The digital asset’s price action has cast a long shadow of bearish sentiment, culminating in a dismal close for both weekly and monthly candles. Monday’s trading session saw BTC/USD further exacerbate its decline, breaching its April 2025 low to reach its lowest levels since November 2024, according to data from TradingView. This continuous erosion of value has fueled deep concerns regarding Bitcoin’s resilience and prompted many to declare that the worst is far from over.

Prominent trader Roman, in his latest analysis on X, articulated this grim forecast, stating, "$76k is the last support before 50k area." He emphasized the substantial volume accompanying the recent price drop, interpreting it as further confirmation of entrenched bearish price action. Roman explicitly declared, "Again, we are in the bear phase of the market and I’m anticipating 50k and potentially lower." This perspective underscores a widely held belief that the market is currently undergoing a structural downtrend, where previous support levels are unlikely to hold, paving the way for significantly lower valuations.

Indeed, the prospect of Bitcoin plunging below the $50,000 mark is not a new one, with Cointelegraph having previously reported on various downside BTC price targets extending into this critical psychological and technical zone. Echoing the broader market sentiment, crypto trader, analyst, and entrepreneur Michaël van de Poppe advised his X followers to monitor precious metals for signs of a bottom before anticipating an end to the crypto "bloodbath." He highlighted a "massive bloodbath" in silver, which had plummeted over 40% in two days, noting that "when commodities fall, crypto follows," suggesting a deep correlation between traditional and digital asset markets during periods of extreme volatility.

Adding to the cautious stance, trader CrypNuevo indicated that even a temporary relief bounce might not be imminent. He updated his followers on his targets for the week, suggesting that any significant BTC price reversal would likely only materialize after a retest of the area near the old all-time highs from the 2021 bull market. "Now, we’re very close to this level and I’ll pay attention to it," he confirmed, implying that a re-evaluation of these historical peaks is necessary before any sustained recovery can begin.

In a contrasting but equally significant observation, some analysts focused on "gaps" in the CME Group’s Bitcoin futures market, specifically at $84,000 and $95,000. These gaps, representing price discrepancies between the closing of one trading session and the opening of the next, often act as magnets for future price action. Andre Dragosch, European head of research at crypto asset manager Bitwise, commented that a "Large CME gap implies that this latest move was rather a ‘fake out’ to the downside," suggesting that the recent sharp drop might be a deceptive maneuver before a reversal upward to fill these higher gaps. This perspective offers a glimmer of hope amidst the dominant bearish narrative, hinting at potential upside corrections, albeit within a broader downtrend.

Shifting to technical indicators for signs of a macro bottom, market participants are closely monitoring Bitcoin’s Relative Strength Index (RSI) on weekly time frames. The RSI, a popular momentum oscillator that gauges whether an asset is "overbought" or "oversold," is currently approaching a critical level. With a weekly RSI reading of 32.2, Bitcoin is only two points above the "oversold" territory (typically below 30). Trader Mags noted the historical significance of this, pointing out that similar levels were last observed at the conclusion of the 2022 bear market, suggesting that while painful, the current downturn is pushing Bitcoin into historically undervalued regions that have previously preceded reversals. On lower time frames, the analytics account Frank Fetter further highlighted that at $76k, the BTC 1-day RSI was the most oversold it had been since the $26k level, reinforcing the extreme short-term capitulation.

However, a more cautious long-term outlook comes from trader and analyst Titan of Crypto, who examined the stochastic RSI on the monthly chart. He argued that Bitcoin’s macro bottoming phase would require considerable time to unfold. "Historically, when the monthly stochastic RSI settles below 20, it tends to confirm the start of a bear market. Price usually needs time to build a proper bottom," he explained. Titan of Crypto further elaborated that "In past cycles, meaningful reversals only occurred after the stochastic RSI moved back above 20, signaling that the bottoming process had already played out. This is why I remain cautious with claims that ‘the bottom is already in.’ We may be witnessing confirmation, not completion." This analysis suggests that while oversold conditions are present, the market may endure an extended period of consolidation and lower prices before a sustainable recovery.

Beyond the immediate crypto sphere, significant macroeconomic headwinds are exerting considerable pressure. The US corporate earnings season is in "full swing" this week, with tech giants Amazon and Google due to report. This follows a challenging week that saw downside for Intel and Microsoft, despite both companies exceeding earnings expectations. This broader asset sell-off, described by trading resource The Kobeissi Letter as a period of "elevated" uncertainty, presents an additional layer of complexity for crypto investors.

