In a stunning display of geopolitical irony, America’s ambitious strategy to hobble China’s access to cutting-edge artificial intelligence chips, championed vigorously by the Trump administration, has not only failed to stifle the People’s Republic but has inadvertently accelerated its ascent as a self-reliant tech powerhouse, increasingly luring global investors away from Silicon Valley’s perceived bubble. This pivot marks a profound realignment in the global technology landscape, signaling a potential shift in the epicenters of AI innovation and investment.

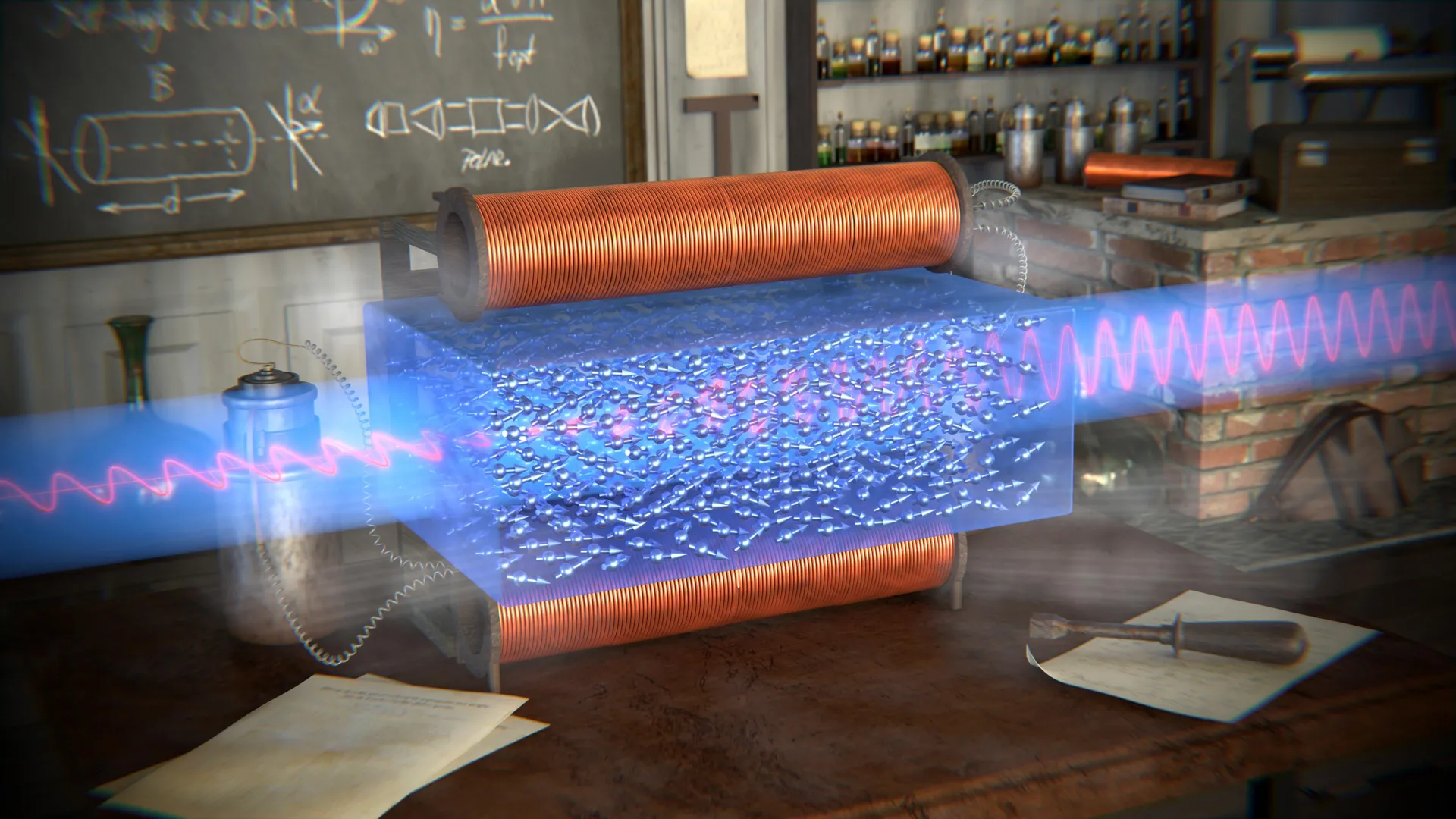

The initial rationale behind the U.S. embargo, which intensified significantly during the second Trump administration, was rooted in a dual objective: to safeguard national security by preventing China from leveraging advanced AI for military applications and to maintain American technological supremacy. The restrictions targeted high-performance graphics processing units (GPUs) from companies like Nvidia, crucial for training sophisticated large language models (LLMs) and other AI systems. These chips, particularly models like the H100 and A100, and their "nerfed" derivatives designed specifically for the Chinese market, such as the H800, A800, and later the H20, were deemed critical chokepoints. By denying China access to these essential components, Washington hoped to slow its AI progress, compelling it to remain dependent on Western technology or fall further behind.

However, as reported by Reuters in late 2025, the reality has diverged sharply from these expectations. Global investors, increasingly wary of the burgeoning AI bubble on Wall Street—a speculative frenzy reminiscent of the dot-com era where valuations often soar far beyond tangible earnings—are now channeling significant capital into Chinese tech companies. This shift is not merely a pragmatic hedging strategy; it reflects a growing conviction that China’s tech sector offers more stable growth and substantial long-term returns, bolstered by robust government backing and a clear trajectory towards self-sufficiency.

While Chinese tech firms’ LLMs might still lag modestly behind their U.S. counterparts in raw computational power or certain benchmarks, investors are not viewing them as a mere second-best option. Instead, the narrative has shifted dramatically. Beijing’s relentless drive for technological independence, framed as a national imperative, has created an environment ripe for domestic innovation and investment. This strategic resolve, combined with a colossal domestic market and rapid AI monetization opportunities, is proving to be an irresistible draw.

