Lawmakers in the US state of Kansas are currently engaged in a significant legislative endeavor, considering a pioneering bill that would establish a state-managed Bitcoin and broader digital assets reserve fund. This initiative, rather than relying on direct purchases of volatile cryptocurrencies with taxpayer money, proposes an innovative funding mechanism: the accumulation of unclaimed digital property. This strategic approach highlights a growing trend among states to engage with the burgeoning digital asset economy while mitigating direct financial risks often associated with crypto investments.

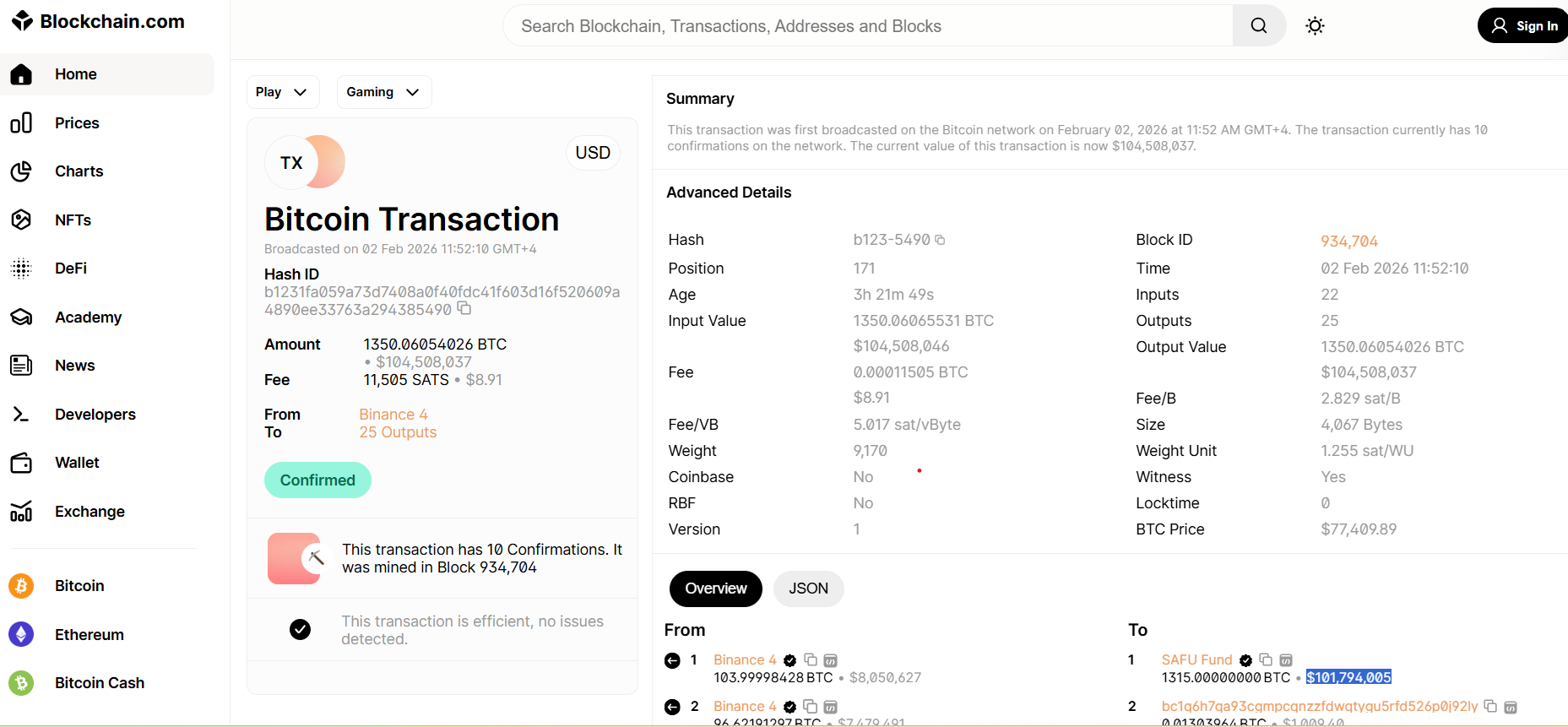

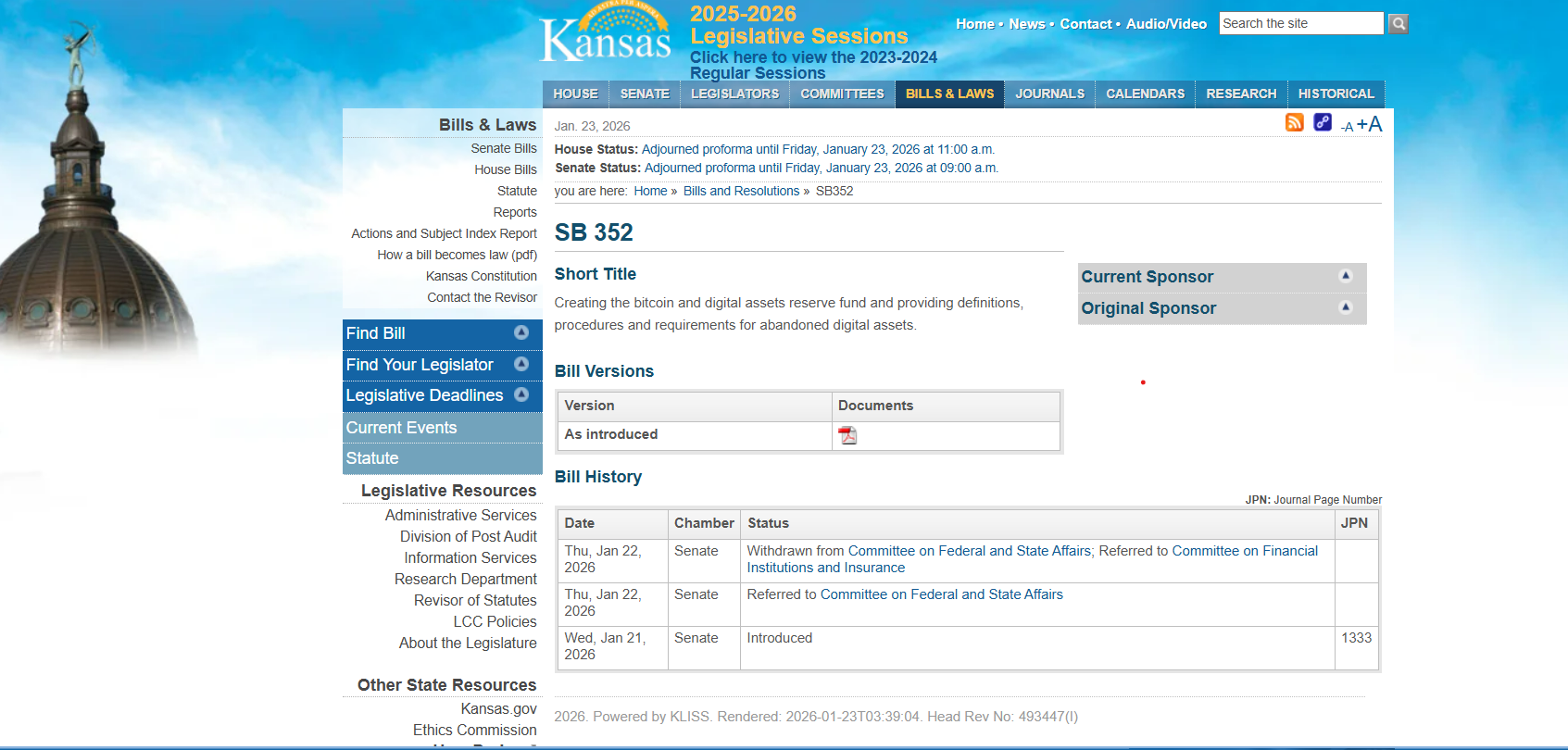

Kansas Senate Bill 352, formally introduced by Senator Craig Bowser on a recent Wednesday, represents a landmark proposal aiming to solidify the state’s position at the forefront of digital asset policy. The bill meticulously outlines the creation of a "Bitcoin and digital assets reserve fund" within the state treasury, an entity designed to be meticulously administered by the state treasurer. This fund’s distinctiveness lies in its funding sources, which are explicitly defined to include airdrops, staking rewards, and interest accrued on abandoned digital assets. These assets would be those currently held under the state’s existing unclaimed property law, thereby repurposing a traditional legal framework for a modern asset class.

The scope of the fund is intentionally broad, encompassing not only cryptocurrencies like Bitcoin (BTC) but also "other digital-only assets." This comprehensive definition ensures the fund’s adaptability to future innovations in the digital asset space. Crucially, the bill explicitly states that the fund will not be financed through direct purchases of Bitcoin or other digital assets by the state. This "no direct purchase" clause mirrors a similar cautious stance observed at the federal level, particularly the White House’s contemplation of a US Strategic Bitcoin Reserve funded through forfeited BTC rather than open-market acquisitions. This shared philosophy underscores a conservative approach to state involvement in crypto, prioritizing asset recovery and passive accumulation over active market participation.

Under the provisions of SB 352, a portion of the incoming digital assets would be directed towards the state’s general fund, with 10% of each digital asset deposit being credited. However, Bitcoin itself would be deliberately kept out of the general fund, likely to shield the state’s primary financial reservoir from the inherent volatility of the cryptocurrency market. This segregation signals a nuanced understanding of Bitcoin’s unique characteristics and its role as a potential long-term store of value, distinct from day-to-day operational funds.