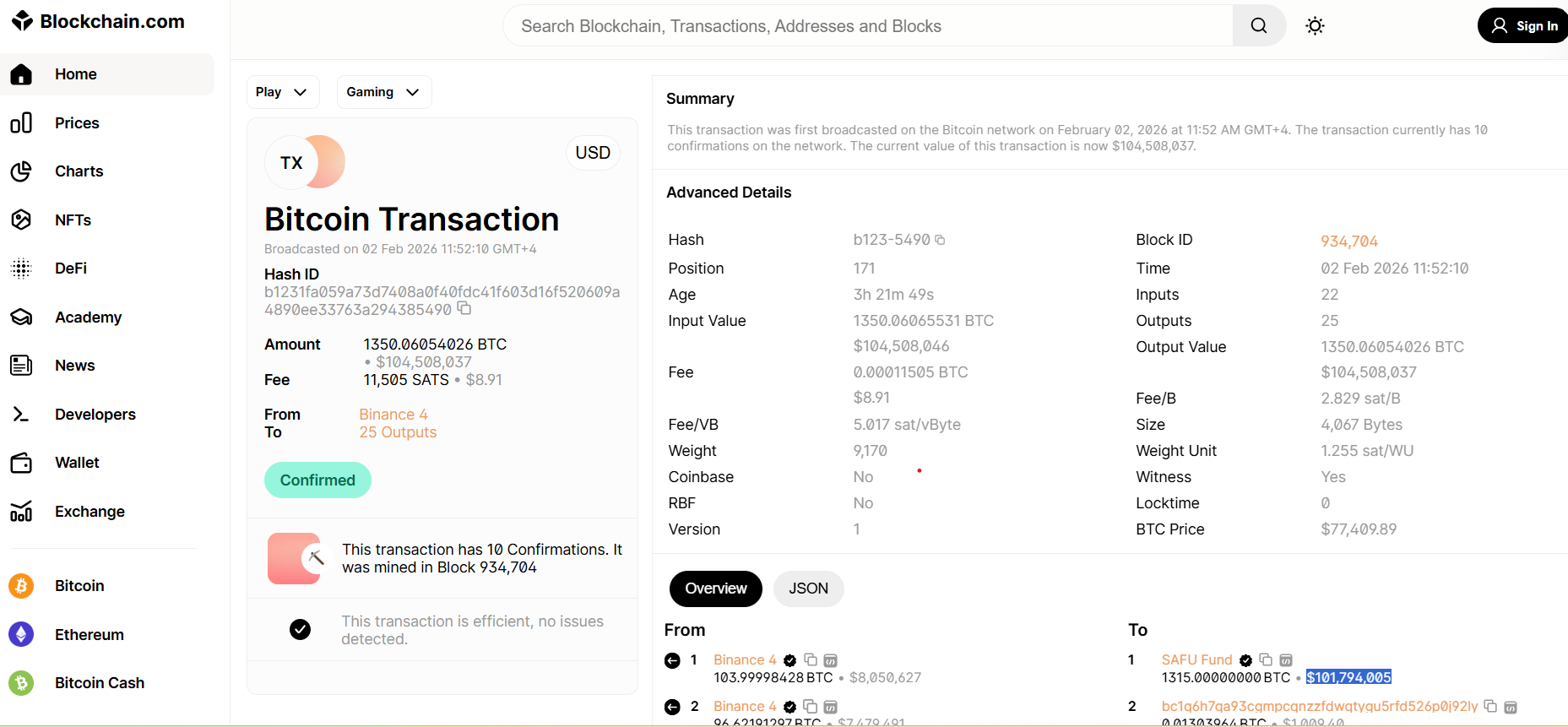

Analytics firm Mosaic Asset Company highlighted Bitcoin’s role as a potential leading indicator for impending financial market stress. In its newsletter, "The Market Mosaic," Mosaic stated, "At a time when fund manager sentiment is pushing near bullish extremes, Bitcoin could be sending a warning on the outlook for financial market liquidity." The firm pointed out that BTC/USD appears to be cementing a bearish head and shoulders reversal pattern, stressing that "The continued breakdown in Bitcoin could be sending a warning on financial market liquidity later in the year." This implies that Bitcoin’s current weakness might foreshadow broader liquidity issues across global financial markets. Concerns about US inflation rebounding later in 2026, exacerbated by the December Producer Price Index (PPI) print exceeding estimates, further contribute to this bearish macro outlook. The official statement from the Bureau of Labor Statistics (BLS) noted, "The index for final demand less foods, energy, and trade services moved up 0.4 percent in December, the eighth consecutive increase," indicating persistent inflationary pressures. This week, unemployment numbers and public speaking engagements by multiple Federal Reserve officials will be key data points influencing market sentiment. Jeff Mei, chief operations officer at the BTSE exchange, linked the current crypto downside directly to upheaval surrounding the new Fed Chair, Kevin Warsh, whose potentially hawkish stance is unsettling markets.

