A quarter-century of relentless venture capital investment has culminated in staggering figures: over $4 trillion injected into startups globally, giving rise to nearly 100,000 new companies. These numbers, impressive on their own, hint at a profound transformation occurring beneath the surface of the global economy, even as the innovation landscape often appears stubbornly static to the casual observer.

Since the dawn of the new millennium, a precise $4.2 trillion has fueled the global startup engine, meticulously tracked and analyzed, leading to the creation of 97,982 scaleups worldwide. Among these, a select 7,030 have distinguished themselves by raising over $100 million in capital – a group we aptly term the ‘Scalers.’ Even more exclusive is the club of ‘Super Scalers,’ comprising 473 companies that have surpassed the formidable $1 billion mark in total capital raised. These are not merely statistics; they represent immense value creation, job generation, and technological advancement that are reshaping industries and daily lives across the globe.

These illuminating insights are drawn from the latest comprehensive report, “The Calm Before the AI Storm: Global Innovation Ecosystems: Who Leads, Who Lags, and Who Could Rise – Startup Ecosystem Stars 2025 Report.” This seminal work, a collaborative effort between Mind the Bridge and Crunchbase, was unveiled during the prestigious Startup Ecosystem Stars Awards held recently in Paris, offering an unparalleled look into the dynamic yet often deceptively calm world of innovation.

The Innovation Paradox: Nothing Seems To Move (On The Surface)

When one examines the “Startup Atlas 2025” and compares it with its 2024 predecessor, a peculiar paradox emerges. Despite the continuous churn of the “new economy,” which consistently spawns industry disruptors at an impressive rate – nearly 8,000 new scaleups added since January alone – the overarching picture of global innovation appears largely unchanged. The top-tier ecosystems, the established giants, seem to retain their dominance with an iron grip. For a significant portion of the world, particularly aspiring hubs and emerging markets, this apparent stasis is far from good news; the balance of power, at first glance, remains largely unmoved.

This phenomenon can be attributed to the powerful gravitational pull of concentration. Capital, talent, and expertise tend to gravitate towards existing centers of excellence, creating a reinforcing loop where success begets more success. Breaking into these established echelons requires immense effort and time, making year-over-year shifts in the top rankings incremental rather than revolutionary.

However, this surface-level stability is akin to the tip of an iceberg. The true dynamism, the transformative forces that will eventually reshape the visible landscape, are operating extensively below the surface. This subterranean activity – the nascent startups, the evolving funding models, the regional surges, and the technological breakthroughs – often remains invisible until it has gathered enough momentum to manifest as significant, undeniable change. And it is this underlying dynamism that holds the key to understanding the true trajectory of the global startup economy.

A Decade In The World of Innovation: Everything Does Move

To truly grasp the magnitude of the shifts underway, one must zoom out, extending the temporal lens beyond a mere annual comparison. A decade in the startup world is not just a passage of time; it is a geological era, a period of profound evolution where foundational shifts occur, and landscapes are irrevocably altered.

