The news that Trump Media and Technology Group (TMTG), the parent company behind the social media platform Truth Social, intends to combine with the fusion energy innovator TAE Technologies is, without hyperbole, a first of its kind. This merger agreement, structured as an all-stock transaction valued at more than $6 billion, proposes that upon its closing, shareholders of each company will hold approximately half of the combined entity. While the immediate market reaction saw shares of Trump Media close up 42% on Thursday, it’s crucial to note that this surge still leaves the company’s stock significantly below its initial trading highs following its Nasdaq debut in March 2024 via a SPAC merger, with its latest market capitalization hovering around $4 billion.

The sheer incongruity of this proposed pairing has left media insiders, energy technology aficionados, and the general public broadly scratching their heads. A social media platform, often associated with political discourse and celebrity, merging with a company dedicated to harnessing the power of the sun on Earth – the ultimate clean energy source – seems like a storyline ripped from science fiction rather than a corporate press release. To offer some context to this bewildering development, a closer look at Crunchbase data reveals the robust and increasingly attractive nature of the fusion energy space, with TAE Technologies standing out as a particularly well-funded and differentiated player within this cutting-edge sector.

Trump Media and Technology Group itself has had a tumultuous journey since its inception. Formed around the concept of creating an alternative media ecosystem, its flagship product, Truth Social, launched with the stated aim of fostering open and free discourse, positioning itself against perceived censorship on mainstream platforms. Its public market entry was achieved through a special purpose acquisition company (SPAC) merger with Digital World Acquisition Corp. (DWAC), a process that often allows companies to go public faster and with less regulatory scrutiny than a traditional IPO. This route, however, also carries inherent volatility, and TMTG’s stock performance post-merger has been a testament to that, experiencing dramatic swings influenced by news cycles, user engagement metrics, and broader market sentiment around tech and media stocks. Its valuation, while briefly soaring, has struggled to stabilize at its initial debut levels, indicating a search for a more robust and diversified business model beyond its current social media offering.

Enter TAE Technologies, a company operating at the absolute forefront of scientific and engineering innovation. Founded in 1998 as Tri Alpha Energy, TAE has spent over two decades pursuing what many consider the holy grail of energy: nuclear fusion. Unlike nuclear fission, which powers existing nuclear plants by splitting atoms, fusion energy aims to replicate the process that powers the sun – fusing light atomic nuclei to release vast amounts of energy with virtually no long-lived radioactive waste and abundant fuel sources (like isotopes of hydrogen found in water). This promise of clean, limitless, and safe energy has captivated scientists and investors alike for decades.

