French crypto hardware wallet provider Ledger is reportedly preparing for an initial public offering (IPO) in the United States, a strategic move that could see the company valued at more than $4 billion, according to sources familiar with the matter cited by the Financial Times. This ambitious plan underscores the growing institutional interest in the digital asset space and the escalating demand for robust security solutions amidst a landscape fraught with increasing cyber threats.

Ledger, a pioneering force in the realm of secure cryptocurrency storage, is currently engaged in preliminary discussions with prominent investment banks, including Goldman Sachs, Jefferies, and Barclays. These discussions are focused on the logistics and potential timeline for a US listing, signaling a significant step for the Paris-headquartered firm founded in 2014. The selection of such high-profile financial institutions indicates the seriousness and scale of Ledger’s IPO aspirations, as these banks typically play crucial roles in underwriting, market analysis, and investor relations for major public offerings.

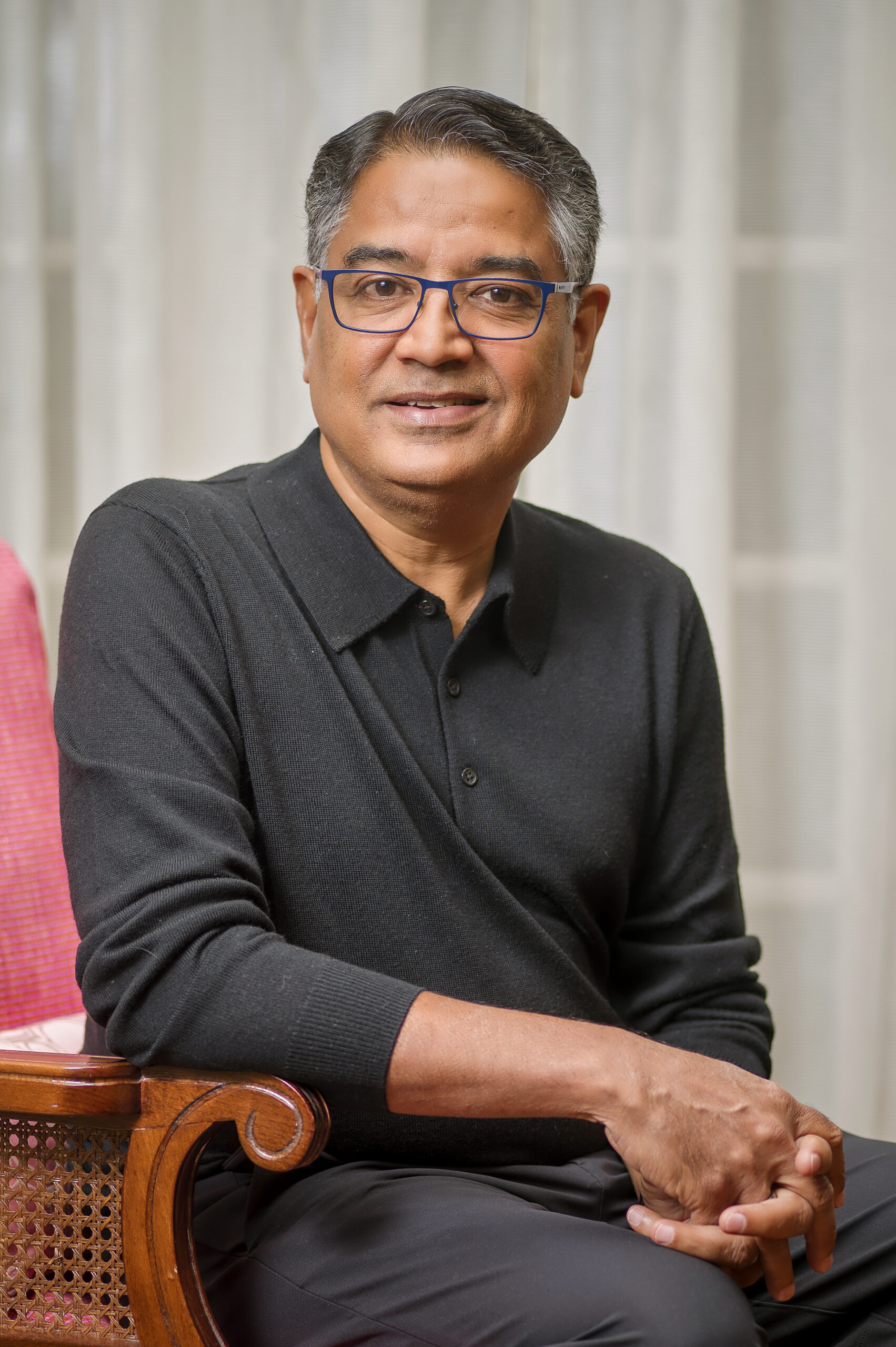

The move to seek public capital in the United States is not entirely unexpected. As early as November 2025, Ledger CEO Pascal Gauthier openly expressed the company’s intentions to pursue either a major fundraising round or a public listing, specifically targeting New York. Gauthier’s reasoning was clear and pragmatic: he noted that the necessary capital and investor appetite for crypto-centric ventures were "certainly not in Europe," pointing to the more mature and expansive financial markets in the U.S. as a preferred destination for growth-stage crypto companies. This sentiment reflects a broader trend where many innovative blockchain and crypto firms, despite their global origins, often look to the U.S. for significant capital injection due to its deeper pools of venture capital, more established regulatory frameworks for tech listings, and a greater understanding among institutional investors of the nascent digital asset economy.

If these IPO talks materialize, they would powerfully illustrate the surging demand for reliable crypto storage solutions. The digital asset ecosystem has witnessed an alarming rise in sophisticated cyberattacks and breaches, making secure self-custody a paramount concern for both individual investors and institutions. According to a grim report by blockchain analytics firm Chainalysis, over $3.4 billion in cryptocurrency was stolen in 2025 alone. This staggering figure highlights the urgent need for robust security infrastructure, which is precisely where Ledger positions itself as a market leader. The company’s core offering revolves around hardware wallets – physical, USB-like devices designed to store users’ private keys offline. By isolating these critical cryptographic keys from internet-connected devices, hardware wallets provide an impenetrable barrier against online threats such as malware, phishing attacks, and remote hacking attempts, offering a superior level of security compared to software wallets or custodial services.