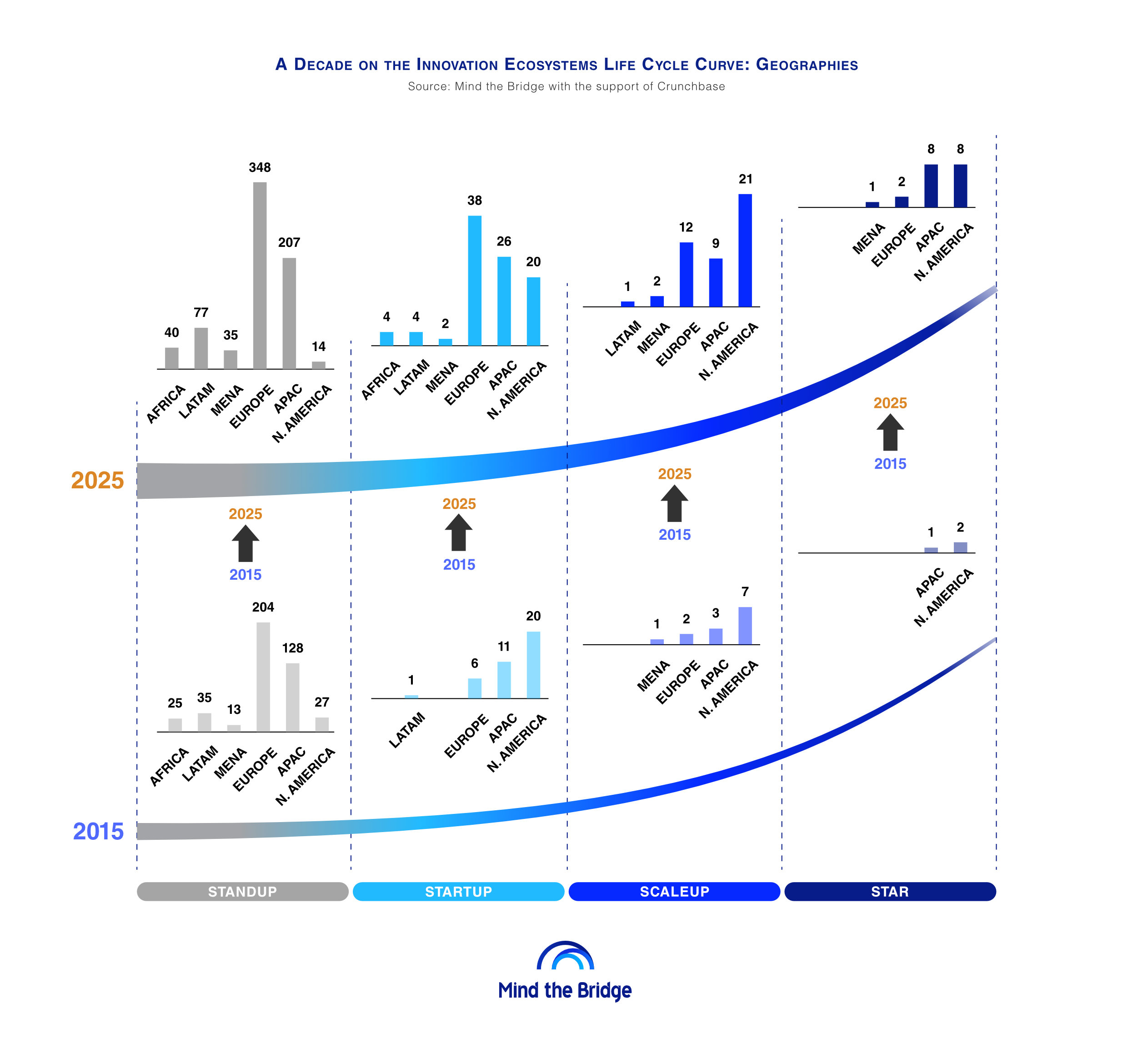

The Innovation Ecosystem Life Cycle Curve, a conceptual framework used to map the maturation of startup hubs, perfectly illustrates this. While its fundamental shape remains consistent – depicting stages from nascent ‘Standup’ to mature ‘Star’ ecosystems – the curve has become dramatically more crowded, with a discernible shift in weight towards the later, more developed stages. This indicates a broad maturation of the global innovation landscape.

Consider the stark contrast between 2015 and today. Just a decade ago, fewer than 500 startup ecosystems populated the global curve. The ‘Star’ stage, representing the pinnacle of innovation hubs, was an exclusive club comprising only three global tech titans: Silicon Valley, New York, and Beijing. The ‘Scaleup’ stage, indicative of significant growth and capital attraction, boasted a mere 13 ecosystems. The startup scene was simpler, less diffused, and heavily concentrated in a few dominant regions, primarily the U.S. and the APAC region.

Fast forward ten years, and the landscape is radically different, almost unrecognizable in its complexity and expansion. Nearly 900 ecosystems now feature on the curve, representing an almost doubling of recognized innovation hubs. The ‘Star’ stage has swelled to include 19 ecosystems – a remarkable sixfold increase – signifying a broader distribution of global innovation leadership. Similarly, the ‘Scaleup’ stage has seen robust growth, now counting 45 ecosystems, a 3.5x expansion. This explosion in numbers underscores a fundamental decentralization of innovation, even if the very top remains highly concentrated.

Looking into the crystal ball, the trends suggest an even more crowded and complex future. By 2030, it’s entirely plausible that the life cycle curve could host over 1,500 ecosystems globally, marking a massive expansion of the innovation frontier. Within this expanded universe, 40 to 50 ecosystems are projected to achieve ‘Star’ status, and 90 to 100 could reach the ‘Scaleup’ stage. Practically speaking, this future presents a significant challenge for venture capitalists, corporate innovation scouts, and policymakers alike. Navigating this increasingly dense and dynamic landscape will demand sophisticated tools, deep analytical capabilities, and a keen understanding of emerging regional nuances. The traditional methods of "innovation hunting" will become woefully inadequate in this dramatically more complex environment.

The Shifting Geography of the Startup Economy

Beyond the sheer numbers, the geographical distribution of startup activity has also undergone significant evolution. While the upper echelons of the innovation curve still exhibit a familiar pattern of dominance, important shifts are occurring, particularly in the mid-tiers.