The turmoil extends beyond crypto, with record-breaking volatility observed in precious metals. Gold plummeted to $4,400 per ounce during Monday’s Asia trading session, marking its lowest levels in nearly a month. Over just three daily candles, XAU/USD shed more than 20% from its $5,600 all-time high, with gold and silver combined wiping out a staggering $4 trillion in market capitalization. Mosaic Asset Company directly attributed this market U-turn to the announcement of Warsh as Fed chair, noting markets’ extreme sensitivity to "bad" news after their prolonged record run. They summarized, "Concerns over a hawkish Fed chair who is less accommodative to the capital markets sparked a reversal higher in the U.S. dollar off a key level and contributed to a massive decline in precious metals." The report further detailed, "Following news of the Warsh nomination, gold prices fell nearly 10% while silver plunged by over 30%. Those were the worst single-day declines since the early 1980s." This widespread contagion across asset classes underscores the severity of the current market environment.

US stocks futures reinforced the gloomy outlook as the week commenced, while US dollar strength sought to cement a rebound from multiyear lows. The US dollar index (DXY) dropped to 95.50 on Jan. 30, a level not seen since 2022. Mosaic acknowledged that "While a declining dollar has been a big driver behind gain in precious metals, the failed breakdown last week was likely a key catalyst in the sharp pullback in gold and silver." Traditionally, a strong dollar implies weakness for risk-on assets like crypto, and a more hawkish Fed position could ensure a DXY recovery, further pressuring Bitcoin. Analyst and author Joey Keasberry expressed surprise at the dollar now possibly delivering a "significant bottom," cautioning X followers, "That could mean an old-fashioned risk-off environment is about to turn heads."

Adding to the bearish narrative from an on-chain perspective, Bitcoin’s recent price action, despite falling to its lowest levels in nearly a year, has failed to inspire renewed investor interest to "buy the dip." On-chain analytics platform CryptoQuant, in its latest research, described a "structural vacuum" in US spot demand. Examining the Coinbase Premium – the difference in price between Coinbase’s BTC/USD and Binance’s BTC/USDT pairs – CryptoQuant highlighted a significant deterioration compared to last year. Contributor TeddyVision wrote in a Quicktake blog post, "In Feb – Apr 2025, Coinbase Premium was negative, but it came in bursts. Discounts showed up, got worked off, and didn’t stick. That’s more consistent with tactical selling than a market with no bid." He contrasted this with the current situation: "Now it’s different. The negative prints are deeper and they stick. Premium stays below zero for long stretches, with only brief, shallow relief. That’s not just selling – it’s U.S. spot demand staying on the sidelines."

A persistent negative Coinbase Premium implies that Asian demand is currently outpacing that from the US, effectively making Wall Street trading hours a consistent source of downside BTC price pressure. The premium has remained negative since mid-December, with only two failed attempts to break back into positive territory. On Jan. 30, it plunged to -0.177, its lowest level in over a year. CryptoQuant concluded, "Short dips can happen for many reasons. But when the discount persists even after price has already adjusted, it usually means buyers aren’t stepping in." This data point starkly illustrates the profound lack of buying conviction from institutional and retail investors in the United States, a critical market for Bitcoin.

In summary, the confluence of deeply bearish technical signals, a challenging macroeconomic landscape marked by inflation concerns, a hawkish Federal Reserve, and a broad market sell-off across precious metals and equities, combined with a distinct lack of US spot demand indicated by the Coinbase Premium, paints a grim picture for Bitcoin in the immediate future. The collective analysis strongly suggests that Bitcoin is poised for further declines, likely diving below the $50,000 threshold, before the market can definitively establish a bottom and pave the way for a potential recovery. Investors are urged to conduct their own thorough research and exercise extreme caution in this highly volatile and uncertain environment.