Concerns are mounting that global equity markets may be drifting into another bubble, fueled by relentless optimism about artificial intelligence (AI). If that bubble cracks in 2026, the repercussions could be widespread, with Bitcoin (BTC) and the broader cryptocurrency market potentially among the first to feel the fallout. The burgeoning AI sector, characterized by colossal investments and ambitious projections, is increasingly drawing comparisons to historical market frenzies, prompting economists and financial analysts to issue stark warnings about a potential "severe" meltdown.

Key Takeaways:

- A significant percentage of fund managers identify an "AI bubble" as the biggest tail risk for markets in 2026.

- Massive capital expenditures by tech giants are outpacing revenue generation in AI, creating an unsustainable growth model.

- Unlike the dot-com era, the current AI expansion is largely debt-driven, raising the specter of cascading failures across financial sectors.

- Bitcoin’s positive correlation with traditional equity markets, particularly tech stocks, makes it vulnerable to an AI-induced downturn.

- While a correction is anticipated, increased institutional exposure might mitigate the severity of Bitcoin’s potential decline compared to past bear markets.

- Analyst projections for Bitcoin’s potential floor range from $60,000 to $75,000 in the event of an AI bubble burst.

AI Bubble Can Trigger "Severe" Meltdown in Stocks

The financial world is increasingly fixated on the possibility that the current AI boom is morphing into an unsustainable bubble. This sentiment is not merely speculative; it is reflected in the concerns of institutional investors. In November, a staggering 45% of fund managers surveyed by Bank of America (BofA) flagged an "AI bubble" as the market’s biggest tail risk for the coming year. This figure represents a dramatic increase from just 11% in September, underscoring a rapid shift in sentiment and a growing unease about the sustainability of current valuations. A "tail risk" refers to the probability of an event occurring that would have a severe, negative impact on a portfolio or market, indicating that a significant portion of the financial elite views an AI correction as the most potent threat on the horizon.

This apprehension is further compounded by a broader consensus among investors. More than half of the respondents in the BofA survey stated their belief that AI stocks are already trading in "bubble territory." This assessment stems from a critical observation: while investment in AI infrastructure and development is soaring, the actual return on investment (ROI) for many of these endeavors remains poor or nonexistent. This imbalance between aggressive spending and tangible, profitable outcomes is a classic hallmark of speculative bubbles.

Major technology companies, often referred to as "hyperscalers," have been at the forefront of this investment surge. Giants such as Meta Platforms, Amazon, Microsoft, Alphabet (Google’s parent company), and Oracle have significantly ramped up their AI infrastructure spending throughout 2025. These companies are pouring billions into developing advanced AI models, building massive data centers, acquiring specialized hardware like AI chips, and recruiting top AI talent. The sheer scale of these investments is unprecedented.

According to Alexander Joshi, Head of Behavioral Finance at Barclays UK, this spending spree is only projected to intensify. Combined capital expenditures (capex) by these hyperscalers are predicted to surge an astonishing 64% year-over-year, potentially exceeding $500 billion by 2026. Joshi emphasized the monumental nature of this build-out in a November report, stating, "Estimates place AI data centers among the largest infrastructure build-outs in modern history." He further highlighted the broader economic implications: "AI data centers now drive a significant portion of US GDP growth. While not inherently bad, this dependence is risky if AI momentum stalls. If expectations break, the snapback could be severe." This statement encapsulates the core fear: a substantial portion of economic growth is now tied to the continued, robust expansion of the AI sector. Any faltering of this momentum could have a profound and destabilizing effect on the wider economy.

Financial analyst HedgieMarkets offered an even more dire comparison, warning that the current AI boom risks a crash far harsher than the infamous dot-com bubble burst of the early 2000s. HedgieMarkets pointed to a striking financial disparity in 2025: the sector reportedly spent roughly $400 billion to generate a mere $60 billion in revenue, with many firms yet to see any substantial returns on their AI investments. This colossal expenditure for minimal immediate revenue is a stark indicator of speculative overvaluation.

