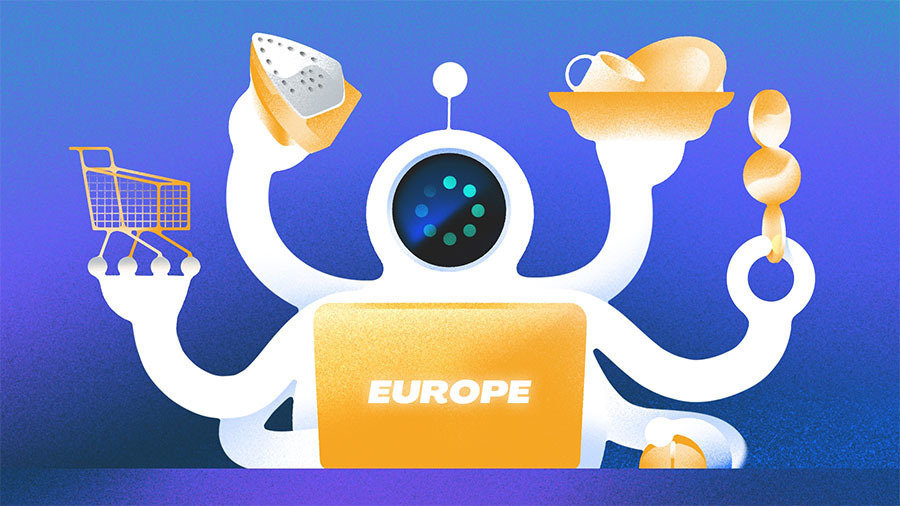

While the overall growth in European venture investment might appear conservative compared to other global markets, it reflects a foundational resilience within the region’s tech landscape. Crucially, the $58 billion invested in 2025 maintained funding levels well above those observed in the pre-COVID era, continuing a three-year streak of robust performance that belies ongoing global economic uncertainties. This consistent upward trajectory indicates a maturing ecosystem, increasingly capable of attracting and deploying substantial capital. A particularly salient trend within this growth was a pronounced shift towards deep tech funding, encompassing a wide array of sophisticated technologies from advanced materials to quantum computing, reflecting Europe’s strategic commitment to foundational innovation.

However, the European narrative diverged somewhat from the more explosive growth witnessed in North America, particularly concerning the AI-driven investment surge. North American companies experienced a staggering 46% year-over-year increase in venture funding in 2025, largely propelled by colossal "mega rounds" directed at AI-related enterprises. This disparity highlights different market dynamics, investor appetites, and potentially varying stages of AI commercialization and regulatory environments between the two continents, even as AI became a leading force in both. Europe’s growth, though more gradual, suggests a methodical and strategic build-out of its tech capabilities rather than a speculative rush.

A Strong Finish to the Year: The Quarterly Uptick

Despite the year’s overall measured growth, the final quarter of 2025 painted a particularly optimistic picture for European venture funding. Q4 saw a significant acceleration, with investments reaching $16.6 billion. This represented a robust 20% increase quarter-over-quarter and an even more impressive 27% surge year-over-year, according to Crunchbase data. This strong finish indicates a renewed investor confidence and perhaps a gathering momentum that could carry into 2026.

Several prominent deals contributed to this Q4 resurgence, showcasing the diversity and strength of Europe’s innovative landscape. London-based Kraken, an energy software provider, secured a substantial round, highlighting the continent’s commitment to sustainable and efficient energy solutions. Finland’s Oura, known for its smart rings, continued to attract investment, underscoring the growing interest in health tech and wearable technology. Paris-based Brevo, a customer engagement platform, demonstrated the ongoing demand for sophisticated B2B software solutions. Dutch online grocer Picnic further solidified the digital transformation of retail, while London-based Nscale, a cloud GPU provider, positioned itself at the forefront of the infrastructure required to power the AI revolution. These diverse investments across different sectors signal a healthy and multifaceted venture environment.

AI Takes Center Stage: A Historic Shift in Sectoral Leadership

The most groundbreaking development in European venture funding in 2025 was undoubtedly the ascendancy of artificial intelligence. For the first time in the region’s history, AI surpassed all other sectors to become the leading recipient of venture capital, attracting approximately $17.5 billion in funding. This figure represents a dramatic increase from just over $10 billion invested in AI in 2024, illustrating an undeniable acceleration of interest and investment in the field. This surge reflects a global recognition of AI’s transformative potential and Europe’s strategic efforts to foster its own AI champions.