A critical aspect of SB 352 involves substantial amendments to Kansas’s existing unclaimed property statutes. These amendments are designed to introduce formal legal definitions for "digital assets" and "airdrops," terms that currently lack clear legal standing in many state codes. Furthermore, the bill meticulously spells out the procedures and protocols for how the state should treat such assets once they are deemed abandoned. This legislative clarity is paramount, as the increasing prevalence of digital assets has created a legal gray area for states grappling with how to manage, secure, and eventually return or utilize forgotten cryptocurrencies and other digital holdings. The bill’s journey through the legislative process has seen it referred to the Committee on Financial Institutions and Insurance on Thursday, following its initial review by the Federal and State Affairs Committee, indicating a thorough vetting process by relevant bodies.

The concept of unclaimed property has long been a fixture in state treasuries, acting as a consumer protection mechanism where states hold onto assets (like dormant bank accounts, uncashed checks, forgotten safe deposit box contents) until their rightful owners or heirs can claim them. However, applying these traditional laws to the digital realm presents unprecedented challenges. Digital assets, by their nature, are decentralized, often pseudonymous, and lack physical form. Proving ownership, determining fair market value at the time of abandonment, securing these assets (especially with private keys), and establishing clear recovery processes are complex issues that traditional unclaimed property statutes were never designed to address. This Kansas bill, therefore, is not merely about creating a fund but about modernizing the legal framework to accommodate the digital age, providing much-needed clarity for both the state and its citizens who may hold forgotten digital assets.

This bill is not an isolated incident in Kansas’s engagement with digital assets. It follows earlier proposals, such as Senate Bill 34, which was introduced in January 2025. SB 34 aims to empower the Kansas Public Employees Retirement System (KPERS) to allocate up to 10% of its substantial assets to spot Bitcoin exchange-traded funds (ETFs). While still pending in the Senate Committee on Financial Institutions and Insurance, this parallel initiative underscores a broader legislative interest in integrating digital assets into state financial strategies, ranging from direct state reserves to institutional investment opportunities for public sector pensions. The potential for pension funds to invest in Bitcoin ETFs signals a significant step towards mainstream institutional adoption, offering diversification and exposure to a new asset class for retirement portfolios.

Kansas is part of a growing cohort of US states where lawmakers are actively introducing Bitcoin or crypto-focused bills. These range from strategic reserve concepts, similar to SB 352, to establishing dedicated task forces for digital asset study, and proposing controlled allocations to digital asset products for various state entities. This proliferation of state-level legislation reflects a bottom-up approach to crypto regulation in the absence of comprehensive federal guidelines, allowing states to experiment with different models and potentially serve as blueprints for national policy.

At the federal level, the concept of a Strategic Bitcoin Reserve has also gained traction. The administration of former US President Donald Trump previously indicated its intention to move forward with plans for such a reserve and a broader digital asset stockpile, funded primarily with forfeited Bitcoin rather than new taxpayer purchases. This strategy emphasizes leveraging seized assets from illicit activities rather than direct market engagement, again highlighting a cautious but interested approach to governmental crypto holdings. A senior White House official reportedly reaffirmed the Bitcoin reserve as a priority for the administration, indicating a sustained interest in this federal initiative despite legislative hurdles, often attributed to "obscure laws" that complicate the process of establishing such a reserve.

Beyond US borders, several nations have already taken decisive steps to incorporate Bitcoin into their national strategies. El Salvador famously adopted Bitcoin as legal tender, integrating it into its economy through direct holdings and facilitating its use in daily transactions. Bhutan, another trailblazing nation, has quietly built a sophisticated strategy around Bitcoin, involving state-linked mining operations and utilizing BTC to back longer-term development projects and special economic zones. These international examples demonstrate a spectrum of approaches, from full economic integration to strategic industrial application, showcasing the diverse ways sovereign entities are engaging with Bitcoin and other digital assets.

The implications of Kansas’s SB 352 are multi-faceted. For Kansas itself, it could establish a novel revenue stream from assets that would otherwise remain in limbo, offering a unique funding source for public services. It would also position the state as a leader in digital asset policy, potentially attracting innovation and talent. For the broader crypto industry, such legislation provides a significant degree of legitimization and regulatory clarity, signaling that states are actively working to integrate digital assets into their legal and financial frameworks. However, challenges remain, including the complexities of secure custody for state-held digital assets, accurate and consistent valuation in a volatile market, and establishing clear legal precedents for future disputes. Public perception and education will also play a crucial role in the successful implementation and acceptance of such a fund.

In conclusion, Kansas Senate Bill 352 represents a forward-thinking attempt to adapt traditional state functions to the realities of the digital age. By creating a Bitcoin and digital assets reserve fund from unclaimed property, Kansas seeks to harness the potential value of abandoned crypto assets without directly exposing taxpayer funds to market volatility. This move, alongside other state-level initiatives and federal considerations, underscores a growing recognition among governmental bodies worldwide of digital assets’ enduring presence and potential utility. The evolving landscape of property law in the digital era is being shaped, one state bill at a time, balancing innovation with prudent fiscal management and laying the groundwork for how future generations may interact with their state treasuries in a decentralized world.