A comprehensive report from UBS Global Wealth Management, released earlier in December 2025, underscored this sentiment, rating Chinese tech as "most attractive" to investors—the highest possible rating in its global asset class assessments. The report highlighted several compelling factors: "strong policy backing, technological self-reliance, and rapid AI-monetization." The UBS researchers explicitly noted that "China’s tech sector ramped up innovation in 2025, with notable advances across the AI value chain," adding that "New Chinese AI models have shown tech leadership, and supportive policy is reinforcing ecosystem resilience." This endorsement from a major global financial institution signals a fundamental re-evaluation of China’s technological trajectory and investment potential.

Institutional investment firms are acting on these insights. Ruffer, a prominent UK-based asset manager, for instance, has been actively increasing its stakes in Chinese tech giants like Alibaba, while simultaneously adopting a strategy of "deliberately limited exposure" to the top U.S. tech firms. This tactical reallocation of capital speaks volumes about the shifting perceptions of risk and opportunity in the global tech market. Gemma Cairns-Smith, an investment specialist at Ruffer, articulated this evolving competitive landscape to Reuters, stating, "While the US remains the leader in frontier AI, China is rapidly narrowing the gap… The moat may not be as wide, or as deep, as many think… The competitive landscape is shifting." Her comments encapsulate the growing realization that America’s technological lead, once considered unassailable, is now being actively contested and eroded.

The roots of this dramatic shift can be traced back years, through successive administrations. Both President Joe Biden and President Donald Trump implemented escalating anti-China trade policies, with chip export controls forming a central pillar. The intention was clear: to deny Chinese companies access to the most advanced semiconductors, particularly those from Nvidia, which held a near-monopoly on high-end AI accelerators. Nvidia, caught between two superpowers, had previously "nerfed" its chips—creating less powerful, export-compliant versions like the H20—in a bid to continue serving the massive Chinese market while appeasing U.S. lawmakers.

However, in April 2025, the Trump administration ratcheted up the pressure further, imposing new, even tighter trade restrictions that included a ban on the sale of certain Nvidia AI chips, including the H20, to the People’s Republic. This move, intended to deliver a decisive blow, instead catalyzed China’s retaliatory measures and accelerated its domestic innovation drive. Beijing swiftly responded by banning its top tech companies from importing Nvidia chips altogether, delivering a huge, albeit perhaps unintended, boost to indigenous Chinese chipmakers. Companies like Huawei, SMIC, Biren Technology, and Moore Threads, already heavily invested in R&D, found themselves with an unprecedented opportunity to fill the void, backed by immense state funding and a captive domestic market. The "Made in China 2025" initiative, and its successor strategies, had long prioritized semiconductor self-sufficiency, and the U.S. embargo inadvertently provided the ultimate catalyst and justification for doubling down on these efforts.

The impact on China’s domestic semiconductor industry was profound. Billions of dollars were poured into R&D, manufacturing facilities, and talent acquisition. Chinese firms, while still facing challenges in replicating the absolute cutting-edge lithography of TSMC or ASML, made significant strides in design, packaging, and even certain manufacturing processes. The emphasis shifted from merely acquiring foreign chips to designing and producing competitive alternatives, fostering an entire ecosystem of hardware and software developers optimized for these domestic platforms. This concerted effort has not only reduced China’s reliance on foreign technology but has also cultivated a robust, integrated supply chain within its borders, making it less vulnerable to external pressures.

Recognizing the detrimental impact of these escalating restrictions on American companies, particularly Nvidia, which was losing access to its largest and fastest-growing market, Trump made a quiet reversal in early December 2025, lifting the ban on H20 chips. This eleventh-hour policy shift, however, appears to be a desperate gambit, likely "too little and too late" to reverse the entrenched trends. The damage to trust and market dynamics had already been done. Chinese tech giants had spent months, if not years, re-engineering their systems, forging partnerships with domestic chipmakers, and optimizing their software stacks for local hardware. The momentum towards self-reliance was already unstoppable. Investors, observing this trajectory, had already begun their pivot.

The implications of this development are far-reaching. For the U.S., it raises critical questions about the effectiveness of export controls as a long-term strategy for maintaining technological leadership. While such measures can inflict short-term pain, they risk inadvertently fostering greater self-reliance and competition in target nations, ultimately undermining the very dominance they sought to protect. For American tech companies, losing access to the Chinese market means foregoing immense revenues and potentially falling behind in innovation cycles as China’s market-driven advancements accelerate.

For China, this represents a significant vindication of its strategic long-term planning and a powerful demonstration of its resilience. The forced decoupling has, in essence, accelerated its journey towards technological sovereignty, positioning it not just as a consumer but as a formidable producer and innovator in the global AI landscape. The shift in investor sentiment further legitimizes China’s approach, signaling that the world’s financial markets are adapting to a new, more bifurcated technological order.

The competitive landscape for AI is undeniably shifting. While Silicon Valley continues to push the boundaries of foundational AI research, China is rapidly closing the gap, particularly in the critical areas of application, commercialization, and ecosystem development. The U.S. may retain a lead in "frontier AI," but China’s "strong policy backing, technological self-reliance, and rapid AI-monetization" are creating a powerful alternative that anxious global investors, fearing a U.S. AI bubble burst, are increasingly finding more attractive. The prophetic words of Nvidia CEO Jensen Huang, that "China is going to win" the AI race, now resonate with a newfound, unsettling prescience. Trump’s chip embargo, intended to curb China’s rise, has instead provided the very impetus for its spectacular ascent, fundamentally reshaping the future of global technology.