In a defiant move against prevailing market sentiment, Cathie Wood’s ARK Invest has significantly bolstered its exposure to crypto-linked equities, strategically acquiring substantial shares in industry giants Coinbase, Circle, and Bullish. This bold "buy the dip" maneuver comes as prices slid across the digital asset sector, underscoring ARK’s unwavering conviction in the long-term potential of the cryptocurrency ecosystem despite short-term volatility. The purchases, executed on Friday, reflect ARK’s signature strategy of identifying and investing in disruptive innovation during periods of market weakness, positioning its funds to capitalize on anticipated future growth.

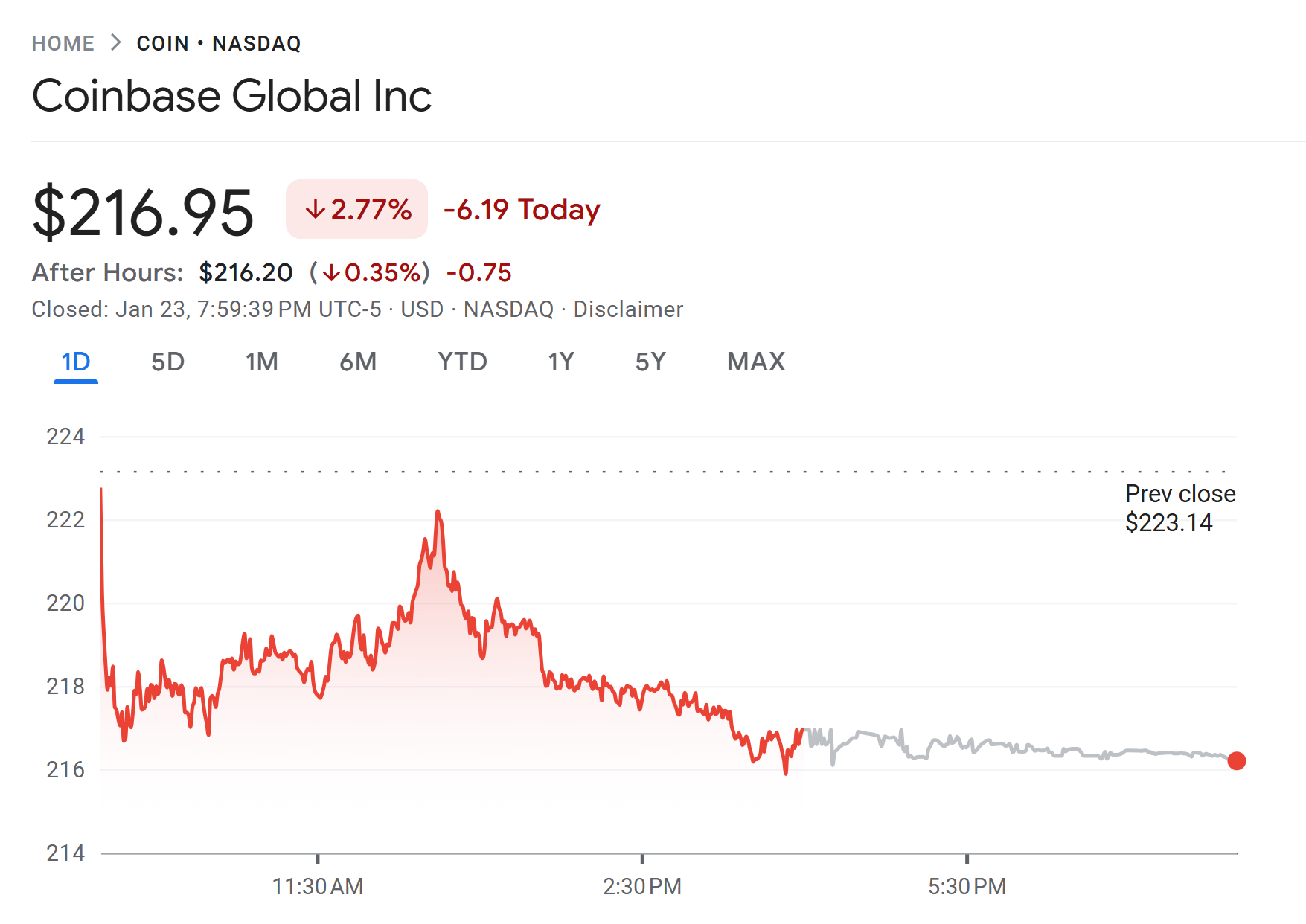

According to ARK’s meticulously documented daily trade disclosures, the firm’s flagship ARK Innovation ETF (ARKK) led the charge, purchasing 38,854 shares of Coinbase Global Inc. Concurrently, the ARK Fintech Innovation ETF (ARKF) added another 3,325 shares, culminating in a substantial acquisition worth approximately $9.4 million in the leading cryptocurrency exchange. This significant investment arrived on a day when Coinbase shares closed down 2.77% at $216.95, indicating ARK’s readiness to accumulate assets at a discount. Coinbase, a pivotal player in the crypto landscape, serves millions of users globally, offering a robust platform for trading, staking, and accessing various decentralized finance (DeFi) services. Its performance is often seen as a bellwether for retail and institutional interest in the broader crypto market, making ARK’s increased stake a strong statement of confidence in its future trajectory and resilience against market fluctuations.

Beyond Coinbase, ARK demonstrated its diversified approach to the crypto sector by adding a combined 129,446 shares of Circle Internet Group across both ARKK and ARKF. This position, valued at roughly $9.2 million, highlights ARK’s belief in the foundational infrastructure underpinning the digital economy. Circle, best known as the issuer of USDC, the second-largest stablecoin by market capitalization, plays a crucial role in facilitating frictionless digital payments and fostering liquidity within the DeFi space. Stablecoins like USDC are increasingly vital for institutional adoption and cross-border transactions, providing a stable bridge between traditional finance and the volatile crypto markets. The acquisition, even as Circle shares slipped a marginal 0.03% on the day, reinforces ARK’s view that payment innovation and stable digital currencies will be key drivers of future financial transformation.

