Australia’s financial watchdog, the Australian Securities and Investments Commission (ASIC), has secured a landmark victory in its ongoing efforts to regulate the burgeoning digital assets sector, with the Federal Court ordering BPS Financial Pty Ltd (BPS) to pay a substantial 14 million Australian dollars (approximately $9.3 million USD) in penalties. This significant ruling addresses the company’s misleading promotion and unlicensed operation of its "Qoin Wallet" product and associated digital token. The decision underscores ASIC’s commitment to consumer protection and regulatory compliance within the complex and often opaque cryptocurrency landscape, sending a clear message to other participants in the Australian market.

The judgment is the culmination of years of diligent legal action initiated by ASIC, which first launched civil penalty proceedings against BPS Financial in 2022. The regulator accused BPS of operating an unlicensed financial services business while simultaneously disseminating a series of deceptive claims regarding its Qoin crypto-linked payment product. These accusations painted a picture of a company operating outside established regulatory frameworks, potentially exposing consumers to undue risk.

According to a Tuesday news release from ASIC, BPS heavily promoted the Qoin Wallet as a "non-cash payment facility" inextricably linked to its proprietary Qoin digital token. The allure of a digital currency backed by a payment system proved attractive to many, but the underlying operations were found to be fundamentally flawed and non-compliant. The Federal Court meticulously examined BPS’s activities, ultimately concluding that between January 2020 and mid-2023, the company engaged in the issuance of a financial product and provided financial advice without possessing the requisite Australian Financial Services Licence (AFSL). This omission constituted a direct breach of the Corporations Act, Australia’s primary piece of legislation governing companies and financial markets.

An AFSL is a critical regulatory instrument, signifying that a financial services provider meets stringent standards for competency, financial integrity, and consumer protection. It ensures that licensed entities adhere to ongoing obligations, including proper disclosure, complaints handling, and risk management. For a company like BPS, dealing with a crypto-linked payment product that involves investment-like characteristics, obtaining and maintaining an AFSL was not merely a bureaucratic hurdle but a fundamental requirement to legally offer its services to the Australian public. The court’s finding that BPS operated without this licence for over three years highlights a serious disregard for regulatory obligations, placing its customers in a vulnerable position.

ASIC Chair Joe Longo emphasized the broader implications of the ruling, stating, "Given the nature of these products, providers must have the appropriate licenses and authorisations, and investors must be able to make decisions based on clear and correct statements, especially as crypto products can be highly volatile, inherently risky and complex." Longo’s remarks underscore the inherent dangers associated with unregulated crypto offerings and reinforce ASIC’s mandate to ensure that consumers are protected from misleading information and unlicensed operators in a sector often characterized by rapid innovation and speculative investment. The BPS case serves as a stark reminder that innovation does not exempt entities from fundamental legal and ethical responsibilities.