The year was marked by several landmark AI funding rounds that underscored this trend. Paris-based Mistral AI, a frontier lab dedicated to developing cutting-edge AI models, raised the largest round of the year, securing close to $2 billion. This monumental investment was notably led by Dutch chip machine manufacturer ASML, a testament to the increasing convergence of hardware and software in the AI ecosystem and Europe’s capacity to attract significant strategic capital for its most ambitious projects. Other substantial European funding rounds in AI included Nscale, which provides crucial cloud GPU infrastructure, and Brevo, which integrates AI into customer engagement platforms. Further demonstrating the breadth of AI applications, Munich-based defense manufacturer Helsing secured significant capital, pointing to the growing importance of AI in national security. London-based Isomorphic Labs, a Google DeepMind spin-off focusing on AI drug discovery, highlighted the intersection of AI and life sciences, while Freiburg, Germany-based Black Forest Labs, another image frontier lab, showcased Europe’s strength in advanced computer vision and AI research. These investments collectively illustrate a concerted effort to build a robust AI ecosystem spanning foundational research, infrastructure, and diverse applications.

Beyond AI: A Deep Dive into Europe’s Evolving Sectoral Priorities

While AI stole the spotlight, other sectors also played crucial roles in shaping Europe’s venture landscape in 2025, collectively reinforcing the continent’s renewed focus on deep tech. The second-largest sector for startup investment was healthcare and biotech, attracting a substantial $13.4 billion. This continued strong performance reflects Europe’s world-class research institutions, robust pharmaceutical industry, and increasing demand for innovative health solutions, from novel therapeutics to digital health platforms. The pandemic undoubtedly accelerated investment in this space, and 2025 demonstrated its sustained momentum.

Hardware emerged as the third-largest sector, with approximately $10.8 billion invested. This figure is particularly significant as it encapsulates a broader commitment to deep tech, demonstrating Europe’s strategic intent to build foundational technologies. The investments within this sector spanned a wide range, including data centers crucial for AI and cloud computing, innovative wearables like Oura’s smart rings, defense technologies, quantum computing advancements, aerospace innovations, sophisticated robotics, and critical energy solutions. This emphasis on tangible, often capital-intensive, hardware and engineering-driven solutions signifies a strategic pivot towards building the physical and digital infrastructure for the next generation of technological advancement, moving beyond purely software-centric models.

In a notable shift, financial services (Fintech), once a dominant force in Europe’s venture scene, receded to the fourth-largest sector for funding in 2025, securing around $7.4 billion. While still a significant sum, its relative decline from a leading position suggests a maturation of the sector, potentially with fewer early-stage entrants and a focus on larger, later-stage rounds, or a re-prioritization of investment towards newer, more disruptive technologies like AI and deep tech. This evolution reflects the dynamic nature of venture capital, constantly seeking out new frontiers of innovation and growth.

Geographical Shifts: UK Leads, but Other Nations Gain Ground

Geographically, the United Kingdom maintained its position as the leading country for venture funding in Europe, attracting approximately $17 billion in 2025. This accounted for about 29% of the total European venture funding. However, this share represented a slight decrease from a third of all funding in 2024, indicating a broader distribution of capital across the continent. While still a powerhouse, the UK’s relative share adjusted as other ecosystems matured and attracted more significant investment.

France emerged as a strong contender, with its startups raising $8.5 billion, closely followed by Germany-based companies, which secured $8.4 billion. Both nations’ startups each represented approximately 15% of the total funding to the continent last year, demonstrating their growing influence and robust innovation ecosystems. Paris and Berlin, in particular, continue to solidify their positions as major tech hubs.

Beyond these top three, other European countries also showed impressive growth. Switzerland was the fourth-largest European country for venture investment in 2025, attracting $3.6 billion, benefiting from its strong financial sector and high-tech industries. The Netherlands followed closely at $3.4 billion, known for its innovative startup scene and strong deep tech focus. Spain saw $2.9 billion invested in its startups, while Finland, home to Oura, secured $2.2 billion. Crucially, with the exception of the UK, each of these countries — France, Germany, Switzerland, the Netherlands, Spain, and Finland — raised more venture funding in 2025 than in 2024. This trend highlights a progressive decentralization of venture capital, with funding increasingly flowing to diverse cities and regions across Europe, particularly those with leading research institutes and specialized talent pools. This broadening geographical spread fosters a more resilient and interconnected European tech landscape.