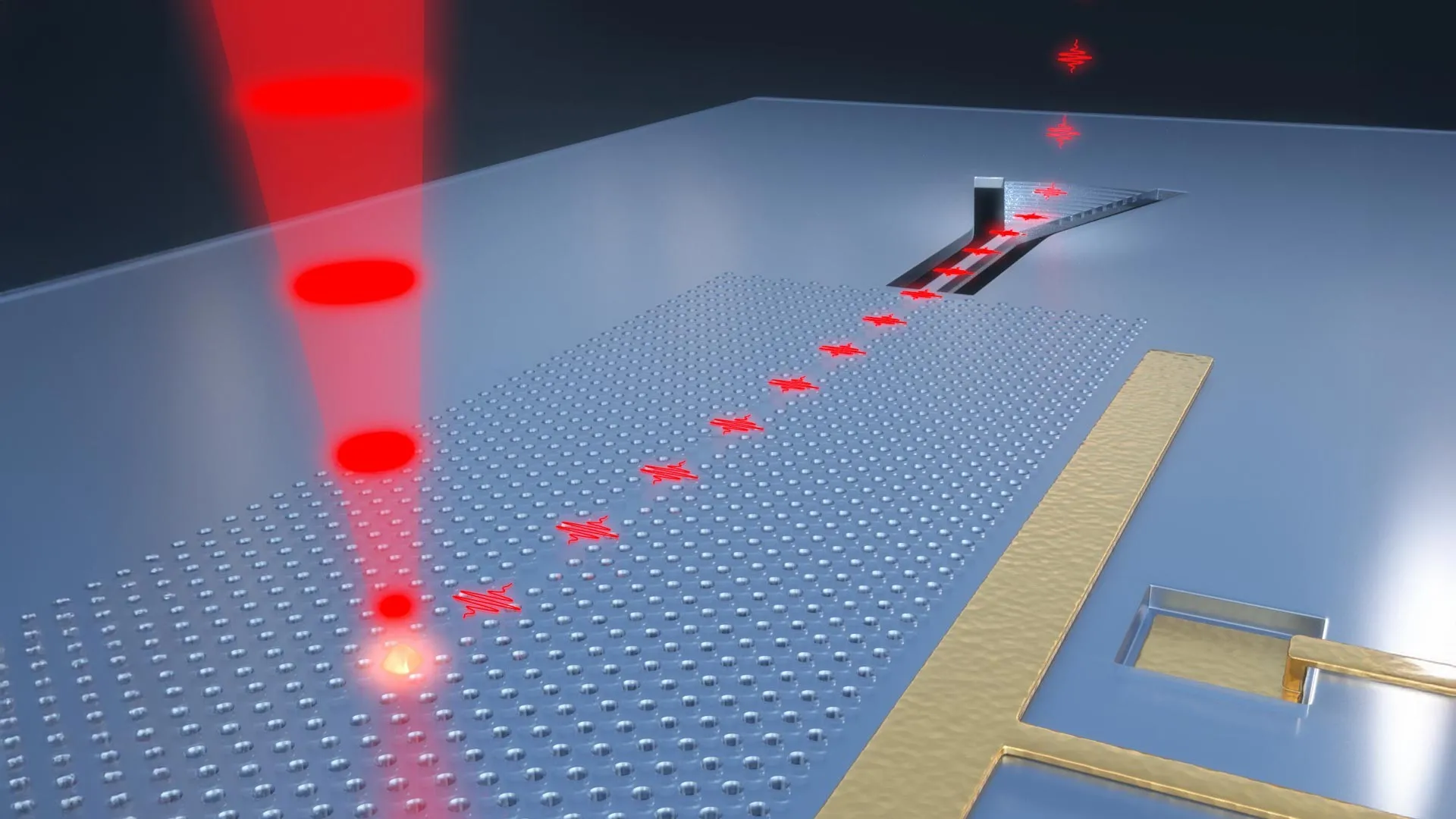

TAE’s specific approach to fusion is based on an advanced beam-driven field-reversed configuration (FRC) plasma confinement concept. This method involves creating a high-temperature, high-density plasma ring and sustaining it using neutral beam injectors and other proprietary technologies. Their long-term, iterative development process has seen them build and operate successive generations of experimental devices, each one pushing closer to the scientific and engineering thresholds required for commercial fusion power. Their latest device, Copernicus, is designed to demonstrate net energy gain, a critical milestone where the fusion reaction produces more energy than is put in to start and sustain it.

What Crunchbase data emphatically highlights is the significant capital flowing into the fusion sector, and TAE Technologies has been a prime beneficiary of this trend. The company has successfully attracted "megarounds" of funding from an impressive roster of "smart money" investors. These aren’t just venture capitalists looking for quick returns; they include strategic investors from the energy sector, tech giants, and impact-driven funds. Notably, TAE has been backed by entities such as Google, Chevron, Saudi Aramco, and Goldman Sachs, alongside philanthropic organizations like Vulcan Inc. (founded by the late Paul Allen). This diverse investor base underscores both the long-term strategic importance of fusion energy and the confidence in TAE’s specific technological pathway. The cumulative funding TAE has secured runs into the hundreds of millions, if not billions, reflecting the capital-intensive nature of fusion research and development, but also the deep pockets and patient capital willing to back such a transformative technology.

Several characteristics differentiate TAE from its competitors in the increasingly crowded fusion startup landscape. Its long operational history, dating back to the late 1990s, means it possesses a wealth of accumulated knowledge, engineering expertise, and proprietary data. While other prominent fusion companies like Commonwealth Fusion Systems (backed by MIT and Eni) or Helion Energy (backed by OpenAI’s Sam Altman) are pursuing different technological pathways (e.g., compact tokamaks or magneto-inertial fusion), TAE’s FRC approach represents a distinct and well-advanced effort. Furthermore, TAE has consistently focused not just on scientific milestones but also on the practical engineering and commercialization aspects, developing technologies that could have applications beyond pure energy generation, such as medical isotopes or advanced propulsion.

The confluence of these factors – TMTG’s search for diversification and stability, and TAE’s significant capital requirements and long-term vision – might, however abstractly, offer a sliver of explanation for this otherwise baffling merger. From TMTG’s perspective, this could be an audacious move to pivot into a high-growth, high-impact sector, potentially re-rating its valuation based on the future promise of fusion rather than the volatile metrics of a social media platform. It could be seen as an attempt to attract a different class of investors, those interested in ESG (Environmental, Social, and Governance) investing and groundbreaking technology. For TAE, the merger could represent an accelerated path to public markets, bypassing the traditional IPO process and potentially unlocking access to a broader investor base and capital pools for the immense funding still required to bring fusion to commercial reality. A public listing, even through an unconventional merger, could provide liquidity for existing investors and a platform for future capital raises.

Yet, the questions persist. The operational synergies between a social media company and a fusion energy developer are virtually non-existent. How will the combined entity manage two vastly different corporate cultures, regulatory landscapes, and business objectives? The challenges inherent in integrating such disparate operations, let alone justifying them to shareholders and the market, are formidable. The $6 billion valuation, while impressive on paper, will be heavily scrutinized, especially given the speculative nature of both TMTG’s current business model and TAE’s long-term commercialization timeline. The market’s initial favorable reaction to TMTG’s stock might be interpreted as investors welcoming any move towards diversification or a perceived "real asset" within the TMTG portfolio, but sustained confidence will depend on clear articulation of strategy and execution.

Despite the obvious "head-scratching" aspect of this particular merger, the broader context of fusion funding is undeniably compelling. The global push for decarbonization, energy independence, and sustainable development has supercharged investment in clean energy technologies, and fusion stands as the ultimate prize. Governments worldwide are increasing funding for fusion research, and private capital has followed suit, recognizing that while the timeline is long, the potential rewards are immense. Breakthroughs in materials science, magnet technology, and computational modeling are accelerating progress, leading to increased optimism that commercial fusion power could become a reality within decades, rather than centuries. This influx of capital and scientific progress is why companies like TAE Technologies, Commonwealth Fusion Systems, Helion Energy, and others are attracting such significant investment, validating the sector as a legitimate, albeit high-risk, long-term investment opportunity.

So, while no one could have reasonably predicted Truth Social merging with a Google-backed fusion company on their 2025 bingo card, the underlying financial trends in the fusion energy sector provide a crucial backdrop. This merger, however unconventional, underscores the fact that Trump Media is attempting to enter a space that has attracted substantial capital from some of the most sophisticated and forward-thinking investors globally. It’s a bold, perplexing, and potentially transformative bet that leverages the intrinsic value and future promise of fusion energy, even if the vehicle for that bet is anything but traditional. The coming months will reveal whether this unprecedented combination can indeed forge a path towards a new kind of corporate synergy, or if it will remain a curious footnote in the annals of M&A history.