"I think the AI bubble is going to pop, and when it does, it’s going to be uglier than people expect," HedgieMarkets cautioned via social media. "Forrester predicts a market correction in 2026, and honestly, I think they’re being optimistic. The sector is spending $400 billion while only bringing in $60 billion in revenue…"

A crucial distinction between the current AI expansion and the dot-com era lies in its funding mechanism. The dot-com bubble was largely equity-funded, meaning companies raised capital by issuing shares. While the subsequent crash led to significant wealth destruction for shareholders, the broader financial system, particularly banks, was relatively insulated. In contrast, today’s AI expansion is heavily debt-driven. Companies are borrowing massive sums to finance their ambitious AI projects. This reliance on debt amplifies the risk of cascading failures. If AI growth expectations collapse, it could trigger defaults across private equity firms that have invested heavily, banks that have lent extensively, insurers holding debt instruments, and even impact already-stressed consumers through broader economic contractions. The interconnectedness of modern finance means a debt-fueled bust could ripple through multiple layers of the global economic system, leading to systemic instability.

Adding to these grave warnings, renowned economic historian Carlota Perez, known for her work on technological revolutions and financial bubbles, cautioned that a simultaneous bust in the AI and crypto sectors could lead to a global economic collapse of "unimaginable proportions." Her perspective underscores the potential for a dual-bubble scenario where the unwinding of one speculative frenzy could exacerbate the other, creating a feedback loop of market downturns.

How Low Can Bitcoin Go if AI Bubble Pops in 2026?

Given Bitcoin’s increasing integration into the broader financial ecosystem, its fate is not entirely decoupled from traditional markets. Tether CEO Paolo Ardoino, a prominent figure in the crypto space, explicitly warned that an AI sector correction could spill over into crypto markets in 2026, identifying it as the year’s "biggest risk for Bitcoin." His bearish outlook is fundamentally rooted in Bitcoin’s observed positive correlation with U.S. equities, particularly tech-heavy indices like the Nasdaq 100.

