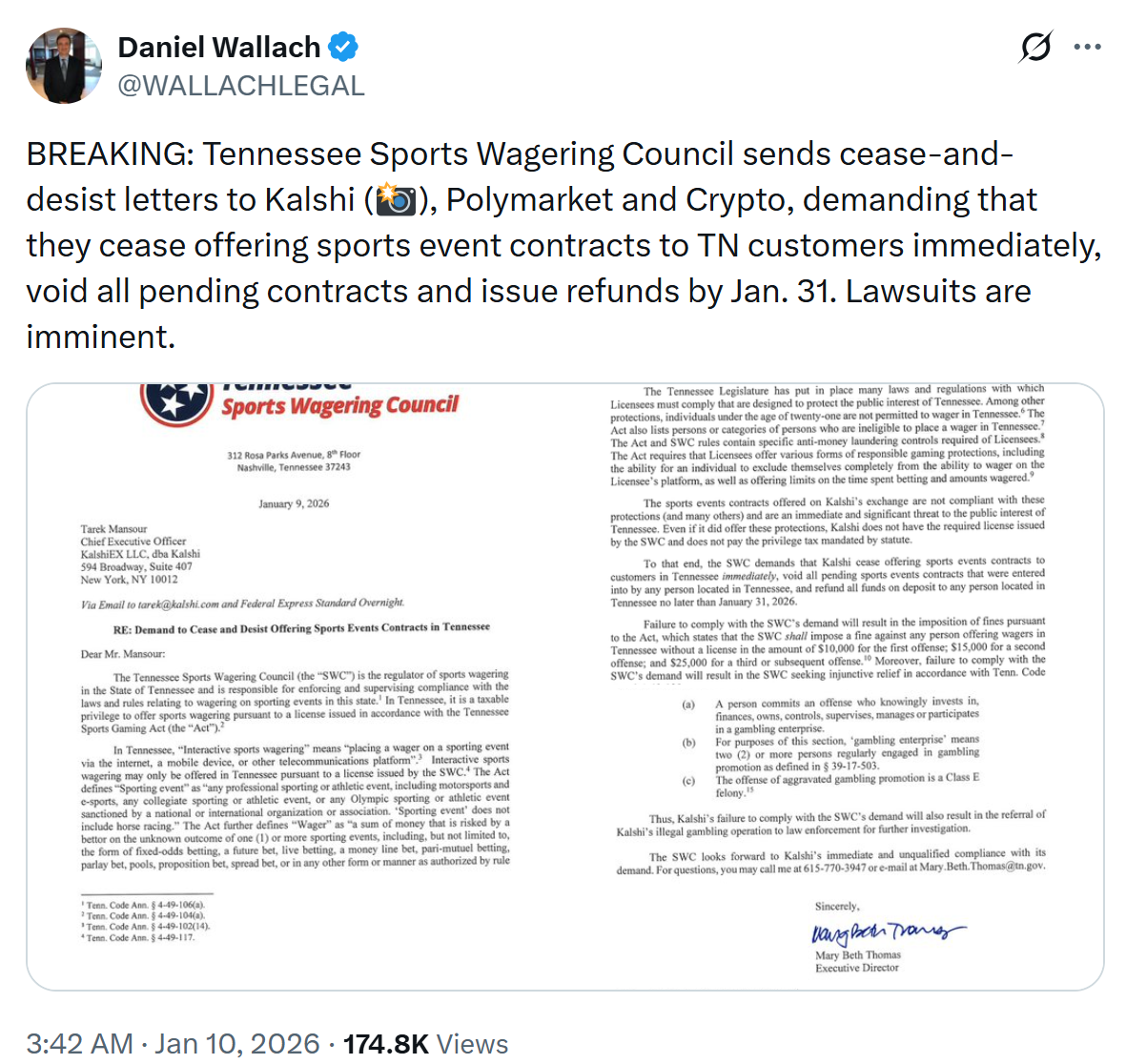

The SWC’s accusations, detailed in copies of the letters published on X by renowned sports betting attorney Daniel Wallach, center on the platforms’ alleged violation of the Tennessee Sports Gaming Act. According to the regulator, the "sports event contracts" listed on Kalshi, Polymarket, and what the SWC termed "Crypto.com’s North American Derivatives Exchange" allow users to place monetary wagers on the outcomes of sporting events. This practice, the SWC emphatically states, falls squarely under the definition of sports wagering, a domain exclusively reserved for entities holding a specific license issued by the state of Tennessee. The council firmly rejected the notion that merely packaging these products as "event contracts" or utilizing a derivatives exchange framework exempts them from the state’s comprehensive gambling statutes.

Beyond the core issue of unlicensed wagering, the Tennessee regulator underscored significant concerns regarding consumer protection. Licensed sportsbooks in Tennessee are subject to a strict regulatory framework designed to safeguard users, including rigorous age verification processes, robust responsible gaming tools to prevent addiction, and stringent anti-money laundering (AML) controls. The SWC asserted that these vital protections are conspicuously absent from the offerings of Kalshi, Polymarket, and Crypto.com, leaving Tennessee residents vulnerable to potential harm, financial exploitation, and the risks associated with unregulated gambling environments. The lack of these safeguards represents a critical failure to uphold the public interest, a responsibility the SWC is mandated to enforce.

