For Animoca Brands co-founder Yat Siu, 2025 will be remembered as "the Trump year," not because US President Donald Trump ultimately saved crypto, but because the industry placed an overly optimistic bet on his administration, fundamentally mispricing everything from potential tariffs to anticipated rate cuts. The crypto market, driven by a surge of speculative fervor, had positioned Trump as a "cheat code" for explosive growth in 2025, anticipating a deregulatory wave and a pro-business environment that would directly benefit digital assets. However, this fervent hope largely failed to materialize, leaving Bitcoin (BTC) limping into the year’s end, facing its fourth annual decline in history and marking a significant reality check for an industry that had perhaps become too reliant on political narratives. The speculative capital, particularly within the memecoin sector, was heavily sucked into political side quests, with a proliferation of politically-themed tokens diverting attention and liquidity from projects with genuine utility. One of the sector’s longest-running and most influential builders, Yat Siu, believes the market profoundly over-trusted the new president, failing to understand the broader macro priorities that would ultimately dictate market sentiment.

Reflecting on the year, Siu offered a measured assessment: "If I had to give it a grade, I would say B-/C+." He observed that many traders and investors treated crypto as if it were Trump’s "first child," implying it would receive paramount attention and favorable policy. In reality, Siu candidly stated, "we’re probably his third, fourth or fifth child, maybe even an eighth child." This analogy perfectly captured the disconnect: while the crypto community was focused on specific regulatory relief, Trump’s primary priorities — aggressive tariffs on imports, escalating trade wars with major economies, and intense fights over the Federal Reserve’s monetary policy — hit risk assets hard across the board. Siu pointed out the obvious but often overlooked truth: when the president initiates a tariff war, he’s "not thinking about what’s going to happen to the price of Bitcoin," but rather about national economic strategy and geopolitical leverage. These actions, designed to reshape global trade, inherently increase market volatility and push investors away from riskier assets like cryptocurrencies, directly counteracting the positive sentiment the crypto community had hoped for.

