal from bearish sentiment. If confirmed, this would effectively undo the "death cross" that occurred in mid-October, which typically signals a bearish trend. While the daily chart still shows the golden cross as a distant reality after its own death cross hit a month later, longer-term perspectives offer a different narrative. Trader SuperBro highlighted that another pair of crucial trendlines, the weekly 100-period SMA and Exponential Moving Average (EMA), are already flipping green. Historically, in previous Bitcoin bear markets, the 100-week EMA crossing under the 100-week SMA marked the onset of significant BTC price downside, often leading to a 50%+ crash to the cycle bottom within weeks. However, 2026 is proving to be an outlier. SuperBro remarked on X, "This is an unprecedented bullish deviation from prior cycles," reinforcing the growing claims, as reported by Cointelegraph, that Bitcoin’s 2025 performance suggests the four-year BTC price cycle theory may no longer be a valid predictive model.

Beyond technical indicators, all eyes are fixed on risk assets and commodities as markets navigate the repercussions of the US military’s recent actions in Venezuela. The surprise headlines broke outside traditional finance (TradFi) trading hours over the weekend, leaving the crypto market to provide the world’s only real-time price response. The total crypto market cap has since swelled by 5% since Friday, reclaiming the significant $3 trillion valuation. More notably, Bitcoin’s price action has once again converged with that of traditional safe-haven assets like gold and silver. XAU/USD (gold) was up 2% at the time of writing on Monday, pushing towards a rematch with December’s all-time highs of $4,450 per ounce. Paradoxically, despite the geopolitical escalation, the implications of a potential US takeover of Venezuela’s vast oil and gas reserves have sent global energy prices lower, while the US dollar strength is nearing its highest levels in almost a month. Trading resource The Kobeissi Letter accurately predicted that assets across the board would "move" significantly once TradFi traders returned, noting, "Energy prices are DROPPING amid a major escalation in geopolitical tensions. This should tell you all you need to know." Kobeissi advised readers to "keep watching" gold and silver, anticipating continued volatility and directional shifts.

A potentially massive bull factor specifically for Bitcoin stems from the intensifying debate on social media surrounding Venezuela’s alleged BTC reserves. While still largely a matter of speculation, the country is widely thought to have amassed a considerable Bitcoin stockpile, estimated to be between 600,000 and 660,000 BTC (valued at $55-60 billion), as a strategic means of circumventing stringent US sanctions. Crypto analyst and commentator MartyParty elaborated in an X post, "Prior to 2026, Venezuela’s official/on-chain holdings were minimal (e.g., ~240 BTC from seizures/mining reported in some trackers). The $60B figure refers specifically to this alleged off-the-books reserve built to bypass sanctions." The confirmation or movement of such a substantial holding could have profound implications for Bitcoin’s supply dynamics and global perception as a geopolitical tool.

The first full trading week of 2026 also brings several important US macroeconomic data releases that will undoubtedly influence risk-asset sentiment. The focus this week will be heavily on employment trends, with key releases including December ISM Manufacturing PMI data, December ADP Nonfarm Employment data, November JOLTS Job Openings data, the December Jobs Report, and January MI Consumer Sentiment. These numbers are arriving at a time when the labor market continues to exhibit signs of stress, creating a dilemma for the Federal Reserve. The Fed must decide on interest-rate changes at its January 28 meeting. For risk assets, another rate cut would be highly welcomed, but current sentiment does not yet strongly support that outcome. The latest data from CME Group’s FedWatch Tool puts the odds of even a minimal 0.25% cut at a mere 17.2%, suggesting the Fed is likely to hold rates steady.

Despite the Fed’s cautious stance, analysis from some quarters anticipates that already loose financial conditions will continue to underpin stock market performance, at least through the first half of the year. Trading resource Mosaic Asset Company, in its regular newsletter "The Market Mosaic," wrote, "I anticipate conditions favoring the bull market to persist into the start of 2026, including a growing economy and ample liquidity supporting loose financial conditions." However, Mosaic issued a critical warning: a resurgence in inflation could dramatically alter the landscape in the latter half of 2026. "I believe a major transition will be looming for the stock market, and that a rising money supply will eventually force tighter monetary policy in the world’s major economies," the newsletter cautioned. Cointelegraph previously reported that the shifting composition of the Fed continues to tip the balance in favor of officials who advocate for additional rate cuts, a stance that aligns with the preferences of President Donald Trump.

However, Bitcoin’s rebound from below $90,000 may not be an easy one, facing significant headwinds purely from internal crypto market forces. New data from on-chain analytics platform CryptoQuant indicates that large-volume traders, commonly known as whales, are already looking to lock in modest profits and reduce their BTC exposure. The week beginning December 29 saw monthly highs in net inflows to Binance, the largest global exchange, with the Bitcoin tally alone nearing $1.5 billion. CryptoOnchain, a contributor to CryptoQuant, wrote in a "Quicktake" blog post, "Such sizable transfers of BTC and ETH from private wallets to an exchange typically indicate one of two intentions: preparation for selling or the use of these assets as collateral in derivatives markets." CryptoQuant further warned that buying power was conspicuously not matching these inflows, with stablecoin netflows remaining "essentially flat." CryptoOnchain added, "Most of this activity reflected internal shifts—primarily USDT moving between the ERC-20 and TRC-20 networks—rather than fresh capital entering the exchange." A subsequent QuickTake post underscored the active whale selling across various exchanges. The two-week moving average of the exchange whale ratio indicator, which gauges the proportion of inflows originating from the ten largest whale entities, has now reached its highest point since March 2025. CryptoOnchain commented, "Historically, such movements are a precursor to selling and increased supply pressure," suggesting that while Bitcoin battles for a new bull trend, significant internal selling pressure from large holders could create substantial volatility and resistance.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.