A colossal $11 billion Bitcoin whale, a figure renowned for accurately forecasting the significant $19 billion market downturn in October, is once again making waves in the cryptocurrency market, positioning for a substantial price appreciation across leading digital assets and signaling a potential market recovery. This latest series of strategic maneuvers saw the influential investor liquidate a staggering $330 million in Ether (ETH) before promptly opening three highly leveraged long positions totaling an immense $748 million, betting aggressively on the upward trajectory of Bitcoin (BTC), Ether (ETH), and Solana (SOL).

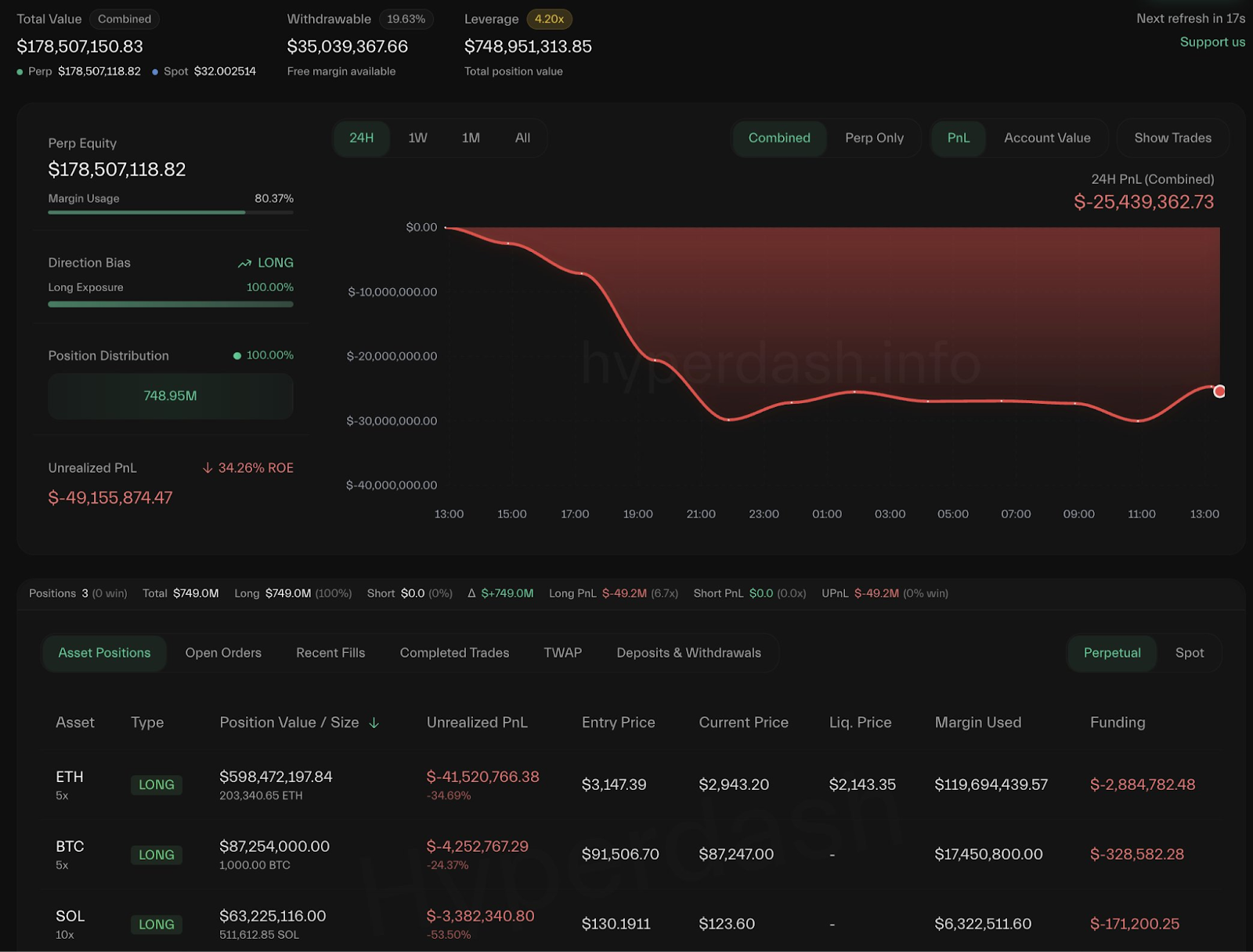

The whale’s actions are meticulously tracked by blockchain analytics platforms, providing an unprecedented level of transparency into the movements of the market’s most impactful participants. According to an X post by blockchain data platform Lookonchain on Tuesday, the largest of these new positions is a colossal ETH long, valued at $598 million, initiated at an entry price of $3,147. This high-stakes bet carries a significant liquidation risk, as the position would be automatically closed if Ether’s price were to drop below $2,143, highlighting the considerable leverage and potential volatility involved in such a trade.

The very concept of a "whale" in the cryptocurrency market refers to an individual or entity holding an exceptionally large amount of a particular cryptocurrency, sufficient to significantly influence market prices if they were to execute large trades. Their movements are often seen as indicators of broader market sentiment among sophisticated investors, making their actions a focal point for analysts and traders alike. This particular $11 billion Bitcoin whale has earned a reputation for shrewd market timing, with their previous accurate prediction of a major market correction cementing their status as a key player whose moves warrant close observation. The fact that they are now reversing course and betting big on an upturn sends a powerful signal to the market, suggesting that they perceive current conditions as ripe for a rally.