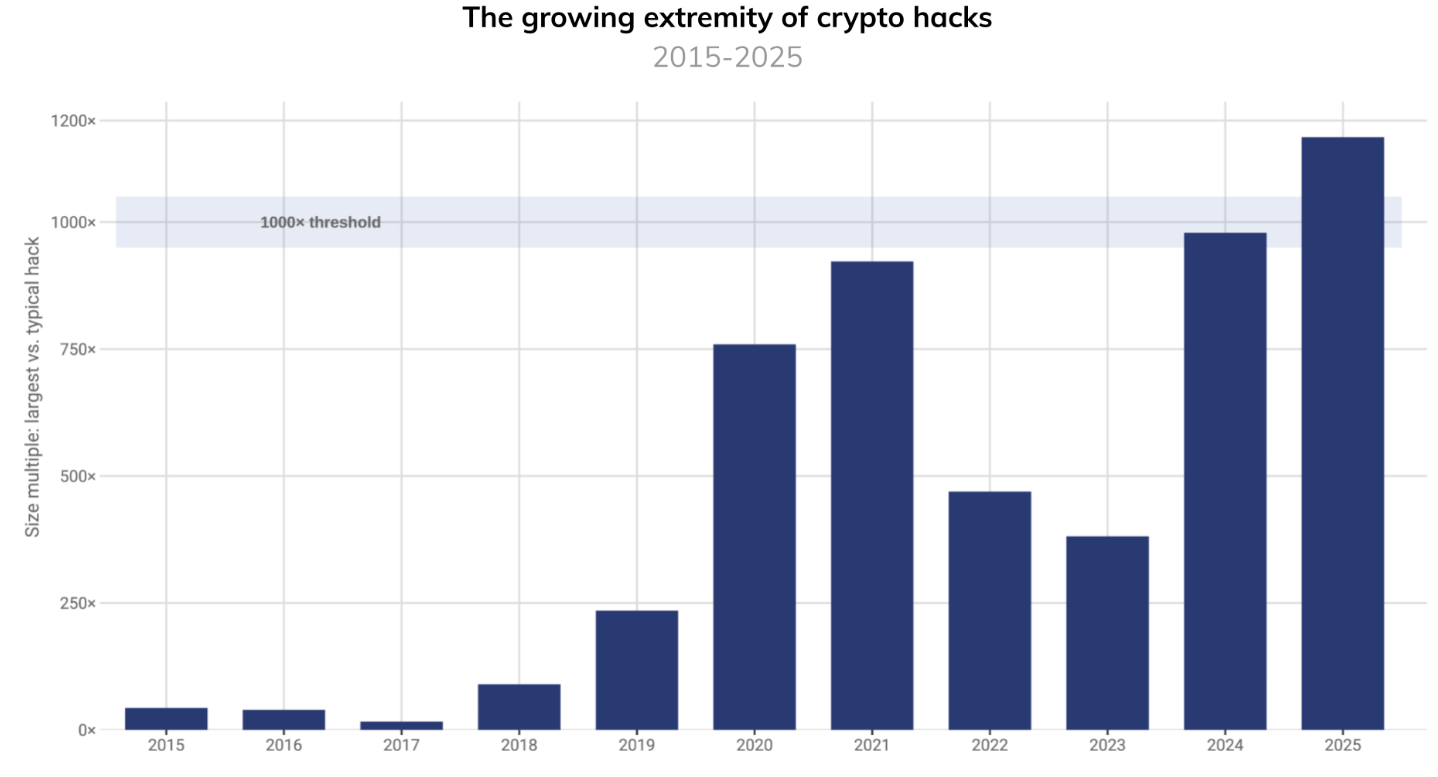

Against this backdrop of heightened security risks, Ledger experienced an unprecedented "record year in 2025," with its revenue soaring into the "triple-digit millions." This impressive financial performance directly correlates with the increasing frequency and scale of crypto hacks. As Gauthier himself warned in late 2025, "We’re being hacked more and more every day […] hacking of your bank accounts, of your crypto, and it’s not going to get better next year and the year after that." This stark assessment underscores the enduring and escalating nature of cyber threats in the digital age, positioning Ledger’s hardware wallets not just as a convenience, but as an essential defense mechanism for digital asset holders. The Chainalysis data further emphasizes this point, revealing that the funds stolen in the largest attacks of 2025 were a thousand times greater than those in a typical crypto hack, even surpassing the peak levels observed during the 2021 bull market. This indicates a significant escalation in the sophistication and target value of cybercriminals, making robust, offline security solutions more critical than ever.

Ledger, founded in Paris, has been at the forefront of the hardware wallet market for nearly a decade. Its product lineup, including popular models like the Ledger Nano S Plus, Nano X, and the more recent Ledger Stax, has become synonymous with secure self-custody. These devices empower users to maintain full control over their digital assets by ensuring that their private keys, which are essentially the proof of ownership, never leave the secure element of the device. This approach aligns with the core ethos of decentralization in cryptocurrency, where individuals are encouraged to be their own bank and avoid relying on third-party custodians, which can become single points of failure. The ongoing debate around self-custody and decentralized finance (DeFi) regulation, as highlighted by "New SEC submissions," further emphasizes the importance of solutions like Ledger’s. Regulators globally are grappling with how to oversee digital assets while balancing innovation with consumer protection, making secure, user-controlled storage solutions a vital component of a healthy and compliant crypto ecosystem.

The potential for a Ledger IPO comes hot on the heels of another significant event in the crypto custody sector: the public listing of BitGo on the New York Stock Exchange. BitGo, one of the world’s largest crypto custody providers, made its market debut on Thursday, offering a tangible precedent for investor appetite in the crypto infrastructure space. BitGo’s shares (BTGO) opened at $22.40, a robust 24% increase from its initial IPO price of $18, and surged