Further solidifying its bet on institutional-grade crypto infrastructure, ARK also invested in Bullish, acquiring 88,533 shares across the same ETFs, an investment totaling approximately $3.2 million. Bullish, an institutional-focused digital asset exchange, differentiates itself through its proprietary automated market making (AMM) technology, designed to provide deep liquidity and attractive pricing for sophisticated traders. As institutional participation in crypto continues to grow, platforms like Bullish are expected to capture a significant share of trading volume, catering to the specific needs of hedge funds, asset managers, and corporate treasuries. Despite Bullish shares declining 2% during the session to close at $35.75, ARK’s investment signals a conviction that the institutionalization of crypto trading is an irreversible trend with substantial long-term upside.

This strategic reallocation of capital wasn’t merely about buying crypto assets; it also involved a deliberate trimming of positions elsewhere in ARK’s extensive portfolio. Notably, the firm divested 12,400 shares of Meta Platforms, an action valued at approximately $8.03 million. This move underscores ARK’s dynamic portfolio management, where capital is continually re-evaluated and shifted towards areas perceived to offer the highest growth potential. The decision to reduce exposure to a tech giant like Meta, which has heavily invested in the metaverse, while simultaneously increasing stakes in core crypto infrastructure, speaks volumes about ARK’s concentrated focus on what it identifies as truly disruptive and undervalued opportunities within the digital asset space.

The recent downturn in crypto markets, particularly during the fourth quarter of 2025, had indeed weighed heavily on several of Cathie Wood’s ARK ETFs, as previously reported. ARK’s quarterly report candidly highlighted crypto-linked equities as a major source of weakness across its flagship products during this period. Coinbase, in particular, emerged as the largest detractor, significantly impacting the performance of the ARK Next Generation Internet ETF (ARKW), ARKF, and ARKK. This underperformance was attributed to Coinbase shares falling more sharply than Bitcoin (BTC) and Ether (ETH), a trend exacerbated by a 9% quarter-on-quarter decline in spot trading volumes on centralized exchanges following a significant liquidation event in October. This context is crucial, as it illustrates that ARK is not merely buying into an upswing but is actively accumulating during periods of stress, adhering to its philosophy of investing in innovation through cycles of volatility.