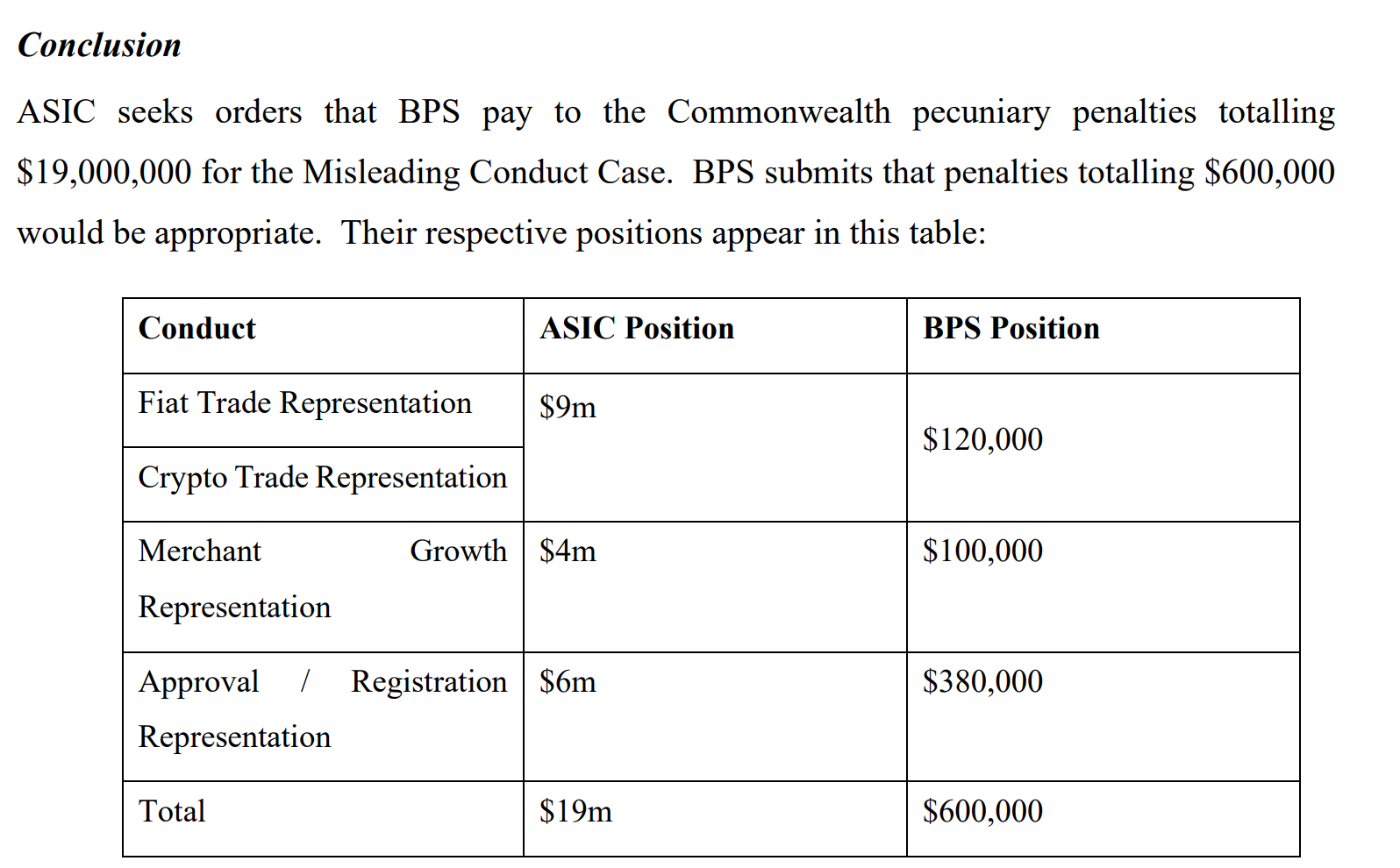

The penalties imposed on BPS Financial were multifaceted, reflecting the gravity of its misconduct. The court ordered $1.3 million specifically for the unlicensed conduct, acknowledging the fundamental breach of operating without an AFSL. A much larger sum of $8 million was levied for the misleading and deceptive representations made to the public. These representations formed the core of BPS’s marketing strategy, enticing users with promises that the court ultimately found to be false. The combined total penalty of AUD 14 million (USD 9.3 million) is one of the most significant fines ever imposed by an Australian court in a crypto-related enforcement action, signaling a decisive shift towards stricter oversight of the digital assets market.

In her scathing judgment, Judge Downes described BPS’s actions as "serious and unlawful misconduct." Her assessment delved into the operational failures within BPS, noting the direct involvement of senior management in the illicit activities and the profound inadequacy of the company’s compliance systems. This indicates that the breaches were not merely oversights but rather a systemic failure at the highest levels of the organization to adhere to legal and regulatory standards. The lack of robust internal controls and the active participation of leadership in promoting misleading claims painted a picture of a company that willfully circumvented its obligations.

