Zocks’ rapid ascent in the highly regulated financial technology landscape is a testament to its compelling solution addressing critical pain points for financial professionals. At its core, Zocks has developed an advanced AI assistant that revolutionizes how financial advisers interact with client data, manage their workflows, and identify growth opportunities. The platform leverages artificial intelligence to meticulously glean and organize information from client discussions, transforming raw conversational data into actionable insights and automating a multitude of traditionally manual tasks. This capability is particularly vital in an industry often characterized by heavy administrative burdens and a persistent shortage of skilled personnel.

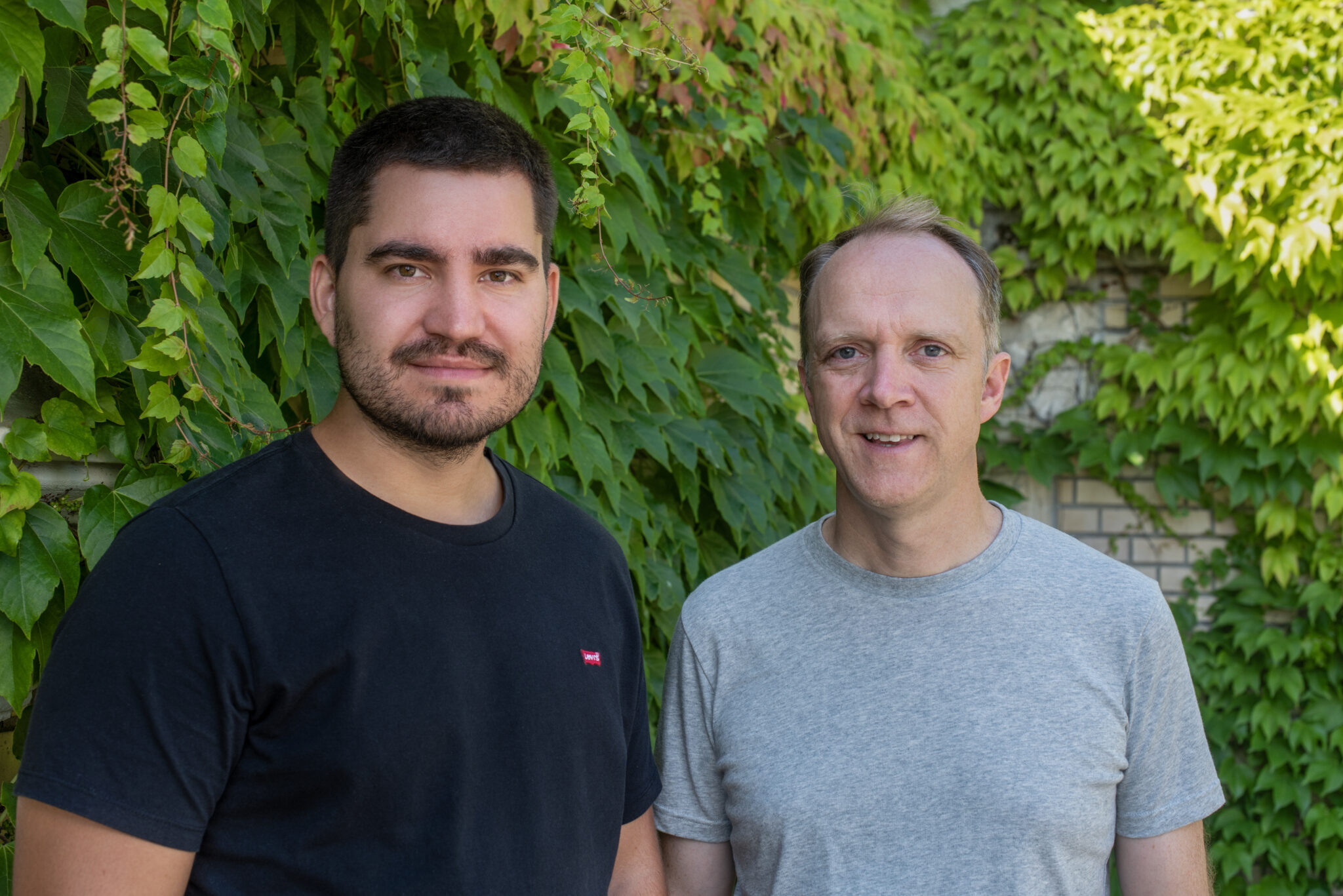

The genesis of Zocks stems from the extensive professional backgrounds of its co-founders, CEO Mark Gilbert and Akos Ratku. Mark Gilbert, prior to co-founding Zocks, amassed over a decade of experience at Microsoft, a titan in enterprise software, followed by more than three years as the vice president of product management at Twilio. During his tenure at Twilio, Gilbert oversaw compliance functions, a role that provided him with unique insights into the immense value locked within corporate communications. He recognized the untapped potential for companies to extract valuable information and insights from their interactions, particularly in highly regulated environments. This revelation sparked the idea that would eventually lead to Zocks. Upon leaving Twilio, Gilbert joined forces with Akos Ratku, and together they embarked on a mission to build a platform that could harness artificial intelligence to systematically organize meeting notes and extract meaningful intelligence from client discussions.

