In a landmark move signaling a strategic pivot towards the burgeoning digital asset landscape, Barclays, one of the world’s preeminent financial institutions with systemic global importance, has announced its inaugural investment in a stablecoin-related enterprise, Ubyx. This significant commitment underscores a growing recognition within traditional finance of the transformative potential of regulated digital money. The United Kingdom-based banking giant confirmed its investment in Ubyx on Wednesday, though the precise financial terms and the size of the stake acquired were not publicly disclosed. Ubyx, a U.S.-based stablecoin clearing platform, is designed to serve as a crucial conduit, connecting regulated stablecoin issuers with established banks and innovative fintech companies, thereby aiming to streamline the integration of digital currencies into mainstream financial operations.

This investment is not merely a financial transaction; it represents a profound strategic alignment for Barclays, reflecting a nuanced understanding of the evolving digital economy. Ryan Hayward, Head of Digital Assets and Strategic Investments at Barclays, articulated the bank’s rationale, stating, "As the landscape of tokens, blockchains and wallets evolves, specialist technology will play a pivotal role in delivering connectivity and infrastructure to enable regulated financial institutions to interact seamlessly." This statement highlights the intricate challenges and opportunities presented by the fragmented nature of the current digital asset ecosystem. The proliferation of various blockchain networks, token standards, and digital wallet solutions necessitates robust, interoperable infrastructure to facilitate secure and compliant transactions for institutional players. Barclays’ backing of Ubyx signals its belief that such specialist technology is indispensable for bridging the gap between legacy financial systems and the nascent world of digital assets, ensuring that future financial flows can occur with efficiency and regulatory adherence.

The Barclays investment follows Ubyx’s successful $10 million seed funding round in June 2025, which itself attracted significant attention and capital from prominent players in the crypto and venture capital space. This earlier round saw participation from the venture capital arms of Michael Novogratz’s Galaxy Digital and the leading U.S. crypto exchange Coinbase, lending considerable credibility and industry validation to Ubyx’s vision and technological approach. The involvement of such key crypto-native investors alongside a global banking behemoth like Barclays paints a compelling picture of convergence between traditional finance and the digital asset sector. It suggests a shared recognition of the need for robust, compliant infrastructure to unlock the broader potential of stablecoins and tokenized assets, moving beyond speculative trading to practical, institutional applications.

Ubyx was founded in March 2025 by Tony McLaughlin, a seasoned veteran of the payments industry, whose extensive experience spans over two decades at Citi, where he managed complex payments and cash flow operations. McLaughlin’s background in traditional banking is a critical asset, imbuing Ubyx with an understanding of the stringent requirements and operational complexities faced by financial institutions. Describing himself on LinkedIn as a "tokenized money maximalist," McLaughlin has been a vocal proponent of the growing role of tokenized financial services, advocating for a future where digital representations of value become standard. His vision extends beyond mere stablecoins to encompass a broader ecosystem of "tokenized deposits" and other forms of regulated digital money, emphasizing the need for a unified and accessible infrastructure.

McLaughlin’s mission for Ubyx is ambitious yet critical: "Our mission is to build a common globalised acceptance network for regulated digital money including tokenised deposits and regulated stablecoins." This goal directly addresses one of the most significant hurdles to widespread digital asset adoption within regulated financial environments – the lack of a standardized, interoperable, and globally accepted framework for digital money transfers and settlements. He envisions a future where "every regulated firm offers digital wallets in addition to traditional bank accounts," signifying a fundamental shift in how financial services are delivered and consumed. This paradigm shift requires a clearing system like Ubyx that can seamlessly integrate various types of regulated digital money, ensuring liquidity, security, and compliance across different platforms and institutions.

During its 2025 seed funding announcement, Ubyx detailed its platform’s design, emphasizing its capacity to facilitate the broad adoption of stablecoins, including those issued by major industry players. Among its key partners, Ubyx listed Ripple, Paxos, AllUnity, and Eurodollar. This collaboration is highly significant. Paxos, for instance, is a regulated blockchain infrastructure platform and a leading issuer of stablecoins like USDP and BUSD (formerly), known for its robust regulatory compliance and institutional-grade services. Ripple, through its XRP Ledger and enterprise solutions, has been focused on cross-border payments and tokenized assets. AllUnity and Eurodollar represent other ventures exploring tokenized financial instruments. The inclusion of such diverse and established partners underscores Ubyx’s commitment to creating an inclusive ecosystem that can accommodate a wide array of regulated digital assets and their respective issuers, thereby maximizing its network effect and utility.

Barclays’ investment in Ubyx marks a pivotal "first" for the bank, as Reuters independently reported. It is the first instance of the global financial giant taking a direct stake in a company specifically focused on stablecoins and their underlying settlement infrastructure. This move is explicitly aligned with Barclays’ broader strategy to "explore opportunities based on new forms of digital money, such as stablecoins," as stated by the bank itself, even as it chose not to disclose the investment’s financial specifics. This strategic exploration suggests a proactive approach to understanding, integrating, and potentially shaping the future of financial services as they converge with blockchain technology and digital assets.

