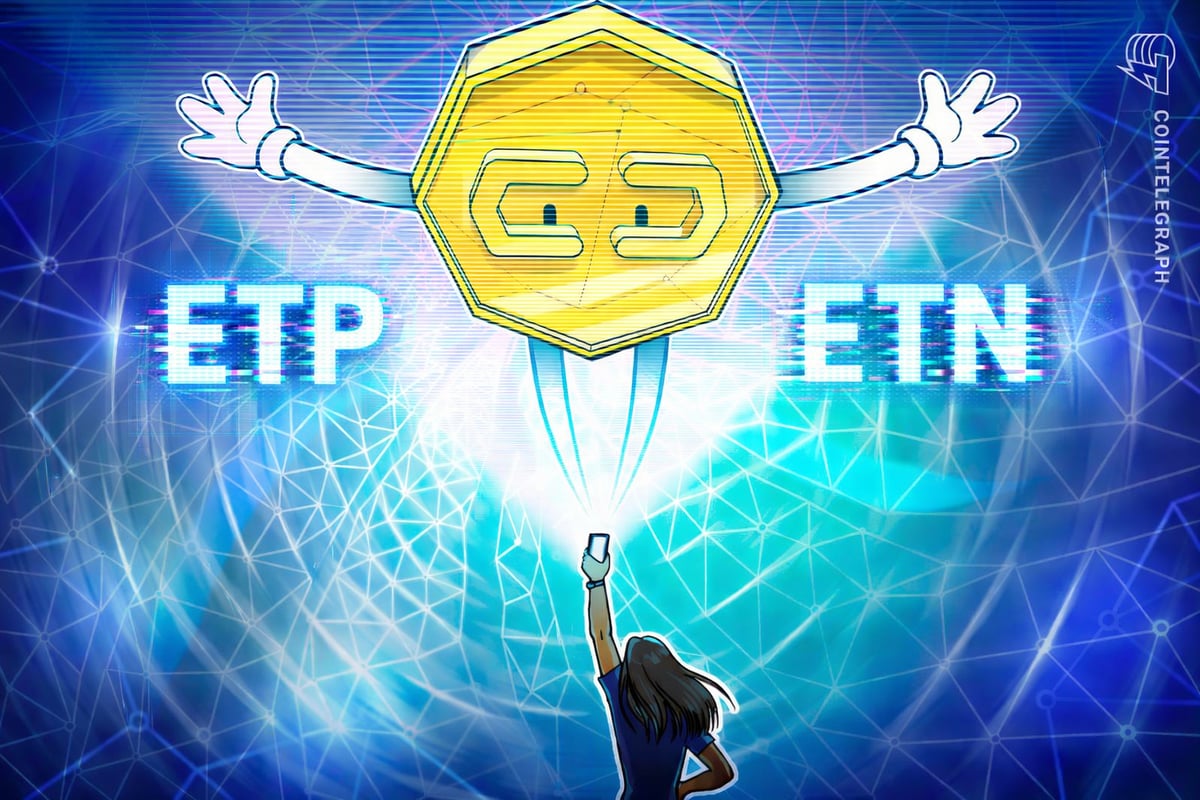

The German banking giant announced on Monday its rollout of crypto exchange-traded products (ETPs) from Bitwise and crypto exchange-traded notes (ETNs) from VanEck. These additions are not ING Germany’s first foray into the digital asset investment space; they join an existing lineup of listed investment vehicles from other key players like 21Shares, WisdomTree, and BlackRock’s iShares. This continuous expansion underscores ING’s commitment to meeting the evolving demands of its client base, which increasingly seeks avenues for digital asset exposure within a familiar and regulated banking environment.

The timing of these launches is particularly noteworthy, coming amidst what has been described as a challenging period for the crypto market. Bitcoin (BTC), the flagship cryptocurrency, has seen its value decline by 10% year-to-date, reflecting a broader market turbulence that has affected numerous digital assets. Despite this volatility, the consistent adoption by major traditional financial institutions like ING Group highlights a strong underlying belief in the long-term potential and structural integration of digital assets into the global financial landscape, irrespective of short-term price fluctuations. This demonstrates a strategic, rather than speculative, approach by ING Germany to cater to a growing segment of investors interested in the crypto space.

New Offerings Cover Bitcoin, Ether, Solana, XRP, and More

The new range of products offers comprehensive exposure to a variety of cryptocurrencies, from established giants to promising altcoins, catering to diverse investment strategies and risk appetites.

Starting in February, ING Germany clients will have the opportunity to trade Bitwise crypto ETPs under attractive conditions. For order sizes of at least 1,000 euros (approximately $1,180), clients can execute trades without any execution fees. Smaller orders, however, will be subject to a modest 3.90 euro ($4.60) commission. This tiered fee structure is designed to encourage larger, perhaps more strategic, investments while still providing accessibility for those looking to start with smaller amounts. Bitwise further highlighted the flexibility of their offerings, noting that "the products can also be used for savings plans without execution fees." This feature is particularly significant, as it enables long-term, systematic investing in crypto assets, aligning with traditional wealth-building strategies that ING Germany clients are accustomed to. The partnership, as stated by Bitwise, solidifies both companies’ long-term commitment to the digital assets sector, signaling a sustained presence and development in this domain.