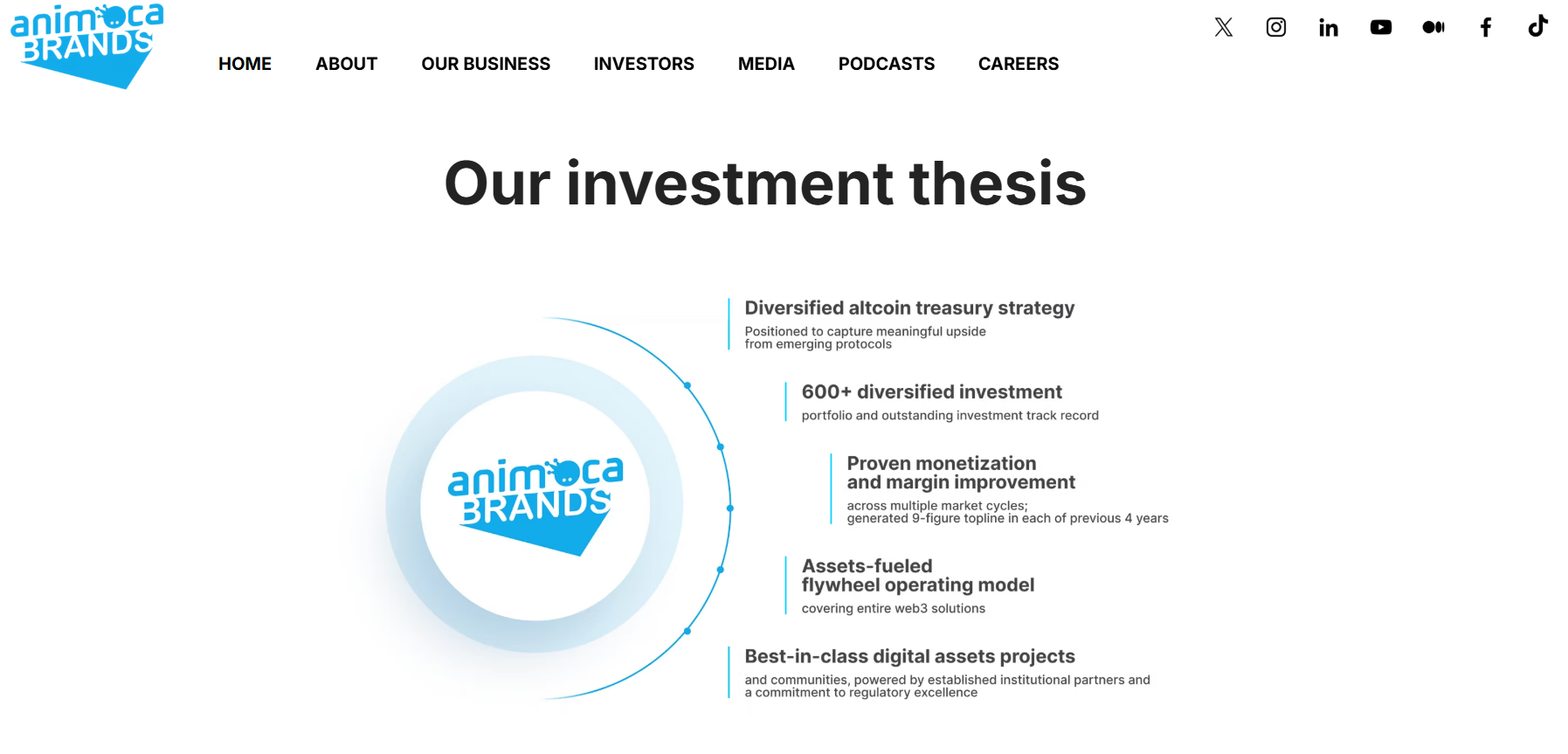

Siu firmly believes that crypto’s much-anticipated "Trump trade" simply didn’t play out as expected in 2025. This market miscalculation, he argues, will serve as a crucial catalyst, forcing the industry in 2026 to pivot sharply towards compliance, robust regulatory frameworks, and, critically, real-world use cases. This shift isn’t merely a suggestion but a necessity for long-term sustainability and mainstream adoption. Animoca Brands itself is strategically positioning for this new era. The company’s planned reverse-merger listing on Nasdaq, through which it aims to become a publicly traded entity, is a calculated bet by Siu that public investors are hungry for an "altcoin proxy" – a diversified, compliant vehicle for exposure to the broader Web3 ecosystem – once clearer regulatory rules are established in the United States. This move underscores Animoca’s confidence in the market’s maturation and the eventual integration of digital assets into traditional financial systems. The strategic decision also reflects a deeper understanding of investor needs, moving beyond direct token purchases to offer a more conventional, regulated investment pathway.

If 2025 was symbolically "Trump’s year," Animoca Brands intends for 2026 to be the year public markets finally gain access to a liquid, comprehensive altcoin proxy. The company’s ambitious plan involves going public via a reverse merger with Currenc Group, a Nasdaq-listed fintech firm. Under the proposed terms, Animoca Brands would emerge owning a substantial 95% of the combined entity. Siu humorously clarified the technicality: "Technically, on paper they buy us," acknowledging, "although we control that." This maneuver is not merely a listing but a deliberate strategy to address a significant gap in the traditional investment landscape.

The core pitch is remarkably straightforward, drawing a parallel with MicroStrategy’s successful model. MicroStrategy has effectively become a leveraged public vehicle for Bitcoin exposure, offering institutional and retail investors a familiar, regulated way to invest in BTC without directly holding the asset. However, as Siu highlights, there is no equivalent for the vast, diverse, and rapidly evolving "long tail" of altcoins and Web3 projects. He poses the critical question: "If you’re an investor and you want to have exposure to crypto, you definitely will need to have your Bitcoin… and then you have the swath of altcoins, and how do you get exposure to that?"

Buying a single base-layer token like Ether (ETH) or Solana (SOL) provides only limited, concentrated access to the broader altcoin ecosystem, Siu argues. It fails to capture the immense innovation and potential across thousands of projects in gaming, metaverse, DeFi, NFTs, and other emerging Web3 sectors. Animoca Brands’ answer is to position itself as a listed, SoftBank-style aggregator of altcoin upside. This means providing public market investors with a meticulously curated and diversified slice of the altcoin and Web3 stack through a single, regulated equity. The firm boasts an impressive portfolio of more than 620 portfolio companies, having invested in roughly 100 new projects last year alone, all managed off its own balance sheet. This expansive reach allows Animoca to identify and back promising ventures early, capturing potential growth across the entire Web3 landscape. Financially, Animoca has demonstrated robust performance, reporting unaudited bookings of $314 million in the 2024 financial year and achieving EBITDA-positive status (profitable on its core operations, before loans and taxes) for four consecutive years. This consistent profitability and strategic investment approach make it an attractive proposition for public investors seeking exposure to the high-growth, yet often opaque, altcoin market. Over time, Siu envisions Animoca itself evolving further, expecting the company to be fully tokenized, thereby transforming into a seamless bridge between traditional equity markets and on-chain ownership – a true hybrid model for the future of finance.

