The Secure Asset Fund for Users, colloquially known as SAFU, was first established by Binance in 2018, during a nascent yet rapidly evolving period for the cryptocurrency industry. Its inception was a direct response to the inherent risks associated with digital asset exchanges, including potential hacks, technical failures, or other extreme events that could lead to user losses. From its very beginning, SAFU was conceived as an emergency insurance fund, a safety net designed to provide peace of mind to Binance users globally. It is continuously bolstered by a percentage of the trading fees collected on the platform, ensuring its ongoing growth and readiness to address potential future contingencies. This proactive approach to user protection has been a cornerstone of Binance’s operational philosophy, aiming to foster trust and stability within its ecosystem amidst the often turbulent and unpredictable crypto landscape.

Prior to this landmark Bitcoin conversion, the SAFU fund primarily comprised a diversified portfolio of stablecoins and other digital assets. Notably, in early 2024, Binance undertook a significant adjustment within its stablecoin holdings, transitioning a substantial portion of SAFU from its proprietary stablecoin, BUSD, into USD Coin (USDC). This earlier move was explicitly framed as an effort to enhance the fund’s liquidity, reliability, and its direct peg to the U.S. dollar, thereby ensuring that the emergency reserves maintained a stable and readily accessible value. The rationale at the time revolved around minimizing volatility within the protective fund itself, ensuring that the nominal value of the safety net remained consistent, irrespective of broader market fluctuations. The decision to now shift a significant portion of this fund entirely out of stablecoins and into Bitcoin represents a fundamental re-evaluation of what constitutes a "secure asset" for long-term user protection in the eyes of the world’s largest cryptocurrency exchange.