Gilbert emphasized the strategic decision to focus exclusively on financial services from the outset, driven by the stringent security and privacy requirements inherent to the sector. "We were focused on very high security privacy areas, and that’s why we started with, and are 100% focused on, financial services," Gilbert explained in an interview with Crunchbase News. He quickly realized the profound value embedded in the conversations financial advisers were having with their clients. These discussions, often rich with critical financial details, client aspirations, and specific needs, represented a treasure trove of information that was frequently underutilized due to manual processing limitations. Gilbert further highlighted the broader industry challenge: a significant shortage of financial advisers coupled with an overwhelming amount of manual work. Zocks aims to bridge this gap by seamlessly integrating communication analysis with advanced AI capabilities, thereby accelerating growth and enhancing efficiency for financial advisers and their firms.

The substantial Series B funding for Zocks is a clear indicator of the robust resurgence within the fintech sector. According to Crunchbase data, global funding to VC-backed financial technology startups reached $51.8 billion in 2025, marking a significant 27% increase from the $40.8 billion raised in 2024. This upward trend reflects renewed investor confidence and a keen interest in innovative solutions that promise to reshape the financial services landscape, with AI-driven platforms like Zocks at the forefront.

Zocks officially launched its offering in February 2024 and has since demonstrated remarkable traction. Today, its sophisticated software is actively utilized by an impressive 5,000 financial firms, including notable industry players such as Ameritas Life Insurance, Cambridge Investment Research, and Carson Group. The startup operates on a scalable SaaS (Software as a Service) model, typically charging per adviser. Its sales strategy encompasses both direct sales to individual advisers and enterprise contracts with larger firms. This dual approach has contributed to Zocks achieving an astounding 8x year-over-year revenue growth, as reported by Gilbert.

A key differentiator for Zocks lies in its "agentic AI" capabilities, which extend far beyond mere information extraction. Gilbert explained that Zocks’ agentic AI not only helps synthesize data from client conversations but also proactively assists advisers with critical follow-up tasks. This includes opening new accounts, meticulously filling out complex forms, and drafting tailored email replies—all while maintaining the stringent compliance and privacy standards mandated by financial services regulations. For instance, Zocks’ agent operates without creating default recordings of conversations. Instead, it "listens" to the discussions and constructs structured tables of information. This enables advisers to pose complex queries, such as: "Tell me all my clients who have children that are coming up on college age but have no 529 plan." The AI agent can swiftly generate such a personalized list. Similarly, an adviser can inquire: "Find me clients with old 401(k)s held outside our management." Zocks will then surface the relevant clients and, crucially, suggest personalized next steps for each, allowing the adviser to take action with a single click. This proactive, intelligent assistance empowers advisers to identify new opportunities and engage clients more effectively.

Gilbert firmly believes that Zocks’ proactive, agent-driven approach sets it apart from other offerings in the market. While many systems focus on "note-taking," which is undoubtedly helpful, Zocks aims for a higher level of utility. "The big difference for us is that we’re able to do that as well and take this information to help the advisers get more out of it. We’re trying to anticipate their needs," Gilbert articulated. The company’s overarching goal is to empower advisers to identify new financial planning opportunities across their entire client base and act with greater speed and precision. This is achieved by suggesting intelligent, data-driven next steps, drawing on the comprehensive data Zocks integrates from various systems.

Currently, Zocks primarily serves clients in the U.S. and Canada, but the company harbors ambitious plans for international expansion, with Europe slated as the next market. Gilbert reiterated the pressing market need: "There’s a shortage of financial advisers and that seems to be getting worse. I think that’s one of the reasons that we’ve seen such a fast uptake." This global shortage of financial professionals underscores the immense potential for AI-driven solutions to augment human capabilities and make financial advice more accessible and efficient.

The investor attraction to Zocks is equally compelling. Arif Janmohamed, a partner at Lightspeed, shared his firm’s initial draw to Zocks’ exceptional founding team. "Mark and Akos are naturally customer-centric and they deeply understand how to build enterprise-grade products that are delightful to use, while scalable, secure and extensible," Janmohamed conveyed via email. He lauded their product vision, which began with a "hero-product" but rapidly evolved into a platform capable of addressing the intricate requirements of mid to large enterprises while also scaling down to cater to smaller companies and individual users.

Laura Bock, a partner at QED Investors, echoed this sentiment, expressing her firm’s admiration for Zocks’ early success in penetrating the enterprise segment. She highlighted the depth of Zocks’ underlying technology and its seamless integration into existing financial workflows as key factors. "They’ve earned the trust of several of the largest RIAs in the country and expanded successfully into adjacent verticals like insurance," Bock noted, emphasizing that such achievements are "difficult to do without a product that truly works in regulated environments." This validation from leading venture capitalists like Lightspeed and QED underscores Zocks’ robust technology, strong market fit, and significant potential for continued disruption and growth in the financial advisory space.

As Zocks continues its trajectory of innovation and expansion, its commitment to providing personalized, proactive, and compliant AI solutions positions it as a vital partner for financial advisers navigating an increasingly complex and demanding industry. The infusion of $45 million in Series B funding will undoubtedly fuel its product development, market reach, and mission to empower financial professionals globally, transforming how financial advice is delivered and consumed.