Siu’s confident bet on an altcoin-proxy initial public offering (IPO) is fundamentally predicated on the expectation that the regulatory landscape in the United States will solidify significantly. He views crucial upcoming US legislation, including the Clarity Act and the GENIUS Act, not as potential impediments but as catalytic forces that will unlock unprecedented growth. These acts, designed to provide clearer guidelines for digital assets, are anticipated to bring much-needed legal certainty to the industry.

"The phrase we like to use is ‘Tokenize or die,’" Siu declared, encapsulating the urgency and inevitability he foresees. He firmly believes that once companies have a clear, unambiguous framework for the issuance, trading, and supervision of tokens, a veritable flood of established incumbents will enter the market. The reasoning is simple: "Crypto companies are happy to skate on the edge… but if you’re an established company, whether you’re public or private, why take the chance?" Traditional corporations, bound by stringent legal and fiduciary duties, cannot afford the regulatory ambiguity that smaller, more agile crypto startups might tolerate.

Siu draws a compelling parallel to the stablecoin market. For years, there was widespread hand-wringing and hesitation among large brands regarding stablecoin adoption due to regulatory uncertainty. However, once stablecoin rules firmed up in Washington, suddenly "everyone is doing stablecoins." This historical pattern, he expects, will repeat itself once the Clarity Act formalizes token classification and market-structure rules next year. This act is crucial because it is expected to delineate what constitutes a utility token versus a security token, providing a legal roadmap for issuers. Once this clarity is achieved, established issuers will confidently launch tokens tied to their existing businesses, products, or services because they finally possess "legal certainty, which they didn’t have before." This certainty dramatically lowers the risk profile for large-scale corporate adoption of tokenization.

In this context, real-world assets (RWAs) and tokenized securities are poised to serve as the critical bridge between traditional finance and the burgeoning crypto economy. This sector is not merely a niche but an industry expected to grow into the trillions by 2030, representing a massive opportunity for companies like Animoca. Recognizing this potential, Animoca has already begun forging significant RWA partnerships, including a pivotal deal with Grow, a major Chinese asset manager. This collaboration aims to work on asset tokenization and facilitate access to token markets for traditional clients, demonstrating Animoca’s proactive approach to integrating Web3 technologies with conventional financial instruments. These initiatives lay the groundwork for a future where virtually any tangible or intangible asset can be represented and traded on a blockchain, unlocking new levels of liquidity and efficiency.

Siu believes the next major thematic shift for crypto is already in motion. "The theme of institutionalization of crypto will continue," he affirmed, indicating a steady march towards greater mainstream financial integration. However, 2026, he predicts, will specifically be about "new retail" entering the market under clearer rules and, crucially, with products built around tangible use, not just pure speculation. Until now, a trend that reached its zenith during the memecoin season of 2025, so much of the industry’s focus was on catering to existing crypto traders and launching tokens and memecoins with platforms like Pump.fun. In that environment, builders could prioritize narrative over product, launching tokens without having to deeply consider where the customer would come from or what real-world problem the token solved. However, Siu asserts that current market conditions are forcing a necessary reset.

The "memecoin madness" of 2025 was vividly capped off by the dramatic rise and fall of Trump and Melania Trump-branded tokens early in the year. Official Trump (TRUMP) slid more than 75% from its peak, while Melania Meme (MELANIA) plummeted around 90%, leaving hundreds of thousands of small retail wallets holding significant losses. This speculative frenzy, according to Siu, was "one heck of a vampire attack on the meme community," effectively scorching a large segment of retail investors and simultaneously sucking vital liquidity out of the rest of the market. This episode served as a stark reminder of the dangers of pure speculation and the need for more substantive value propositions.

As capital inevitably rotates away from such high-risk, narrative-driven speculation, Siu envisions the next wave of crypto adoption being driven by products that genuinely solve real problems for diverse user bases, including gamers, creators, and brands. This shift will attract a new demographic of users who may never have considered themselves "crypto people" in the first place, drawing them in through practical applications and tangible benefits rather than speculative promises. With the Clarity Act and GENIUS Act anticipated to lay down a clear path for compliant token issuance, Siu emphatically states, "2026 will be the year of the utility token because everyone will launch a token that has a use case, and we can talk about it." This regulatory clarity will empower legitimate projects to differentiate themselves from purely speculative ventures, fostering an environment where innovation and utility are rewarded.

So, is this a signal that crypto companies are finally growing up? Siu’s response is unequivocal: "They have to, they have to… We’re not the only company going IPO." This collective maturation signifies a pivotal moment for the industry, moving beyond its volatile, speculative adolescence towards a more regulated, utility-driven, and ultimately, sustainable future. The imperative to demonstrate real value and adhere to established frameworks is no longer optional but a fundamental requirement for survival and success in the evolving Web3 landscape.