Based on their recent transaction patterns, the astute whale appears to be strategically positioning themselves for a short-term rally across these three dominant cryptocurrencies. What makes this move particularly noteworthy is their persistence in maintaining these leveraged positions, even while facing approximately $49 million in unrealized losses. This resilience suggests a strong conviction in their bullish outlook, indicating that they believe the current dips are temporary and that a significant rebound is imminent. Leveraging amplifies both potential gains and losses, meaning that while a successful bet could yield enormous returns, an incorrect one could lead to substantial capital erosion or even liquidation. For a whale of this magnitude, however, $49 million in unrealized losses might be considered a manageable draw-down within a broader, high-conviction strategy.

This isn’t the first time this enigmatic whale has captured the market’s attention. Their presence first became prominent in August when they executed a monumental rotation of approximately $5 billion worth of BTC into ETH. This move was so substantial that it briefly positioned them as the largest corporate holder of Ether, surpassing even Sharplink, a well-known corporate treasury firm with significant crypto holdings, as reported by Cointelegraph on September 1. The whale’s initial shift into Ether began on August 21, involving the sale of $2.59 billion in Bitcoin to acquire $2.2 billion in spot ETH and an additional $577 million in an Ether perpetual long position. This audacious move had an immediate and discernible ripple effect, inspiring no fewer than nine other "massive" whale addresses to collectively acquire a staggering $456 million worth of ETH within just a single day, illustrating the significant market-moving influence wielded by this particular investor.

The decision to cash out $330 million in ETH before re-entering with leveraged long positions across BTC, ETH, and SOL is a multifaceted one. Cashing out a portion of their existing ETH holdings could be a strategic move to realize some profits, de-risk their portfolio, or simply free up capital to take on new, higher-conviction, leveraged bets. By then deploying this capital, alongside potentially additional funds, into leveraged longs, the whale is expressing a strong belief that the prices of these specific assets are poised for significant appreciation in the near term.

The selection of Bitcoin, Ether, and Solana for these leveraged positions is also highly strategic. Bitcoin, as the pioneer and largest cryptocurrency, often dictates the overall market sentiment. A bullish bet on BTC suggests confidence in the entire crypto market’s upward trajectory. Ether, the native cryptocurrency of the Ethereum blockchain, underpins the vast decentralized finance (DeFi) ecosystem, NFTs, and numerous dApps. Its ongoing development, including scalability upgrades and its transition to a proof-of-stake consensus mechanism, positions it as a key player in the future of blockchain technology. Solana, on the other hand, has emerged as a formidable competitor, known for its high transaction speeds and low fees, attracting a growing ecosystem of developers and users, and often dubbed an "Ethereum killer" by its proponents. Betting on these three suggests a diversified bullish outlook across the market leader, the leading smart contract platform, and a rapidly ascending challenger.

The details provided by Lookonchain, including the entry price and liquidation threshold for the ETH long, offer critical insights into the whale’s risk management strategy. A liquidation price of $2,143 for an ETH long opened at $3,147 implies a significant amount of leverage is being utilized. While such a drop would represent a substantial percentage decline, the whale’s willingness to operate within these parameters underscores their conviction and possibly their capacity to absorb such losses if the market moves unfavorably in the short term, or to add more collateral to avoid liquidation.

Beyond this individual whale’s actions, broader market data corroborates an increasing confidence among large investors in Ether. Crypto intelligence platform Nansen reports that other crypto whales have also been accelerating their spot Ether acquisitions. Over the past week, these large investors increased their ETH acquisition rate by 1.6-fold, collectively amassing $7.43 million in spot ETH across 19 distinct wallets. This collective uptick in accumulation from a key cohort of large investors is often interpreted as a bullish signal, as their buying power can significantly drive price momentum and reflect underlying strength in the asset.

However, the market presents a fascinating dichotomy. While some whales are accumulating and leveraging up, a different, equally significant segment of the market — the "smart money" traders — appears to be taking a contrasting stance. Nansen, which tracks the industry’s most successful traders based on their returns, labels these as "smart money" and their current positioning suggests a cautious, if not bearish, outlook. These smart money traders are currently net short on Ether for a cumulative $121 million, despite adding $6.5 million in long positions over the past 24 hours. This indicates that their overall sentiment leans towards a price decline for ETH.

Furthermore, this bearish sentiment extends beyond Ether. Smart money traders are also net short on Bitcoin for a cumulative $192 million and on Solana for $74 million. This conflicting data creates a complex picture: on one hand, an influential whale and a broader group of large investors are betting on a rally; on the other, the most successful professional traders are hedging against or actively betting on a downturn. This divergence could stem from different time horizons (the whale betting on a short-term rally versus smart money potentially anticipating longer-term corrections), different risk appetites, or sophisticated hedging strategies where various positions are opened to offset potential risks. It also highlights the inherent uncertainty and diverse interpretations that characterize the volatile cryptocurrency markets.

The implications of this $11 billion Bitcoin whale’s aggressive bullish posture are significant. If their prediction holds true and the market experiences a recovery, their leveraged positions could yield astronomical profits, further cementing their legendary status and potentially influencing even more capital to flow into the market. Conversely, if the market turns against them, the scale of their leveraged positions means the losses could be equally staggering, potentially triggering cascading effects if liquidations occur on a large scale.

Ultimately, the actions of such a prominent whale serve as a powerful narrative in the crypto space, but they are not without risk, nor are they a guaranteed indicator of future market movements. While they provide valuable insights into the sentiment of deep-pocketed investors, the conflicting signals from "smart money" traders underscore the complex and often unpredictable nature of the cryptocurrency market. Investors and enthusiasts alike will be watching closely to see whether this whale’s latest, high-stakes bet on BTC, ETH, and SOL heralds the market recovery they anticipate or if the "smart money" will ultimately prove to be correct in their more cautious outlook. The stage is set for a fascinating period in the crypto markets, with billions of dollars riding on the outcome of these strategic decisions.