Lighter, a decentralized exchange (DEX) specializing in perpetual futures trading, recently executed a monumental token giveaway, distributing Lighter Infrastructure Tokens (LIT) that instantly ranked among the ten most significant airdrops in cryptocurrency history. This substantial event, while celebrating a milestone for early participants, simultaneously ignited vigorous debate within the crypto community regarding the project’s tokenomics and long-term sustainability.

On Tuesday, the innovative DEX airdropped a staggering $675 million worth of LIT to its early supporters, as meticulously documented by blockchain data visualization platform Bubblemaps. The platform’s analysis, shared in a Tuesday X (formerly Twitter) post, not only confirmed the colossal sum but also noted, "$675M airdropped to early participants. $30M withdrawn from Lighter (only)," indicating a relatively low immediate sell-off pressure from the initial recipients. This figure immediately positioned the Lighter airdrop as a landmark event in the digital asset space, capturing the attention of investors and analysts worldwide.

According to comprehensive research by crypto data aggregator CoinGecko, the $675 million valuation places the Lighter airdrop squarely as the 10th largest by US dollar value ever recorded in the burgeoning history of cryptocurrencies. This achievement underscores the growing scale and impact of token distribution events within the decentralized finance (DeFi) ecosystem, which often serve as a crucial mechanism for bootstrapping liquidity, incentivizing community participation, and decentralizing governance. The Lighter airdrop notably surpassed the 1inch Network’s $671 million distribution, which previously held the 10th spot, yet it remained just shy of LooksRare’s $712 million airdrop from 2022, highlighting the increasingly competitive landscape of high-value token launches.

However, even with its impressive ranking, the $675 million sum distributed by Lighter pales in comparison to the industry’s undisputed champion: the Uniswap airdrop of 2020, which saw an astonishing $6.43 billion in value distributed. This historical context illustrates the vast range in the scale of these token events, from significant multi-million dollar distributions to multi-billion dollar foundational launches that have reshaped the DeFi landscape. Other notable top-tier airdrops include those from Arbitrum, ApeCoin, and Optimism, each contributing to the narrative of how projects can effectively decentralize and empower their user bases.

Holders Stay Put Amidst Token Generation Event

The token generation event (TGE) and subsequent airdrop were met with a wave of excitement among Lighter’s earliest adopters. Pseudonymous crypto investor Didi, for instance, publicly reported receiving a substantial six-figure airdrop from the DEX, a testament to the potential rewards for engaging with nascent DeFi protocols. Such stories quickly circulated, fueling optimism and demonstrating the tangible benefits of being an early participant in promising projects.