While the promotional terms extend across the entire Bitwise product range available on Deutsche Börse Group’s Xetra platform – one of Europe’s leading trading venues – the current focus is squarely on three pivotal products. These include the Bitwise Core Bitcoin ETP (BTC1), which offers direct exposure to Bitcoin’s price movements; the Bitwise MSCI Digital Assets Select 20 ETP (DA20), providing diversified exposure to a basket of leading digital assets as identified by the MSCI index; and the Bitwise Physical Ethereum ETP (ZETH), which tracks the performance of Ether. These products cater to investors seeking both broad market exposure and specific, direct bets on the largest cryptocurrencies. The inclusion of a diversified basket ETP like DA20 is particularly appealing for retail investors who may lack the expertise or time to research individual altcoins but still wish to participate in the broader digital asset market’s growth.

VanEck’s contribution to ING Germany’s expanded crypto offerings comes in the form of crypto ETNs, which are listed on the bank’s platform. This suite of offerings is remarkably extensive, encompassing ten distinct securities. These include individual ETNs linked to Bitcoin, Ether (ETH), Algorand (ALGO), Avalanche (AVAX), Chainlink (LINK), Polkadot (DOT), Polygon (POL), and Solana (SOL). Furthermore, VanEck is providing two basket ETNs, which offer diversified exposure to multiple digital assets within a single product. This broad selection from VanEck is crucial as it allows ING Germany clients to access a wider array of altcoins beyond the typical Bitcoin and Ethereum offerings, enabling more granular portfolio construction and exposure to different segments of the crypto ecosystem. VanEck, a well-established name in the ETF and ETN space, brings its extensive experience in structuring financial products to the digital asset arena, enhancing the credibility and reliability of these new offerings.

Understanding ETPs vs. ETNs: Key Distinctions for Investors

To fully appreciate the scope of these new offerings, it’s essential to understand the structural differences between ETPs and ETNs. ETPs, or exchange-traded products, serve as an umbrella category for securities that track the performance of an underlying asset, index, or basket of assets. This broad definition includes popular investment vehicles like exchange-traded funds (ETFs) and, indeed, ETNs. The key characteristic of many ETPs, particularly those like the Bitwise offerings, is that they often hold the physical underlying assets. This means that a Bitcoin ETP, for example, typically holds actual Bitcoin, offering investors indirect exposure without the complexities of direct ownership, storage, or security.

ETNs, on the other hand, are a specific type of ETP structured as unsecured debt securities. Unlike physically-backed ETPs, ETNs do not hold the underlying assets directly. Instead, they are promises from the issuer (in this case, VanEck) to pay a return linked to the performance of an underlying index or asset. This means investors in ETNs are exposed to the credit risk of the issuer, as the product’s value is tied to the issuer’s ability to fulfill its debt obligations. While ETNs offer a convenient way to gain exposure to often hard-to-access markets, investors should be mindful of this issuer credit risk, a factor that differentiates them from physically-backed ETPs or ETFs. Despite this, ETNs remain a popular choice due to their often lower tracking error and tax efficiency in some jurisdictions.

Market Context and Future Outlook

The global crypto ETP market has experienced a turbulent start to 2026, echoing the broader market sentiment. Recent data from CoinShares reveals that global crypto ETPs collectively lost $3.43 billion over a two-week period, contributing to $1 billion in outflows year-to-date. This downturn reflects significant profit-taking and a general cooling of investor enthusiasm following a period of strong gains. However, there are signs of resilience and renewed interest. Following the recent sell-off, Bitcoin ETFs saw a notable rebound on Monday, attracting $562 million in inflows, according to SoSoValue. This immediate recovery suggests that investor sentiment can shift rapidly, and there remains a strong appetite for regulated crypto investment products, especially after market corrections.

For retail investors, the availability of these products through ING Germany offers several compelling advantages. First and foremost is the ease of access. Investing through a familiar banking platform removes many of the hurdles associated with direct crypto purchases, such as setting up accounts on specialized exchanges, managing wallets, and understanding complex security protocols. Secondly, the regulatory comfort provided by investing through a trusted bank like ING Germany cannot be overstated. For many traditional investors, the regulatory oversight and established infrastructure of a bank offer a significant layer of security and legitimacy that may be perceived as lacking in the broader, less regulated crypto market. This comfort factor is crucial for attracting new capital from mainstream investors.

Furthermore, these offerings provide unparalleled diversification opportunities within the crypto space. Clients can now effortlessly gain exposure to a broad spectrum of digital assets, from market leaders to promising altcoins, all within their existing banking and brokerage accounts. The option for savings plans with zero execution fees for Bitwise products further encourages a long-term, disciplined approach to crypto investing, mirroring how many individuals build wealth in traditional asset classes.

From a strategic perspective, ING Germany’s move is more than just an expansion of product offerings; it’s a statement about the future direction of retail banking. By integrating digital assets into its core services, ING is positioning itself at the forefront of financial innovation, catering to a digitally native generation of investors while also onboarding more traditional clients into the crypto ecosystem. This initiative also highlights the increasingly sophisticated regulatory environment in Germany, which, under the guidance of BaFin (the Federal Financial Supervisory Authority), has been progressive in establishing frameworks for crypto securities, thereby facilitating such mainstream adoption.

In conclusion, ING Germany’s launch of crypto ETPs and ETNs in partnership with Bitwise and VanEck represents a pivotal moment for retail investors in Europe and the broader digital asset market. It democratizes access to a wide range of cryptocurrencies through a trusted, regulated, and user-friendly platform. Despite prevailing market turbulence, this strategic expansion by a major traditional bank underscores the enduring institutional belief in the long-term value and transformative potential of digital assets. As more such partnerships emerge and regulatory clarity improves, the line between traditional finance and the crypto economy will continue to blur, ushering in a new era of integrated financial services. This development not only benefits ING Germany’s clients but also sets a precedent for other financial institutions to follow, accelerating the mainstream adoption and maturation of the global digital asset landscape.