Beyond the substantial financial penalty, the Federal Court imposed a series of far-reaching restrictions on BPS, designed to prevent future misconduct and ensure transparency. Crucially, the company has been explicitly barred from operating any financial services business without holding a valid license for the next 10 years. This long-term prohibition effectively freezes BPS out of the regulated financial services sector for a significant period, allowing ASIC to monitor its activities closely. Furthermore, BPS has been ordered to publish court-mandated publicity notices prominently on both the Qoin Wallet app and its website. These notices will serve as a public admission of the company’s wrongdoing and will inform users and the wider public about the court’s findings, thereby correcting past misinformation. Finally, BPS has been directed to cover the majority of ASIC’s legal costs, adding to the financial burden and underscoring the consequences of prolonged litigation and non-compliance.

The journey to this judgment has been protracted, highlighting the complexity of prosecuting cases involving novel digital assets. ASIC initially launched its civil penalty proceedings against BPS Financial in 2022, alleging misleading claims and unlicensed conduct linked to its Qoin token. The legal battle saw earlier judgments handed down in 2024, which found BPS to have engaged in misleading and deceptive conduct by making false statements about the Qoin Wallet. These judgments were subsequently upheld on appeal in 2025, demonstrating the robustness of ASIC’s case and the courts’ consistent interpretation of the Corporations Act in relation to digital asset offerings.

The specific misleading claims that BPS was found guilty of included:

- Official Approval or Registration: BPS falsely claimed that the Qoin product was officially approved or registered by regulatory bodies. Such claims can lend an undeserved air of legitimacy and security to a product, misleading investors into believing it has undergone rigorous vetting.

- Ready Exchange for Fiat Currency or Other Crypto-Assets: BPS asserted that Qoin tokens could be easily exchanged for traditional fiat currency or other established cryptocurrencies. In reality, the liquidity of Qoin was severely limited, making it difficult for users to convert their holdings, trapping their value within the Qoin ecosystem.

- Widespread Merchant Acceptance: The company promoted Qoin as being widely accepted by merchants, suggesting a broad utility and an active network. The court found this claim to be exaggerated, with actual merchant adoption significantly less than portrayed, diminishing the practical value of the token for consumers.

These false representations were central to BPS’s marketing efforts and contributed significantly to the harm experienced by consumers who invested in or used the Qoin product based on these assurances. The court’s findings on these specific claims provide critical clarity on what constitutes misleading conduct in the context of digital asset promotions.

This enforcement action also takes place against a backdrop of evolving regulatory approaches to digital assets in Australia. In December, ASIC notably finalized new exemptions aimed at simplifying the distribution of stablecoins and wrapped tokens. These measures removed the necessity for intermediaries to hold separate Australian Financial Services licenses for certain activities, allowing firms to utilize "omnibus accounts" with appropriate record-keeping. This initiative extended earlier relief and aimed to reduce compliance costs for businesses operating legitimately in the digital asset and payments sectors. The contrast between this proactive regulatory easing for compliant entities and the aggressive enforcement against BPS highlights ASIC’s dual strategy: fostering responsible innovation while cracking down on illicit operations.

ASIC Chair Joe Longo further articulated the regulator’s forward-looking perspective in a Tuesday report titled "Key issues outlook 2026." In this report, Longo flagged several critical risk areas for the year ahead, including retail exposure to opaque private credit, operational failures in superannuation, high-risk investment sales threatening retirement savings, AI-related consumer harm, and crucially, "regulatory gaps in digital assets and fintech." The BPS Financial case directly addresses these identified regulatory gaps, serving as a powerful precedent for how existing laws can be applied to new financial technologies, even as the regulatory framework continues to develop.

The Federal Court’s decision against BPS Financial is a pivotal moment for Australia’s digital assets landscape. It underscores the critical importance of licensing, transparency, and truthful representation in the promotion of crypto-linked products. For consumers, it reinforces the message that regulatory bodies are actively working to protect them from misleading claims and unlicensed operators. For businesses in the crypto space, it serves as a robust warning that the Australian Securities and Investments Commission will not hesitate to take strong enforcement action against those who fail to comply with the Corporations Act and other relevant financial services laws, regardless of the innovative nature of their offerings. The Qoin penalty is a testament to ASIC’s resolve to bring order and accountability to a sector that has long grappled with regulatory uncertainty.