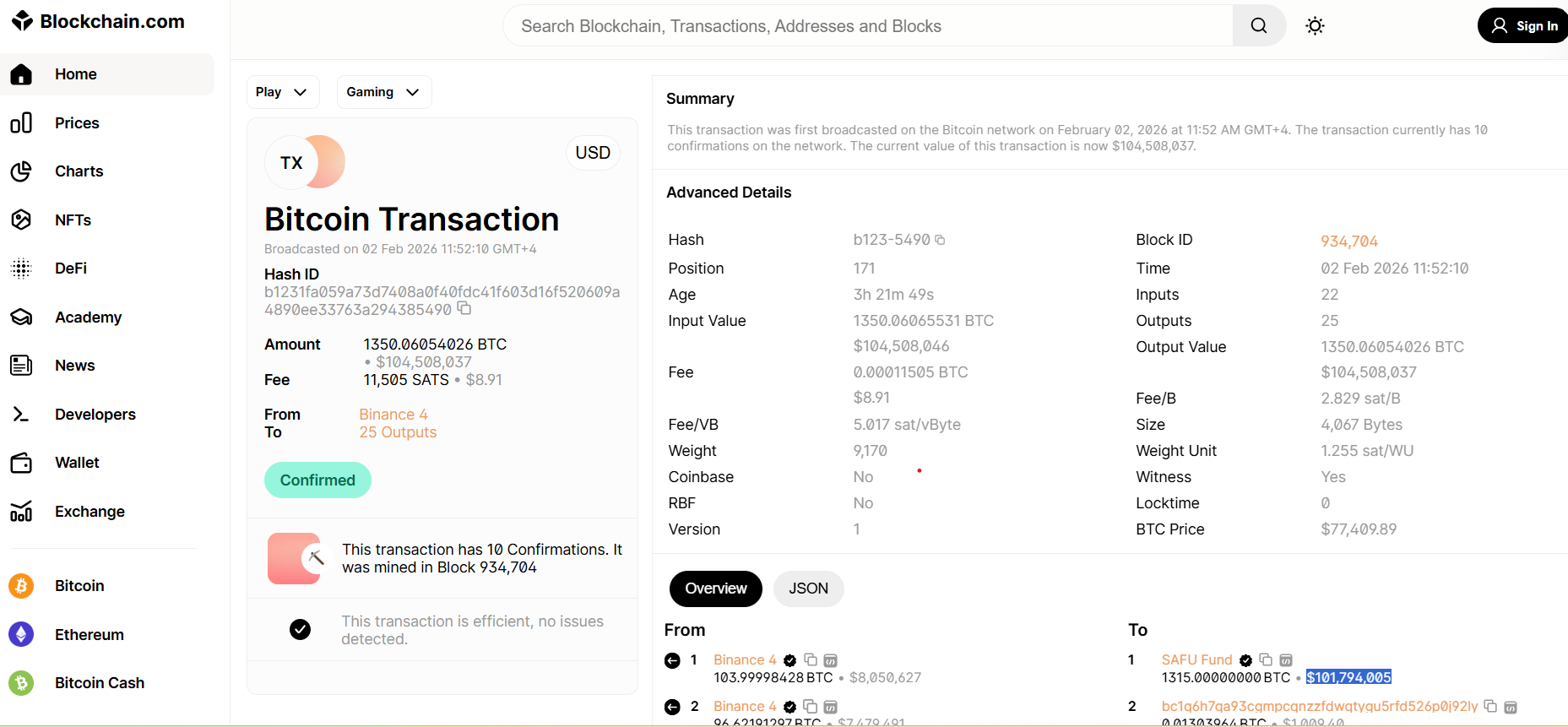

Binance’s spokesperson confirmed to Cointelegraph that despite the asset class conversion, the fundamental purpose of the SAFU fund remains unchanged: to serve as an indispensable backstop for users in the event of extreme incidents or unexpected losses. However, the choice of Bitcoin for this new allocation speaks volumes about Binance’s evolving perspective on the future of finance and the role of digital assets. By replacing stablecoins with Bitcoin, Binance is effectively endorsing BTC as the ultimate long-term store of value within the digital economy, a conviction that aligns with a growing number of institutional investors and corporate treasuries. This move transforms SAFU from a fund primarily designed for stability into one that also carries significant growth potential, albeit with increased exposure to market volatility. The remaining $900 million of the $1 billion fund is earmarked for similar BTC allocations, with Binance expecting to complete the full conversion within the next 27 days, indicating a rapid and decisive implementation of this new strategy.