further to reach as high as $24.50 on its first day of trading. This strong performance signals a healthy demand from public market investors for companies that provide essential, secure services within the cryptocurrency ecosystem, particularly those focused on institutional-grade custody. The positive reception for BitGo’s IPO, further validated by a strategic investment from YZi Labs, a venture capital firm linked to former Binance CEO Changpeng Zhao, provides a compelling case study for Ledger’s own ambitions. While BitGo primarily serves institutional clients with its enterprise-level custody solutions, Ledger focuses more on the retail market with its hardware wallets, though it also offers institutional-grade solutions through Ledger Enterprise. Both companies, however, operate within the critical realm of digital asset security, suggesting that investors are increasingly recognizing the fundamental value of secure infrastructure in a rapidly maturing industry.

Ledger’s decision to pursue a US IPO represents more than just a fundraising exercise; it signifies a pivotal moment for the crypto hardware and security industry as a whole. A successful listing would not only inject substantial capital into Ledger for further research and development, global expansion, and talent acquisition, but it would also confer a significant level of mainstream validation upon the entire self-custody movement. Public market scrutiny, while demanding, can also lead to increased transparency, corporate governance, and investor confidence. While Ledger declined to officially confirm the report about a potential US IPO when contacted, the market signals and previous statements from its CEO strongly suggest a clear strategic direction.

The journey to an IPO, however, is not without its challenges. Ledger will need to navigate rigorous regulatory requirements, address potential market volatility, and continue to innovate in a highly competitive landscape that includes other hardware wallet providers like Trezor and SafePal, as well as evolving software and institutional custody solutions. Furthermore, maintaining public trust in the face of any potential security vulnerabilities or market downturns will be paramount. Nevertheless, with its strong financial performance in 2025, driven by an undeniable global need for enhanced digital asset security, Ledger appears well-positioned to capitalize on the growing demand for robust, self-custody solutions as the cryptocurrency market continues its trajectory towards mainstream adoption and institutional integration. The prospect of a Ledger IPO heralds a new era for crypto security, potentially ushering in greater investor confidence and a more secure future for digital asset holders worldwide.