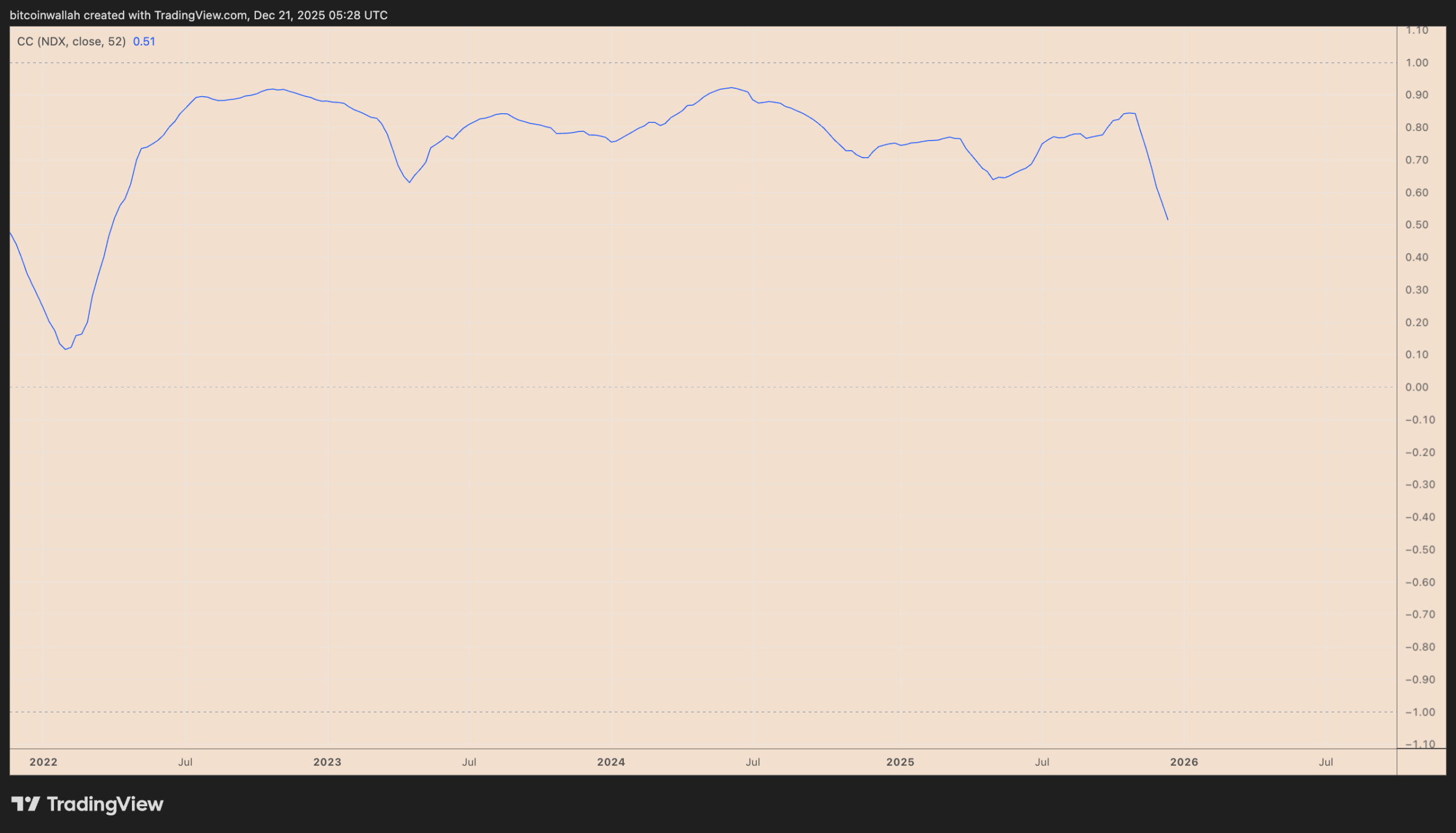

Historically, Bitcoin has often been touted as "digital gold" or a hedge against traditional financial instability. However, in recent years, especially with the influx of institutional money and its treatment as a risk-on asset, Bitcoin has demonstrated a tendency to move in tandem with technology stocks. When traditional markets experience a downturn, driven by risk aversion, Bitcoin frequently follows suit. The 52-week correlation coefficient chart between BTC/USD and the Nasdaq 100 clearly illustrates this trend, showing periods of strong positive correlation, meaning they tend to move in the same direction. This correlation transforms what might otherwise be seen as a diversified asset into one vulnerable to the same macroeconomic forces affecting traditional equities.

Despite the gloomy outlook, Ardoino offered a sliver of hope regarding the potential severity of a Bitcoin correction. He suggested that BTC’s decline would likely not be as severe as the drastic drops witnessed during the 2022 bear market (-77%) or the 2018 bear market (-84%). The primary reason for this tempered expectation is Bitcoin’s increasing institutional exposure. The entry of major financial institutions, investment funds, and even public companies into the Bitcoin space has matured the market, potentially providing stronger support levels and reducing extreme volatility compared to its earlier, more retail-dominated cycles. As of December, Bitcoin was already down by approximately 30% from its record high of $106,200, indicating that some level of correction or consolidation may already be underway, potentially absorbing some of the future shock.

Several analysts have begun to forecast potential price floors for Bitcoin should an AI bubble burst. Analyst Nomad Bullstreet suggested that the Bitcoin price may find strong support and not decline below its average production cost per coin, which they estimate to be in the $71,000-$75,000 range. This "production cost" refers to the average expenses incurred by miners to produce one Bitcoin, including electricity, hardware, and operational costs. Historically, this cost has often acted as a psychological and sometimes literal support level, as miners would be less inclined to sell below their breakeven point, potentially reducing supply. This target area also aligns with previous technical analysis, which identified a prevailing bearish flag pattern, often indicative of further downward movement after a period of consolidation.

Further corroborating these bearish but contained projections, a report attributed to Fundstrat Global Advisors, a prominent research firm, alongside analysis from Fidelity, one of the world’s largest asset managers, projected Bitcoin’s price to hit $60,000–$65,000 in 2026. This consensus from multiple reputable financial entities provides a clearer picture of the potential downside for Bitcoin, suggesting that while significant, the correction might remain within a defined range, rather than an unmitigated freefall. These projections indicate a substantial but not catastrophic downturn, reflecting a market that is more mature and perhaps more resilient due to its institutional backing than in previous cycles.

The looming specter of an AI bubble burst in 2026 represents a significant challenge for global financial markets. Its potential impact on Bitcoin, driven by an increasingly strong correlation with traditional equities, cannot be understated. While the exact timing and severity remain uncertain, the growing chorus of warnings from fund managers, economists, and crypto industry leaders necessitates careful consideration for investors in both traditional and digital asset classes. The outcome will depend not only on the dynamics of the AI sector itself but also on the resilience of the broader financial system to absorb a debt-fueled shock of potentially "unimaginable proportions."

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision. While we strive to provide accurate and timely information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of any information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information.