It’s worth noting that while crypto assets were a primary drag, other portfolio components also faced headwinds. Roblox, for instance, was the second-largest detractor on ARK ETFs, despite reporting strong third-quarter bookings growth. Its shares fell after the company issued a cautious outlook, warning of declining operating margins in 2026, and faced additional pressure following Russia’s ban of the platform. This broader context of mixed performance across ARK’s portfolio reinforces the strategic importance of its recent crypto acquisitions, signaling a renewed doubling down on digital assets as a key driver for future returns.

ARK Invest’s continued and deepening interest in the crypto market is underpinned by its incredibly bullish long-term projections. The firm unequivocally expects the digital asset market to expand dramatically, potentially reaching an astounding $28 trillion by 2030. This monumental growth, as detailed in ARK’s "Big Ideas 2026" report, is projected to be driven largely by escalating Bitcoin adoption and significant price appreciation. The report forecasts the crypto market expanding at a staggering 61% compound annual growth rate (CAGR) over the period, with Bitcoin anticipated to account for a dominant share, roughly 70%, of the total market value.

Such a forecast has profound implications for Bitcoin’s price. ARK’s analysis suggests that if approximately 20.5 million Bitcoin have been mined by 2030, this projection implies a Bitcoin price soaring into the unprecedented range of $950,000 to $1 million. This audacious target is not based on speculative fervor alone but on tangible trends. The firm cited growing institutional participation as a critical catalyst, noting a significant increase in the share of total Bitcoin supply held by Bitcoin ETFs and corporate treasuries throughout 2025. This institutional embrace, coupled with increasing mainstream adoption and the expanding utility of blockchain technology across various sectors, forms the bedrock of ARK’s optimistic outlook.

The "Big Ideas" report also delves into the macro factors supporting this growth, including the potential for Bitcoin to serve as a hedge against inflation, its role in emerging markets, and its increasing acceptance as a global store of value. Furthermore, the report explores how smart contract platforms, decentralized finance (DeFi), and non-fungible tokens (NFTs) will contribute to the broader digital asset economy, creating new avenues for value creation and wealth transfer. ARK believes that the underlying technology of blockchain is fundamentally transformative, capable of revolutionizing financial systems, supply chains, and even the internet itself, giving rise to Web3.

Cathie Wood and her team have consistently articulated a vision where digital assets move beyond niche speculation to become an integral part of the global financial architecture. Their "buy the dip" strategy in Coinbase, Circle, and Bullish is not a reactive measure but a proactive step aligned with this long-term, high-conviction thesis. By investing in companies that represent the core infrastructure and key applications of the crypto economy, ARK aims to capture the exponential growth anticipated from the ongoing digital revolution.

However, ARK’s strategy is not without its critics. Investing heavily in volatile, high-growth sectors carries inherent risks, and the performance of ARK ETFs has, at times, faced significant drawdowns during broader market corrections or shifts in investor sentiment away from growth stocks. The regulatory landscape for cryptocurrencies remains fluid and uncertain across many jurisdictions, posing potential challenges for companies like Coinbase and Circle. Geopolitical events, technological disruptions, and unforeseen market dynamics could also impact these ambitious projections.

Despite these potential headwinds, ARK Invest’s latest moves unequivocally signal its deep-seated belief in the enduring power and transformative potential of digital assets. The acquisitions of Coinbase, Circle, and Bullish during a market downturn are a testament to Cathie Wood’s conviction that these companies are not just speculative plays but foundational pillars of a burgeoning $28 trillion digital economy. For investors tracking ARK’s movements, these trades offer a clear window into a high-stakes strategy that seeks to leverage short-term market dislocations for long-term, disruptive growth in the world of crypto. The firm’s continued commitment to this vision, even in the face of market turbulence, positions it as a significant player in shaping the future of finance.