On the right-hand side of the curve, representing the most mature and capital-rich stages, the dominance pattern remains similar, though slightly more distributed. What was once a stage led almost exclusively by the U.S. (with two ecosystems) and China (with one) now sees the ‘Star’ stage shared more broadly, with the U.S. and APAC each boasting eight such ecosystems. Israel, London, and Paris stand out as notable exceptions, punching above their weight to secure positions among these global innovation leaders. Their success can be attributed to factors such as robust government support for R&D, world-class academic institutions fostering deep tech, strong corporate venturing activities, and a culture of entrepreneurship that leverages global networks despite smaller domestic markets.

However, moving left along the curve, towards the ‘Scaleup’ and earlier stages, Europe’s ascendance becomes undeniable. At the ‘Scaleup’ stage, Europe now counts an impressive 12 ecosystems, a dramatic increase from just two a decade ago, effectively surpassing APAC in this category. This growth is indicative of a maturing European ecosystem, benefiting from increased venture capital flows, a growing pool of skilled talent, pan-European initiatives fostering collaboration, and a burgeoning entrepreneurial culture that is increasingly comfortable with ambition and scale.

Furthermore, in the ‘Startup’ and ‘Standup’ stages – the foundational tiers of innovation – Europe now leads as the region with the highest number of ecosystems overall. This broad, diversified base is a testament to the continent’s deep well of talent, research, and nascent entrepreneurial activity. The critical question, however, remains: Is this a sign of immense latent potential, poised to emerge and challenge the global leaders, or is it merely the result of structural fragmentation, where numerous smaller ecosystems struggle to consolidate resources and scale to the levels seen in the U.S. or China? Overcoming regulatory hurdles, fostering cross-border collaboration, and attracting larger, later-stage capital will be crucial for Europe to convert this broad base into a greater share of ‘Star’ ecosystems.

A final, crucial observation concerns the regions of Latin America, the Middle East, and Africa. With a few significant exceptions – notably Israel in the ‘Star’ stage, and Dubai, São Paulo, and Istanbul in the ‘Scaleup’ stage – these vast and populous regions are largely absent from the highest tiers of innovation. In the ‘Startup’ stage, they collectively represent only 10 out of 93 ecosystems. It is primarily in the foundational ‘Standup’ stage that we finally see larger volumes from these regions, with 73 out of 721 ecosystems. This disparity highlights a significant untapped potential. These regions possess immense human capital, rapidly digitizing populations, and unique local challenges that can spur innovative solutions. The pressing question is when and how this immense innovation potential will finally surface, requiring sustained investment, supportive policy environments, and robust infrastructure development to foster their growth beyond nascent stages.

The Calm Before The AI Storm: Navigating the Future

The report’s title, “The Calm Before the AI Storm,” hints at the next great wave of disruption. Artificial intelligence is not merely another technology; it is a foundational shift that promises to reshape every industry, accelerate innovation cycles, and potentially redraw the global innovation map once again. The current, deceptively calm period might be the brief interlude before AI dramatically amplifies both the concentration of power in existing hubs and the rapid emergence of new, AI-centric ecosystems.

For innovation hunters – the VCs seeking the next unicorn, and the corporates looking for strategic acquisitions or partnerships – navigating this increasingly complex and AI-driven landscape will become a serious headache. The sheer volume of ecosystems, coupled with the accelerating pace of technological change, demands a proactive, data-driven approach to identify genuine potential amidst the noise. The future success of innovation ecosystems, and the entities within them, will hinge on their ability to adapt, specialize, and integrate AI into their core strategies.

In conclusion, the startup economy embodies a profound paradox: while year-to-year comparisons might suggest an unchanging tableau, a broader historical perspective reveals a landscape in constant, often dramatic, flux. What appears as stillness on the surface is, in fact, the quiet accumulation of monumental shifts occurring beneath. The global innovation ecosystem has expanded exponentially, diversified geographically, and is now poised on the precipice of an AI-driven transformation. Understanding these subtle yet powerful movements is not just an academic exercise; it is essential for anyone seeking to thrive in the dynamic, ever-evolving world of entrepreneurship and innovation.

For more detailed insights and comprehensive data, the full report, “The Calm Before the AI Storm: Global Innovation Ecosystems: Who Leads, Who Lags, and Who Could Rise,” is available for download here.

Alberto Onetti is the esteemed chairman of Mind the Bridge and a distinguished professor at the University of Insubria. A serial entrepreneur, Onetti has successfully launched three startups, including Funambol, which stands among the top five Italian scaleups in terms of capital raised. He is widely recognized as a leading international expert in open innovation, possessing extensive experience in designing and managing open innovation projects – including venture clients, venture builders, intrapreneurship programs, and Corporate Venture Capital (CVCs) – with numerous multinational corporations. Onetti also provides advisory and training services on these critical subjects. He contributes regularly to Sifted (Financial Times) and various other influential tech blogs, offering insightful commentary on the innovation landscape.

Illustration: Dom Guzman

Stay up to date with recent funding rounds, acquisitions, and more with the Crunchbase Daily.