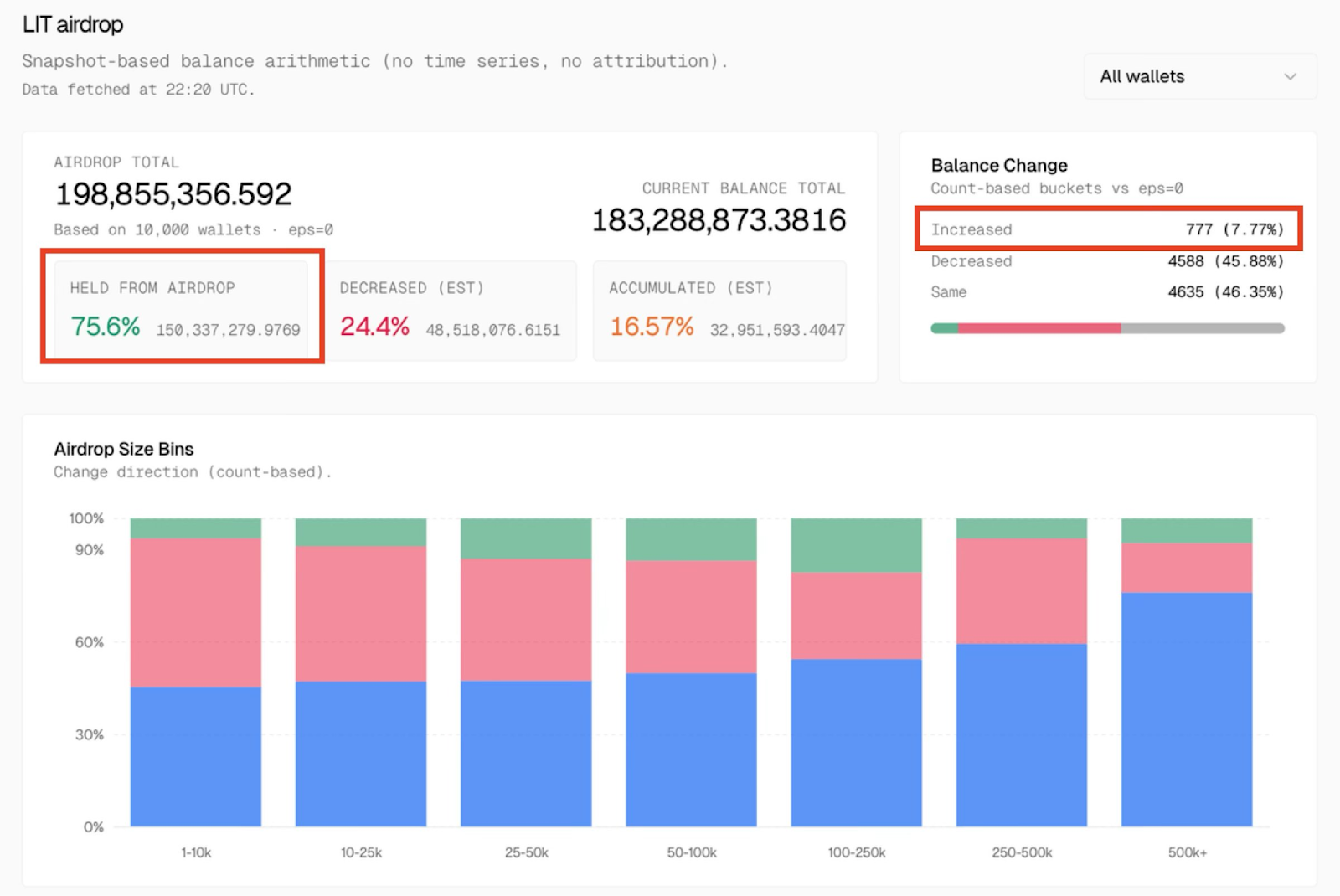

Perhaps more critically for Lighter’s long-term prospects, initial data on token holder behavior indicated a strong vote of confidence. As of the day following the airdrop, approximately 75% of the recipients were still holding their newly acquired LIT tokens. Even more encouragingly, about 7% of recipients had actively bought additional LIT tokens on the open market. These figures, shared by blockchain sleuth Arndxt in an X post, signal a robust belief in the future of the long-awaited DEX token, differentiating it from many "dump and run" airdrop scenarios where recipients quickly liquidate their holdings. This sustained holding pattern suggests that a significant portion of the Lighter community views LIT not merely as a free windfall but as a valuable asset with long-term growth potential, aligning with the project’s vision.

Tokenomics Spark Community Debate

Despite the successful distribution and initial holder retention, Lighter’s tokenomics have become a focal point of concern and criticism within the community. The project’s allocation strategy reserves 50% of the total LIT supply for the ecosystem, while the remaining 50% is designated for the core team and early investors. While team and investor allocations typically come with a one-year cliff (meaning no tokens can be sold for the first year) followed by a multi-year vesting schedule (tokens are gradually released over several years), designed to align their interests with the project’s long-term success, the specific percentages have raised eyebrows.

Several community members vocally expressed their apprehension, with some, like CocoFusionLabs, pointing out that a 50% team allocation was "excessively high" for a decentralized finance project, where a greater emphasis is often placed on community ownership and decentralization from the outset. Others drew critical comparisons to the tokenomics model presented by one of Lighter’s main rivals, Hyperliquid. These critics, such as nn_blossoms, suggested that adopting a similar structure without significant differentiation or a more community-centric approach could be a potential misstep for Lighter in a highly competitive market. The core of this criticism lies in the tension between attracting and retaining top talent and investors (who require significant incentives) and fostering a truly decentralized, community-governed ecosystem. High team allocations, even with vesting, can create perceived centralization and potential future sell pressure, which can dampen investor sentiment.

Market Performance and the Path Forward

Following its auspicious launch, the LIT token quickly established a significant presence in the market. As of 11:20 a.m. UTC on the day of the reporting, LIT boasted a robust market capitalization of $678 million, with its price trading above $2.71, according to data from crypto intelligence platform Nansen. This immediate market validation reflects the high anticipation and perceived value of Lighter’s offering in the perpetual futures space.

However, not all market observers were entirely bullish on the long-term prospects for those entering at current price levels. Crypto investor Casa, in a Tuesday X post, offered a more cautious perspective, suggesting that buying LIT at its initial trading prices might only yield a "short-term trade." For the token to present a genuine "long-term market opportunity," Casa emphasized the critical need for "significantly more trading volume" and, crucially, sustained "user retention." This expert analysis highlights the challenges faced by new DeFi projects: beyond the initial hype and airdrop-driven liquidity, real value accrual depends on the organic growth of its user base, consistent trading activity, and the sticky adoption of its platform features. Lighter will need to demonstrate competitive advantages, robust security, and a compelling user experience to convert early adopters into loyal, active users.

The Lighter airdrop serves as a vivid illustration of the complex dynamics at play in the rapidly evolving crypto landscape. While securing a spot as the 10th largest airdrop in history is an undeniable achievement, it also brings heightened scrutiny. The decentralized exchange’s journey will now depend heavily on its ability to navigate the community’s concerns regarding its tokenomics, convert initial interest into sustained platform engagement, and solidify its position amidst fierce competition in the perpetual futures market. The coming months will be crucial for Lighter to prove its long-term viability, moving beyond the initial success of its historic token distribution to build a truly resilient and decentralized ecosystem.