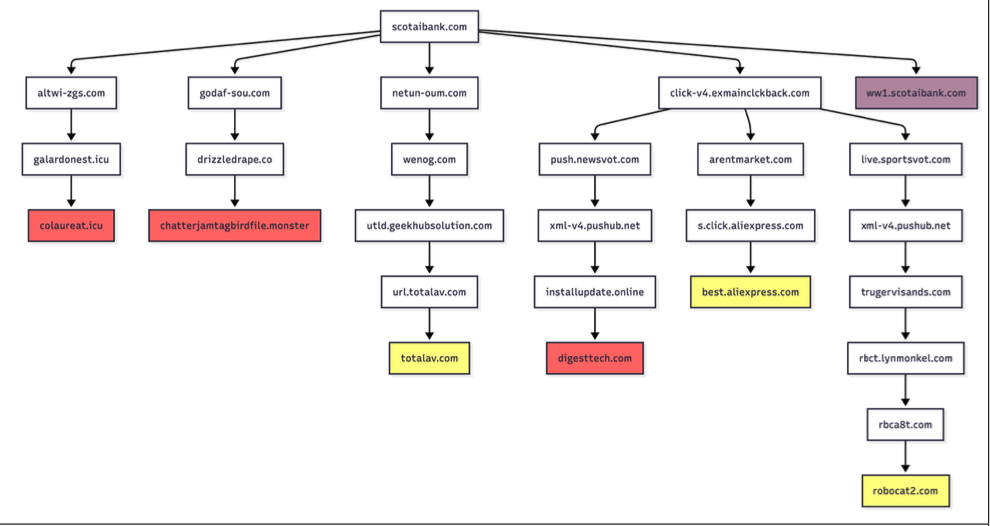

This investment also represents a notable and potentially transformative shift in Barclays’ long-standing approach to the broader cryptocurrency space. For years, Barclays, like many of its peers in traditional finance, maintained a cautious, if not outright skeptical, stance towards cryptocurrencies. The bank frequently highlighted the inherent risks associated with digital assets, particularly their volatility and susceptibility to illicit activities. This conservatism led to various restrictions on crypto-related transactions. A prominent example of this cautious approach occurred in June 2025, when Barclays announced it would begin blocking cryptocurrency purchases made using Barclaycard credit cards, explicitly citing the extreme volatility of cryptocurrencies as the primary reason for this decision. This measure reflected a prevailing industry sentiment that viewed crypto largely as a speculative, high-risk asset class that posed significant challenges to consumer protection and financial stability.

However, the investment in Ubyx signals a maturation of Barclays’ perspective. It suggests a distinction is being drawn between the highly speculative nature of many cryptocurrencies and the infrastructural utility and regulatory potential of stablecoins and tokenized assets. By investing in Ubyx, Barclays is not endorsing speculative crypto trading; rather, it is backing a platform designed to facilitate the compliant, regulated use of digital money within existing financial frameworks. This shift indicates a move from simply highlighting risks to actively engaging with and investing in solutions that aim to mitigate those risks through robust infrastructure, clear regulatory pathways, and institutional-grade services. It underscores a strategic evolution from passive observation to active participation in shaping the future of regulated digital finance.

The implications of Barclays’ investment extend far beyond the immediate financial transaction. It serves as a powerful validation for the stablecoin industry and the broader movement towards tokenized financial instruments. When a systemically important global financial institution like Barclays places its confidence and capital behind a stablecoin clearing platform, it sends a clear signal to regulators, other financial institutions, and the market at large that digital money, particularly in its regulated forms, is becoming an integral part of the future financial architecture. This move could catalyze further institutional adoption, encouraging other banks and financial service providers to explore similar integrations and investments.

Moreover, Ubyx’s focus on connecting regulated issuers with banks and fintechs is crucial for achieving mass adoption. Many existing stablecoin solutions operate in silos or lack the necessary bridges to traditional banking infrastructure. Ubyx aims to standardize the redemption and settlement processes, making it easier for financial institutions to incorporate stablecoins into their offerings without encountering undue operational or compliance hurdles. This standardization is vital for fostering liquidity, reducing friction, and ensuring that digital money can move efficiently across different platforms and jurisdictions, much like traditional fiat currencies do today.

In conclusion, Barclays’ investment in Ubyx is a watershed moment, illustrating the increasing convergence of traditional finance and the digital asset world. It signifies a sophisticated understanding by a major bank that while speculative cryptocurrencies may remain volatile, regulated stablecoins and tokenized deposits represent a fundamental innovation for payments, settlements, and broader financial services. By backing Ubyx, Barclays is not just investing in a technology company; it is investing in the infrastructure that could underpin the next generation of global finance, enabling seamless, compliant, and efficient digital money flows within a framework that aligns with regulatory expectations. This strategic move positions Barclays at the forefront of financial innovation, signaling a proactive embrace of the future of money and setting a precedent for other global institutions to follow suit in building the necessary bridges for a truly interconnected digital economy.