The orders issued by the SWC are comprehensive and demand immediate and retrospective compliance. The companies have been explicitly instructed to cease all offerings of sports-related contracts to Tennessee residents without delay. Furthermore, they are required to void all existing contracts entered into by users within the state and, critically, to refund all funds deposited by these users by a specified deadline of January 31, 2026. Failure to adhere to these mandates carries severe consequences, including substantial financial penalties of up to $25,000 per offense. The SWC also warned that persistent non-compliance could escalate to injunctive relief—a court order compelling compliance—and even referrals to law enforcement agencies for further investigation into potential illegal gambling operations, raising the specter of criminal charges.

A central point of contention in this dispute, and in similar cases nationwide, is the federal registration status of Kalshi and Polymarket. Both platforms are registered with the U.S. Commodity Futures Trading Commission (CFTC), a federal agency responsible for regulating the U.S. derivatives markets. Kalshi, in particular, operates under a CFTC-regulated designated contract market (DCM) license. The companies often argue that their "event contracts" are financial instruments akin to futures or options, falling under the exclusive jurisdiction of the CFTC, thereby pre-empting state gambling laws. However, the Tennessee Sports Wagering Council firmly maintained that federal registration does not, and cannot, override the state’s inherent authority to regulate sports wagering within its geographical borders. This jurisdictional clash highlights a growing regulatory ambiguity at the intersection of financial derivatives and gambling, particularly as technology blurs traditional definitions.

Prediction markets, at their core, are platforms where users bet on the outcome of future events by buying and selling "shares" in those outcomes. These shares fluctuate in value based on market sentiment and probabilities. While often touted for their potential in forecasting and aggregating information, their application to sports events directly mimics traditional sports betting. The SWC’s stance aligns with a growing number of state regulators who view these sports-related contracts not as sophisticated financial instruments, but as thinly veiled gambling products, regardless of the underlying technical structure or federal registration. The council’s argument underscores the principle that the substance of the activity – wagering money on a sports outcome – dictates its regulatory classification, not merely its nomenclature or technological wrapper.

This action by Tennessee is not an isolated incident but rather part of a burgeoning national legal battle spearheaded primarily by Kalshi against various state regulators. Just last month, a significant development occurred in Connecticut, where a U.S. federal judge temporarily blocked state regulators from enforcing a cease-and-desist order against Kalshi. This temporary reprieve granted Kalshi a crucial moment to advance its legal arguments. The Connecticut Department of Consumer Protection had similarly accused Kalshi, alongside Robinhood and Crypto.com, of offering unlicensed sports wagering through online event contracts. Kalshi swiftly challenged Connecticut’s move in court, asserting that its event contracts fall under federal commodities law and are exclusively regulated by the CFTC. Judge Vernon Oliver’s ruling mandated a pause in Connecticut’s enforcement while the court deliberates Kalshi’s request for a preliminary injunction, with filings due in January and oral arguments scheduled for mid-February.

The Connecticut case serves as a crucial precedent and mirrors Kalshi’s ongoing legal offensive across multiple states. Kalshi has initiated lawsuits against regulators in New York, Massachusetts, New Jersey, Nevada, Maryland, and Ohio, all challenging similar state-level interpretations that classify its prediction market contracts as illegal gambling. The core of Kalshi’s argument in these diverse jurisdictions remains consistent: that its products are legitimate financial derivatives under federal oversight, not gambling. These cases collectively underscore the urgent need for clearer regulatory guidelines at both federal and state levels concerning the nature and legality of prediction markets, particularly when they involve events traditionally associated with gambling.

Crypto.com’s inclusion in the Tennessee order is also noteworthy. While Kalshi and Polymarket are primarily known as prediction market platforms, Crypto.com is a major cryptocurrency exchange. Its alleged involvement in offering sports event contracts, particularly through what the SWC termed "North American Derivatives Exchange," suggests either a specific product offering by Crypto.com or a partnership that facilitated such contracts. This highlights the broader trend of cryptocurrency platforms diversifying their offerings, sometimes venturing into areas that draw the scrutiny of traditional financial and gambling regulators. The SWC’s mention of Crypto.com underscores the increasing intermingling of crypto assets, derivatives, and sports wagering, creating new regulatory challenges.

The broader implications of Tennessee’s order and the ongoing multi-state legal battles are profound. They represent a critical juncture for the burgeoning prediction market industry in the United States. Should state regulators successfully assert jurisdiction, it could severely restrict the types of events prediction markets can offer, potentially limiting them to non-sports related outcomes or forcing them to acquire costly and complex state gambling licenses. Conversely, if Kalshi and other platforms prevail in establishing federal pre-emption, it could pave the way for a more unified national regulatory framework for prediction markets, albeit one that might clash with state-level consumer protection priorities regarding gambling. The outcome of these cases will undoubtedly shape the future landscape of online wagering, financial innovation, and regulatory authority in the digital age, impacting not only the involved companies but also the millions of users participating in these markets. The current regulatory environment for both cryptocurrency and online gambling in the US is marked by increasing scrutiny from various authorities, making these legal battles pivotal in defining the boundaries of what is permissible.