Investment Stages: Late-Stage Resurgence and Early-Stage Stability

An analysis of funding by stage in Q4 2025 revealed interesting dynamics. Late-stage funding reached its highest amount in two years, totaling $9.2 billion across 87 deals. This represented a substantial 65% increase by amounts year-over-year, suggesting growing investor confidence in more mature European companies and a willingness to commit larger sums to proven ventures. This late-stage buoyancy could indicate that European startups are successfully scaling and attracting significant follow-on capital, a crucial step for building global champions.

Early-stage funding, encompassing Series A and Series B rounds, reached $5.3 billion in Q4 across more than 250 funding rounds. This figure, however, was down 4% year-over-year. While a slight dip, it could reflect a more cautious approach from early-stage investors or a natural rebalancing after previous peaks. Seed funding, the earliest stage of investment, remained stable, reaching $2 billion in Q4 across more than 750 deals, aligning with totals year-over-year. The consistency in seed funding is a positive sign for the pipeline of future innovation, ensuring a continuous stream of new startups entering the ecosystem.

The Investor Landscape: European Firms Lead the Charge

The investor landscape in Europe in 2025 was predominantly shaped by Europe-based venture and private equity firms, which led or co-led the largest funding rounds into the region’s startups. This indicates a strong and maturing domestic investor base, deeply familiar with the nuances of the European market and committed to fostering local innovation. However, the influence of global capital remained significant, with a mix of venture or private equity firms from the U.S. and Asia also participating in and often leading key rounds. This blend of local expertise and international capital provides a robust funding environment for European startups, combining regional insights with global reach and resources.

Looking Ahead: A Strategic Trajectory

In conclusion, 2025 marked a pivotal year for European venture funding. While the overall growth was measured, the continent demonstrated remarkable resilience, maintaining funding levels well above pre-COVID benchmarks. The most significant takeaway is the historic shift towards AI leadership, signaling Europe’s strategic commitment to cutting-edge technologies and its ambition to compete on the global stage in this critical domain. This AI focus, coupled with a broader emphasis on deep tech sectors like healthcare, biotech, and hardware, underscores a renewed focus on science, engineering, and foundational innovation. This strategic pivot is also manifesting geographically, with funding increasingly distributed across various European countries and cities boasting strong research institutes. As Europe continues to nurture its deep tech capabilities and build out its AI ecosystem, the stage is set for a sustained period of innovation and growth, promising an exciting trajectory for the years to come.

Methodology

The data presented in this comprehensive report is directly sourced from Crunchbase, reflecting reported data as of January 4, 2026. It is important to note that data lags are typically more pronounced at the earliest stages of venture activity, meaning seed funding amounts, in particular, often increase significantly after the formal end of a quarter or year as more deals are reported. All funding values are expressed in U.S. dollars unless explicitly stated otherwise. Crunchbase meticulously converts foreign currencies to U.S. dollars at the prevailing spot rate on the date when funding rounds, acquisitions, IPOs, and other financial events are reported, even if these events were added to the database much later than their initial announcement. This ensures accuracy and consistency in financial reporting.

Glossary of Funding Terms

- Seed and Angel: This category encompasses seed, pre-seed, and angel rounds. Crunchbase also includes venture rounds of an unknown series, equity crowdfunding, and convertible notes valued at $3 million (USD or its as-converted USD equivalent) or less.

- Early-Stage: This stage includes Series A and Series B rounds, along with other similar round types. Crunchbase classifies venture rounds of unknown series, corporate venture, and other rounds between $3 million and $15 million (inclusive) as early-stage.

- Late-Stage: This category consists of Series C, Series D, Series E, and subsequent lettered venture rounds following the standard "Series [Letter]" naming convention. It also includes venture rounds of unknown series, corporate venture, and other rounds exceeding $15 million. Corporate rounds are only included if the company has previously raised an equity funding round at the seed through venture series stage.

- Technology Growth: This refers to a private-equity round raised by a company that has previously secured a "venture" round, essentially encompassing any round from the previously defined stages that falls under a private equity structure.