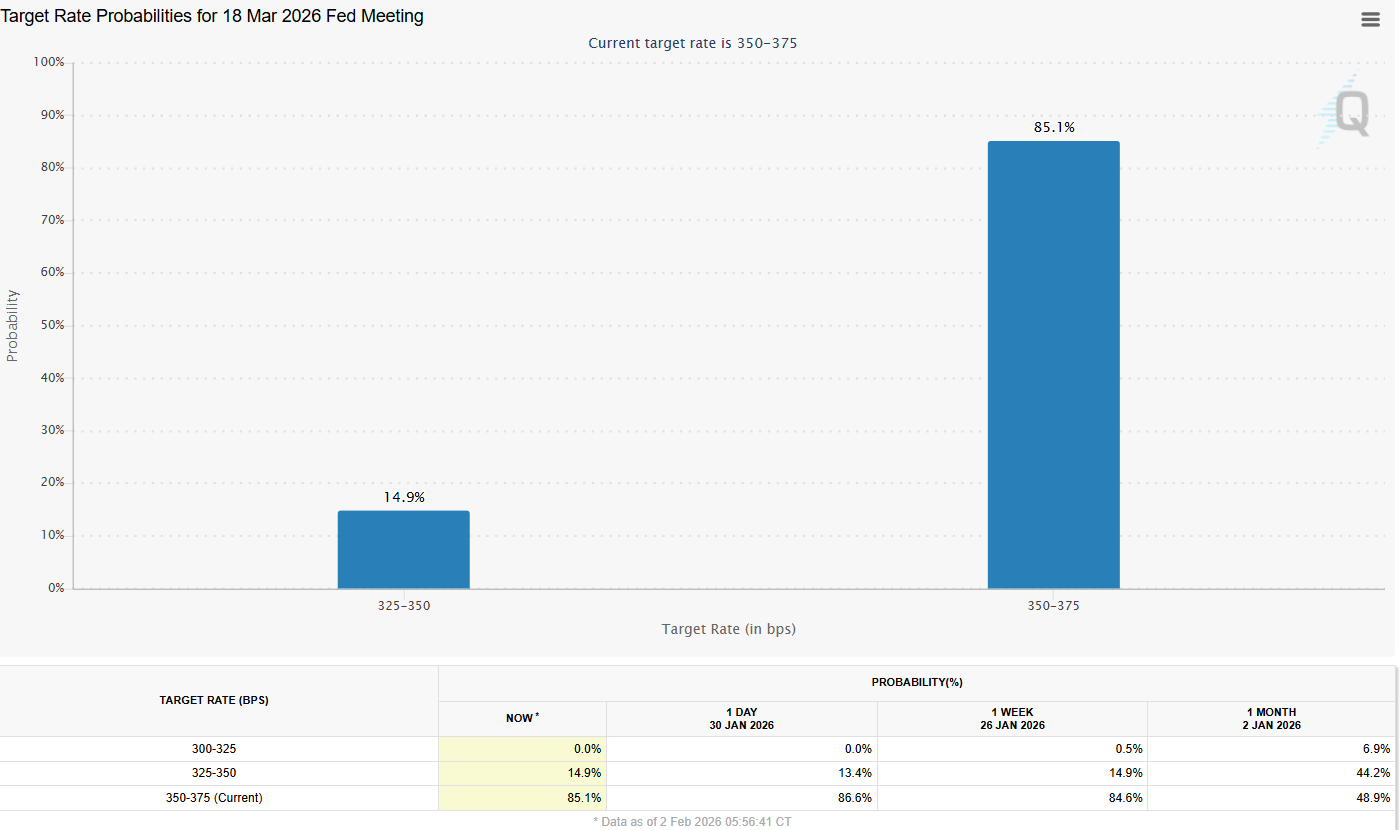

The timing of this announcement is particularly noteworthy, coming amidst a period of considerable market turbulence. The broader cryptocurrency market has recently experienced a sharp sell-off, which saw the price of Bitcoin briefly dip below the $75,000 mark. In this context, Binance’s substantial purchase can be interpreted as a strong "buy the dip" signal, demonstrating confidence in Bitcoin’s resilience and long-term appreciation potential even during periods of downturn. This strategy mirrors the approach often championed by prominent Bitcoin maximalists and institutional investors, such as Michael Saylor’s MicroStrategy, which has consistently used market corrections as opportunities to accumulate more BTC, cementing its position as a corporate Bitcoin treasury pioneer. MicroStrategy’s recent hints about adding more Bitcoin after the weekend crash further underscore the sentiment that market dips present opportune moments for strategic accumulation by those with a long-term bullish outlook.

The implications of Binance’s decision extend beyond its immediate impact on the SAFU fund. This move could potentially set a new precedent for other major cryptocurrency exchanges and digital asset platforms globally. If the industry’s largest player is confident enough to back its user protection fund with a volatile asset like Bitcoin, it might encourage others to reconsider their own reserve strategies. This shift reinforces Bitcoin’s narrative as "digital gold" and a premier hedge against inflation and economic instability, further cementing its status as a mature, investable asset class. It also signals a deeper institutional acceptance and integration of Bitcoin into core financial strategies, moving beyond speculative trading to fundamental asset allocation.

However, the decision to hold Bitcoin in a user protection fund also introduces new considerations. While stablecoins offer price stability, BTC’s value fluctuates significantly. This means the nominal value of the SAFU fund, when measured in fiat currency, will now be subject to Bitcoin’s price movements. In a severe bear market, the dollar value of the fund could temporarily decrease, raising questions about the immediate liquidity and sufficiency of the "backstop" during an extreme incident. Conversely, in a bull market, the fund’s value could appreciate considerably, providing an even larger safety net. Binance’s strategic choice suggests a strong belief that Bitcoin’s long-term appreciation will outweigh its short-term volatility, making it a superior asset for safeguarding user interests over extended periods. It implies a long-term vision where the growth of the underlying asset enhances the protection offered, rather than merely preserving its initial fiat value. This approach might necessitate a robust risk management framework, potentially including rebalancing strategies or a diversified portfolio where BTC is a significant, but not exclusive, component.

Furthermore, this conversion highlights the increasing sophistication of asset management within the crypto space. Exchanges are evolving beyond mere trading platforms to become custodians of significant wealth, requiring treasury management strategies that rival traditional financial institutions. Binance’s transparent announcement and the ability to track the transaction on the blockchain underscore a commitment to accountability, allowing the community to monitor the fund’s composition and value. Such transparency is vital for maintaining user trust, especially in an industry that has faced its share of scrutiny regarding asset custody and financial integrity.

In conclusion, Binance’s decision to convert its $1 billion SAFU fund into Bitcoin, starting with a $101 million initial buy, represents a pivotal moment for the exchange and the broader cryptocurrency ecosystem. It is a bold declaration of confidence in Bitcoin’s enduring value and its role as a foundational asset for the future. By moving away from stablecoins, Binance is not just changing the composition of its emergency fund; it is making a profound statement about its long-term vision for user protection and asset management in the digital age. This move will undoubtedly spark discussions across the industry, potentially inspiring other entities to re-evaluate their own treasury and reserve strategies, further accelerating Bitcoin’s integration into the mainstream financial landscape and solidifying its position as the ultimate digital store of value. The coming weeks, as the full conversion unfolds, will be closely watched by market participants, as this strategic shift by the world’s largest exchange could have far-reaching implications for market dynamics and institutional adoption alike.